There are different levels of losses in the markets right now:

- If you own value stocks, it’s not too bad (down 2-3%)

- If you own an S&P 500 index fund, it’s a minor correction (down 6-7%)

- If you own the Nasdaq 100, it’s a correction (down 11-12%)

- If you own small caps, it’s a bear market (down 20% as of last week)

- If you own Facebook, it’s a 1987 crash (down 26% in a single day this week)

- If you own crypto, it’s a crash (down 40-60%)

- If you own certain hyper-growth stocks, it’s a depression (down 50-80%)

If you’re invested in one specific group listed here, you’re either doing not so bad or you’re losing your shirt.

But what if you have your investments spread across all or many of these assets?

Yes, you’re experiencing some pain in certain parts of your portfolio but there are other pieces that are picking up the slack.

And those areas where markets are getting killed right now were the assets that were booming in years past. And when those assets were booming, some of the assets that are now doing well were underperforming.

Markets don’t always work like this but you get the idea.

This is why diversification is both wonderful and difficult depending on what’s going on with the individual pieces of your portfolio.

Let’s take Facebook as an example.

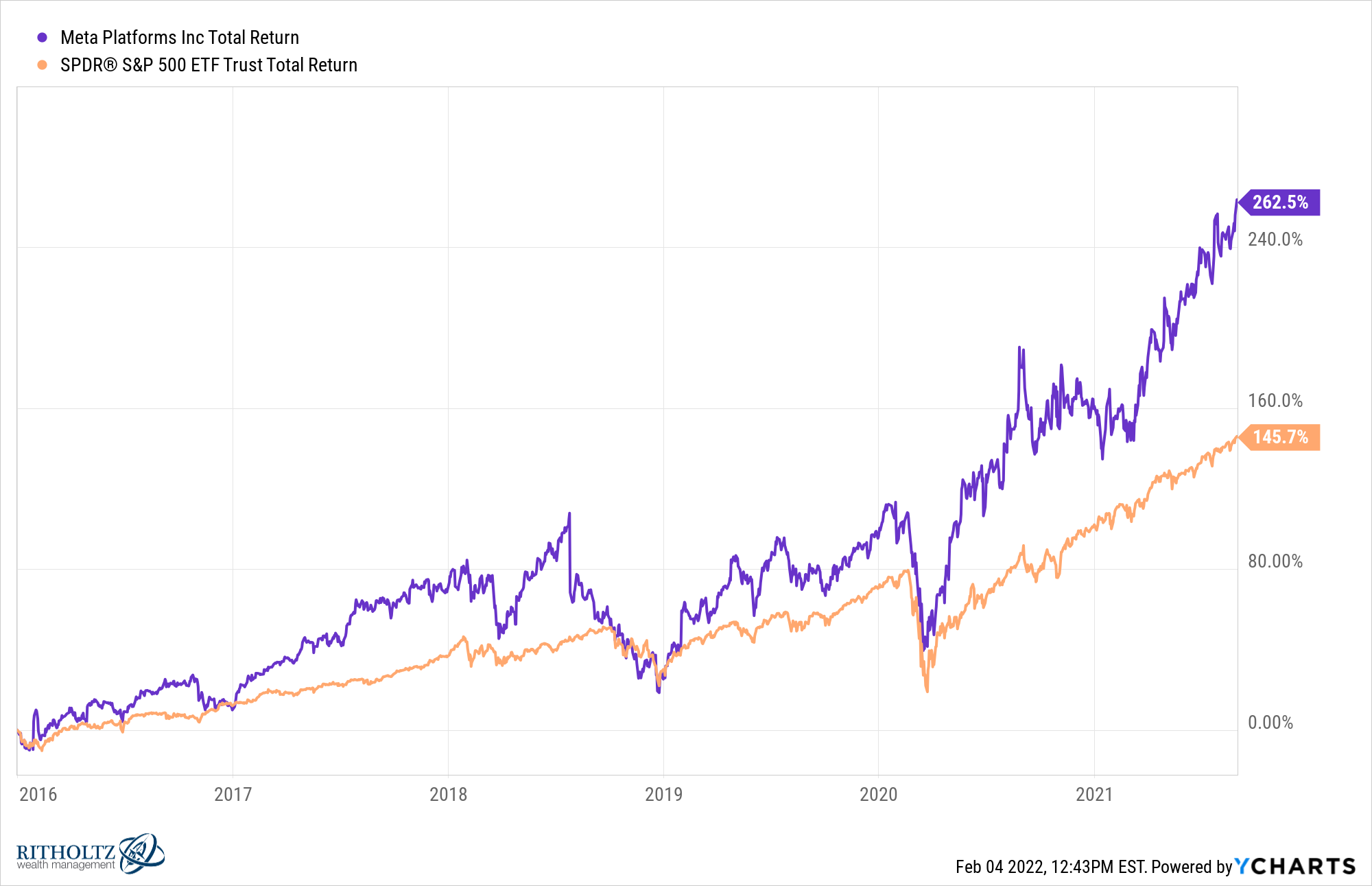

From 2016 through the end of this past summer, the company was outperforming the market by a wide margin:

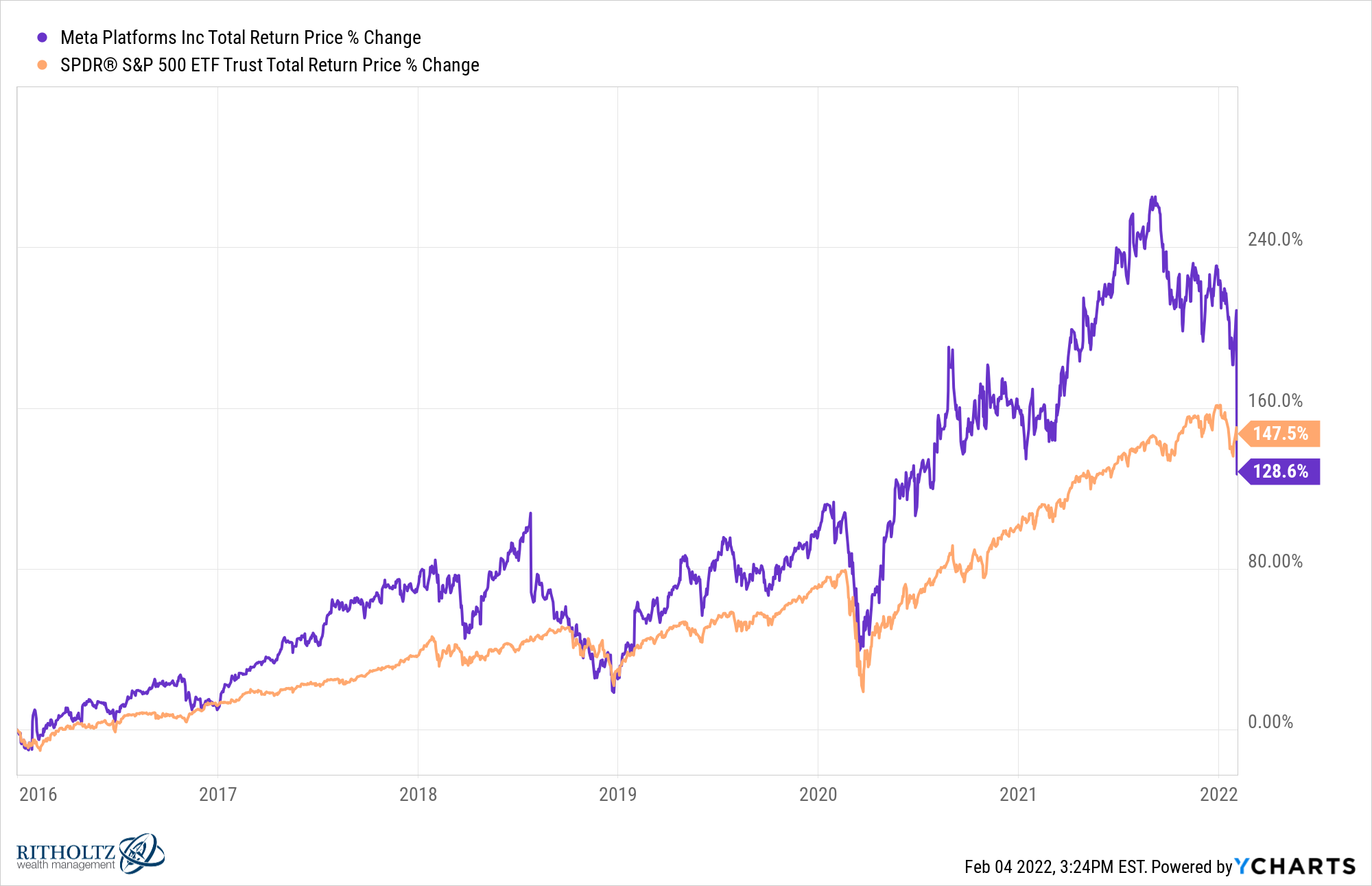

Now let’s look at the updated performance numbers through this week:

All of that outperformance is now gone after a few bad months and one vicious down day.1

Facebook’s 1987 moment led to the biggest dollar losses ever for a single stock, erasing $230 billion in market cap on Thursday. Before this crash, Mark Zuckerberg’s company was the 5th biggest stock in the S&P 500.

Yet on that day when the 5th biggest stock in the market was down 26%, the stock market as a whole was only down 2.5%.

Now a 2.5% down day isn’t great but it’s certainly not the end of the world.

And as luck would have it, Amazon followed up Facebook’s 1987-like one-day crash by gaining more than $200 billion in market cap, one of the biggest one-day gains in history.

By diversifying you avoid having a single point of failure in your portfolio.

Another way to look at this is to check in on the current losses in some of the underlying stocks in the U.S. stock market.

The overall U.S. stock market (Russell 3000 Index) is down roughly 7% from all-time highs. This is still minor correction territory.

But within that universe there are a lot of stocks that are getting crushed:

- 60% of stocks are currently down 20% or more from all-time highs

- 30% of stocks are currently down 40% or more from all-time highs

- 15% of stocks are currently down 60% or more from all-time highs

The returns from the stocks that aren’t in massive drawdowns are more than making up for the big losers,

Of course, being diversified means you’re never going to be invested exclusively in the best-performing names either.

You don’t win games by blow-out margins practicing diversification. And sometimes you may even lose for a time. The examples I’m using here are short-term in nature.

Diversification is not undefeated but it’s never gotten blown out either.

Michael and I discussed the difficulty involved in stock-picking and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why Isn’t the Stock Market Down More Right Now?

Now here’s what I’ve been reading lately:

- Why simple is smart (The Atlantic)

- Investing is a problem-solving exercise (The Big Picture)

- When will be a good time to buy a house? (The Atlantic)

- Wise words on handling market gyrations (Novel Investor)

- Forecasting is hard (Collaborative Fund)

1I’m cherry-picking time frames here. If you went back to their IPO the stock is still outperforming but I’m trying to make a point here.