Today’s Animal Spirits is brought to you by YCharts:

Enter your information here to claim a FREE YCharts Professional account through December 16th, 2022 (first 100 submissions)

On today’s show we discuss:

- Immaculate disinflation hopes dashed?

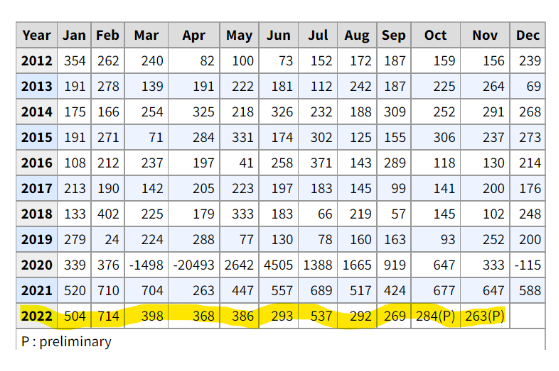

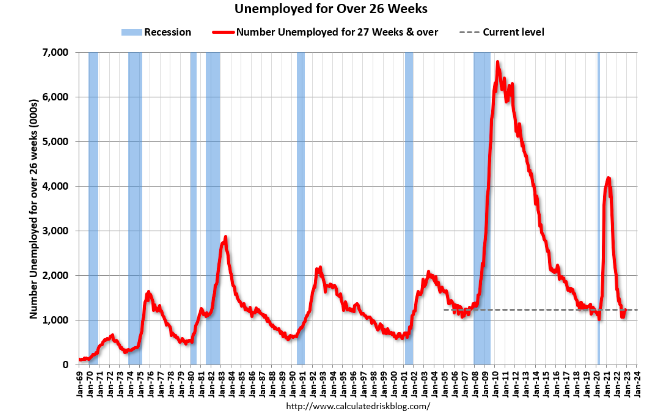

- Comments on the November employment report

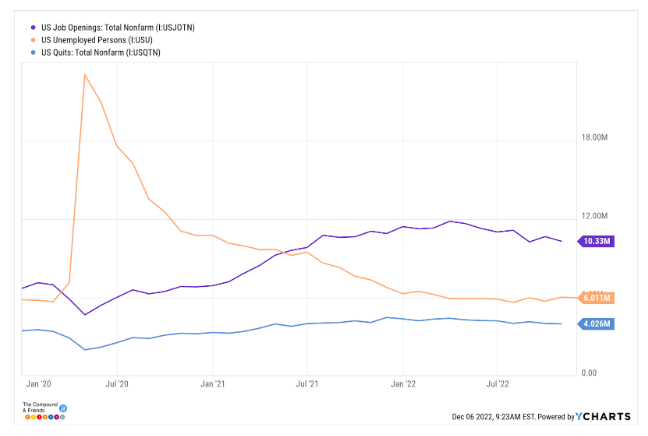

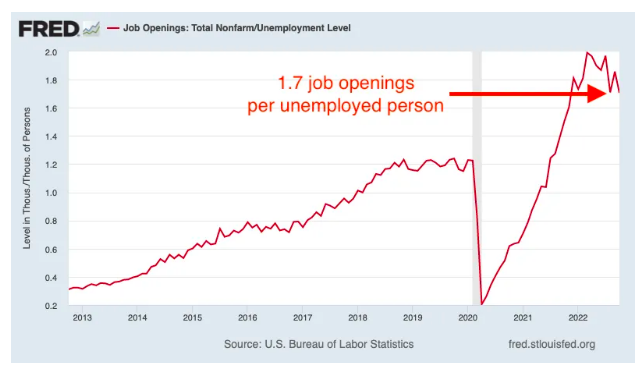

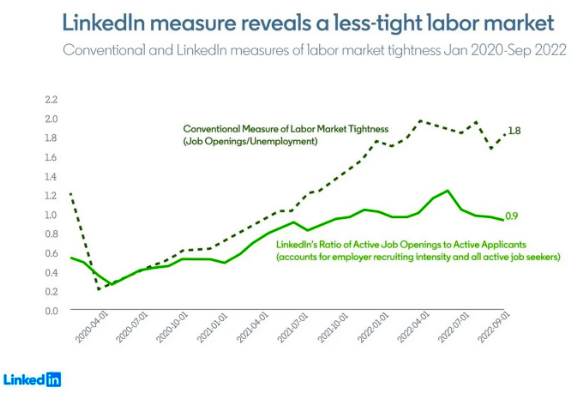

- Were there really twice as many job openings as unemployed people?

- Sam Bankman-Fried’s hedge fund took a big hit to prop up FTX exchange

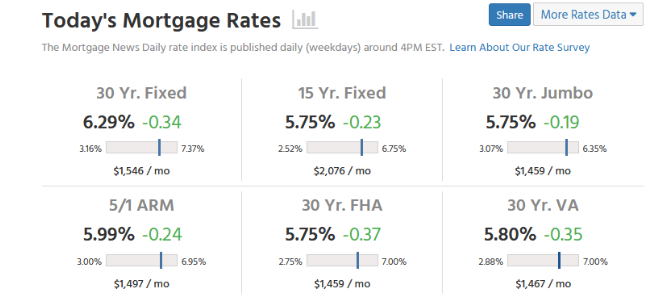

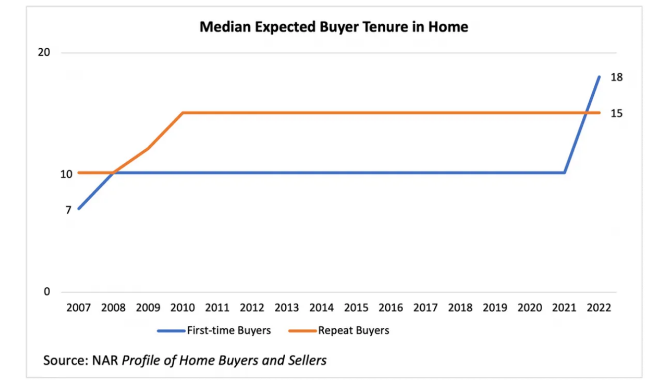

- Forecasting real estate trends for 2023

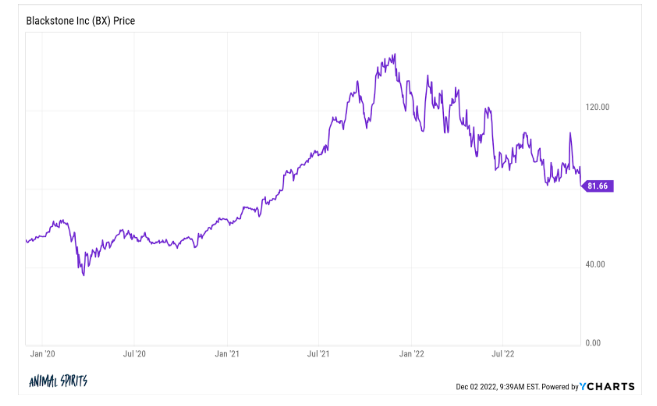

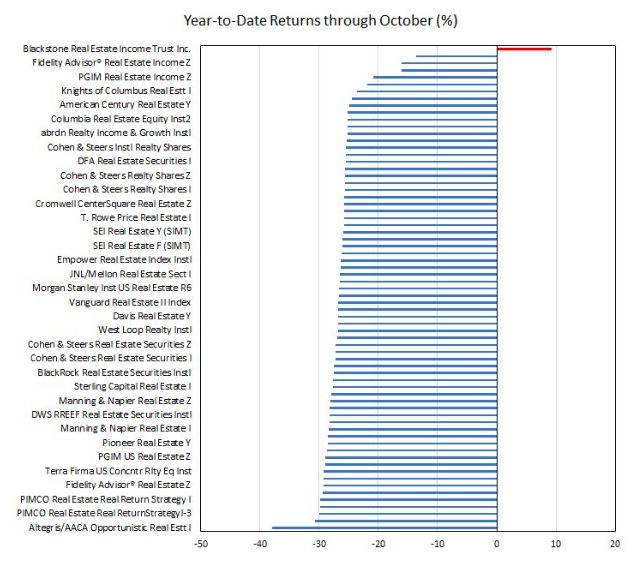

- Blackstone limits redemptions from real estate vehicle, stock sinks

- When it comes to investments, the VIP section isn’t always better

- Blackstones BREIT stockholder FAQs

- 11 takeaways from the 2022 profile of home buyers and sellers

- Was this $100B deal the worst merger ever?

- Liverking responds to steroid allegations

- Your creativity won’t save your job from AI

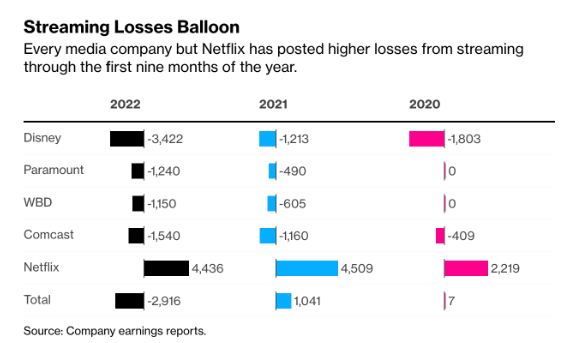

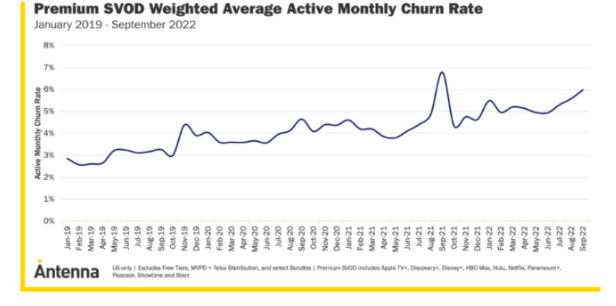

- Hollywood wants you back in theaters, whether you want to or not

Listen Here:

Recommendations:

Charts:

Tweets:

A look at the shift of active/passive market shares across major @MorningstarInc category groups in the U.S. mutual fund and ETF universe over the 20 years through October 2022. pic.twitter.com/RnqmOVxv8c

— Ben Johnson, CFA (@MstarBenJohnson) November 30, 2022

You probably want to revise your views on inflation and it’s overall dynamic more based on today’s jobs report than any other data report this entire year.

And not in a favorable direction.

— Jason Furman (@jasonfurman) December 2, 2022

You probably want to revise your views on inflation and it’s overall dynamic more based on today’s jobs report than any other data report this entire year.

And not in a favorable direction.

— Jason Furman (@jasonfurman) December 2, 2022

The continued strength of real consumer spending is pretty remarkable. Accelerating over the past few months as inflation has eased. pic.twitter.com/8abbOr4QaA

— Ben Casselman (@bencasselman) December 1, 2022

Wow: the October personal saving rate was the second lowest ever recorded (data goes back to 1959).

The two-month moving average was actually the lowest ever recorded and the three-month moving average was the third lowest. pic.twitter.com/a0oKqRtKbk

— Jason Furman (@jasonfurman) December 1, 2022

A look at the shift of active/passive market shares across major @MorningstarInc category groups in the U.S. mutual fund and ETF universe over the 20 years through October 2022. pic.twitter.com/RnqmOVxv8c

— Ben Johnson, CFA (@MstarBenJohnson) November 30, 2022

Look at $JEPI & $USFR sneaking into the Top 10 ETFs by YTD flows with >$10b each, a massive feat for a non-Big Five firm with non-core ETFs. Sub-plots: JPM has left rival Goldman in dust and WisdomTree has hustled its way to new life after curr-hedged hangover. h/t @psarofagis pic.twitter.com/MbwWYyMpse

— Eric Balchunas (@EricBalchunas) December 6, 2022

Lumber makes the round-trip. Back to pre-pandemic levels. pic.twitter.com/U9BGllD1K6

— Steve Saretsky (@SteveSaretsky) December 2, 2022

Google searches for "inflation" fell to their lowest level since the start of the year in November. Searches are still highest in the DC area. pic.twitter.com/OjYSZk077Y

— Bespoke (@bespokeinvest) December 2, 2022

The biggest news in this release is large upward revisions in wage growth for September and October and a big number for November.

This is the second time this year we've seen AHE revisions like this dashing the hopes that maybe nominal wages growth was cooling. pic.twitter.com/gRxGnv5e3B

— Jason Furman (@jasonfurman) December 2, 2022

Our releases from the Strategic Petroleum Reserve – and my call for global partners to release reserves of their own – have helped gas prices drop below where they were prior to Putin’s invasion of Ukraine.

We're blunting Putin's price hike.

— President Biden (@POTUS) November 29, 2022

Nearly a third of the discussion about “Job Cuts” from US company earnings calls are stemming from the technology sector, which doesn’t employ that many people. @SamRo in @TKerLLC says less than 3% of total employment.

Made using {TA<Go>} pic.twitter.com/sYKVySF4vV

— Michael McDonough (@M_McDonough) December 2, 2022

*WELLS FARGO CUTS HUNDREDS MORE MORTGAGE EMPLOYEES ON SLOWDOWN

— zerohedge (@zerohedge) December 1, 2022

https://twitter.com/JHWeissmann/status/1597671746815291392

BREAKING: The Senate voted down a deal, 52-43 that would have granted rail workers 7 paid sick days.

This was the crux of the rail strike standoff. Railroad workers in the U.S. do not receive a single paid sick day.

— Lauren Kaori Gurley (@LaurenKGurley) December 1, 2022

42% of homes have no mortgage as of Q2 2022! That is incredible https://t.co/Z0N1FnP5PV

— Taylor Marr (@TaylorAMarr) December 2, 2022

Robinhood to pay a 1% 'match' on customer contributions to retail individual retirement accounts https://t.co/1QoVUsakqY

— CNBC (@CNBC) December 6, 2022

SHOCKING: Liver King was on steroids 💉

Leaked emails shows that Liver King was taking almost $12k worth of pharmaceutical HGH per month, three injections per day. All while promoting his brand of holistic lifestyle, ancestral tenants, and eating raw meat on camera. pic.twitter.com/dl6AhuknBP

— OutKick (@Outkick) November 29, 2022

— Joe Weisenthal (@TheStalwart) December 2, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.