Today’s Animal Spirits is brought to you by Simplify ETFs

See here for more information on the Simplify Volatility Premium ETF

On today’s show, we discuss:

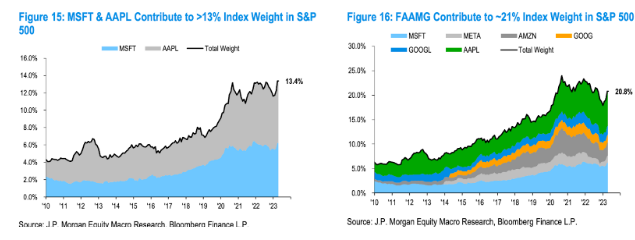

- The FAAMGs are more than just 5 stocks

- AWOCS on S&P 500 concentration here and here

- The bear market survivors share their biggest lessons

- Larry Summers – get out of US Equities

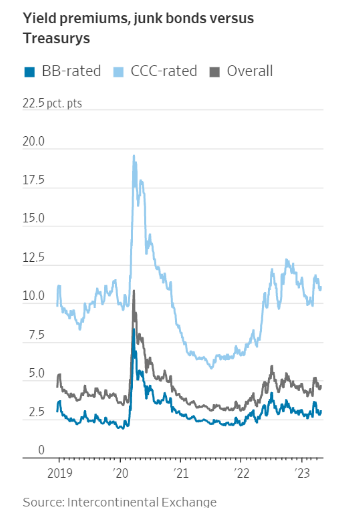

- Junk bonds shake off recession worries

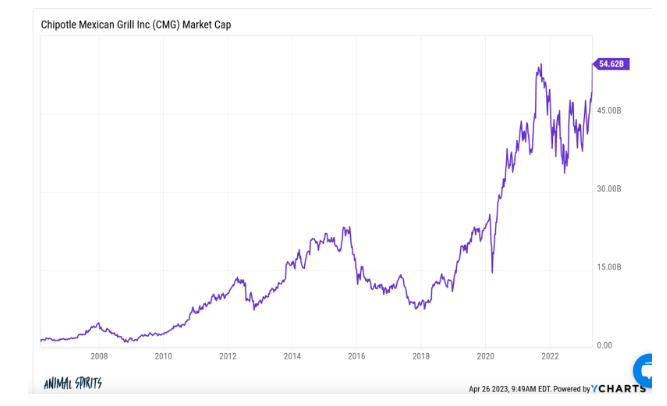

- All this junk food making all-time highs

- First Republic is seized, sold to JPM in second-largest US bank failure

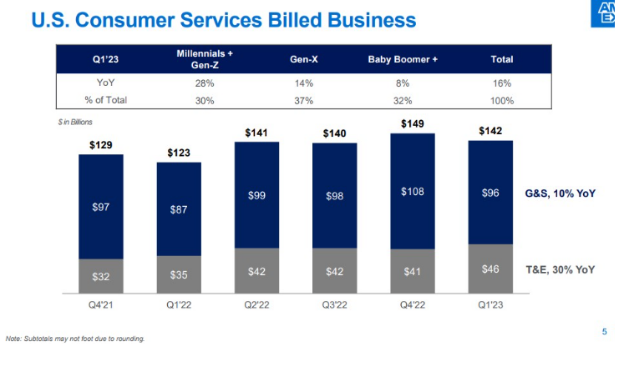

- Why goods spending isn’t falling

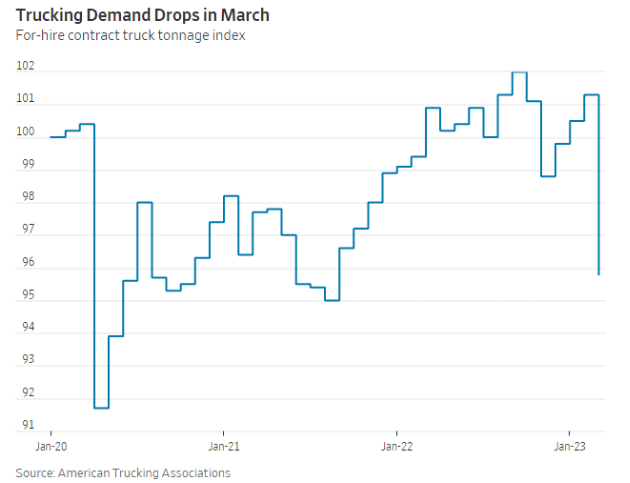

- Sliding diesel prices signal warning for US economy

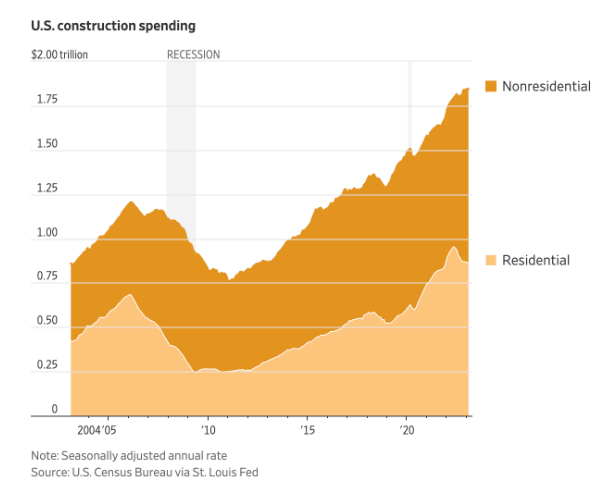

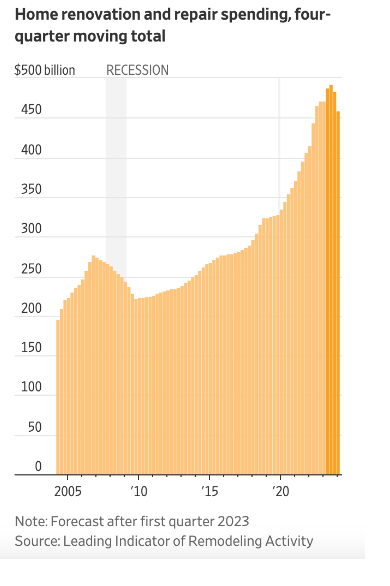

- The building boom is prolonging market pain

- Home buyers are eager but sellers are scarce, creating real gridlock

- Millennials are fueling a generational housing bubble

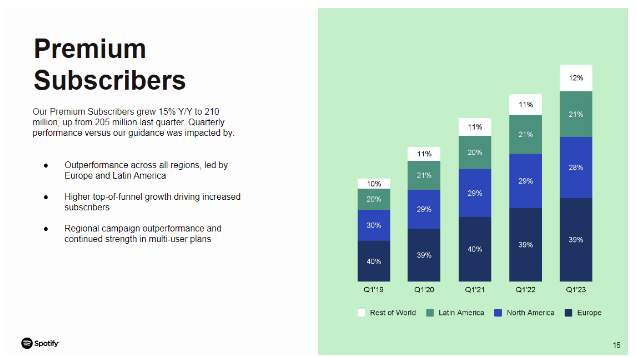

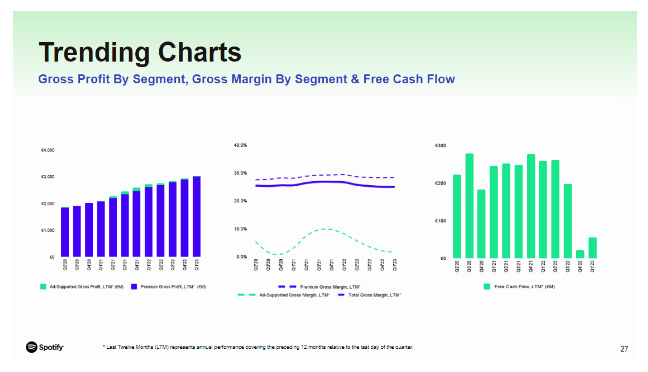

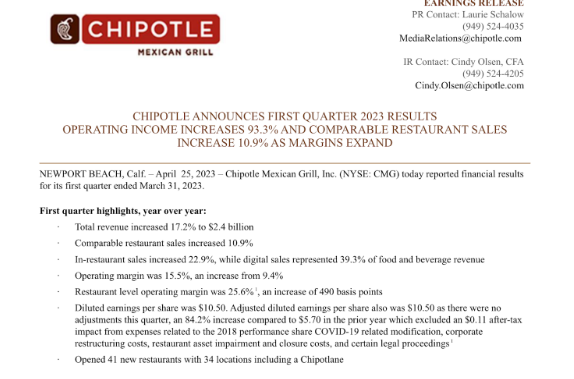

- Great Quartr: Promo code AnimalSPIRITS (one word) only for the full year

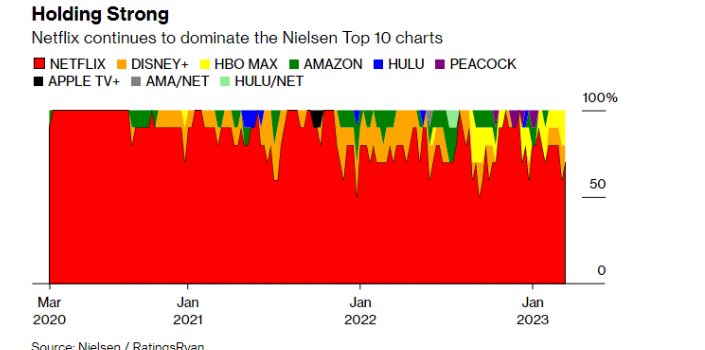

- These are the most popular TV shows on the internet

Future Proof:

Listen Here:

Recommendations:

Charts:

Tweets:

surging Big Tech (big 7 up 31% YTD vs 3% for rest of S&P 500) pic.twitter.com/viVzpiZ3M8

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) April 28, 2023

https://twitter.com/katie_martin_fx/status/1650901959199670284?s=43&t=5gCjdH7Y55vaEUt3JGR2sg

APOLLO: “None of the indicators the NBER recession committee normally looks at suggest that we are in a recession at the moment.” [Slok] pic.twitter.com/of272RzxeX

— Carl Quintanilla (@carlquintanilla) April 26, 2023

Here's a breakdown of GDP by component

Consumer spending was the biggest boost to growth, and inventories were the biggest drag pic.twitter.com/GErtgTv1TZ

— Callie Cox (@callieabost) April 27, 2023

Just a reminder that the dollar size of the economy still far exceeds the pre-pandemic trend path. And it was not because of some immaculate spending that emerged out of nowhere. It was a policy choice, one that both propelled inflation and spurred a rapid recovery. @jasonfurman pic.twitter.com/d8BAXS7mOi

— David Beckworth (@DavidBeckworth) April 27, 2023

U.S. house prices have turned around, going from modest declines to modest growth in most regions

notably, prices in the Pacific and South Atlantic Divisions still falling per latest FHFA house price report. Other regions positive pic.twitter.com/wMlfQ2ruFo

— 📈 Len Kiefer 📊 (@lenkiefer) April 26, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.