There were a number of reasons for the large losses in financial markets this past year — the Fed went on a rating hiking rampage, bond yields rose a great deal, inflation hit 40 year highs, there was a war and about a dozen other factors.

However, there was also an Occam’s razor answer for the losses in financial markets in 2022.

Sometimes the reason asset prices fall is because they went up too much in the first place.

If you look at last year’s performance numbers in a vacuum you would assume the world is coming to an end. But if you look at last year’s performance numbers in the context of the returns that preceded them, the losses make a lot more sense.

For instance, the S&P 500 was down 18% in 2022 and that was a very bad year for the market. But the S&P was up more than 31% in 2019, 18% in 2020 and nearly 29% in 2021.

The Nasdaq 100 showed even higher returns leading up to its nearly 33% losses in 2022. The tech-heavy index gained 39% in 2019, 49% in 2020 and 27% in 2021. That was good enough for a 3 year total return of more than 160% from 2019-2021. Even with the one-third drop in prices in 2022, the Nasdaq 100 is still up almost 80% since 2019.

You can’t expect gains to be that high forever. Markets don’t work like that.

The gains and losses were even more pronounced for many of the high-flying funds and individual stocks.

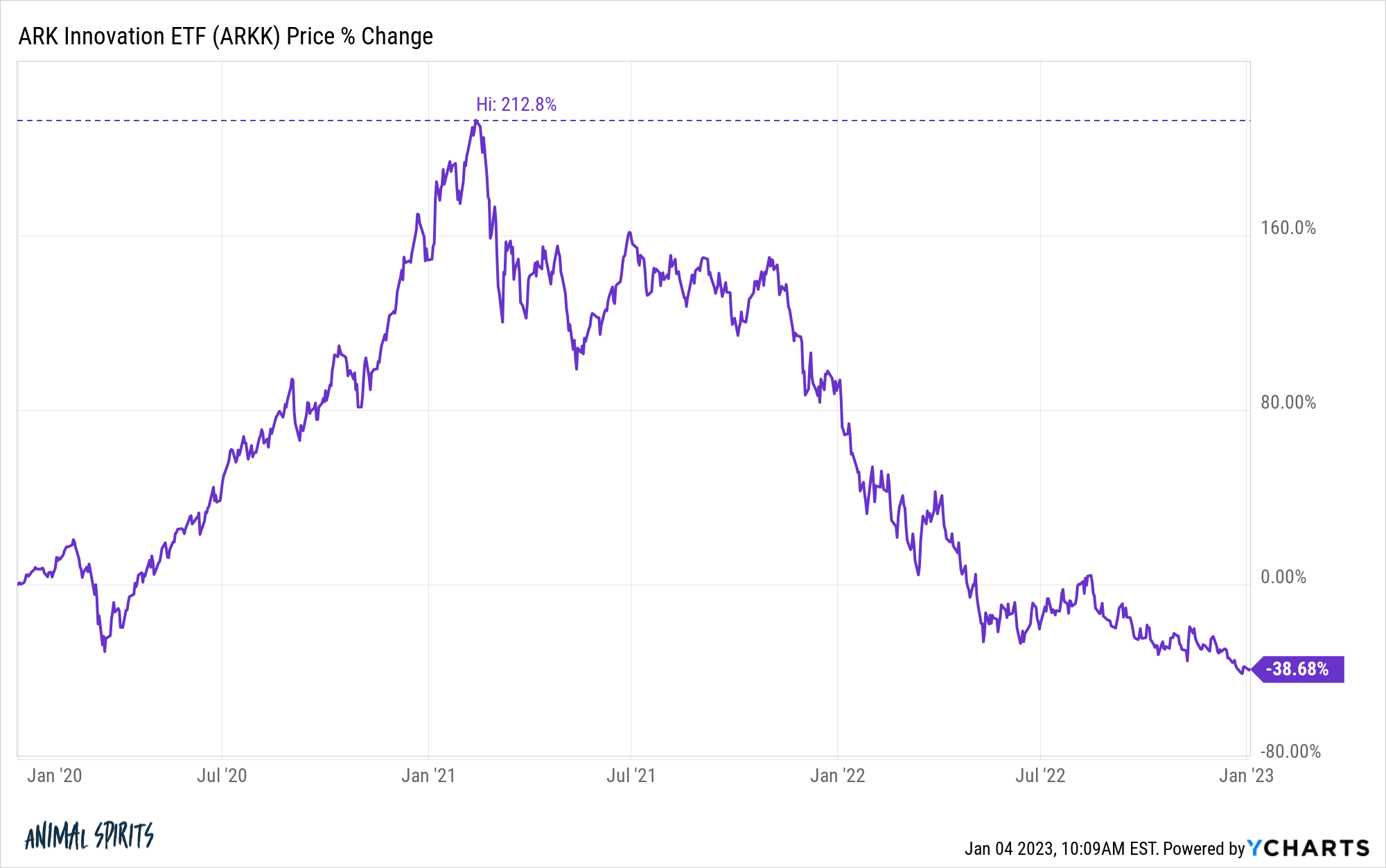

How could a fund like ARK Innovation fall 23% in 2021 and then another 67% in 2022?

Probably because the fund was up more than 210% from the start of 2020 until it peaked in early-2021.

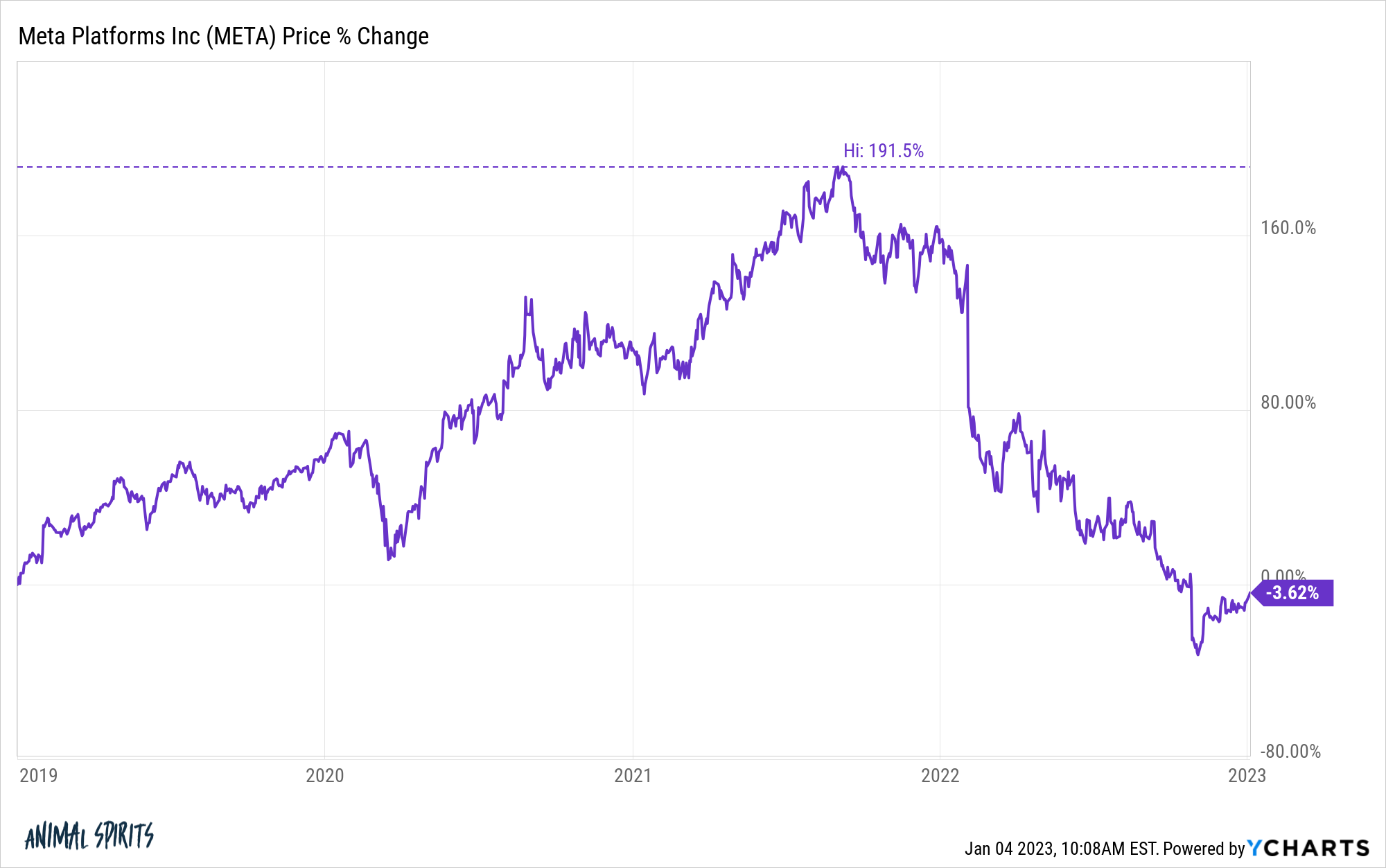

How could a stock like Facebook fall 64% last year?

Probably because the stock was up nearly 200% from the start of 2019 through the fall of 2021.

How could a stock like NVIDIA get cut in half in 2022?

Gains of 77%, 122% and 126% in the prior 3 years might have something to do with it.

How could Tesla crash 65% for its worst year ever as a public company?

Maybe because the share price rose more than 740% in 2020 and another 50% from there in 2021.

I could go through countless other examples of stocks with similar return profiles that got wrecked in 2022 — Amazon, Netflix, Paypal, Shopify, Peloton, Zoom, Carvana and a host of others.

There’s a reason it’s called mean reversion and not nice reversion.1

We have a tendency to extrapolate the recent past indefinitely into the future, so the pendulum almost always swings too far in both directions.

When investors are too greedy they bid up prices and expectations to the point of madness. And when investors are fearful they sell first and ask questions later.

The highs usually go too high and the lows usually overshoot to the downside.

The hard part about mean reversion is it doesn’t operate on a set schedule. The human psyche is not as reliable as physics.

You could be right about the eventual direction of an asset but completely off on the timing because it’s impossible to predict regime changes with precision.

Alan Greenspan coined the phrase irrational exuberance about the stock market in December 1996. He was right about the idea but wrong about the timing.

Stocks did eventually crash, but from the time of his speech through the end of the 1990s, the S&P 500 would rise an additional 100%. The Nasdaq was up nearly 220% from there.

Big gains and big losses are part of the deal when investing in the markets because we humans can’t help but take things too far. Unfortunately, our emotions are so unpredictable that it’s difficult to time the wild swings in either direction.

Just know that you can’t expect to earn huge gains year after year without a high probability of huge losses to follow.

Further Reading:

Nothing Fails Quite Like Success in the Stock Market

1I know this is not the real reason but it works here so just go with it.