A reader asks:

I’m 63, retired, living on a meager pension and Social Security. Doing OK now, but counting on my IRA in a few years. Currently have a 60/40 portfolio of diversified stocks and bonds, including World Bonds and International and domestic stocks. I’m not thrilled with the returns that bonds are giving me, but I don’t know that there is a viable alternative. Can I find attractive risk/return in REITs, or high-dividend-paying stocks without sacrificing capital? Or should I just accept the bond portfolio for what it is and ride it out?

Staying put is certainly an option here, especially if this is an asset allocation you are comfortable with. But let’s look at some of the other options since so many investors are worried about the bond portion of their portfolios today.

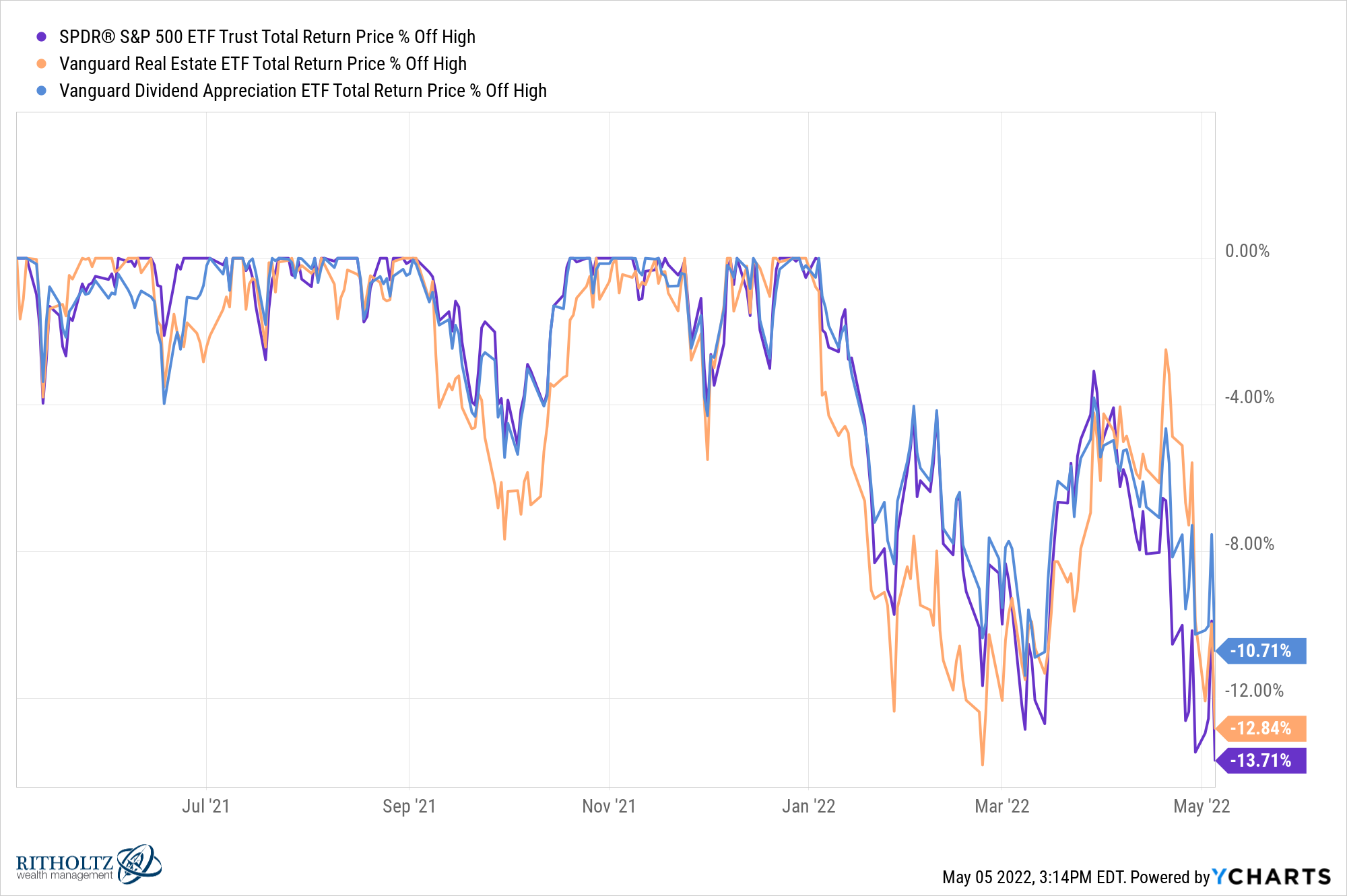

Stocks with growing and/or high dividend yields and REITs do offer more income than a simple index fund but when the stock market is falling, these strategies act like stocks:

Dividend stocks do tend to be less volatile than the overall market but you can see they are still in the midst of a correction just like stocks. Same thing with REITs.

I’m not saying you shouldn’t diversify into these strategies. That income can help provide some cushion during a sell-off but this is still equity-like risk.

Another option would be a barbell portfolio that increases your allocation to risk assets, getting out of bonds and going to cash.

The late-Peter Bernstein wrote a piece called How True Are the Tried Principles? for the Investment Management Review back in the 1980s that made the case for this strategy:

Although cash tends to have a lower expected return than bonds, we have seen that cash can hold its own against bonds 30 percent of the time or more when bond returns are positive. Cash will always win out over bonds when bond returns are negative.

The logical step, therefore, is to try a portfolio mix that offsets the lower expected return on cash by increasing the share devoted to equities. As cash has no negative returns, the volatility might not be any higher than it would be in a portfolio that includes bonds.

His point about cash outperforming when bond returns go negative is certainly applicable in today’s rising interest rate environment.

Bernstein offered up a mix of 75% in stocks and 25% in cash equivalents as an alternative to the 60/40 stock-bond portfolio.

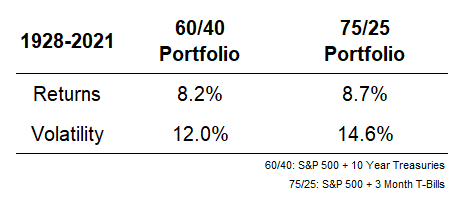

I have return data on stocks (S&P 500), bonds (10 year treasuries) and cash (3-month t-bills) going back to 1928 so let’s take a look at the returns for each:

These are simple portfolios rebalanced on an annual basis. You can see the returns are similar while the 75/25 portfolio does have slightly higher volatility. But things look close enough that it makes for an interesting comparison.

What about performance in a rising rate environment?

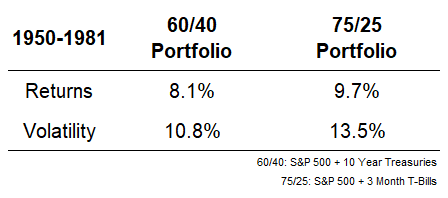

The 10 year treasury yield went from 2% in 1950 to 15% by 1981. Inflation averaged 4.3% over this 3+ decade period. These were the returns:

Still more volatility for the 75/25 portfolio but this time it outperformed by a much wider margin.

Why was this the case?

Cash outperformed bonds.

While 10 year treasuries returns 2.8% annually from 1950-1981, 3-month t-bills were up 4.6% per year. This happened because 3-month t-bill rates went from 1% in 1950 to 11% by 1981 and averaged 4.6% over the course of this time frame.

Since investors can roll over their fixed income investments in short-term debt much faster than long-term debt, cash outperformed bonds.

It’s possible for interest rates to continue moving higher but not a foregone conclusion.

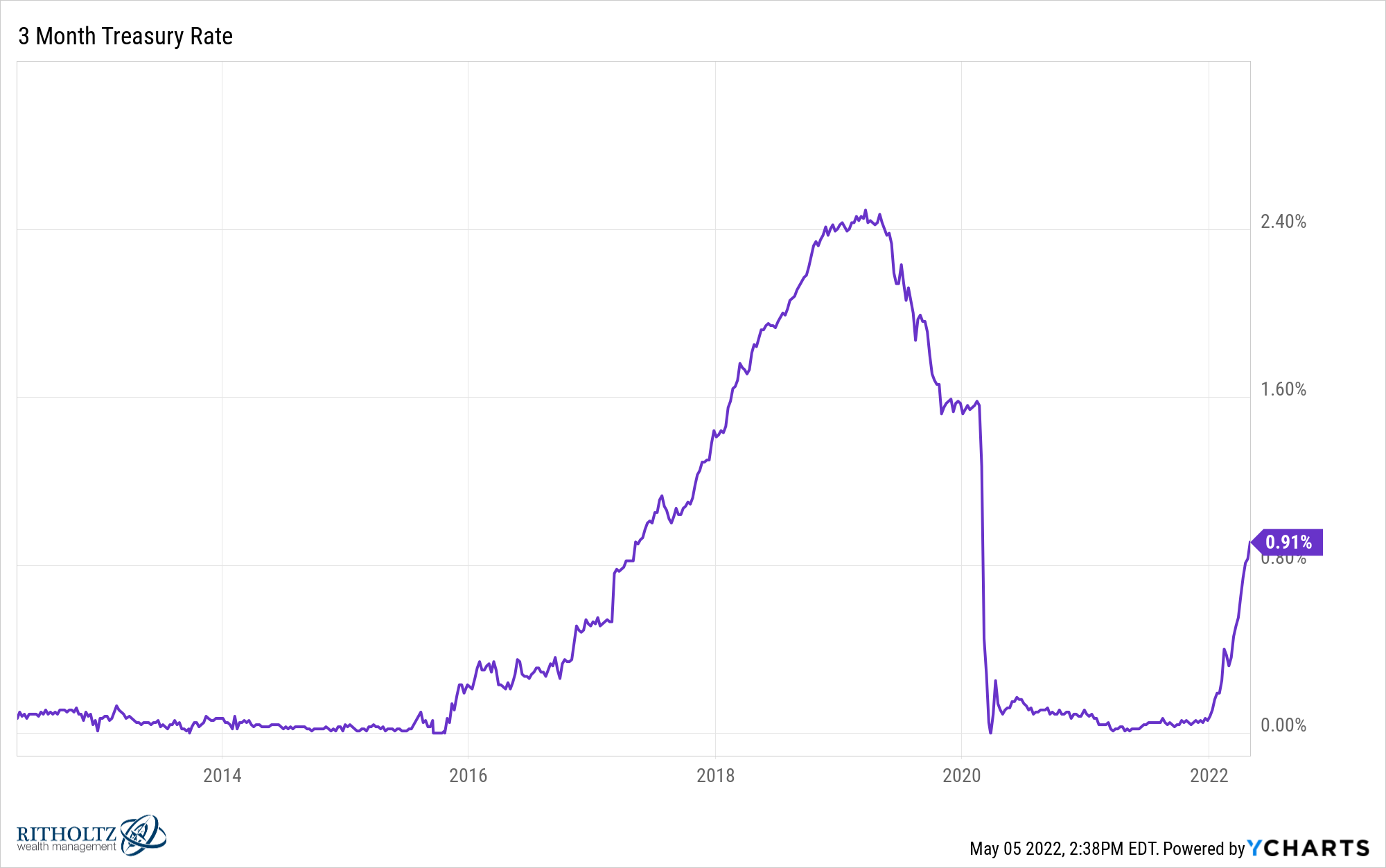

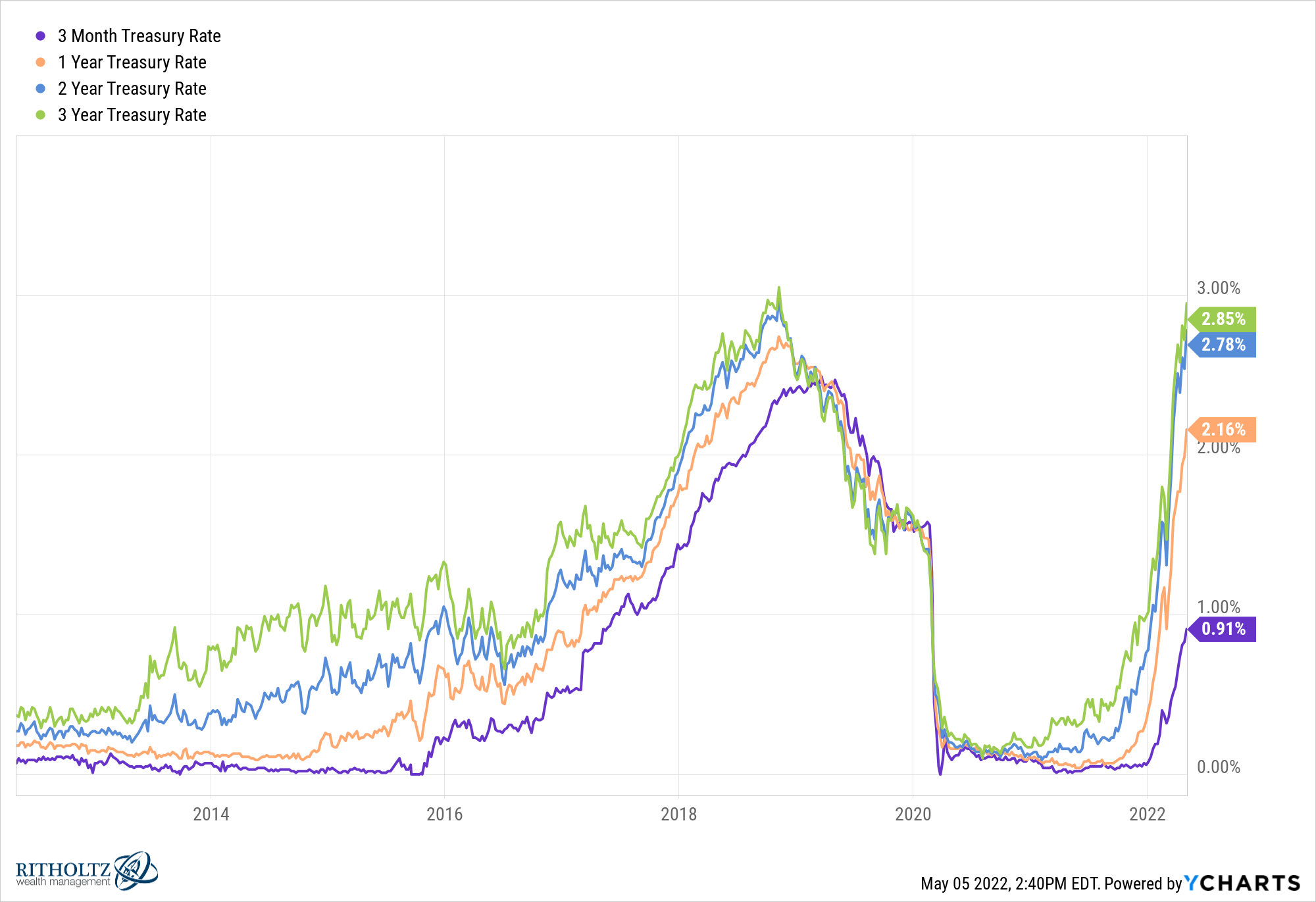

Right now the 3-month t-bill yields just 0.9%:

This is just a tad lower than the 8.4% yield that existed in 1989 when Bernstein wrote his piece about the 75/25 portfolio.

Today’s yields are paltry by comparison but they’re much higher than they were 2 years ago when the pandemic first hit.

You can finally find some yield on short duration bonds and bond funds right now for the first time in a while:

Two and 3-year treasury yields are both fast approaching 3%.

The average yield to maturity on the iShares 1-3 Year Treasury ETF (SHY) is now 2.6%. That’s not bad for the safer portion of your portfolio. There is still some interest rate risk in a fund like this but rates have already risen substantially and the shorter duration means you get to reinvest at higher yields much faster in a rising rate environment.

A 75/25 portfolio is not a perfect solution but the perfect solution doesn’t exist right now.

If you want to earn higher returns on your portfolio in the current market environment, you have to live with higher volatility.

We talked about this question on this week’s Portfolio Rescue:

Kevin Young joined me again to discuss when to change your financial plan, 401k contributions when you don’t get a company match and securities-based lines of credit.

And here’s the podcast version:

Further Reading:

Interest Rates Are Getting Weird