One of the defining characteristics of every younger generation is they assume the generations that came before them had it easier.

And one of the defining characteristics of every older generation is they think the younger generations are softer.

My belief is some generations have been luckier than others but every cohort has been forced to deal with uncomfortable times, especially in their younger years.

Baby boomers dealt with the inflationary 1970s and double-digit mortgage rates in the early 1980s. Gen X was starting to make some money just as the country went into two recession and two massive stock market crashes. Millennials graduated college into the teeth of the Great Financial Crisis and one of the worst labor markets we’ve seen in decades.

Gen Z’s burden is dealing with the highest inflation in four decades as well as insanely high housing costs.

Another rite of passage every young generation goes through is thinking about how screwed they are financially.

Other generations had cheaper housing, better job markets, higher incomes, they didn’t have to pay for this, etc.

Complaining about people older than we are brings us together as a united front.

Don’t get me wrong — young people these days have plenty of challenges, financially speaking.

College is more expensive. Student loans are more prevalent. If you didn’t buy a house in the pre-2021 era, you missed out on the opportunity of a lifetime to borrow at ridiculously low rates for the biggest purchase of your life.

I feel for young people who missed the boat.

Higher housing prices, higher mortgage rates and higher student loan borrowing costs are going to make it challenging for many young people starting out in their careers.

But young people are doing better than you think these days, financially speaking.

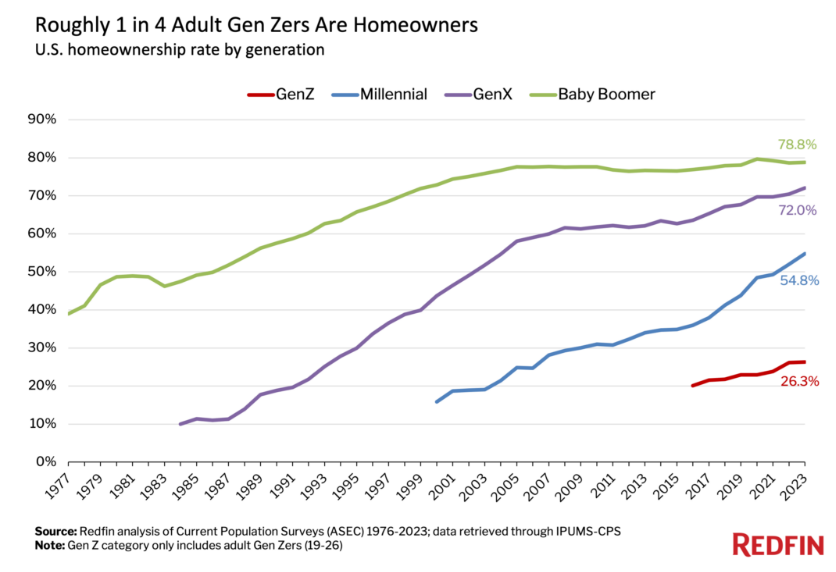

Redfin shows that one in four adult Gen Zers already own a home:

And just look at that jump in millennial home ownership in the past few years.

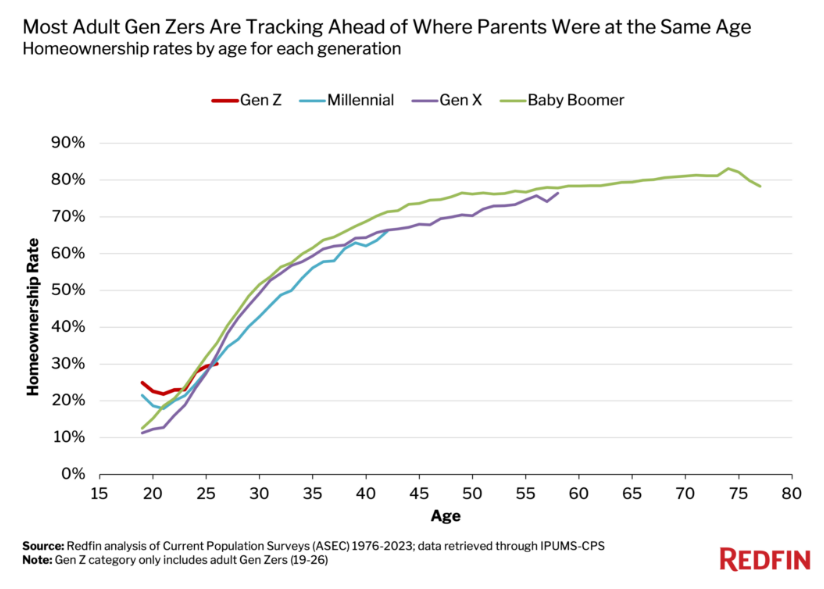

In fact, millennials, Gen Z and Gen X are basically on track with baby boomers when they were are the same age in terms of homeownership rates:

In the 2010s everyone said millennials would never own a home because the economy was so crappy, they had just watched their parents live through the housing crash and no one was going to move to the suburbs anymore.

In the 2020s everyone is saying Gen Z will never own a home because housing prices are too expensive and mortgage rates are too high.

One out of every four adults in the Gen Z generation already owns a home. Nearly one-third of all 25 year olds owned a home by the end of 2022.

I’ll be honest — those numbers are way higher than I would have expected.

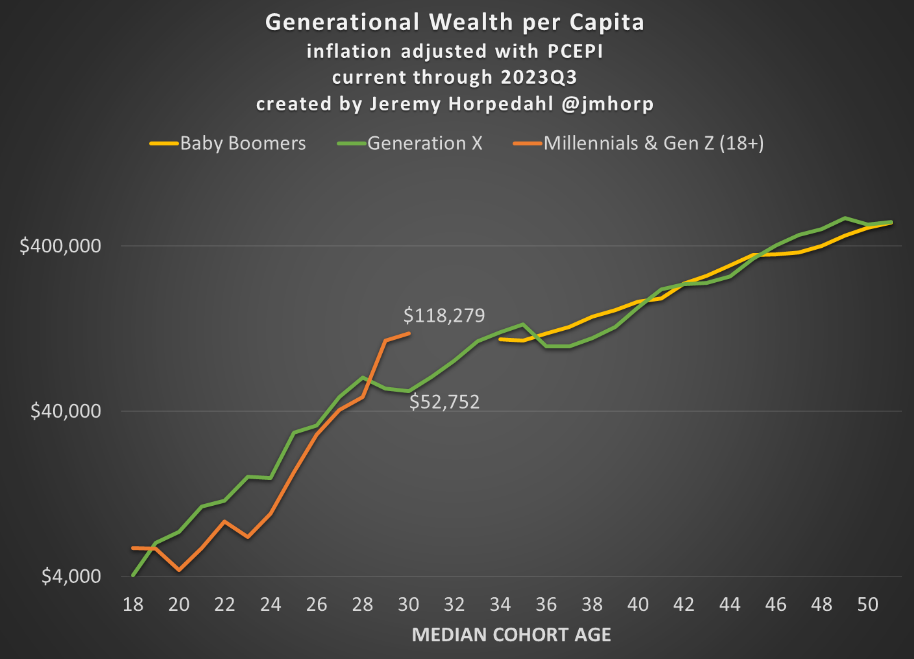

It’s not just housing. The overall financial picture for young people is better than most people would assume as well.

Jeremy Horpedahl compared young people today to Gen X and baby boomers at the same age when it comes to how much wealth they hold. Young people today are even wealthier than previous generations at the same age!

Again, these stats were shocking to me. I never would have guessed that would be the case.

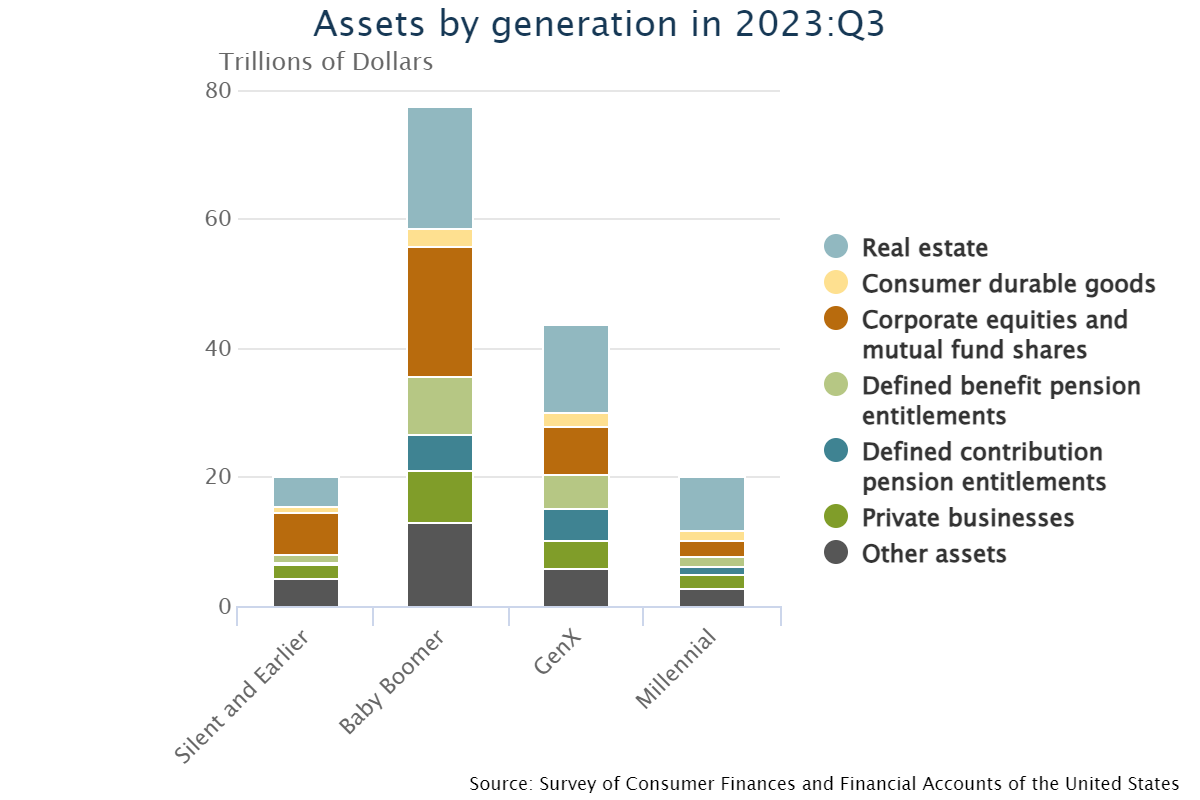

And it’s not just the young people who were lucky enough to buy a house before the pandemic boom. Here is the net worth breakdown by assets:

Real estate has helped but millennials are diversified as much as prior generations when it comes to wealth.

Baby Boomers are obviously still in control when it comes to wealth in this country. And I know there are plenty of young people who are struggling these days.

But as a collective group, millennials and Gen Z are doing much better than the media would have you believe. A lot of young people own homes. A lot of young people have built up some wealth.

Yes, the 2020s is a more challenging market for homebuyers. I feel for those young people who missed out on generationally low housing prices and mortgage rates.

There are a lot of young people who are disillusioned with the current environment and I understand that line of thinking if you just missed out on one of the greatest housing bull markets in history.

Things will likely be tougher from here.

But I’m surprised the finances of young people look as good as they do considering everything we’ve been through.

Further Reading:

How Rich Are the Baby Boomers