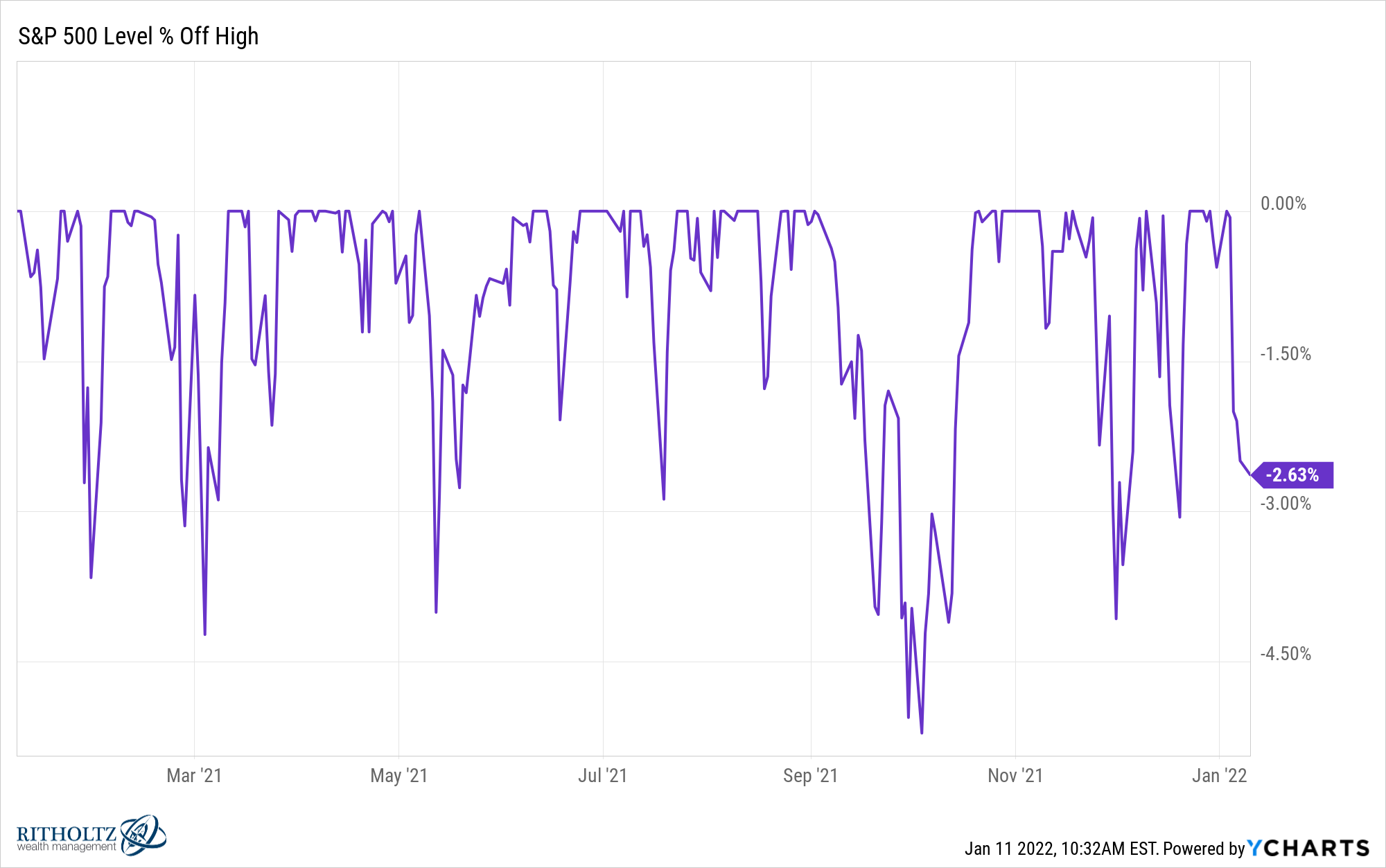

Here’s a live look at the S&P 500 while certain parts of the market are getting absolutely destroyed:

Let’s take a look at the carnage.1

You can see the S&P 500 continues to be the Rasputin of all stock markets:

We’re less than 3% off all-time highs yet it feels like the market is teetering on the brink of disaster.

The Nasdaq 100 is down around 6% from its highs so big tech stocks are still holding up as well:

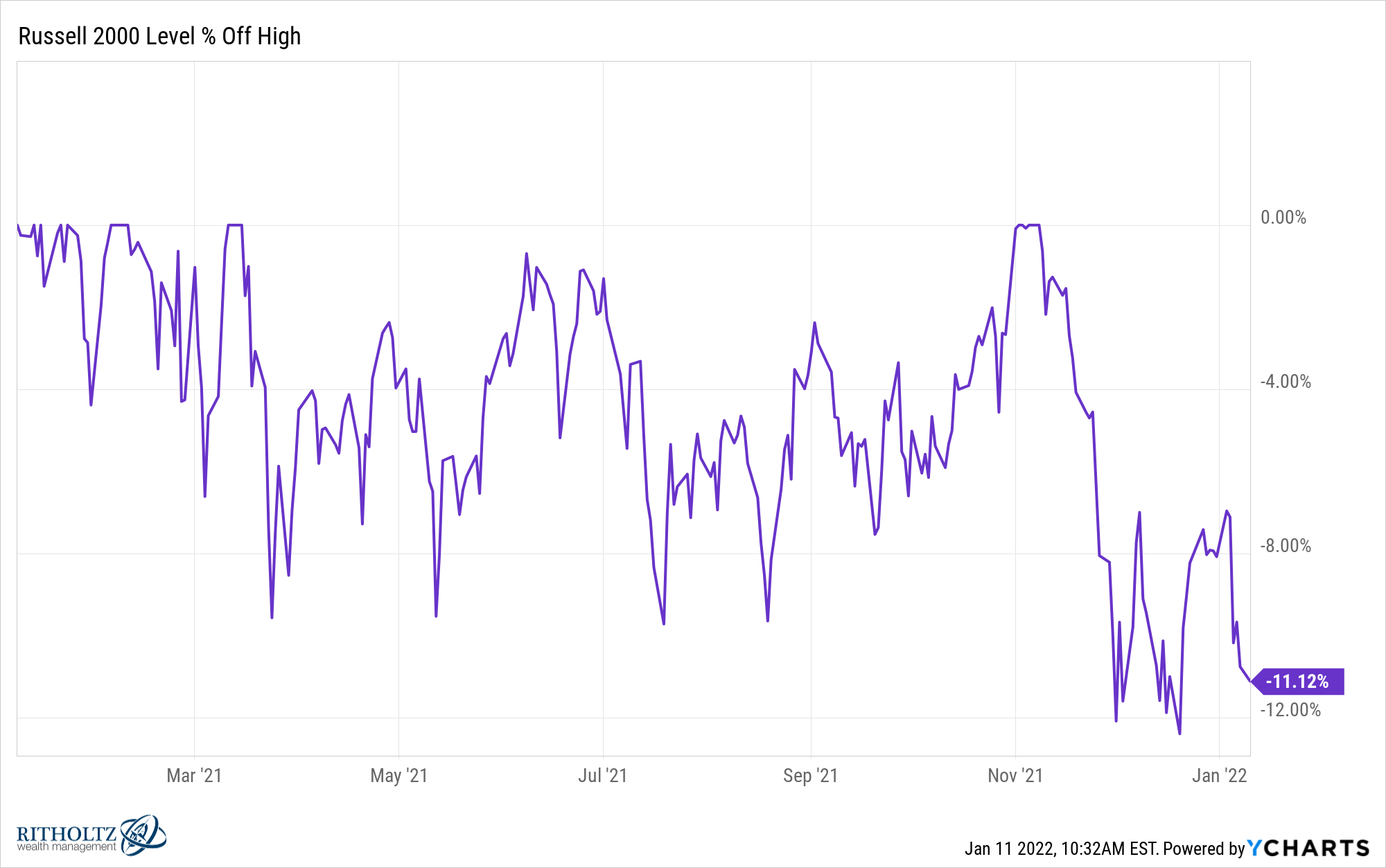

Small cap stocks are in the midst of a correction as the Russell 2000 is now down more than 11%:

This makes sense when you realize small caps are consistently more volatile than large caps. Over the past 10 years, the Russell 2000 has experienced six separate double-digit corrections, including three fairly brutal bear markets.2

During this same time frame the S&P 500 has experienced four corrections including a single bear market.

So far things don’t look so bad.

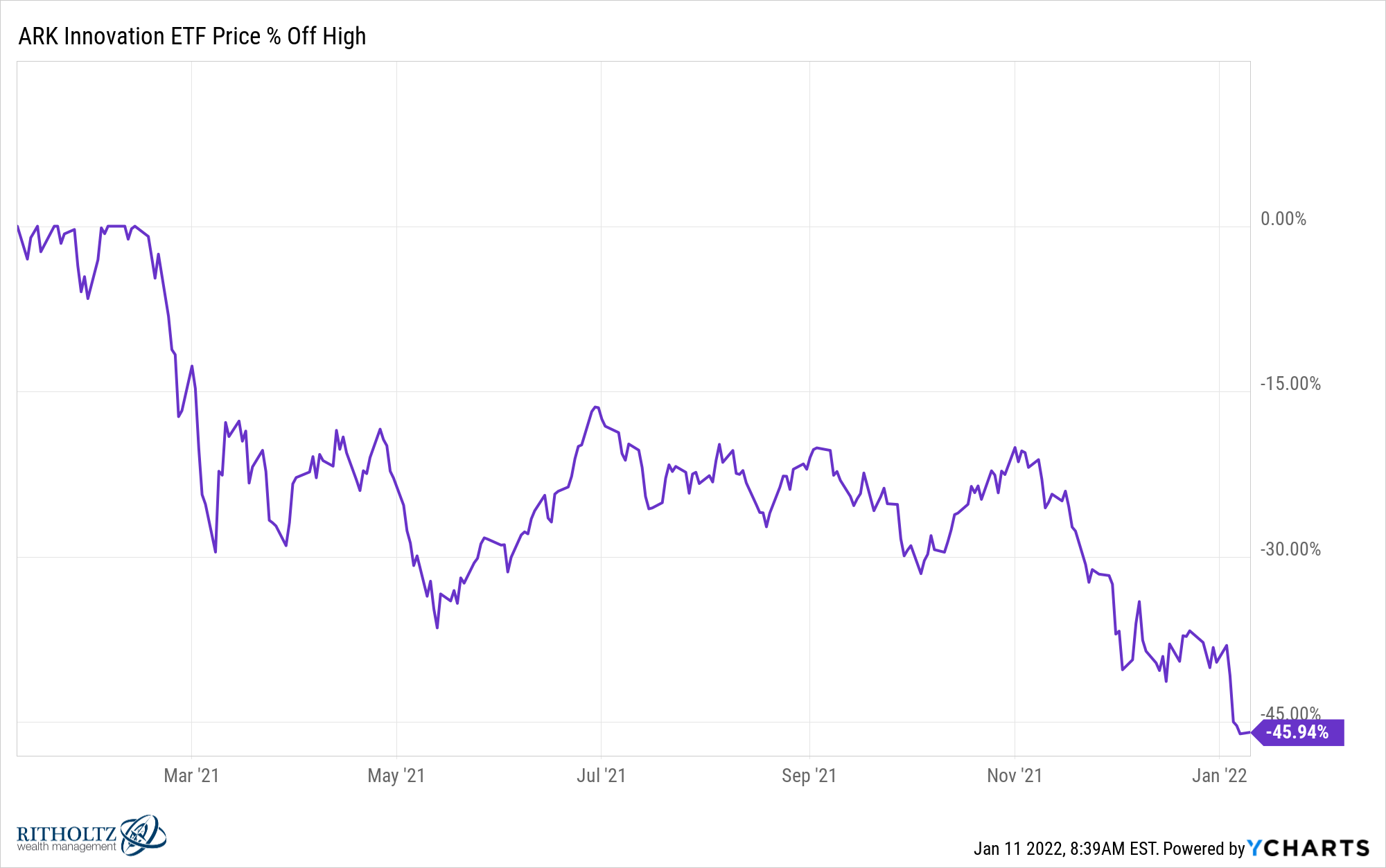

But take a look at the previously high-flying ARK Innovation Fund (ARKK):

It’s down almost 50% from its highs.

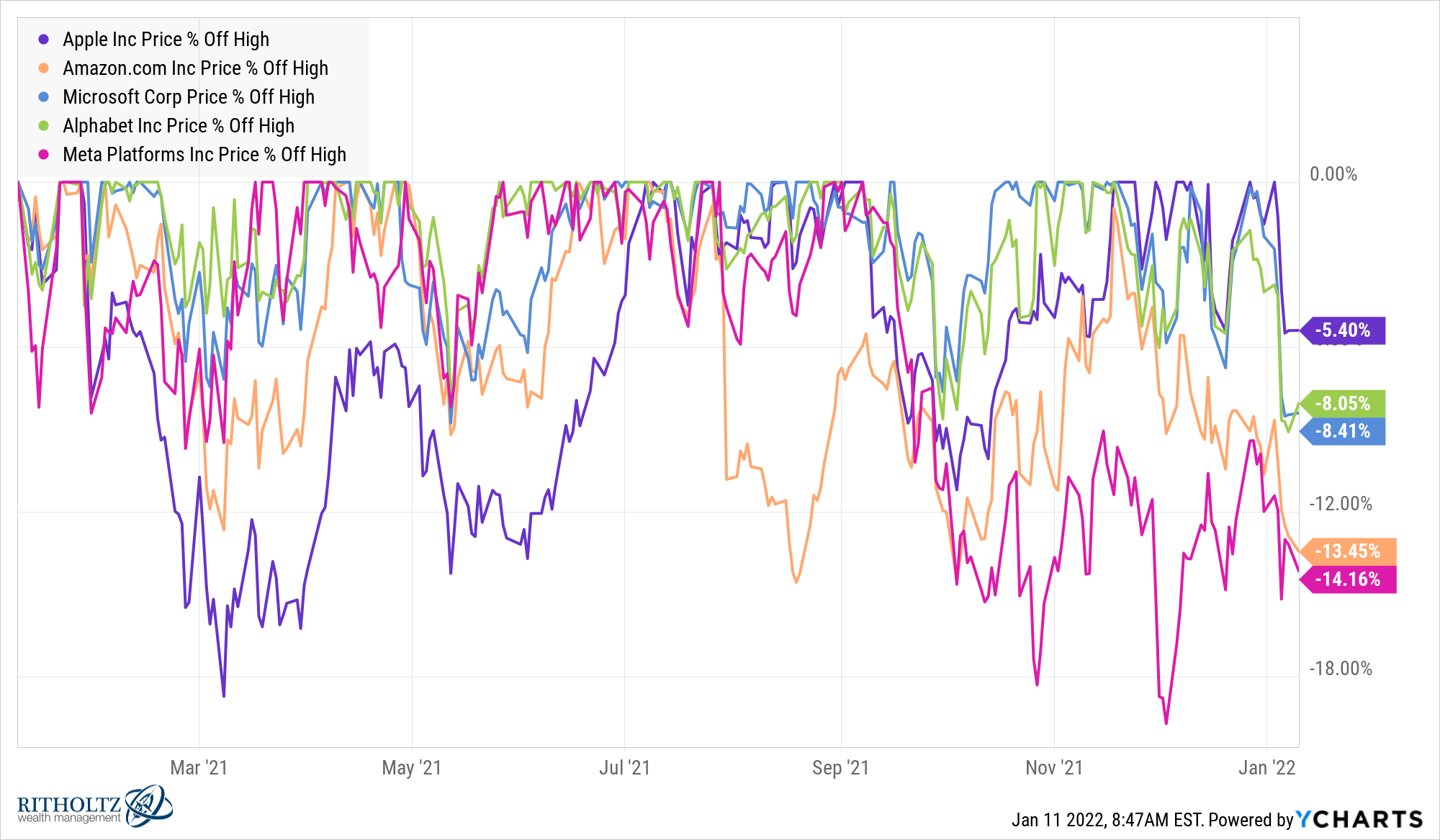

I could have included dozens and dozens of other stocks but here’s a list of some name brands that are all in the midst of their own personal bear market:

Then you have companies like Robinhood, Zillow and Peloton that are all more than 70% off their highs.

By my calculations, there are currently 100 stocks in the S&P 500 down 20% or more from their 52-week highs.

So what’s going on here?

How is the stock market overall holding up so well when it seems like so many stocks are getting killed at the moment?

Most pundits will tell you it’s being propped up by all of the biggest names in the index. After all, Apple, Amazon, Microsoft, Google and Facebook make up nearly one-quarter of the S&P 500.

There is this idea that the generals tend to get shot last so these companies will be the next shoe to drop.

That could be the case but it appears some of these stocks have already begun to fall:

All five of these stocks are down more than the market right now.

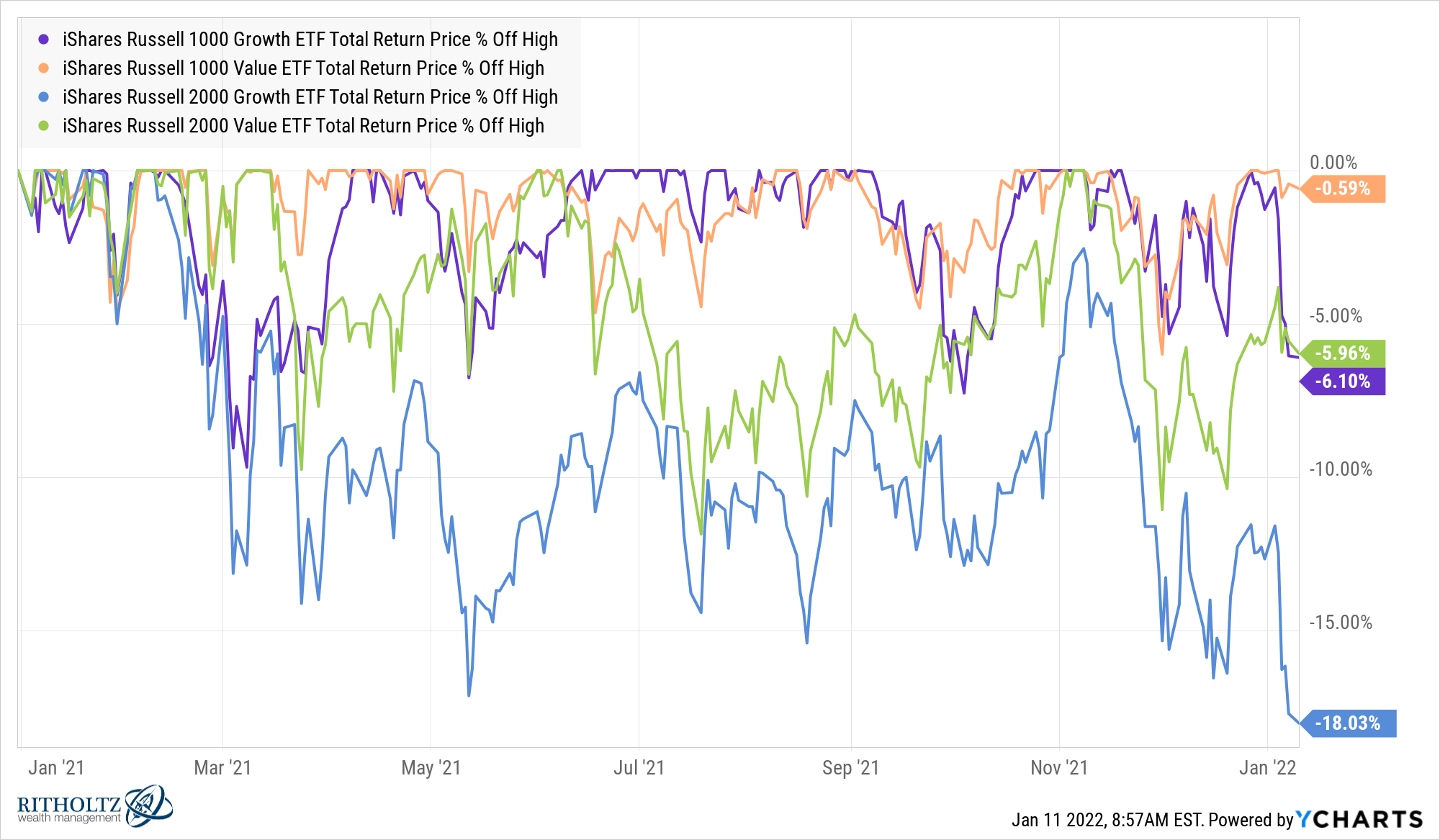

One explanation here is value stocks are finally outperforming growth stocks. In terms of drawdowns, large value stocks are outperforming large growth stocks by almost 6% in this correction:

Small value stocks are outperforming small growth stocks by 12%.

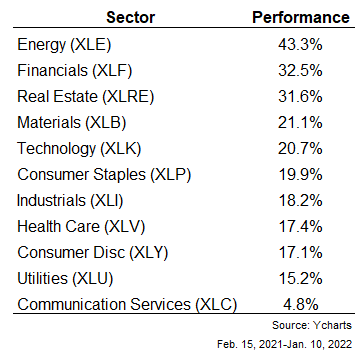

It’s also instructive to look at sector performance. I’m cherry-picking here but these are the sector returns from mid-February of 2021 when many of the high-flying growth stocks peaked:

The S&P 500 is up around 20% over this period so the sectors that are outperforming are energy, financials, real estate and materials. These are not the most exciting industries people have been paying attention to so it’s not surprising investors may have missed this rotation.

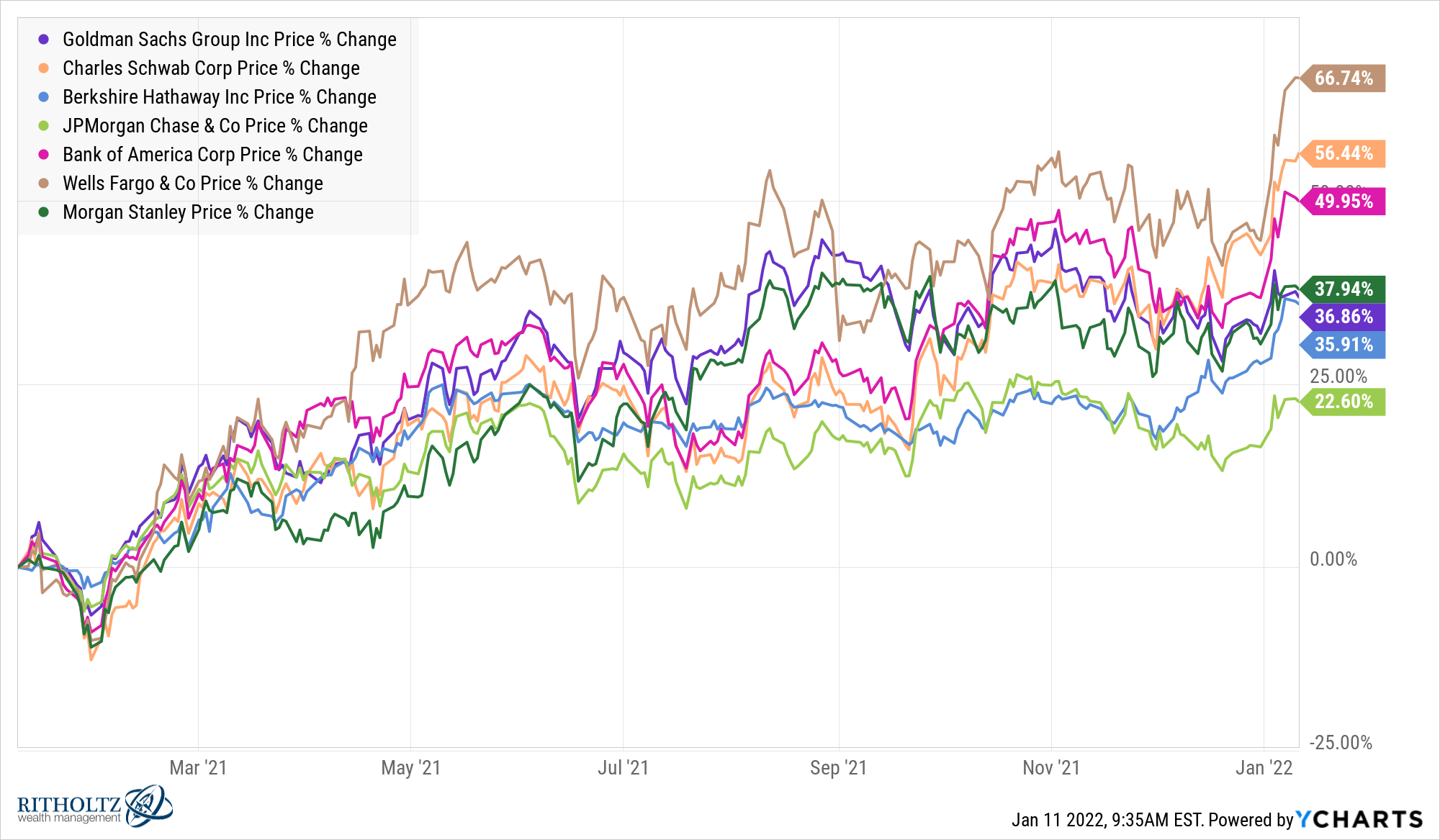

Just look at the performance of some of the biggest financial names over the past year:

These stocks are all breaking out higher. This is another cherry-picked datapoint but Berkshire Hathaway is outperforming Bitcoin by 40% over the past year (37% to -3%).

Basically, we’ve seen a performance rotation from exciting growth stocks to boring old value stocks.

Maybe the rest of these stocks will play catch-up to the carnage eventually. That’s always a possibility.

But if you’re wondering why some of your favorite stock picks are down 20-60% while the stock market doesn’t seem to care you now know the answer.

It seems investors bid up the prices of growth stocks to a point where the fundamentals couldn’t possibly justify those valuations.

And the sectors that were left for dead just so happened to be positioned for a period of rising inflation and higher economic growth.

It doesn’t always work out this neatly for index investors but this is another feather in the cap of diversification.

Further Reading:

Updating My Favorite Performance Chart For 2021

1All numbers through the close on Monday.

2Down 26% in 2016, 27% in 2018 and 42% during the 2020 pandemic crash.