On July 30, 1931, a young lawyer named Benjamin Roth wrote the following in a diary he kept throughout the Great Depression:

Magazines and newspapers are full of articles telling people to buy stocks, real estate etc. at present bargain prices. They say that times are sure to get better and that many big fortunes have been built this way. The trouble is that nobody has any money.

At that point the Dow was already down nearly 65% from its all-time highs from the fall of 1929. Anyone intent on buying the dip had already exhausted their dry powder.

And when you consider the economy was in the throes of the biggest contraction ever with the unemployment rate well above 20%, it’s not surprising nobody had any money.

Yes, housing and real estate were cheap but they were cheap for a reason. And that reason — a depression — made it basically impossible for anyone to take advantage of depressed prices.

This is often the case when financial assets are on sale.

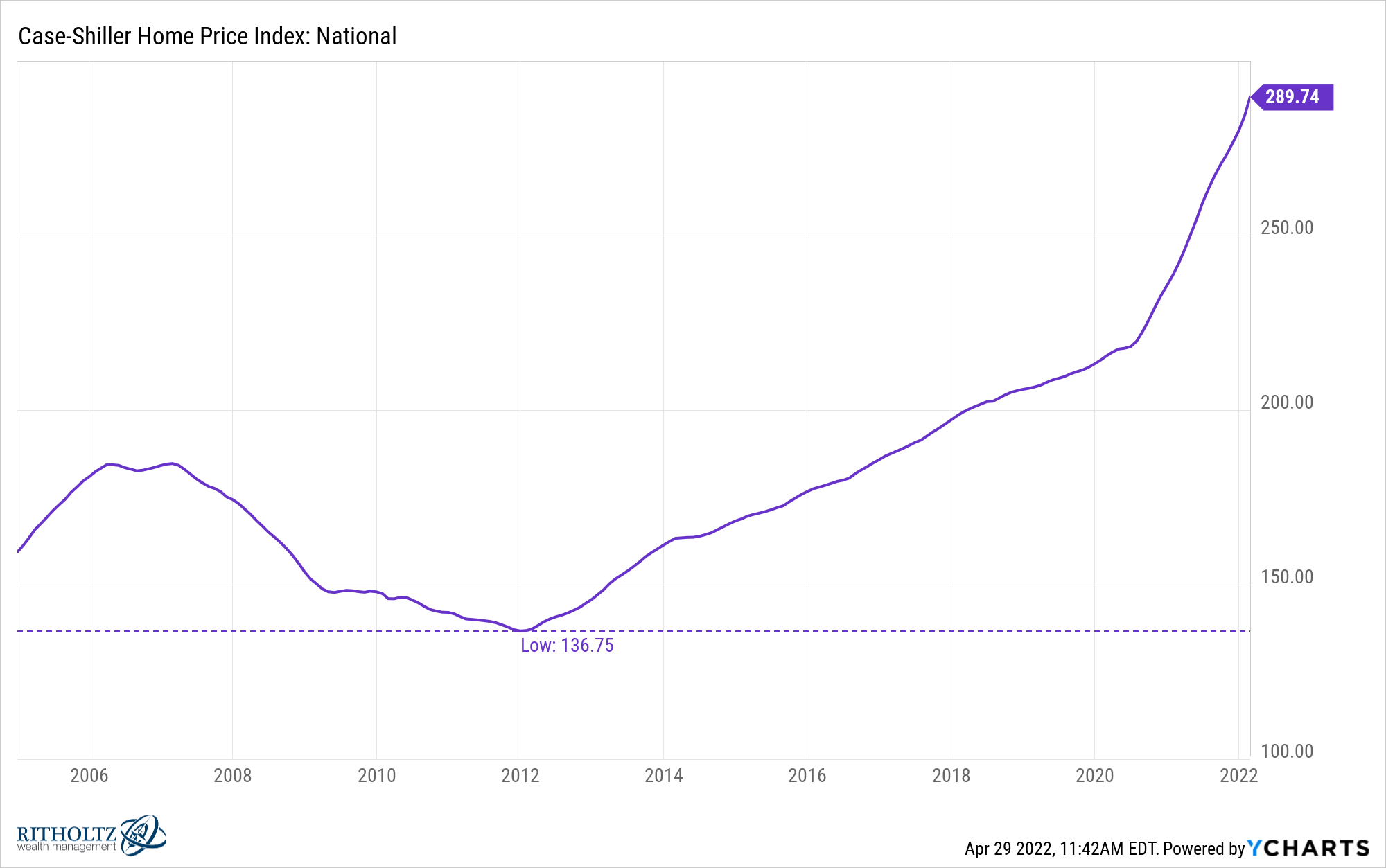

Just look at housing prices from the bottom of the real estate crash:

Prices are up more than 110% nationally from the bottom in 2012. And you didn’t have to nail the timing to experience massive gains in residential real estate. Pretty much any purchase made during the 2010s is up substantially from those levels.

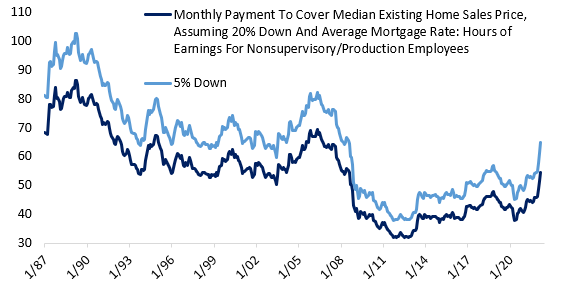

George Pearkes from Bespoke Investments shared a chart that shows the housing affordability index going back to the 1980s:

On a quarter-over-quarter basis housing affordability shot up nearly 18% in the latest reading from skyrocketing mortgage rates and housing prices.

But look at that trough in the 2010s. Housing was ridiculously cheap throughout the 10s/tens/teens (what are we calling that decade?) because housing prices were down and mortgage rates were low.

That’s a wonderful combination if you were in the market for a house.

Here’s the problem — yes, housing was affordable but a lot of people couldn’t afford to buy a house on the cheap because of the Great Financial Crisis.

The economic recovery was slow. The unemployment rate started the decade at nearly 10%. It didn’t go below 6% until late-2014. Plus, people were still repairing their balance sheets from the 2008 crash.

It was a great time to buy a house but many Americans couldn’t afford to buy one.

I actually think it’s possible history is going to have a difficult time judging the 2010s from a financial perspective. By many measures it was a great decade but it sure didn’t feel like it at the time.

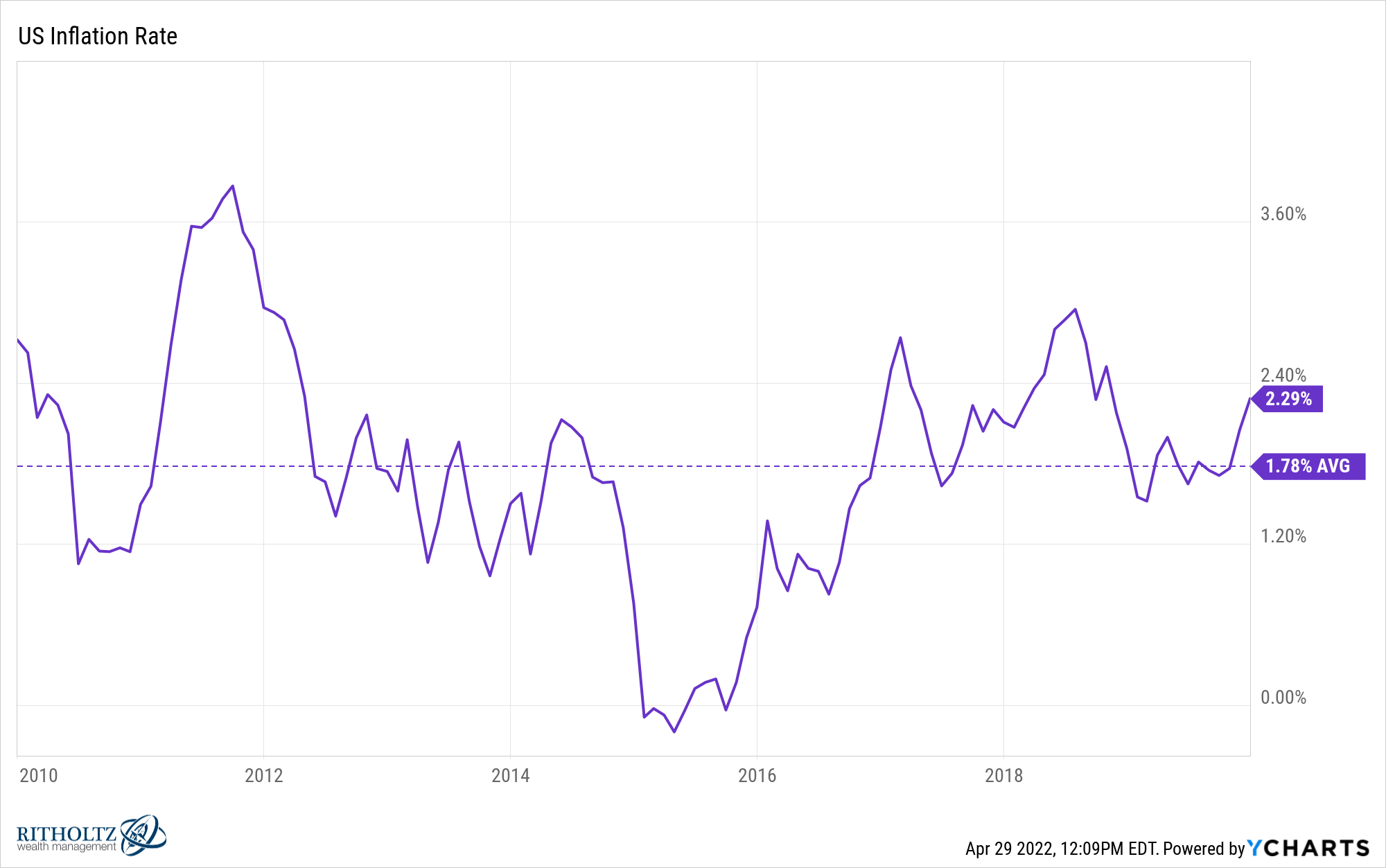

The inflation rate was low, averaging less than 2% for the entirety of the decade:

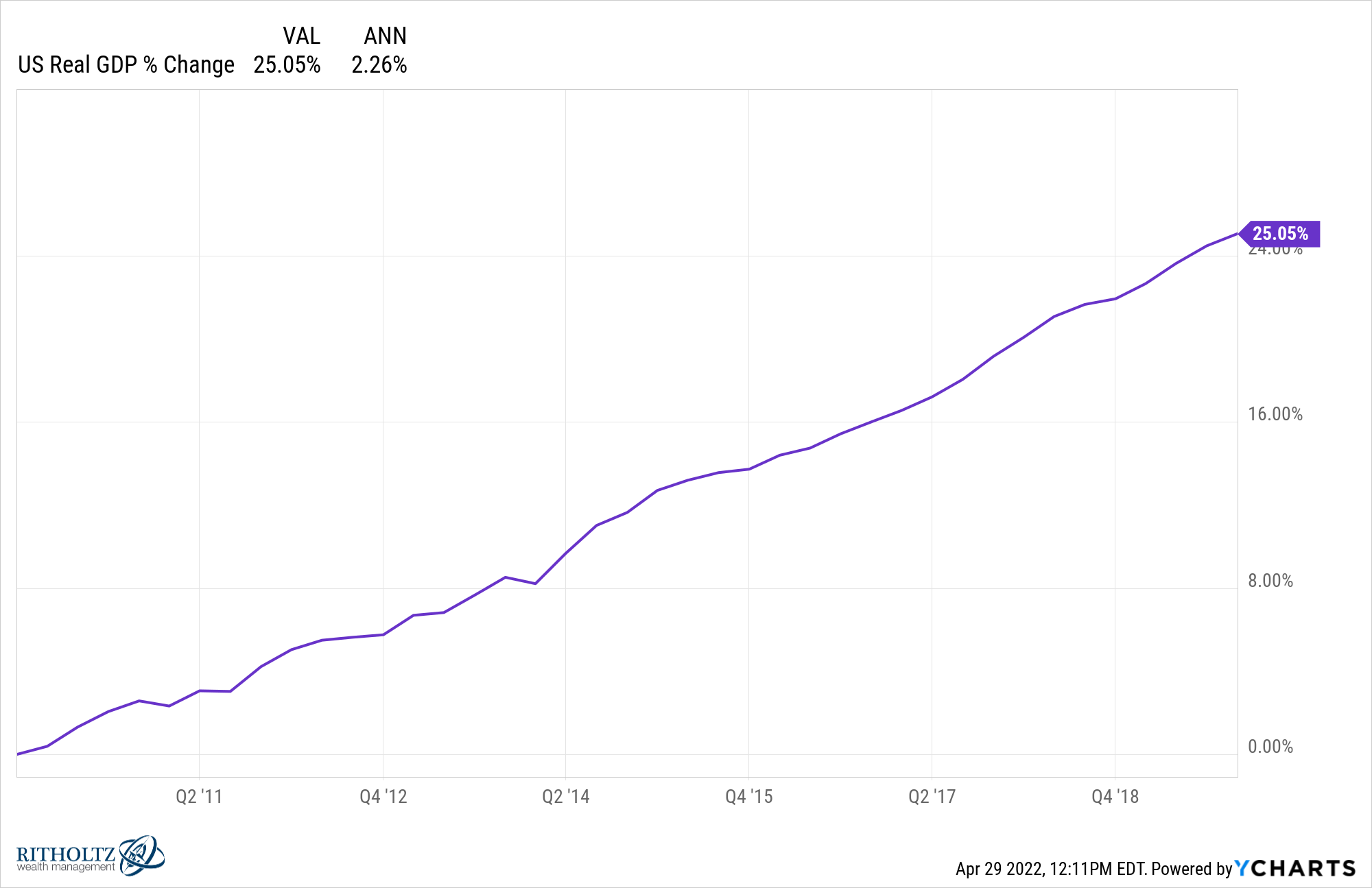

Economic growth wasn’t going gangbusters but there was little volatility and not a single recession coupled with slow and steady growth:

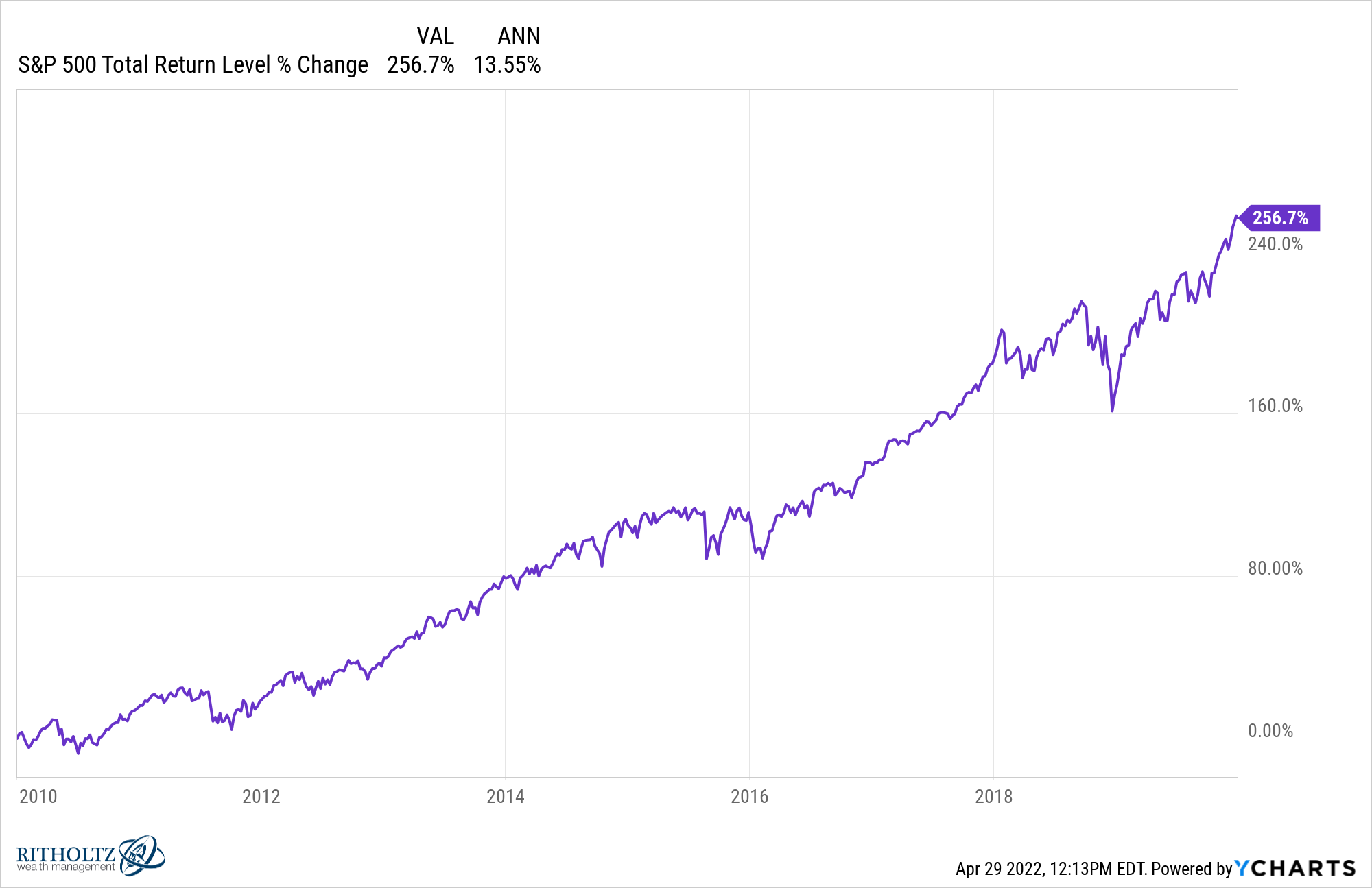

It helps that there was a gigantic crash in 2008 but the U.S. stock market was lights out in the 2010s, returning almost 14% per year:

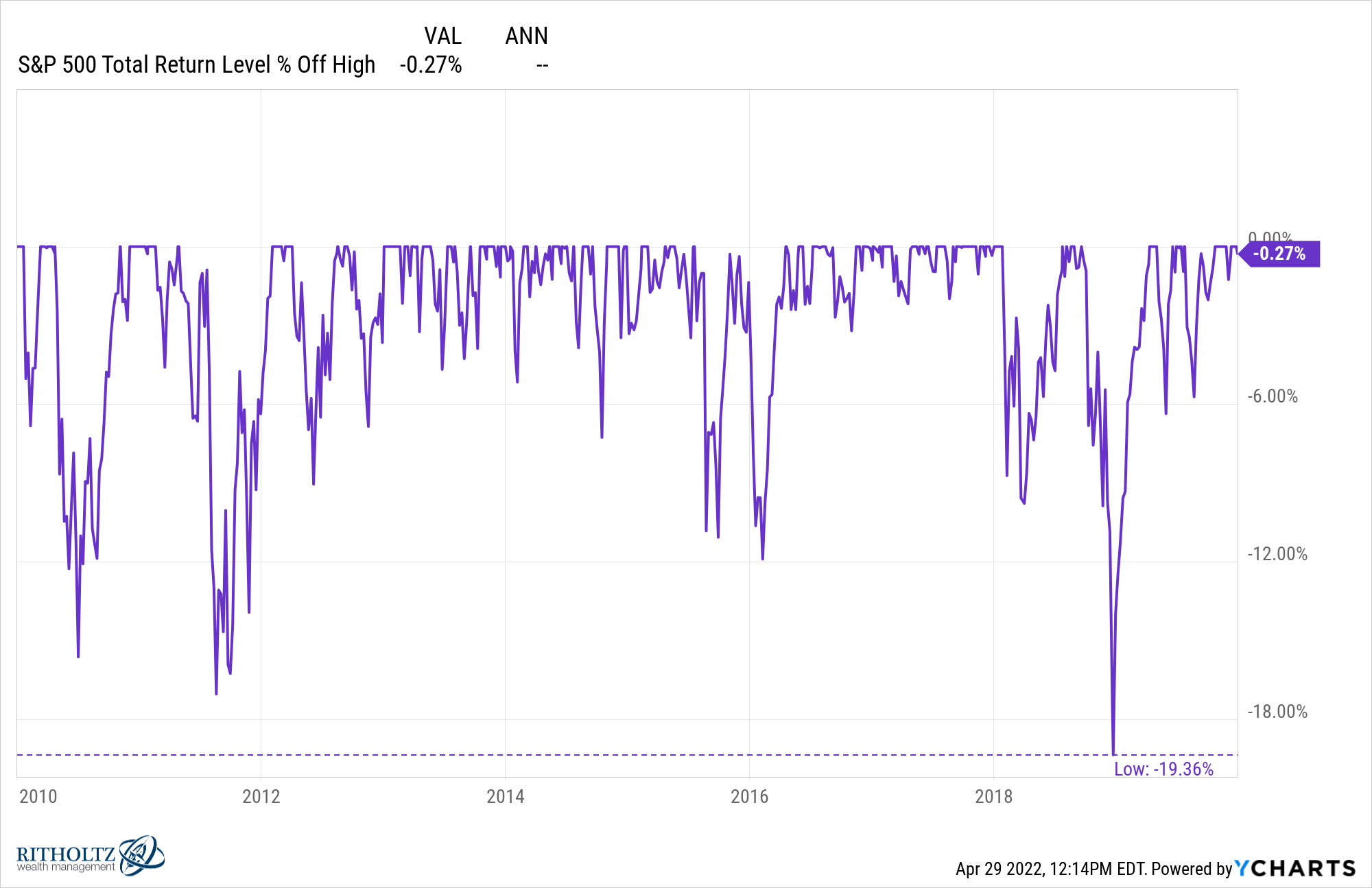

And the worse downturn was just a shade lower than the 20% threshold for a bear market:

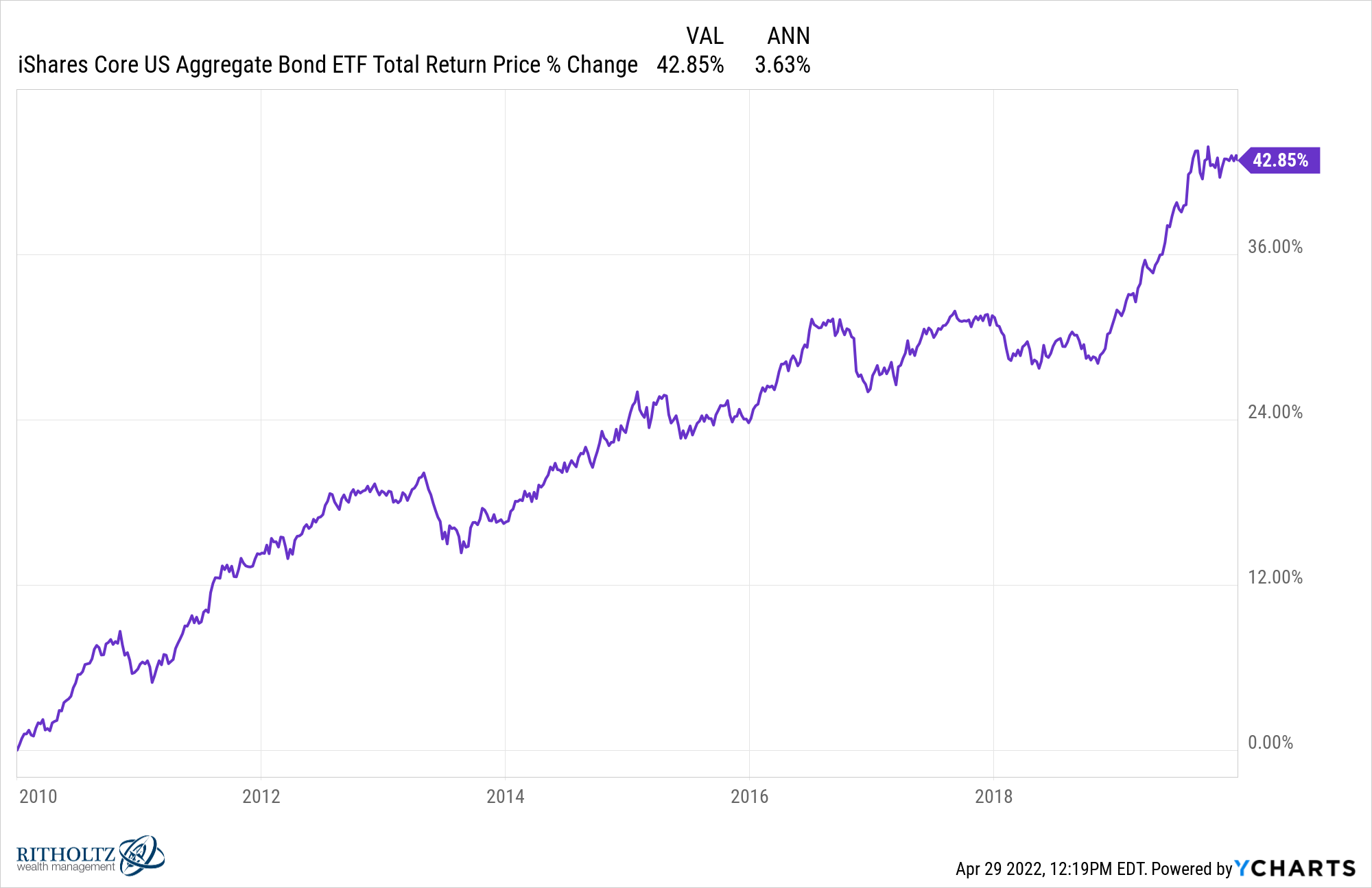

The bond market didn’t hit it out of the park but had steady returns with little volatility:

I already mentioned mortgage rates but it’s worth pointing out the 4% average is the lowest ever over any decade-long period:

Add it all up and the 2010s look much better in hindsight, especially when compared with the current environment.

The problem is hindsight doesn’t take into account the fact that many households were still walking off their economic pain from the 2008 crisis and couldn’t take advantage.

Unfortunately, the economy is unfair like that sometimes.

When financial assets are cheap, many people don’t have the means to buy them.

And when many people have the means to buy financial assets, it often occurs when they are expensive.

Buy low, sell high is easier said than done.

Michael and I discussed the 2010s potentially being underrated and more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why You Can’t Always Swing at a Fat Pitch During a Crisis

Now here’s what I’ve been reading lately:

- Elon Musk and the ghost of Jay Gould (Axios)

- Adaptive defiance (Prime Cuts)

- Incoherence (Reformed Broker)

- A stock is not an index (Dollars and Data)

- Never saw it coming (Collaborative Fund)

- 5 lessons from Clown College (Humble Dollar)

- Hindsight capital (Big Picture)