A reader asks:

Laid off twice, once in 2015, again in 2020 due to Covid. 5 jobs since then, currently VP of Sales at a logistics company. I’ve got about 5 months of household income saved, and for a few years it sat in my Vanguard Brokerage account, earning zero in their stable value fund. Stupid? Maybe, but it was safe. So, where do you recommend people put their funds specifically designated as “Emergency Funds”? What do you think about online banks?

I was in the same boat with my savings account, earning next to nothing for years.

Now the situation is completely different. With the Fed raising rates so aggressively, savers can finally earn decent yields on their cash in safe, liquid vehicles.

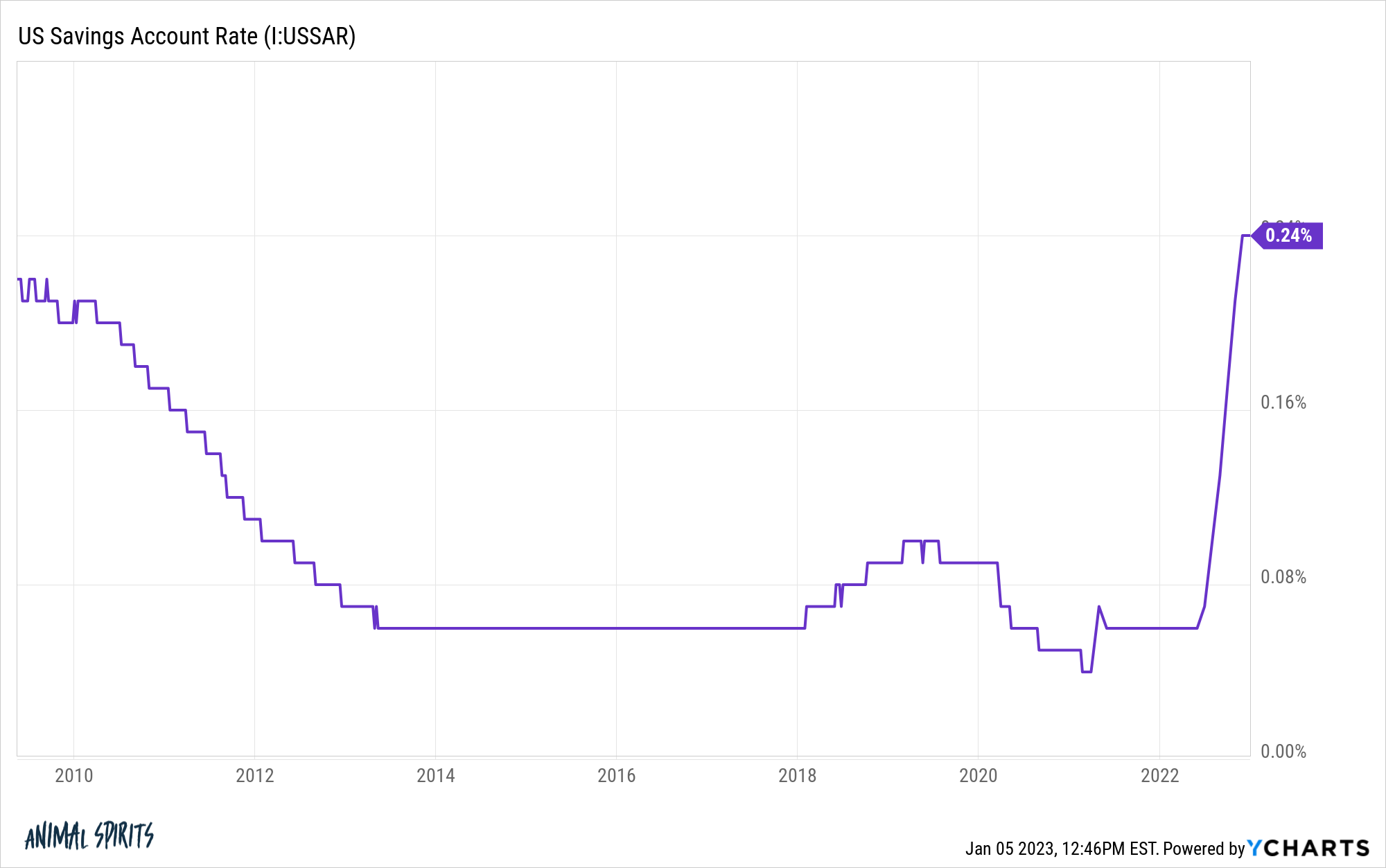

Just don’t expect to find much yield if you keep that money at a big brick-and-mortar bank. This is the average savings account rate for all financial institutions in the United States that are insured by the FDIC:

This feels criminal to me with the Fed Funds Rate above 4% and short-term Treasury bills yielding almost 5%.

There are likely trillions of dollars sitting in these savings accounts earning bubkis.

I am a fan of online savings accounts. I’ve probably used one or all of them at some point over the past 10 years or so.

The reason online banks are able to offer higher yields is because they have no bank branches where you have to walk through that maze of ropes to get to the teller. There aren’t as many overhead costs and there is more competition online.

Off the top of my head there is Ally, Marcus, Capital One 360, SoFi and probably a bunch of others I am missing. You also have cash management options at places like Betterment, Wealthfront and Robinhood. A quick internet search of these providers gave me rates somewhere in the range of 3.3% to 3.8%.

That’s not enough to live off the interest but it’s much better than the 0.25% rates many places were offering at the outset of the pandemic when the Fed took rates to zero.

There are other options out there as well. You can find a plethora of ETFs with Treasuries in duration of 1 year or less than pay 4% or more right now.

I saw a 12 month CD this morning at 4.3%.

I’ve seen money market rates as high as 4% or more at many of the large fund companies in recent weeks.

Series I Savings Bonds are still sporting a 6.9% yield until April (at which point I would expect that yield to drop quite a bit).

There are plenty of options.

Do your homework as always, but savers no longer have to go far out on the risk curve to find yield for cash and short-term savings goals.

We talk a lot about risk tolerance for investors but few people ever discuss risk tolerance for your personal finances.

This reader has obviously dealt with some volatility in their career with all of the layoffs and job changes so that should color how they think about allocating those funds.

Another reader asks:

I have over 180 hours of PTO that I will never even come close to fully collecting. Those hours equal to 4.5 weeks of vacation or pay if I resign or get laid off. Do you think it’s a viable option to use my unused PTO as an emergency fund? I’m building up my liquid cash emergency fund and I have close to two months saved. If this is a viable option, two months of cash savings is all I would need to save. Thoughts?

Some experts think you need at least 3 months’ worth of spending in savings as a fallback plan. Others want you to have 6 months of spending in an emergency account. Still others go out one year.

My stance has always been that 12 months is a ridiculous number for 90% of the population. Most people would have to forgo all other forms of saving for quite some time to get to that amount.

Two months of spending plus another month of pay is a nice fallback plan.

This one depends on how you define an “emergency.”

How easily could you cash in on that vacation pay in a pinch if you really needed the money right away?

Would it take some time for your company to pay it out?

Are you sure that money is coming to you if you get laid off?

Personally, I would feel safer if I had the money in my account as opposed to relying on the company paying it out someday.

A lot of it comes down to what you consider an actual emergency versus some infrequent expenses that you should bake into your budget on a periodic basis.

There are infrequent expenses for things like car repairs, home maintenance, healthcare, etc. that you can and should plan for in advance even if you don’t know the exact amounts or the timing of the outlays.

I wouldn’t consider those emergencies, just periodic spending that isn’t on a set schedule.

Losing your job is definitely an emergency so your employability and career field should come into play here as well.

It also depends on what other kinds of back-up savings you’re willing to tap.

Do you have a home equity line of credit? Taxable investment accounts? Roth IRA contributions? Maybe a 0% introductory rate credit card?

Some people are more comfortable than others when it comes to tapping these sources for liquidity.

My whole thing with my savings account is I don’t want to jump through a bunch of hoops to get my money out or earn some more yield.

Ben’s cash philosophy boils down to safety, security, liquidity and ease of access (both into and out of your account).

The good news is you don’t have to jump through a lot of hoops right now to find better yields for your savings. This is the first time we can say that in many years.

We answered these questions and more on Portfolio Rescue this week:

We also hit on questions about inflation, investing in the stock market and how to think about your portfolio in retirement.

Further Reading:

How Series I Savings Bonds Work