I don’t like making big, bold macro predictions.

There are too many unknown variables involved and even if I did nail my macro forecast, it probably wouldn’t help my portfolio anyway since the market reaction to the economic data is more important than the data itself.

Last week Michael and I were on Plain English with Derek Thompson discussing the confusing nature of the current macro environment.

You could easily talk yourself into a number of different scenarios right now so it’s not difficult to see both sides at the moment of many economic arguments.

But Derek held our feet to the fire, basically forcing us to pick a side: Gun to your head — recession or no recession in 2023?

Forced to choose I said no recession. So did Derek and Michael.

This answer was surprising to each of us because if you had asked me the same question 9-10 months ago, I would have definitely said yes to a recession in 2023.

Why?

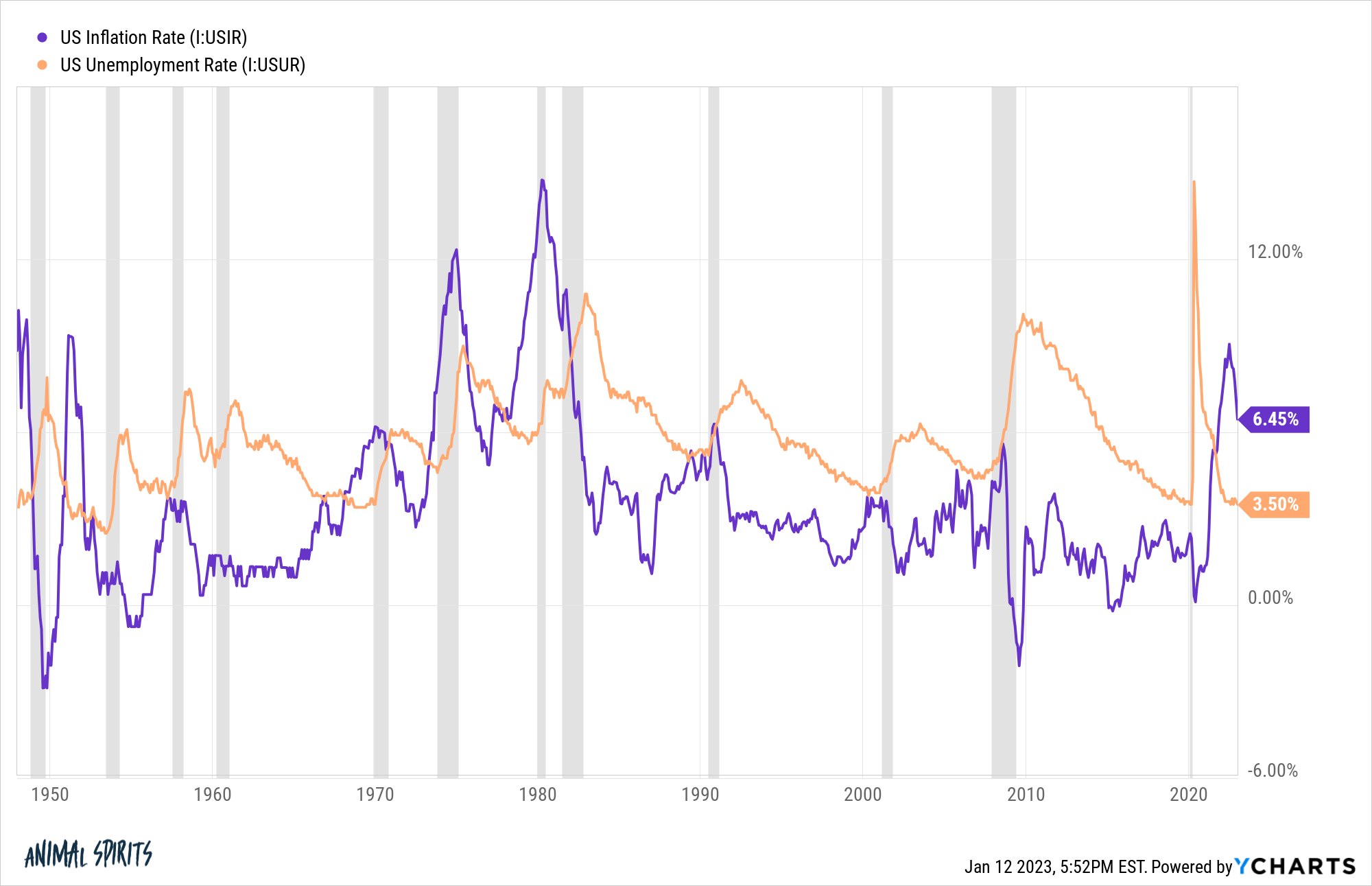

For one, every time we’ve experienced a big spike in inflation historically, we’ve needed a recession and a rise in the unemployment rate to bring inflation back down:

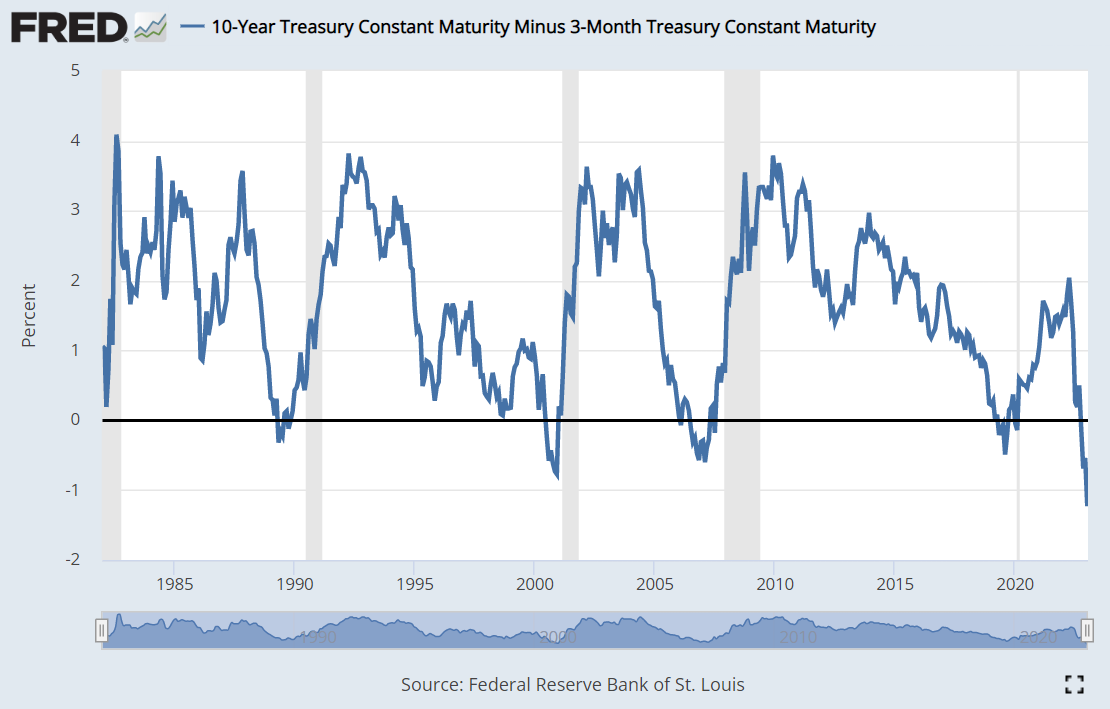

Another indicator that’s been flashing red for some time now is the yield curve, which is about as inverted as it’s ever been:

Short-term bond yields are much higher than long-term bonds and this is an indicator with a perfect track record of front-running a recession (although it doesn’t happen right away).

If you use market or economic history as a guide, it would be almost impossible to think we could avoid a recession. Plus, things were already trending in the wrong direction for inflation and then the war happened which only made things worse.

It almost doesn’t seem logical to consider a soft landing in the economy where inflation falls, the unemployment rate doesn’t rise too much and GDP growth doesn’t take too much of a hit.

I think it’s possible we could buck the trend here is for a few reasons:

The labor market remains strong. I’ve never seen anything like the current jobs market. There are still businesses that can’t find enough employees. Wages keep rising (although at a slower pace). The unemployment rate continues to fall.

Workers have likely never had more bargaining power than they do right now.

Just look at wage growth by gap broken out by people changing jobs versus people staying in their current role:

If you switch jobs right now, there is a much better chance of getting a bigger raise than if you stay put.

This is the first time in 40-50 years that workers finally have the upper hand over employers.

Can this continue?

I honestly don’t know. If it does it would make sense that we can avoid a big-time slowdown in the economy.

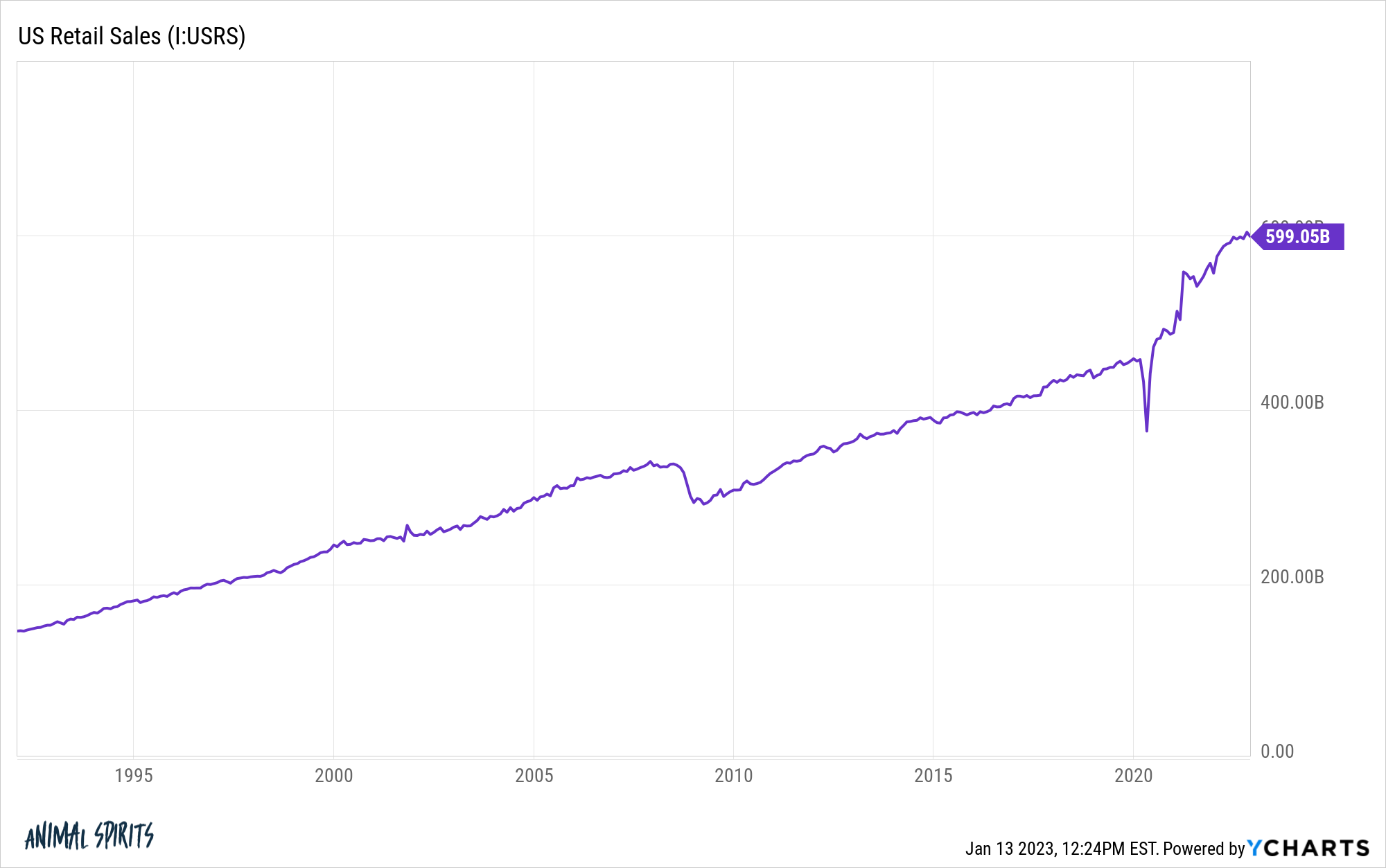

The consumer was prepared for a slowdown. U.S. households have likely never been better positioned to ride out high inflation or the potential for a slowdown in the economy.

Consumers were already repairing their balance sheets by paying down debt and building up savings following the Great Financial Crisis. Then the pandemic hit, the government sent out a bunch of money, people stopped spending because they couldn’t do anything and the result was trillions of dollars in excess savings.

The combination of pent-up demand and excess savings has led to an explosion of spending:

Things are finally starting to slow a bit but we’re still nowhere near pre-pandemic spending levels.

And once people get the taste for spending money it’s hard to put that genie back in the bottle.

It might take a recession to get households to rein in their spending.

The pandemic broke economic logic. One of the biggest economic surprises in a cycle filled with them is the fact that nothing has really broken yet. There was this assumption that the markets and the economy couldn’t possibly handle higher rates and that was the reason the Fed kept them so low to begin with.

Not only did borrowing rates rise in 2022, they did so at just about the fastest pace in history.

But a strange thing happened — nothing broke. Yes, financial markets took a hit but the economy has remained resilient. No financial crisis was caused. The unemployment rate didn’t rise.

And inflation is rolling over.

Obviously, it’s possible something still could break.

Maybe all of those excess savings have simply delayed the inevitable. It’s still possible the economy could slow here or inflation could pick back up in the coming year. Or maybe we don’t get a recession until 2024 or 2025.

All I know is I wasn’t really even considering a soft landing when inflation hit 9% but it does feel like there is a chance of staving off a recession because the labor market has remained so buoyant.

And if we do get a soft landing the outlook for markets, rates and the economy probably have to change. I have more questions than answers if this happens:

What if a recession was going to be more bullish for the stock market than continued strength in the economy and labor market?

My assumption was the Fed would have to cut rates after they broke something in the economy. If nothing breaks, that could be good for the markets but it could also present a headwind if rates stay higher for longer.

If we don’t go into a recession, does that mean those juicy yields investors can get on their short-term savings will be around for the time being?

This would be a welcomed development for fixed income investors. You can now earn 4-5% on high-quality short-term debt instruments. If you want to take some more risk, yields are now in the 6% to 9% range depending on your risk profile.

This one is hard to wrap your head around at the moment since longer-term yields are now so much lower than shorter-term yields. That can’t last but the Fed is the one pulling the strings right now so who knows?

Is a non-recession inflationary?

If “everyone” thought we were going to get a recession but it doesn’t happen does that put the inflation risk back on the table? Will businesses begin spending more money? Will households spend even more?

It’s weird to think about the fact that administering a soft landing could actually create more economic complications.

Is inflation coming down because of or despite the Fed?

The Fed has explicitly stated that they want the labor market to soften. And it’s not just that they want wages to stop rising so fast — they want people to lose their jobs to bring inflation down.

But we’re seeing inflation fall right now without a commensurate rise in the unemployment rate.

Maybe the Fed isn’t responsible for inflation falling and it has more to do with pandemic factors running their course than anything.

Sign me up for a situation where we can resolve this crisis without millions of people losing their jobs.

Michael and I discussed the possibility of no recession in 2023 and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

What Kind of Landing Are We Going to Get in the Economy?

Now here’s what I’ve been reading lately:

- What investment beliefs do you hold that most people disagree with? (Meb Faber)

- Why remote work has legs (USA Today)

- Are declining rates responsible for all of the stock gains? (Dollars & Data)

- 2022 was a record year for stock market dividends (Dividend Growth Investor)

- The olympian and the mutated gene (Pro Publica)

- Statistical sobriety (A Teachable Moment)