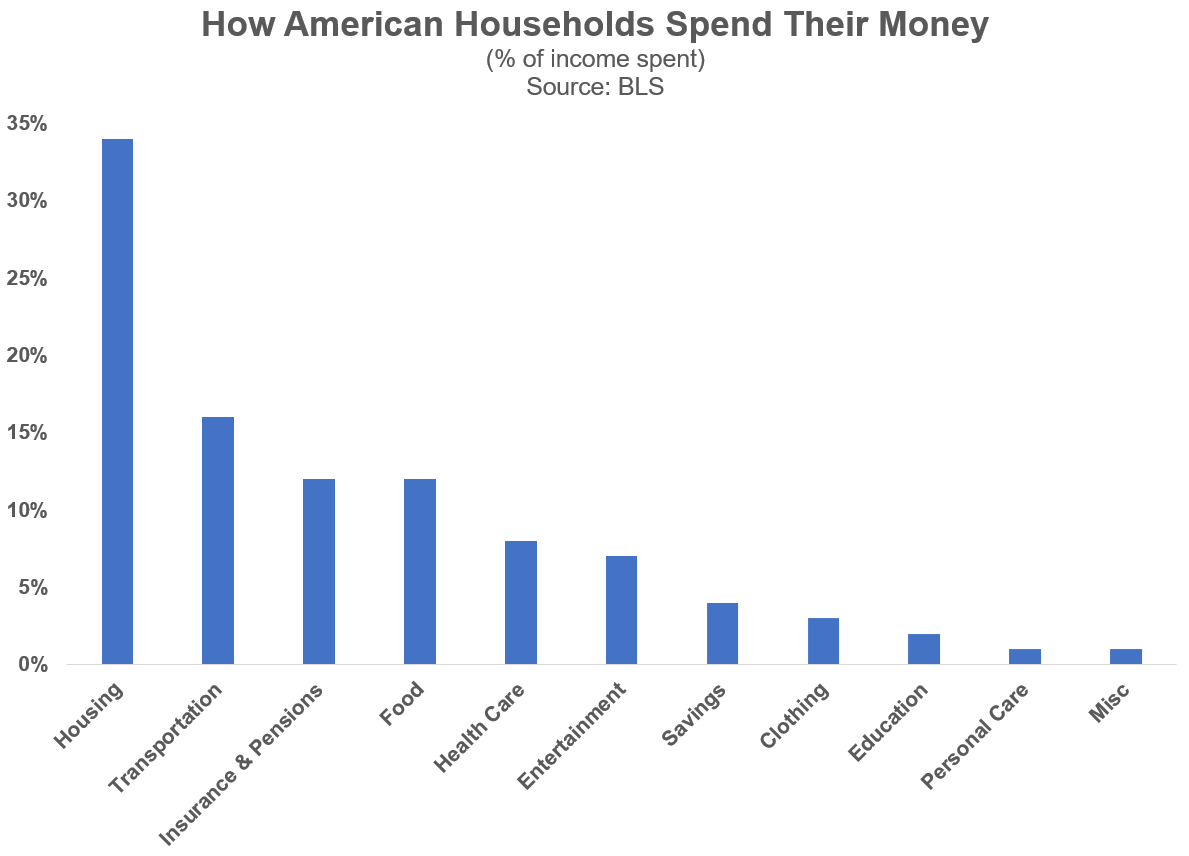

This is how Americans spend their money1 (according to a study by the Bureau of Labor Statistics):

Like most aggregates when you’re dealing with hundreds of millions of people, everyone’s spending is probably somewhat different than these averages.

But directionally these numbers look right to me from a big-picture perspective. The two biggest line items for the majority of households are housing and transportation.

These two categories make up half of the budget in the average American household.

If you want to get ahead financially you have to rightsize housing and transportation. If you spend too much money on your living situation or your vehicle or both you’re going to have a hard time building wealth.

I don’t like to spend shame people but I’ve been concerned for a number of years now about how much people are spending on trucks and SUVs.

It’s getting out of hand.

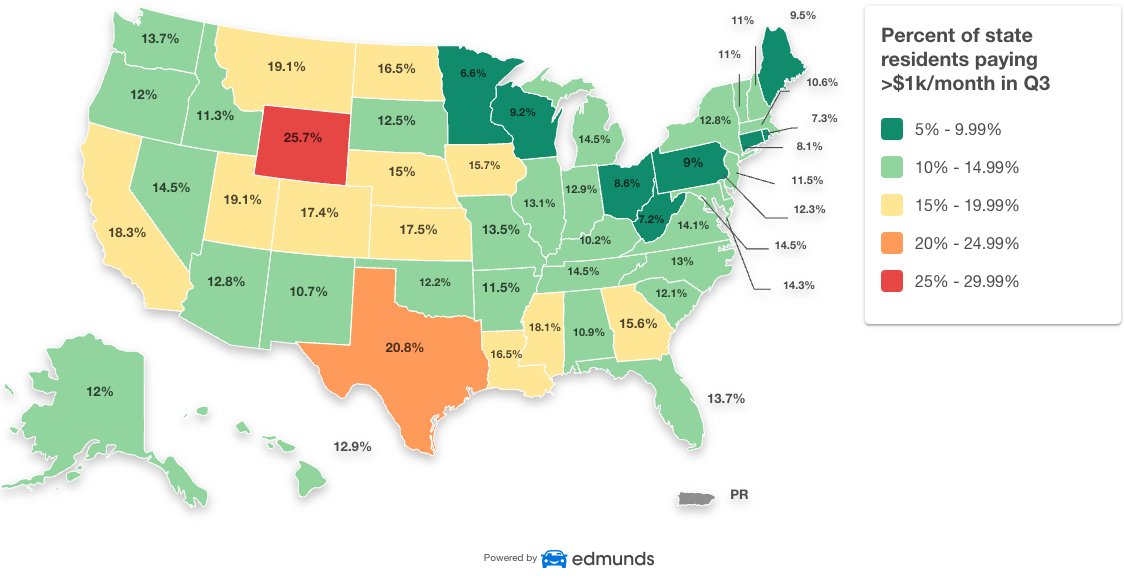

Look at this chart that shows the percentage of residents by state paying $1,000 a month or more for their auto payment:

One-quarter of people in Wyoming are spending more than $1,000/month! More than one-fifth of people in Texas are doing the same. It’s almost 1 in 5 in California.

This is personal finance insanity.

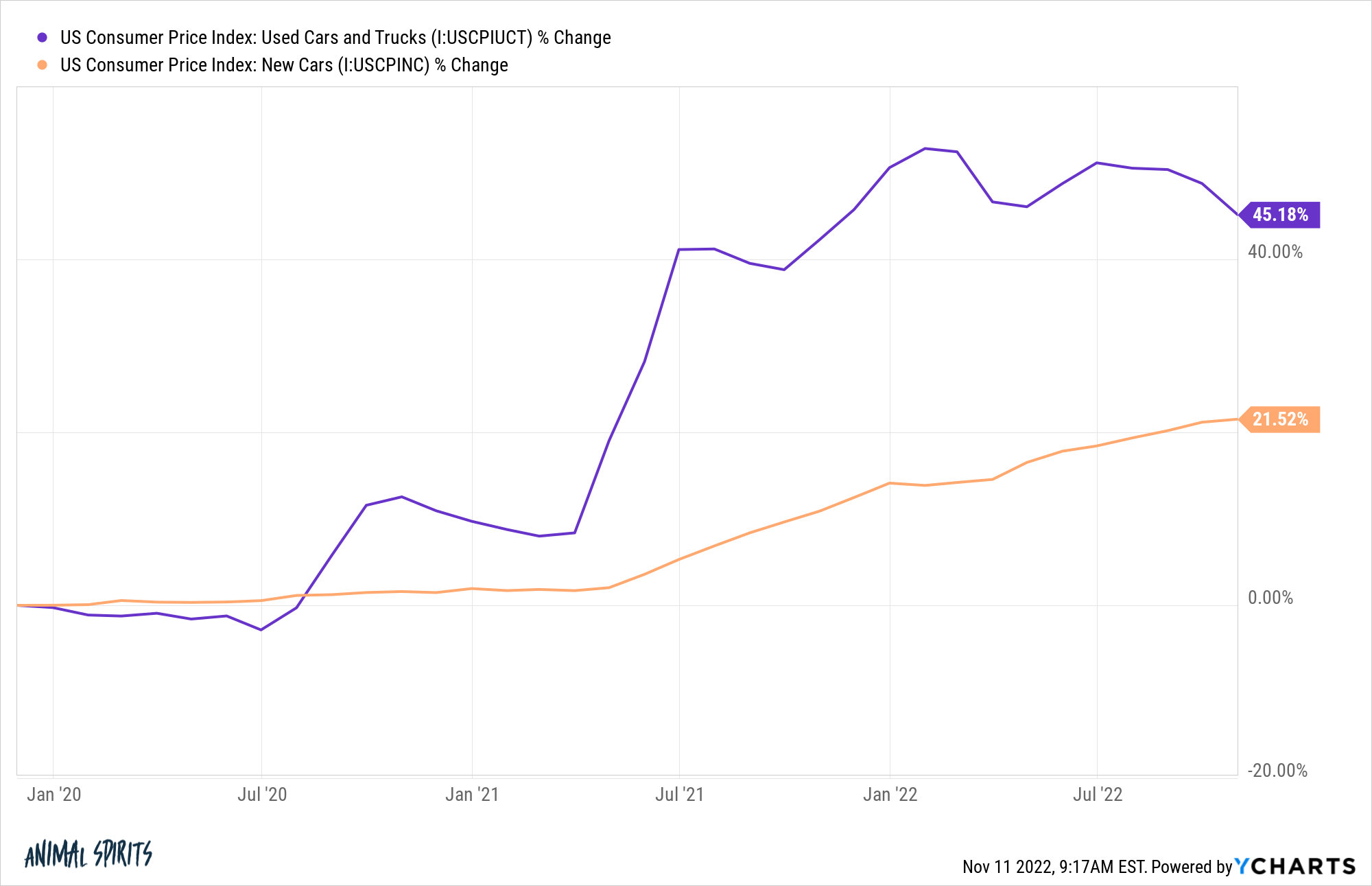

There are a number of economic reasons these payments have been rising in recent years. The supply chain shortages have driven up the cost of automobiles and that’s still not back to normal.

In the past 3 years alone the price of new cars is up more than 20%. Used car prices are up more than 45%:

Anyone who has had the misfortune of needing to buy a vehicle has been in a tough spot in recent years.

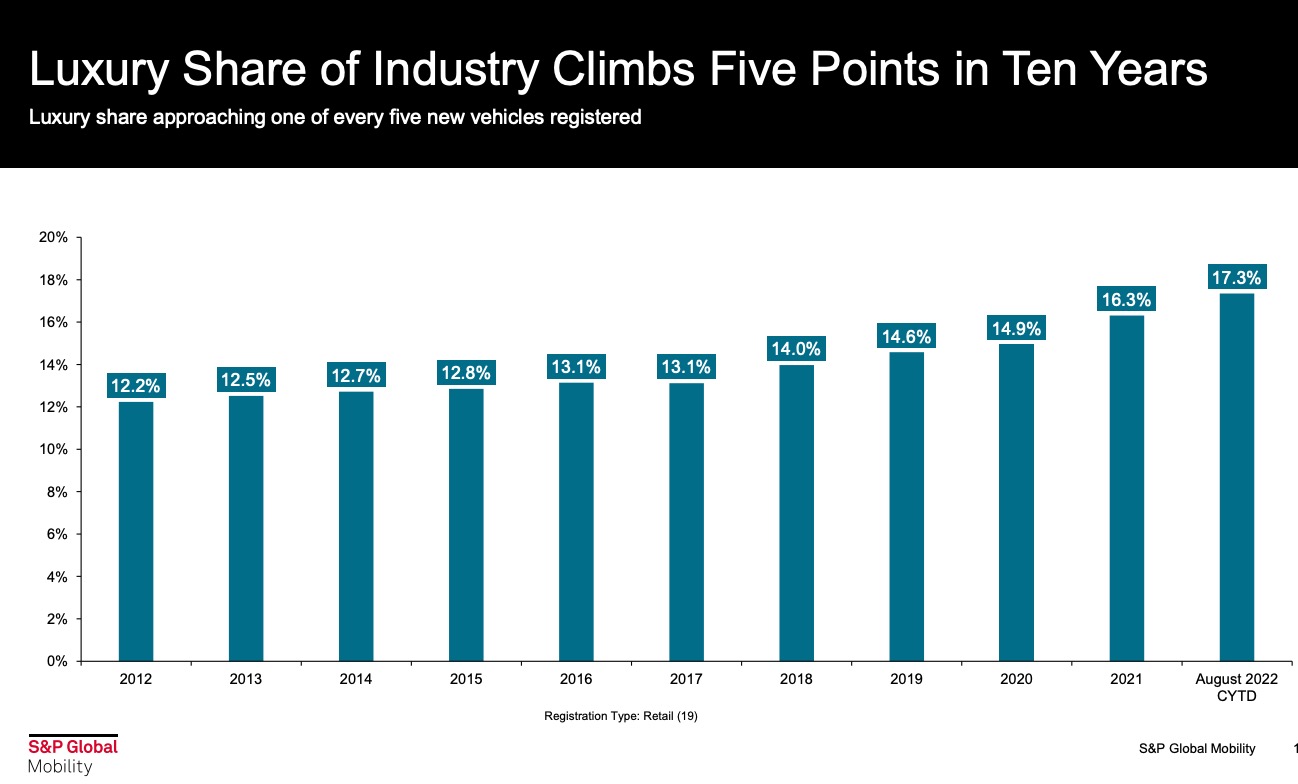

But that’s not the entire explanation. Look at the increase in luxury vehicle purchases over the past 10 years:

It’s almost 20%.

I am an A to B guy when it comes to my vehicle. Some people enjoy driving a nice car, truck or SUV.

And that’s fine — assuming you have the rest of your finances in order and you’re saving money.

If you’re not saving enough, your ridiculously high SUV or truck monthly payment is the likely culprit holding back your wealth.

And if it’s not your vehicle choice, it could be housing that’s holding you back.

The New York Times made the case this week that the housing market is worse than you think.

I tend to agree.

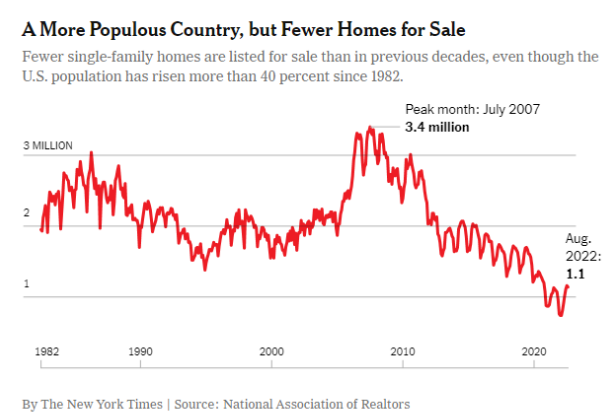

They show the number of single-family homes for sale remains near its lowest level in 40 years:

But this chart is even worse than it looks. The Times points out the U.S. population has risen more than 40% since 1982.

There were around 230 million people in the United States in 1982. There are now more than 330 million. The ratio per person is so much worse now.

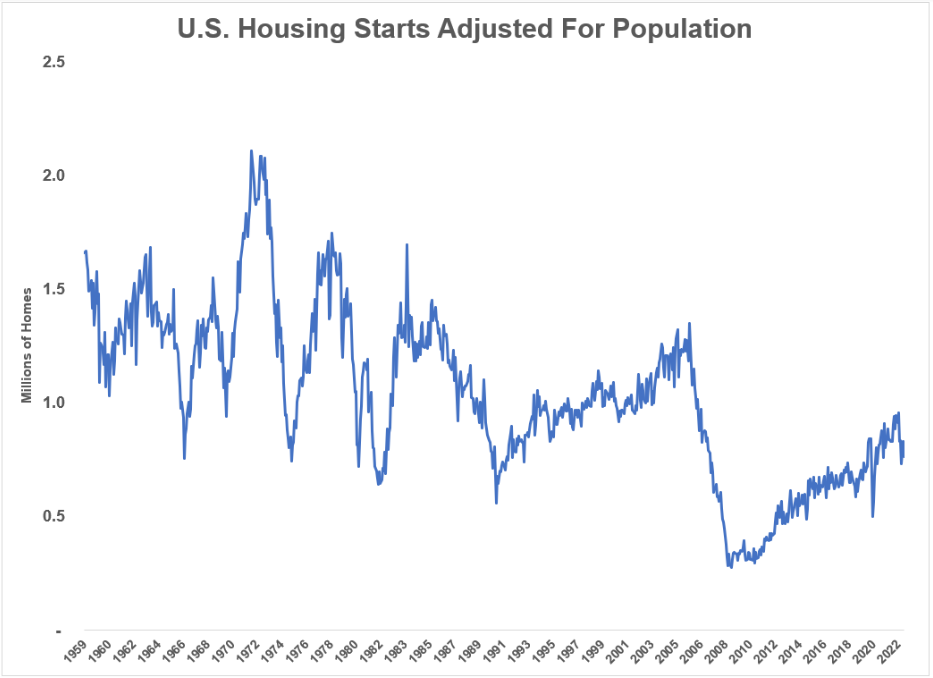

The same is true when it comes to the number of new homes being built. I adjusted U.S. housing starts (when construction begins on a new home) for the population going back to 1959:

We were building so many more homes relative to the size of the population back in the 60s, 70s and 80s. Things were pretty good in the 90s as well.

Then the real estate bubble burst in the 2000s and we haven’t gotten anywhere close to those levels again.

In 1959 there were roughly 176 million people in the U.S. and we were building about 1.6 million homes a year.

We now have 333 million people and the more recent reading shows we built 1.4 million homes in the past year.

Unfortunately, there is a lot of luck involved when it comes to your housing situation. Sure, there are people who buy more house than they can afford but a lot of people get screwed or lucky based on the timing of when they were born and where we are in the housing cycle.

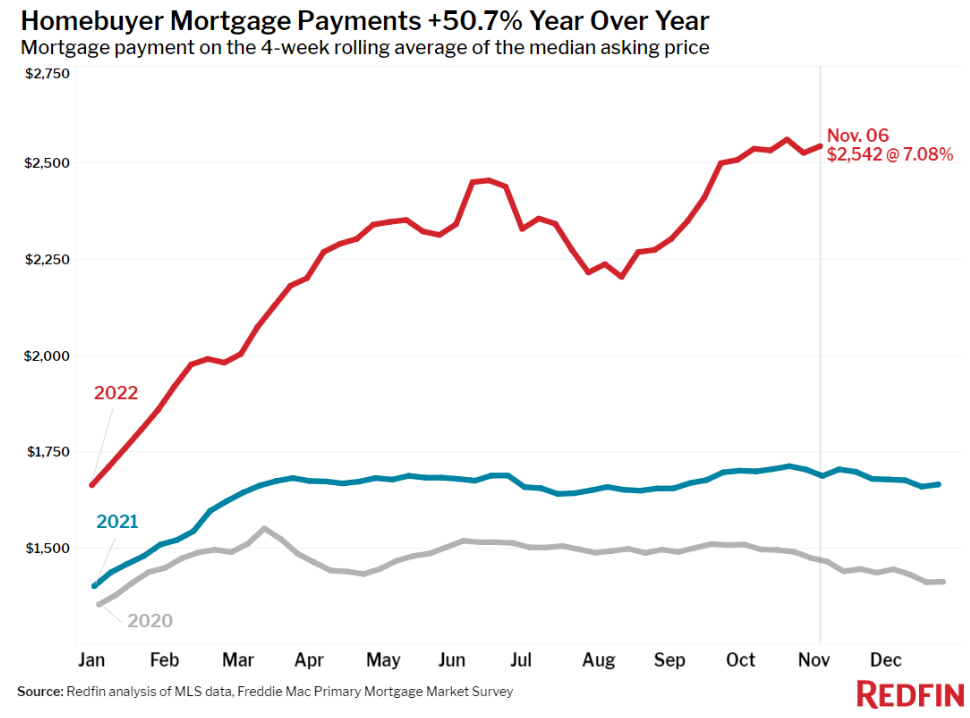

Housing prices are already rolling over from higher mortgage rates but those very same mortgage rates have made it even more expensive to buy a home right now.

Things will level out eventually and hopefully mortgage rates will fall in the years ahead.

But if we don’t build more houses in this country, buying a house is going to be harder and harder for young people in the future.

Michael and I talked about car prices, the housing market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Is the Ford F-150 Partially Responsible For the Retirement Savings Crisis?

Now here’s what I’ve been reading lately:

- Are you afraid of the market? (eToro)

- Pursue mastery, not status (More to That)

- The golden rule of personal finance (Best Interest)

- Helping your girlfriend with retirement planning (Belle Curve)

- The upside of losing (Morningstar)

- 10 ways to survive a bear market (Wealth Found Me)

1This is as a percentage of income so after tax.