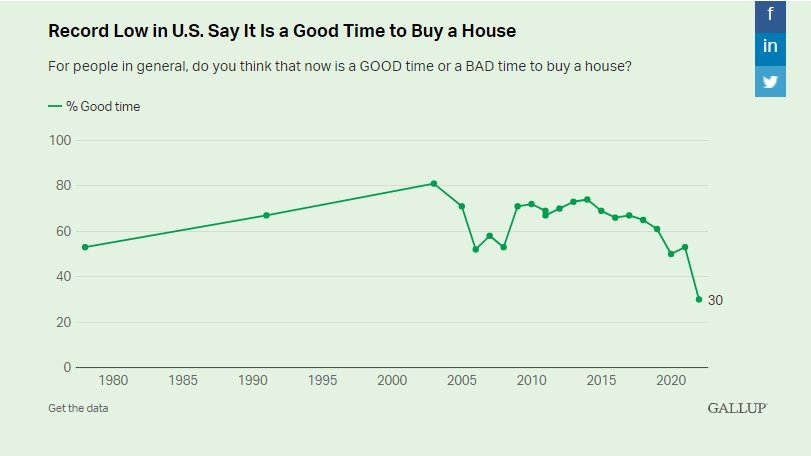

According to a recent Gallup poll, just 30% of Americans think now is a good time to buy a house:

It’s the first time this number has ever been below 50% going back to 1978.

Can you blame them?

National home prices were up 20.9% year-over-year through March.

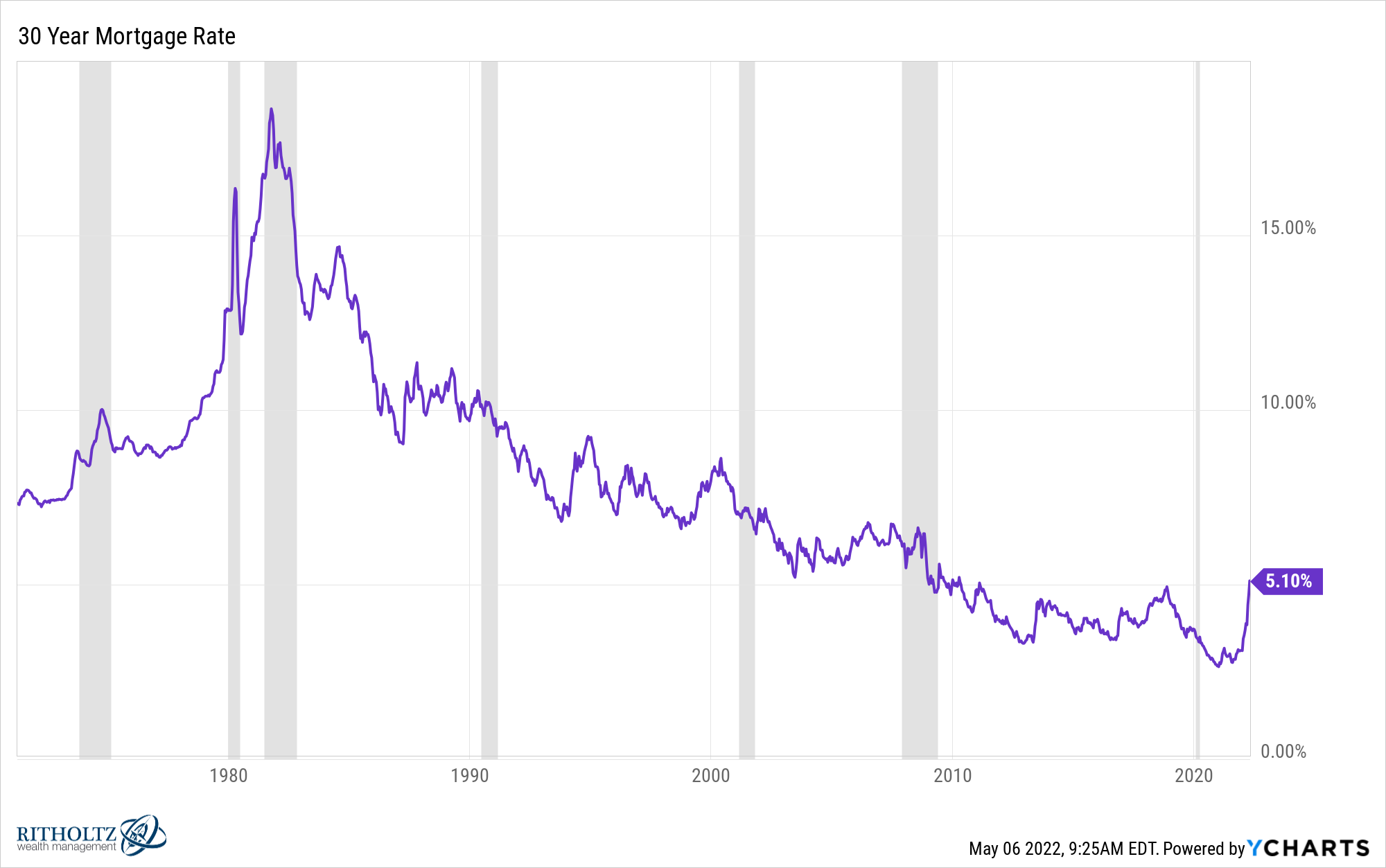

Mortgage rates have gone from less than 3% at the start of the year to well over 5% now, the highest level in 13 years.

Between rising monthly payments and much higher down payments, housing affordability has become a problem in a hurry.

Bloomberg interviewed a housing expert from PIMCO recently who said it’s time to sell:

“It’s only a good investment if you buy it at the right time,” he said. “If I were to buy a house today, I would probably get max 2% return on it. And I can find other things I can make money on other than a house.”

He could be right. The returns in housing over the past 18 months or so have been breathtaking.

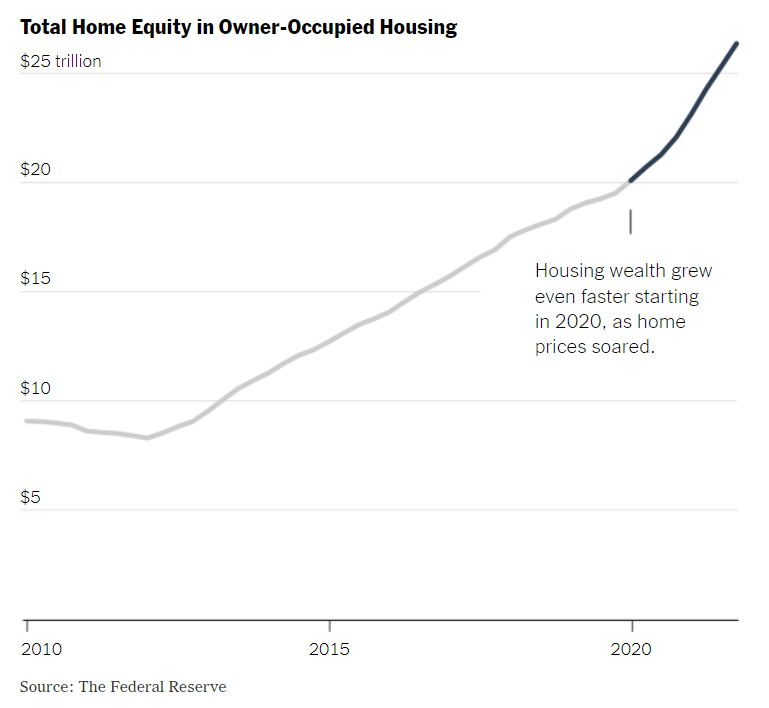

The New York Times calculated Americans have added $6 trillion in housing wealth over the past two years:

And that equity doesn’t include rental properties.

The case for not buying a house is about as strong as it’s ever been and I don’t blame anyone who wants to sit out the housing market right now.

But allow me to play devil’s advocate to see what the other side of the argument is here.

This would be the case for buying a house right now:

Your income should grow over time. Yes mortgage rates and prices are higher but buying a home means locking in a monthly payment. Most people see their incomes rise over time while that payment stays fixed.

It’s obviously more expensive to buy right now but a fixed payment is something you can grow into over time, assuming you have your finances under control.

You’ll probably be able to refinance your mortgage in the next recession. Is the Fed just raising rates to cut off inflation so they can lower them again if/when a recession hits? It’s possible.

And even if the Fed isn’t the culprit, whenever the next recession hits odds are mortgage rates will fall.

Take a look at mortgage rates back to the 1970s and see what happens around the recessionary periods (the gray bars):

They fall!

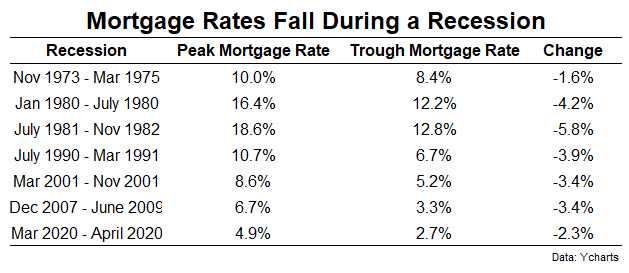

Here’s the data:

The average drop in rates is 3.5%. The average change from the previous level was a decline of around 35% of the total.

Now you could say a lot of this is because interest rates were falling for much of this period but it happened during the rising rate environment of the 1970s and early 1980s as well.

I don’t know when a recession is coming but when it does I would imagine mortgage rates will fall and homeowners will be able to refinance at lower rates yet again.

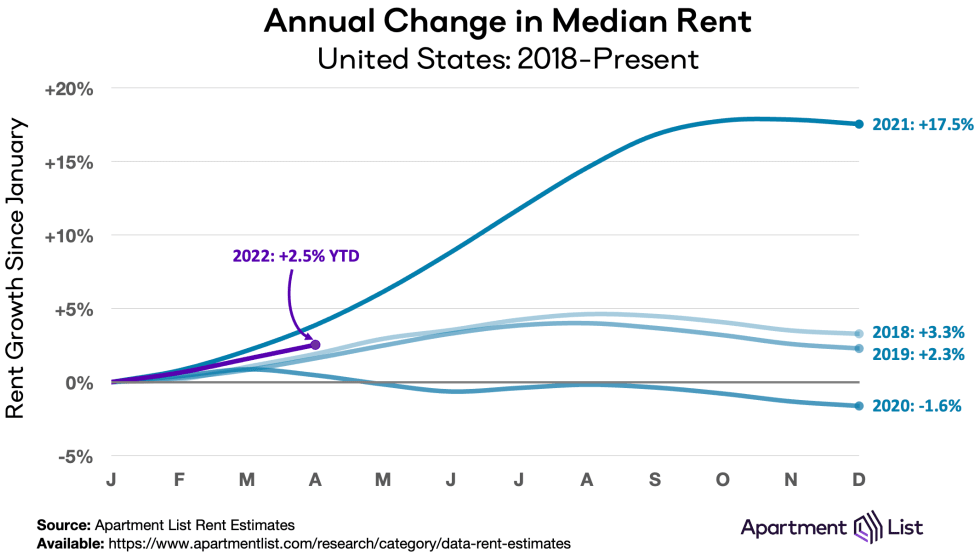

Rents are rising too. Housing acts as a hedge against rising rents. And rents are rising:

According to Apartment List, rent prices are up more than 16% nationally over the past 12 months. Much like housing price growth, this should slow but I’m guessing there are plenty of landlords who kept things in check during the pandemic who are chomping at the bit to raise their rates.

Rent offers more flexibility than buying and doesn’t require ancillary costs like property taxes, maintenance and upkeep.

But your rent costs also rise over time while your monthly payment stays fixed when you buy a house.

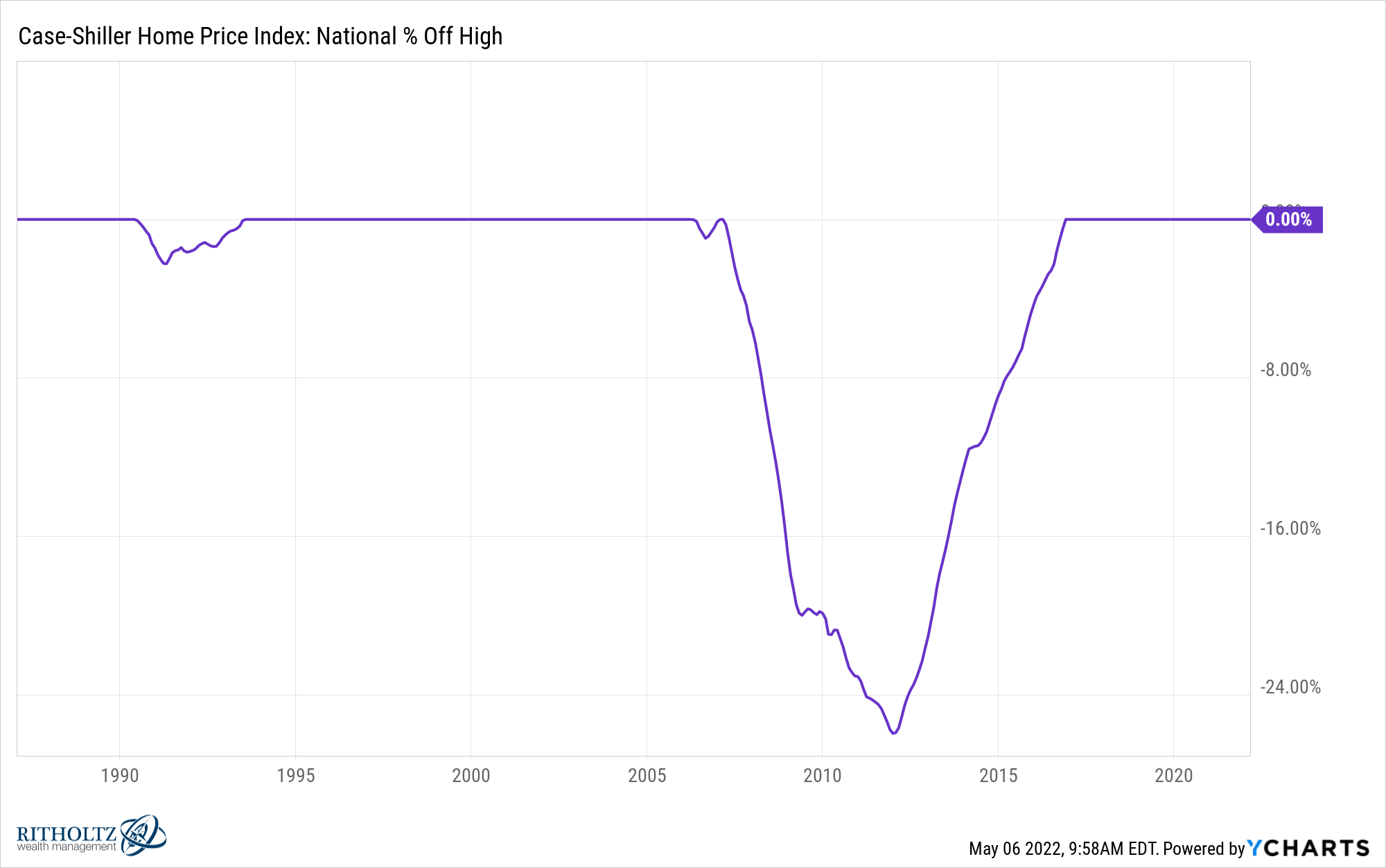

Prices could still get crazier. It’s certainly possible rising mortgage rates and a nasty recession could force housing prices to fall but it’s pretty rare for it to happen:

In the past 35 years, national housing prices have only fallen twice.

What if they just keep going up?

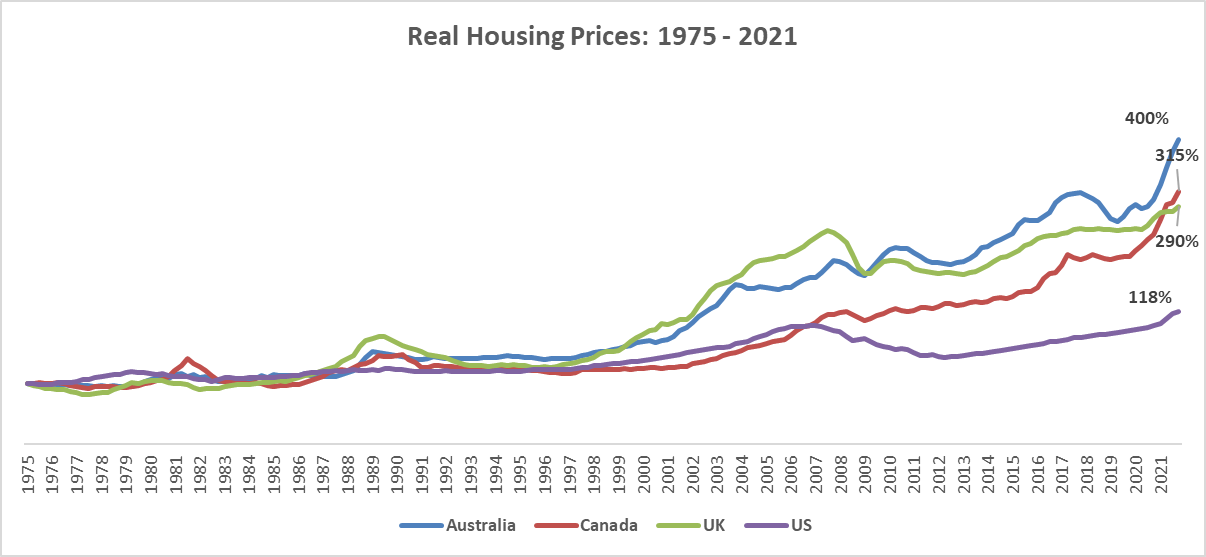

Look at prices in Canada, Australian and Great Britain in comparison to the United States:

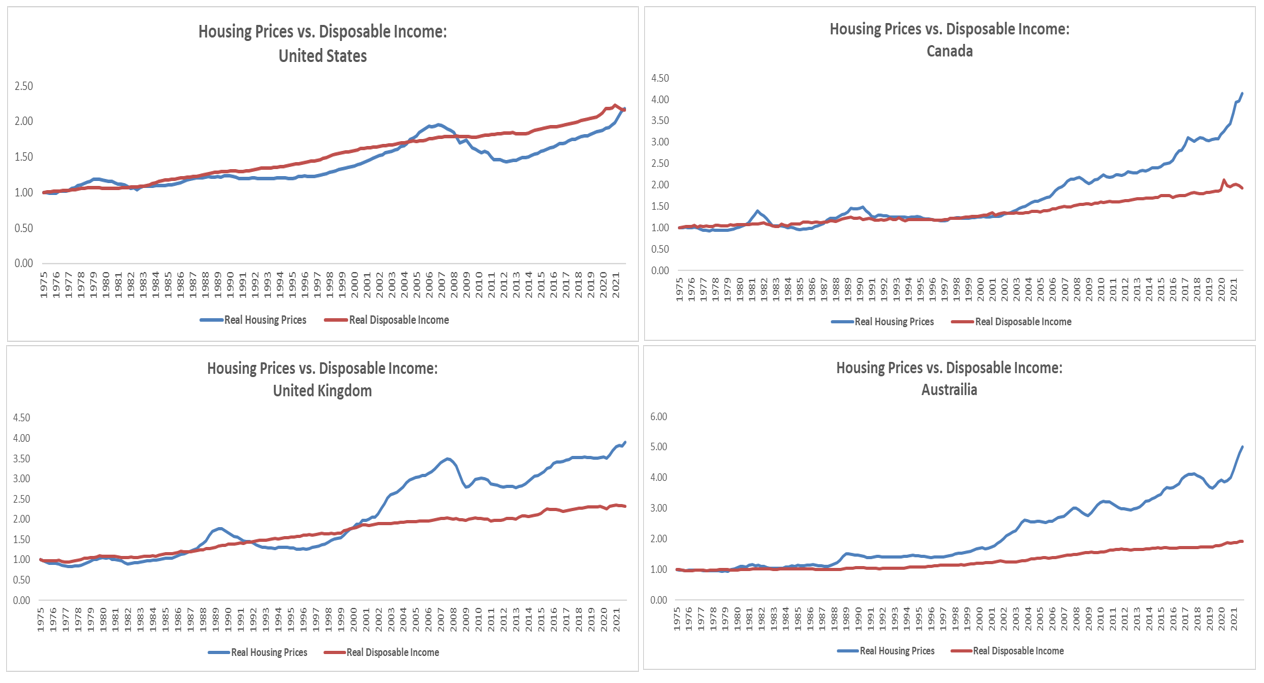

These numbers are even crazier when you compare them to disposable income:

Is it safe to bet on housing prices getting as high as these other countries?

Not necessarily.

Could housing in the U.S. continue to rise through some combination of demographics and lack of supply?

I wouldn’t rule it out.

It’s quite possible housing prices today will seem low by the end of the decade.

Housing doesn’t have to be an investment. A lot of people in the financial markets forget most people don’t look at their house as a financial asset like stocks and bonds.

A house is a place to live. It’s a place to make your own.

It’s also a form of consumption more than an investment opportunity for most homeowners.

You have to live somewhere which means you either pay rent or make mortgage payments.

Trying to time the housing market like it’s the stock market can be a mistake because a home is the most emotional of all financial asset purchases.

No one lives in their Apple shares. No one decorates or landscapes their U.S. treasury bonds. Your school district or neighbors aren’t determined by the mutual funds in your 401(k) plan.

Look, this is probably the worst time ever to be a first-time homebuyer. I can understand why some people are hesitant to buy right now. Buying a home is not for everyone.

But if you want to buy a house and can afford to service the debt then it probably still makes sense even if it might not offer the greatest returns from here.

A house can still pay psychic income which is probably more important when it comes to your happiness.

Michael and I talked about the housing market and more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Buy Low, Sell High is Easier Said Than Done

Now here’s what I’ve been reading lately:

- The Bogle Effect

- Let’s spend some money (Young Money)

- Retirement is really complicated (Random Roger’s Retirement Planning)

- This is average (Irrelevant Investor)

- It’s not different this time (Bull & Baird)

- Ozark season premiere soundtracked by Illmatic (GQ)

- The real enemy (Morningstar)