Today’s Animal Spirits is presented by GiveWell:

We discuss:

- Will Omicron prolong the supply chain and labor market shortage problems?

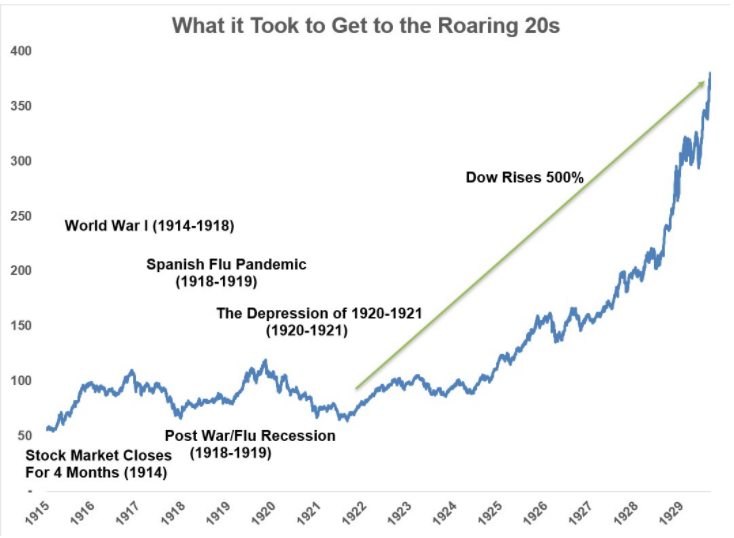

- Did we miss out on our roaring 20s?

- Why I’m never shopping at the mall again

- People have too much stuff

- We’re close to a record number of all-time highs in stocks this year

- Are returns getting close to 1990s levels?

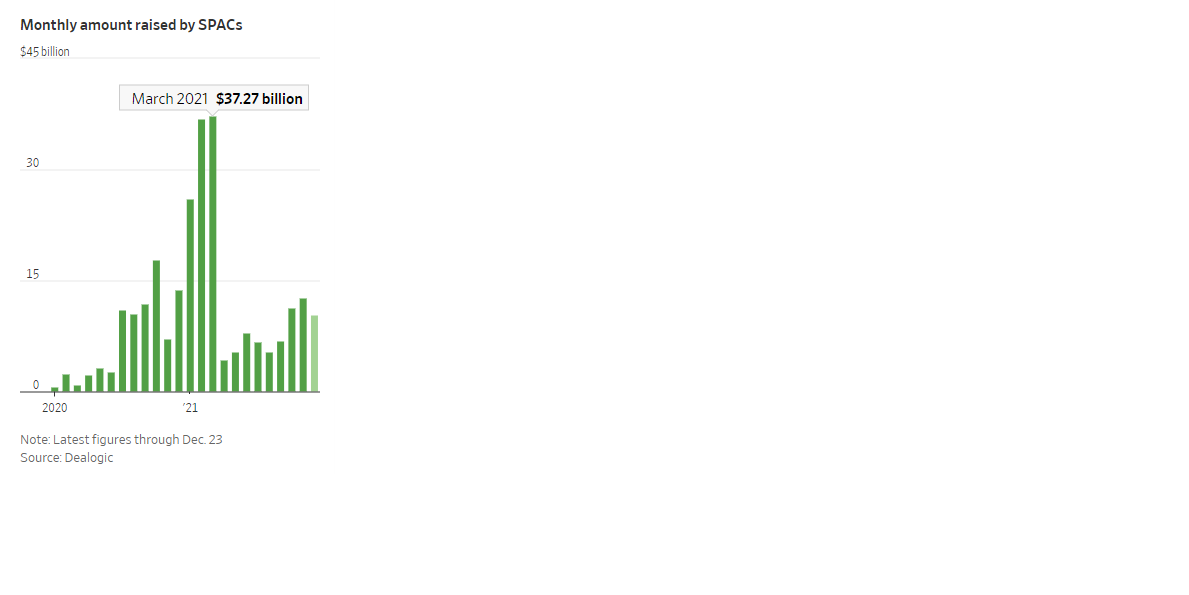

- Celebrity SPACs stink

- Good luck betting against the U.S. economy

- Do investors focus too much on risk?

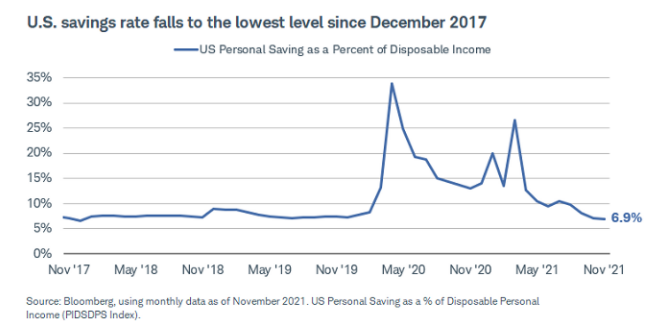

- Is a falling savings rate good for the labor market?

- What fighter jets can tell us about inflation

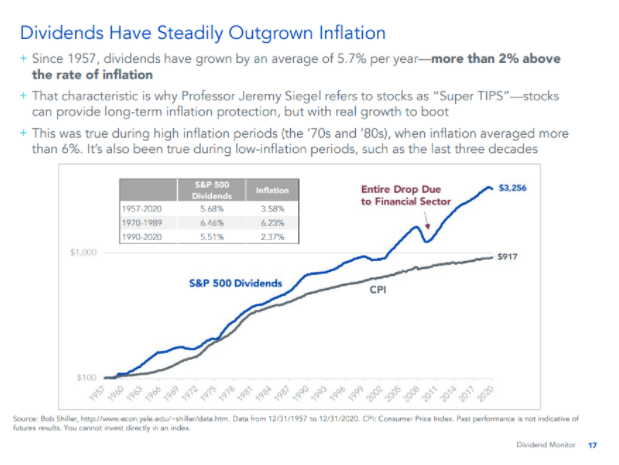

- Why the stock market is your best source of investment income

- Why crypto is going to be so important to creators on the internet

- Are 40% annual returns even possible?

- AMC and the community mentality

- Why I sold Stitch Fix earlier this year when the CEO stepped down

- Who still uses their Alexa?

Listen here:

Transcript here:

Stories mentioned:

- DeFi primer

- How did we ever get to the roaring 20s?

- Early holiday shopping numbers higher

- Celebrity SPACs leave famous winners looking more like losers

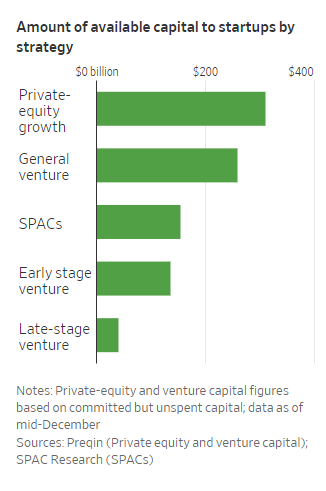

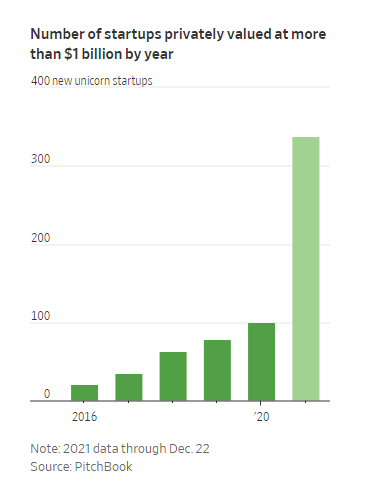

- The $900 billion cash pile inflating start-up valuations

- Don’t underestimate the resilience of the U.S. economy

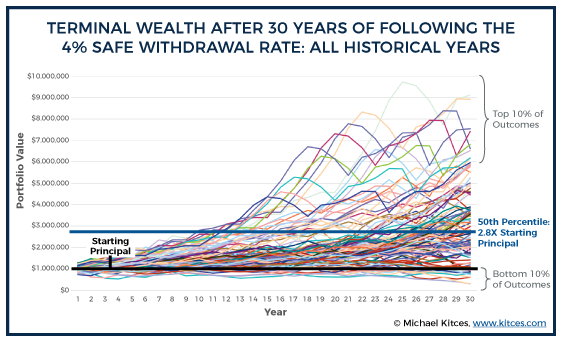

- The extraordinary upside potential of sequence of return risk

- Inflation is soaring in Europe too

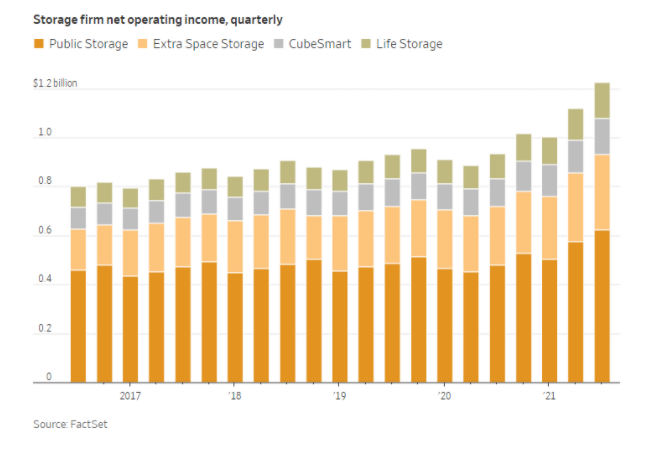

- Self-storage is the pandemic’s hottest property

- The web3 renaissance

- Inside AMC’s crazy year

- No planet for apes

- Amazon’s Alexa stalled with users

Books mentioned:

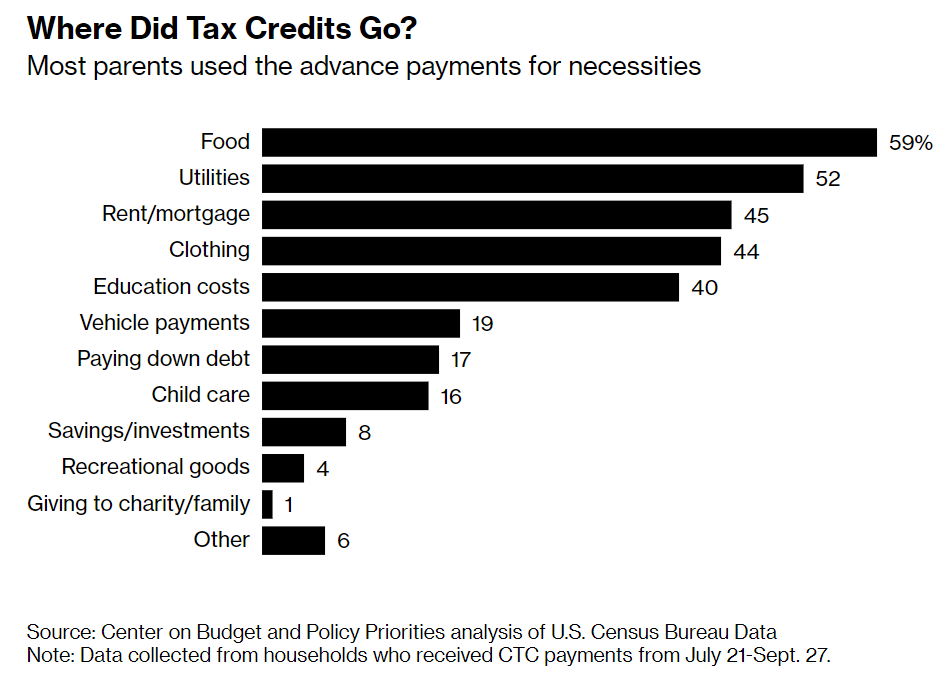

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: