I’ve been looking at the glass-is-half-full side of things as it pertains to the markets lately so I should probably balance things out with some potential risks.

Black swans were all the rage coming out of 2008. Every year people now put out their lists of highly improbable events that could have a large impact on the markets.

Here’s my top 3 for 2022:

1.

2.

3.

I’m sorry but you’re probably not going to predict the next black swan. No one predicted a pandemic would alter life as we know it in late-2019/early-2020.

What about some white swan risks?1

What are the risks that are out in the open that could have an impact on markets but not necessarily prove to be an outlier event?

The biggest risks are often the ones we don’t see coming but the smaller risks can still cause some short-term discomfort.

You could always say war or some other crazy variant or a collapse of civilization as we know it but I’m going to focus on market-related risks here.

1. Inflation. The bond market still doesn’t seem to be too concerned about inflation above 6%. Yes, the 10 year treasury yield has risen a tad over the past week but it’s still hovering around 1.7%, nowhere near the current inflation rate.

There are a lot of factors at play here but it’s possible the bond market simply doesn’t believe high inflation is here to stay.

But what if it is?

The stock market is a great hedge against higher inflation over the long-run. It can be a decent hedge over the short-run but persistently high inflation is not great for stock returns.

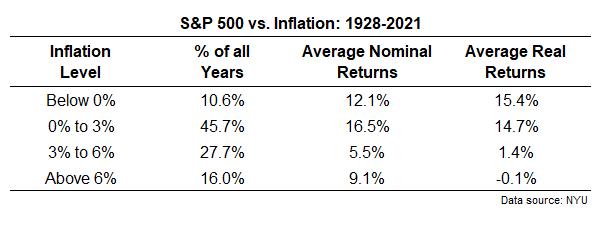

I looked back at calendar year returns for the S&P 500 going back to 1928 and compared them to different inflation regimes:

You can see 0% to 3% is the sweet spot. Nominal returns are actually pretty good when inflation is running at 6% or higher but those returns are swallowed up by inflation when you look on a real basis.

Last year was actually one of the best years on record with inflation running so high. The only time real returns were higher when inflation was 6% or more was in 1975.

Stocks could continue to do well with rising prices but corporations can only pass along higher prices for so long. Eventually, higher than average inflation becomes a headwind to the stock market.

2. The Fed. In 2018 we had two double-digit corrections in the U.S. stock market:

On Christmas Eve of that year we were basically in bear market territory. At the time no one really knew why the market was falling. There wasn’t a good reason.

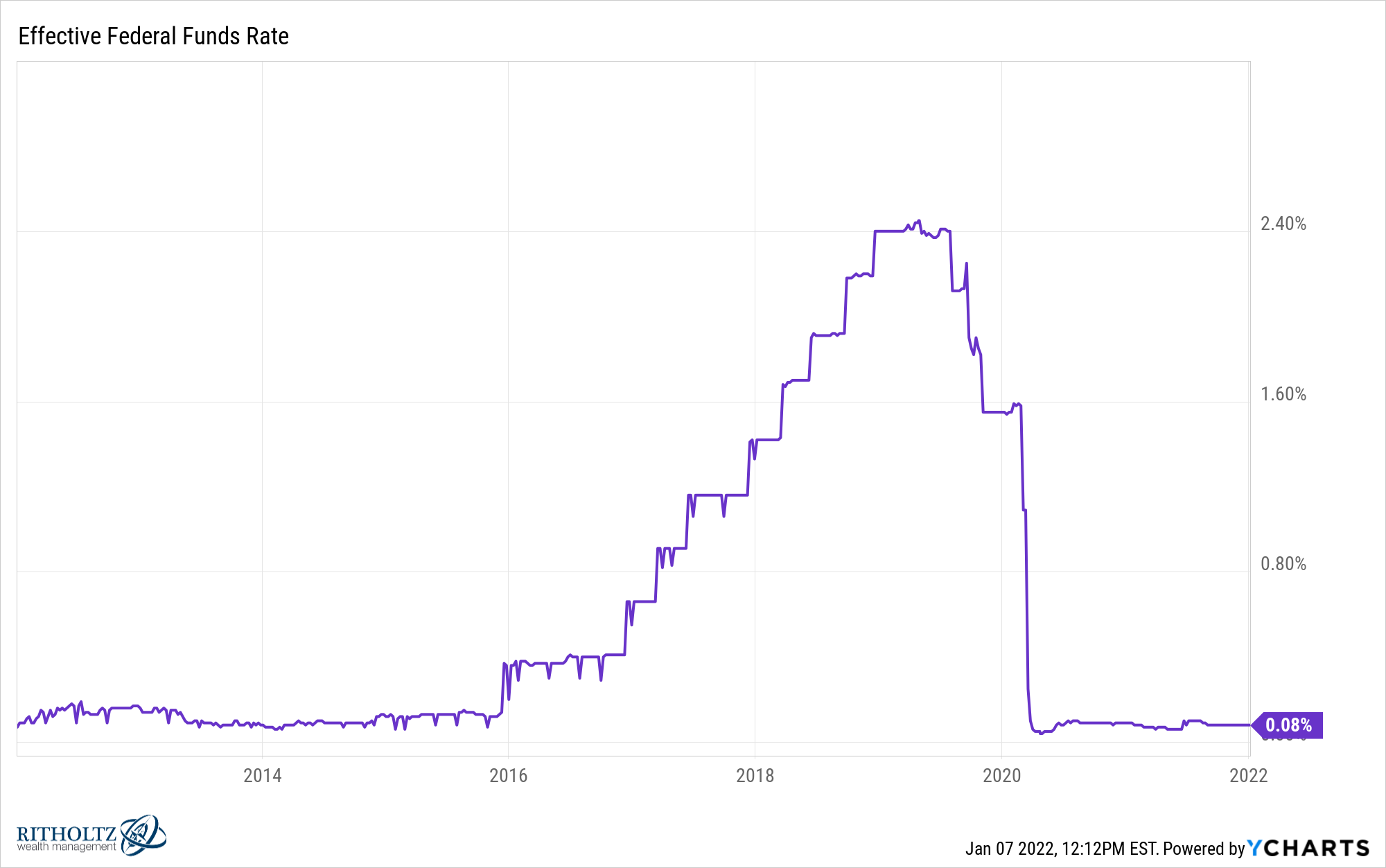

After the fact most people agreed it was the Fed hiking rates:

The Fed raised rates to more than 2% then abruptly changed course after the market sell-off. Mortgage rates also rose to around 5% at the time so it was a decent little tightening cycle.

I don’t know what the line in the sand is for these things anymore but it’s possible too much tightening from the Fed could derail the stock market again.

And last time around they didn’t have inflation or higher economic growth to contend with so it’s hard to see them reversing course quite as quickly if markets don’t like higher rates.

History doesn’t always rhyme, repeat or retweet but it’s not out of the question for the stock market to get a little antsy if the Fed goes on a rate hike spree.

3. Stocks went up too much. Why did the stock market crash in 1987? There are all of these technical reasons about market structure and portfolio insurance but most people don’t realize stocks were up around 40% in the first 8 months of the year before the Black Monday crash.

And that’s after the market was already up nearly 150% from 1982-1986.

Sometimes the reason stocks fall is because they rise too much in a short period of time and investors look for an excuse to lock in some gains.

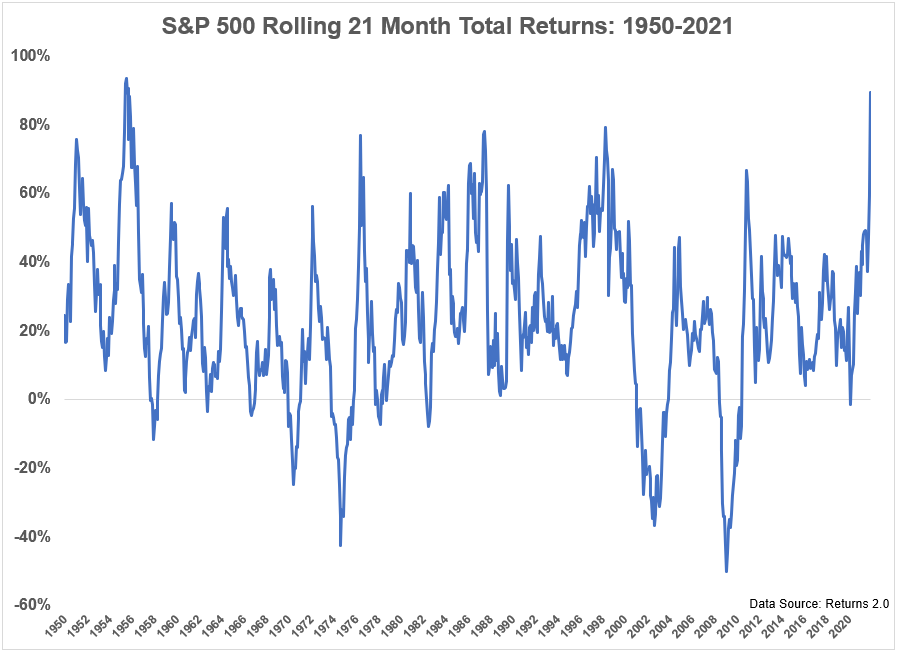

From April 2020 through the end of 2021, the S&P 500 was up 90%. That’s a massive return in a 21-month period. Just look at where it ranks for 21 month total returns going back to 1950:

The only time it was higher was in the 1950s bull market.

Guess what followed this nearly two-year boom?

There was an 11% correction in a month in the fall of 1955. Then in the summer of 1956 stocks tumbled 15%. Less than a year later the only bear market of the 1950s commenced as stocks fell nearly 21%.

Returns were still excellent throughout that decade but trees didn’t grow to the sky and corrections were a natural extension of large gains.

I would be more surprised if we don’t have a 10-20% correction in the next 18 months or so than if we do.

Michael and I talked about how even the best of times require pullbacks on occasion on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Is This the Greatest Bull Market in History?

Now here’s what I’ve been reading lately:

- Rules for buying crashing growth stocks (Irrelevant Investor)

- Are you saving too much money? (Darius Fox)

- The machine (Reformed Broker)

- The oral history of Scream (The Ringer)

- Playing with house money (Young Money)

- And just like that (Belle Curve)

- Playing financial sabermetrics (A Teachable Moment)

- Rich life traps (I Will Teach You To Be Rich)

1Yes I made this one up. Just go with it.