My kids love going to parks on the weekends.

I’m amazed at how much nicer playgrounds are these days than the rust-infested metal contraptions we were forced to play on as kids.

It’s tempting as you get older to hate on the up-and-coming generations because they don’t have the same experiences you did.

Young people these days are snowflakes. It’s all participation trophies and helicopter parenting. When I was young…

I get it.

But as someone who is now quickly approaching old guy status, I find myself less in the get-off-my-lawn camp and more impressed with how much more prepared young people are than I was at their age.

I’ve spoken with a number of college students, young professionals, young advisors and young investors over the years. They have better access to information and technology, they know more, they know where they want to be, they want to learn and they’re bright.

They also ask good questions.

Going through our Google doc for Portfolio Rescue this week I noticed a large number of questions from young people.

So let’s empty the mailbag and go through some rapid-fire questions to see what young people are asking these days:

What are particular sectors/names that come to mind for a young investor in their 20s that are most compelling in your opinion for a 35-40 year time horizon?

This is an easy one — I have no idea.

Picking individual stock winners over the long-term is difficult because many of today’s companies simply won’t be around in 3-4 decades.

Geoffrey West estimates nearly 80% of the 29,000 or so public corporations that were in existence between 1950 and 2009 ceased to exist through bankruptcy, failure, mergers or buyouts.

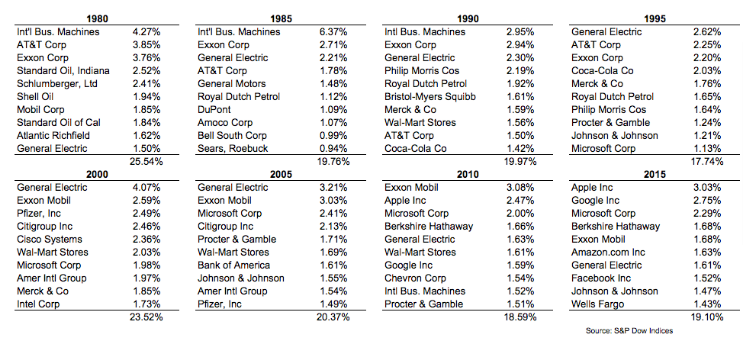

The biggest stocks that dominate the stock market change over time as do the sectors as you can see from the top 10 biggest stocks in the S&P 500 going back to 1950:

Betting on tech stocks seems like a decent idea for the future but you would probably want some diversification through something like the Nasdaq 100.

However, your best bet over 3-4 decades is probably simple buying the entire stock market through an index fund.

Corporations as a whole will continue to innovate and produce profits.

Next question:

What will bring more value in the long run for a child? Pay for your child’s fancy private college which totals 250k? Or simply put that $250k in an index fund for their retirement at the time of college and send them to a middle-tier public school for what is essentially a full ride?

This is a question that is way easier to answer as an older person than a younger person. It’s like telling someone who is newly engaged what a waste of money a big wedding is.

Few young people are going to share those feelings.

My advice would be to avoid scolding them or forcing them to do what you would do now with the benefit of hindsight.

Use this as a financial teaching moment.

Spell out their options and talk about the pros and cons of each choice.

Then let them make an educated decision with all of the facts in front of them.

And if they still pick the expensive school at least they do with their eyes wide open to the financial implications.

Next question:

Long time viewer of the show, love the content you all put out. I’m 23 and just graduated from college. I landed my first job at a financial services firm and I am wondering how I should allocate my earnings. Would you recommend focusing on paying off my student loans (roughly $30k) first? Or should I begin building my portfolio?

I’m sure no one regrets paying off their student loans early but there is something to be said for splitting the difference here

It’s helpful to develop good savings habits early.

A lot of people say they will just start saving when they get older or make more money but something always seems to get in the way.

I like the idea of small wins as a psychological boost to help you keep saving more over time.

Let’s say you split the getting ahead portion of your budget 50/50 between saving and student debt repayments.

When you do pay off your student loans, keep allocating that payment to the same bucket and now you can supercharge your savings rate when the debt repayment rolls off.

Next question:

What are some good questions to ask when selecting a financial advisor, especially as a young person?

Here are some ideas:

- What is your investment philosophy?

- What is the client experience like with your firm?

- How often will we communicate each year?

- How will your firm help me as my finances get more complicated?

- What fees do you charge a client in my circumstances?

- How do you personally invest your own money?

- How do you help me achieve my goals?

Next question:

I have worked hard over the last years, I am in my 30s and I can now afford to buy a house full cash without taking any debt. At interest rates so low, should I instead take a loan, finance the house instead and invest my capital in the stock market?

This question came in before mortgage rates went from 3% to 5%. The hurdle rate here might change the calculus but a lot of this comes down to the tug of war between your relationship with debt and your desire for flexibility.

The problem with tying up the majority of your capital in a home is it’s illiquid. You can’t spend your house.

Unless you absolutely cannot stomach debt in any form, borrowing some money to buy a house, especially when you’re young, has some benefits.

It’s tax-advantaged. It’s a wonderful hedge against inflation since your payment is fixed. And it frees you up to use that cash elsewhere.

But there is no right or wrong answer here. It all depends on how you feel about taking on debt.

We did a lightning round on today’s Portfolio Rescue that included these questions and much more:

Matt Lohrius joined me to discuss the right way to approach offering financial advice to younger clients.

Podcast version here:

Further Reading:

40 Things I Don’t Know by Age 40