Another week in quarantine so Michal and I continue to record Animal Spirits from the comfort of home.

We discuss:

- Why the end of this crisis will only look obvious in hindsight

- How long until people start losing their patience?

- Why fiscal stimulus is so important right now

- The U.S. response to this crisis shows we have some weak points

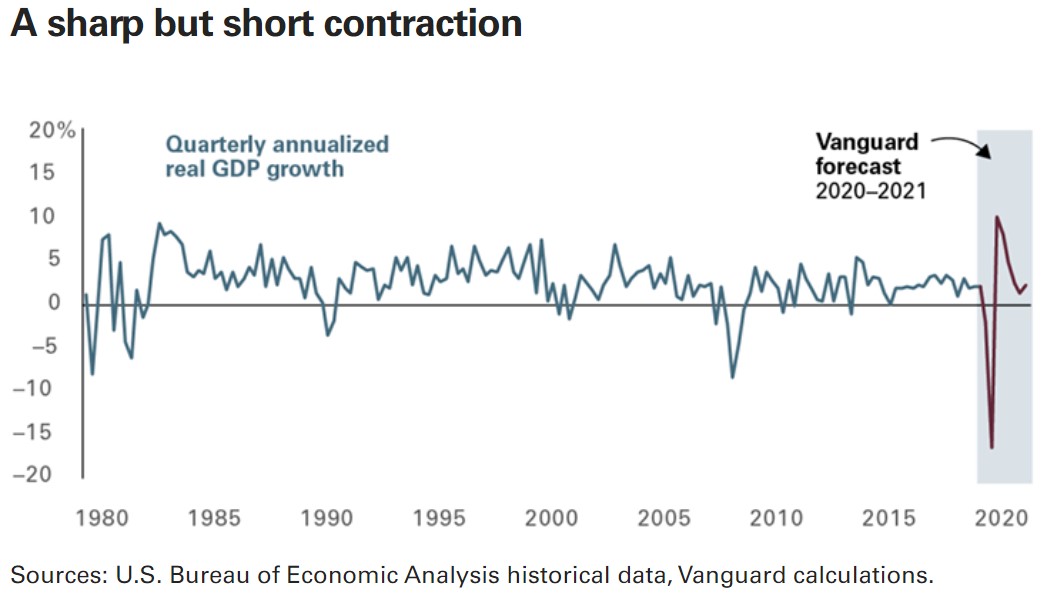

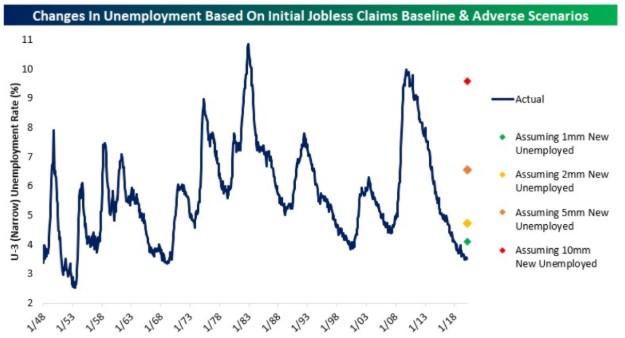

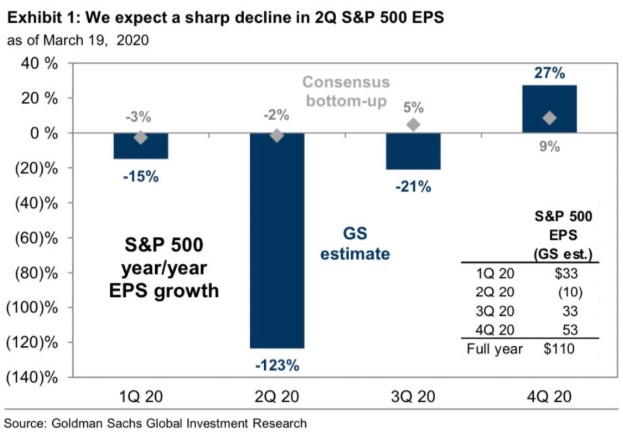

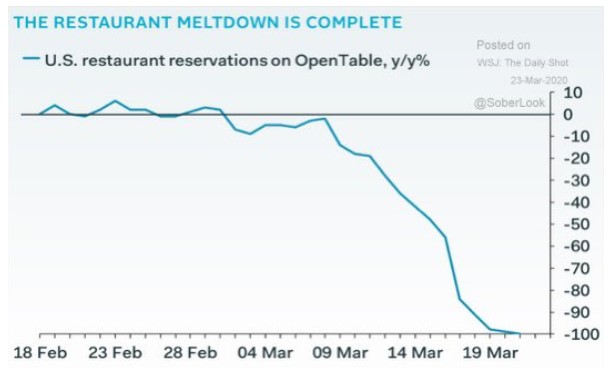

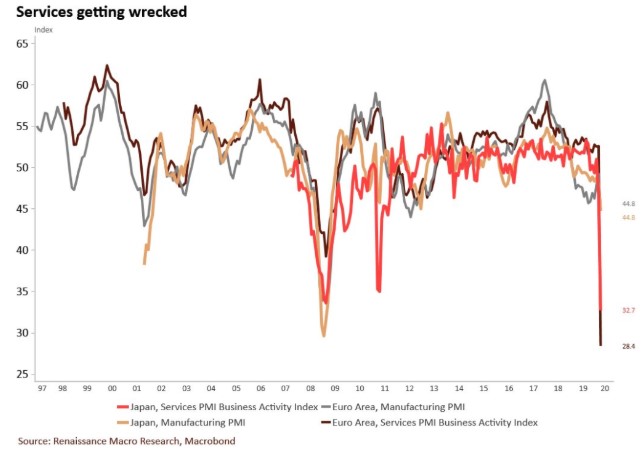

- How bad could the economy get?

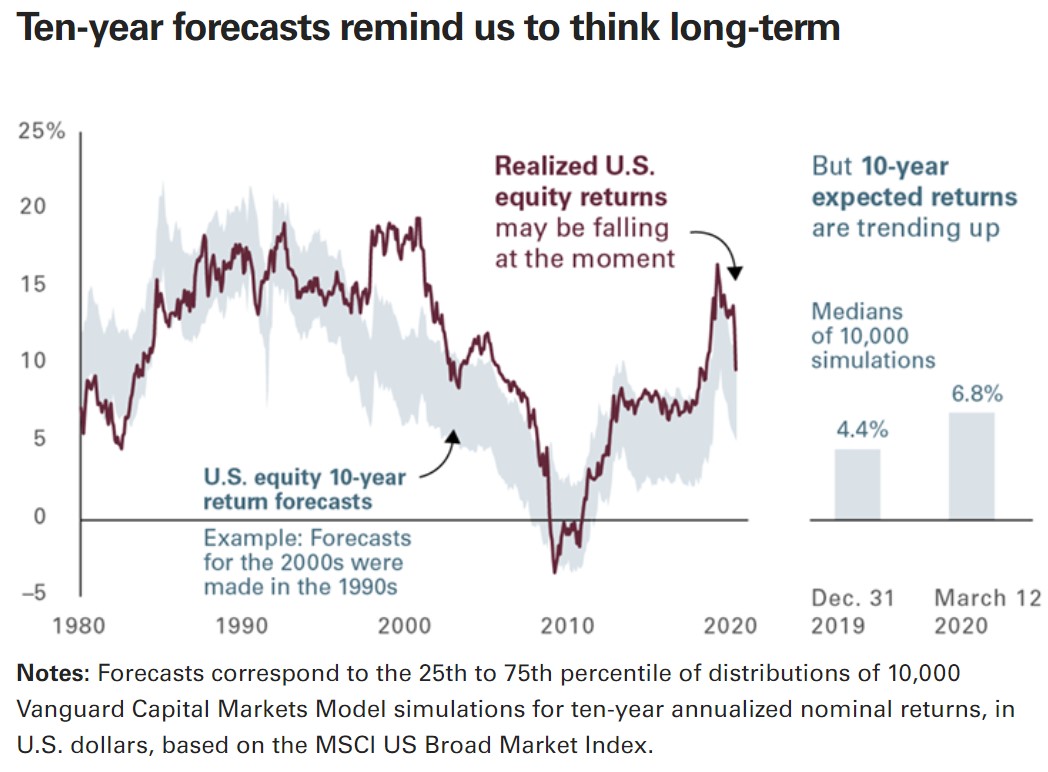

- Expected returns have gone up

- Is it possible the economic damage will be worse than the market damage?

- Denmark’s fiscal experiment

- How do you even begin to calculate valuations at this point?

- How this crisis will overshadow 2008

- Why perma-bears don’t deserve a victory lap

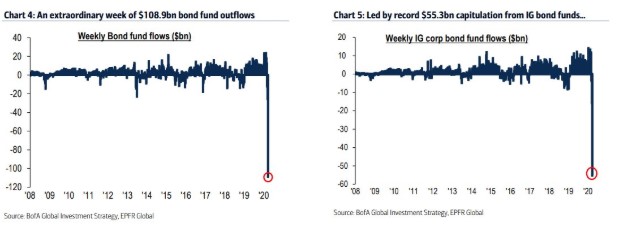

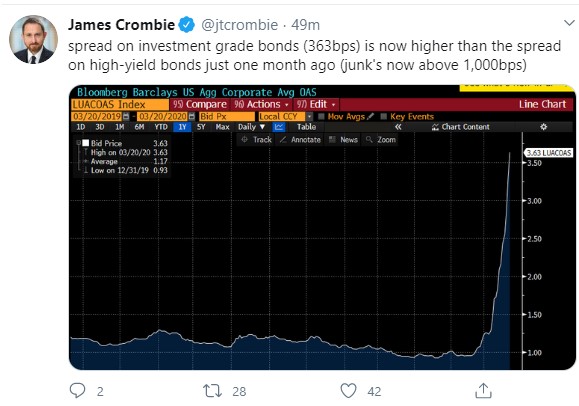

- Craziness in the bond market

- How the bond market is different from the stock market

- Are ETFs making the bond market better or worse?

- A new look at the end of Cast Away and much more

Listen here:

Stories mentioned:

- The panic of 2020

- U.S. jobless rate may soar to 30%

- Denmark’s idea could help avoid a depression

- Stock market valuations

- A viral market meltdown

- Support your local restaurants through dining bonds

- The price of redemptions for bonds

- Investors are fleeing corporate and municipal bonds

- Systemic risk in a crisis

- Why many bond ETFs now trade at a discount

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: