Today’s Animal Spirits is brought to you by AcreTrader and Composer:

See here for more information on AcreTrader and here for AcreTrader disclosures

See here for more information on Composers’ new one-click portfolio and here for Composer disclosures

On today’s show we discuss:

- FTX Held less than $1B in liquid assets against $9B in liabilities

- FTX’s balance sheet was bad

- FTX balance sheet, revealed

- FTX tapped into customer accounts to fund risky bets, setting up its downfall

- SBFs FTX empire faces US probe into client funds

- Sequoia on FTX

- It’s Ok to build wealth slowly (AWOCS)

- Tiger Global slashes value of private tech bets by billions

- The classic 60-40 investment strategy falls apart. “There’s no place to hide.”

- 50 years later, Burton Malkiel hasn’t changed his views on indexing

- Radium Payments

Listen here:

Recommendations:

Charts:

Tweets:

Goldman Sachs reports that its intra-day estimate of U.S. financial conditions from its financial-conditions index eased by over 50 basis points today following the rally triggered by the October CPI print. That is the third-largest single day decline on record.

— Nick Timiraos (@NickTimiraos) November 11, 2022

https://twitter.com/cullenroche/status/1590705967683207169?s=12&t=HZFzftz_gqcw4U-6RBm2Zw

Growth vs value: pic.twitter.com/Z66RO2ytI9

— The Transcript (@TheTranscript_) November 8, 2022

Today a lot of consensus shorts were quietly carted away feet first.

Goldman's non-profitable tech basket was up 15.2%, the biggest one-day move on record! pic.twitter.com/T3cG3Hc709— zerohedge (@zerohedge) November 11, 2022

If there was a museum for ETF charts this one from @psarofagis should be hanging in it. Shows ETF issuer market share by assets, flows, products, revenue and trading. It's all there. Enjoy.. pic.twitter.com/SxpqQt97Mb

— Eric Balchunas (@EricBalchunas) November 8, 2022

The two-year Treasury yield is down to 4.353% today and on pace for its biggest one-day yield decline since **September 2008**

— Gunjan Banerji (@GunjanJS) November 10, 2022

1/ I found evidence that FTX might have provided a massive bailout for Alameda in Q2 which now came back to haunt them.

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇 pic.twitter.com/DtCyPspME0

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

Sequoia on SBF: "To do the most good for the world, SBF needed to find a path on which he’d be a coin toss away from going totally bust."https://t.co/6fi5GnB0J7

— Samuel Lee (@svrnco) November 10, 2022

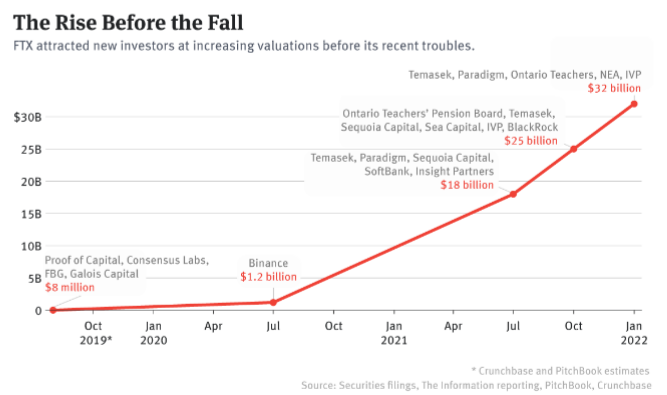

FTX over the last 18 months:

July '21: Raises $900M at $18B

Oct '21: Raises $420.69M at $25B

Jan '22: Raises $400M at $32B

Jul '22: Bails out BlockFi for $250M

Sep '22: Buys Voyager for $1.4B

Nov '22: Acquired by Binance— Tanay Jaipuria (@tanayj) November 8, 2022

FTX Valuation over 2 years. pic.twitter.com/q9vcSQTowk

— Quinten | 048.eth (@QuintenFrancois) November 10, 2022

It’s impressive how this just keeps getting worse

~$380 million of funds just moved from FTX wallet — strange for a Friday night

Wallet: 0x59abf3837fa962d6853b4cc0a19513aa031fd32b

— Will (@WClementeIII) November 12, 2022

This has to be one of most insane parts of this saga. FTX faking an order from the Bahama regulators to sneakily withdraw funds while everything was paused, only to have the Bahama regulator say that FTX was lying! pic.twitter.com/slhMjoVLR3

— Coffeezilla (@coffeebreak_YT) November 13, 2022

This thread will be our last serious one on the topic before we go back to our normal updates and shitposting

We have one of the highest revenue/profit/valuation per employee as any company in the world

— FTX (@FTX_Official) November 7, 2022

FTX ventures or Alameda venture deals with the ones they led highlighted pic.twitter.com/GVGXmxID1p

— Tom Dunleavy (@dunleavy89) November 9, 2022

Bankman-Fried sold FTX equity to employees at 50% discount in spring: Sourceshttps://t.co/8GF6K4fn1e

— The Block (@TheBlock__) November 10, 2022

🚨 JUST IN —

The entire team behind the FTX Future Fund, the Sam Bankman-Fried philanthropy, has resigned.

A holy-shit moment in the world of effective altruism. pic.twitter.com/5YY886OdNh

— Teddy Schleifer (@teddyschleifer) November 11, 2022

The whole damn point of crypto is so that you don’t have to say, “I wonder what that company is actually doing with my money”

— Robert Leshner (@rleshner) November 8, 2022

(2) They buried the lede here $COIN pic.twitter.com/cArCtDVgXa

— . (@WallStCynic) November 12, 2022

Faber on CNBC: $16B in FTX client funds. $5B withdrawn before bankruptcy won't be clawed back. Recovery maybe 10-20c on the dollar for remainder.

— ForexLive (@ForexLive) November 15, 2022

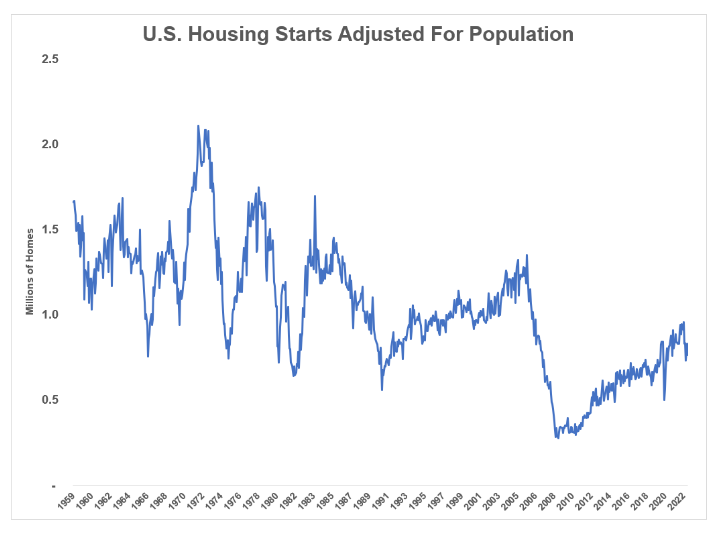

New Home Cancellations increased Sharply in Q3

"Significant shift in market conditions" https://t.co/d3XKOvGRmKIn general, cancellation rates doubled or tripled in the most recent quarter compared to 2021. pic.twitter.com/meWsaRlwh0

— Bill McBride (@calculatedrisk) November 9, 2022

#Harrisburg builder: "October was the worst sales month in 12 years. No buyers, no sales."

— Rick Palacios Jr. (@RickPalaciosJr) November 9, 2022

UPDATE

Among the country's 400 biggest housing markets, 219 have seen home values fall off their 2022 peak. The average decline being -2%.

Another 181 markets remain at their 2022 peak price.

Source: Zillow Home Value Index pic.twitter.com/nnisgTMHQg

— Lance Lambert (@NewsLambert) November 15, 2022

The Streaming Wars visualized 📈

As per yesterday's earnings release, $DIS has officially overtaken $NFLX's total paying subscriber base. It will be very interesting to see what happens when they both introduce their ad-supported tiers. pic.twitter.com/8tPJrW3Yy1

— Quartr (@Quartr_App) November 9, 2022

Over the past three years (through Q1 FY23e), Disney's Direct-To-Consumer (DTC) business has generated cumulative operating losses of ~$8.8 billion

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) November 9, 2022

disney's implied outlook for linear biz is much more terrifying for the industry than the benign and obvious comments Iger made in 2015. today you have a rapid deterioration in subs, weakening ad market, and heavy investment in streaming, against much more levered balance sheets.

— modest proposal (@modestproposal1) November 9, 2022

*DISNEY CLOSES 13% LOWER IN BIGGEST ONE-DAY DROP SINCE 2001

— zerohedge (@zerohedge) November 9, 2022

https://twitter.com/emmakinery/status/1590172342080053248?s=12&t=7BWaEPtlyLzWkm-E0k6OPQ

According to messages shared in Twitter Slack, Twitter’s CISO, chief privacy office, and chief compliance officer all resigned last night.

An employee says it will be up to engineers to “self-certify compliance with FTC requirements and other laws.”

— Casey Newton (@CaseyNewton) November 10, 2022

Crazy how a layoff of 11,000 people at Meta is the No. 3 tech story of the week

— Alex Kantrowitz (@Kantrowitz) November 11, 2022

$AMZN will cut ~10K corporate jobs, the largest headcount reduction in the company's history https://t.co/IFA1VV7wrL

— Vital Knowledge Media (@knowledge_vital) November 14, 2022

$META is laying off ~11,000 employees (or 13% of the workforce). That takes it back to roughly the # of employees it had at the start of the year. If not lower given the hiring freeze was extended thru Q1 as well. https://t.co/lZZl7dYWaM pic.twitter.com/yH8OjINnI1

— Daniel Zhao (@DanielBZhao) November 9, 2022

These lessons have already been learned w $FB / Libra / FinCen debacle.

If you are a social network, with absolutely ZERO regulatory oversight, WHY IN GOD'S NAME WOULD YOU YOLO INTO FINANCIAL SERVICES WHERE YOU WILL BE HEAVILY REGULATED?????https://t.co/gXwl6yAc1x

— Justin M. Overdorff (@jmover) November 9, 2022

REDFIN LAYS OFF 13% OF STAFF, SHUTS DOWN HOME-FLIPPING BUSINESS

— *Walter Bloomberg (@DeItaone) November 9, 2022

You gotta give it to Zillow.

They offloaded the bulk of their iBuyer homes just as the Pandemic Housing Boom hit its peak. pic.twitter.com/ko8hnAsPG8

— Lance Lambert (@NewsLambert) August 9, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. To learn more about the risks of investing in AcreTrader see https://acretrader.com/company/terms#general-disclaimers. To learn more about the risks of investing with Composer see https://www.composer.trade/brochure. For additional advertisement disclaimers see here https://ritholtzwealth.com/advertising-disclaimers/