Warren Buffett once said the reason bubbles exist is because people see neighbors dumber than they are getting rich.

It sure seems like a lot of dumb stuff is making people rich these days.

The fear of missing out, otherwise known as FOMO, has to be at an all-time high.

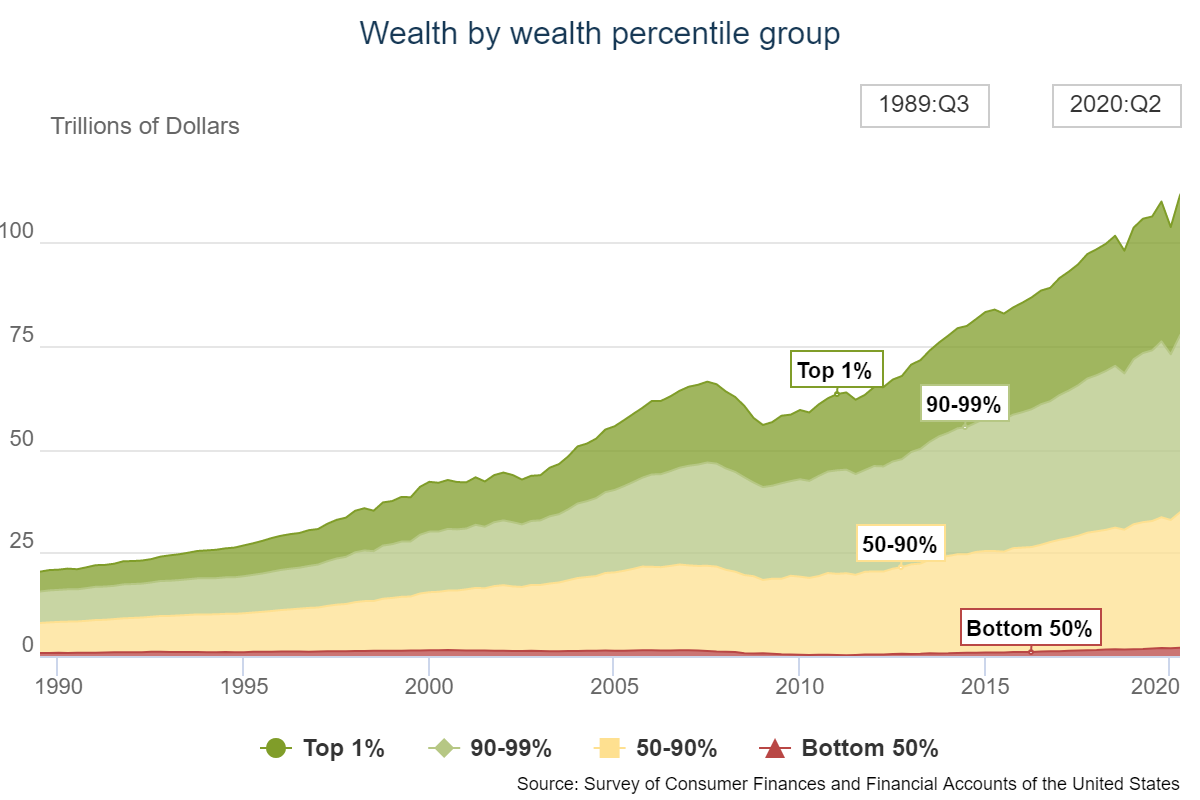

This makes sense considering we as a country have never been wealthier. According to Chris Marsh:

During the pandemic, US household wealth increased by the largest amount since records began in the 1950s—taking household net worth above six times GDP for the first time.

Of course, most of this wealth remains parked in the hands of the top 10% so the rich have only gotten richer:

But this concentration of wealth seems to be happening at warp speed these days and that makes the FOMO even harder to stomach. It’s never been easier to see just how well other people are doing in the headlines, on social media or on daily updates of the wealthiest people in the world.

I’ve developed tiers of FOMO to show why this time feels so much different when it comes to wealth watching.

Here are my 3 levels of FOMO:

Level 1. Long-term FOMO

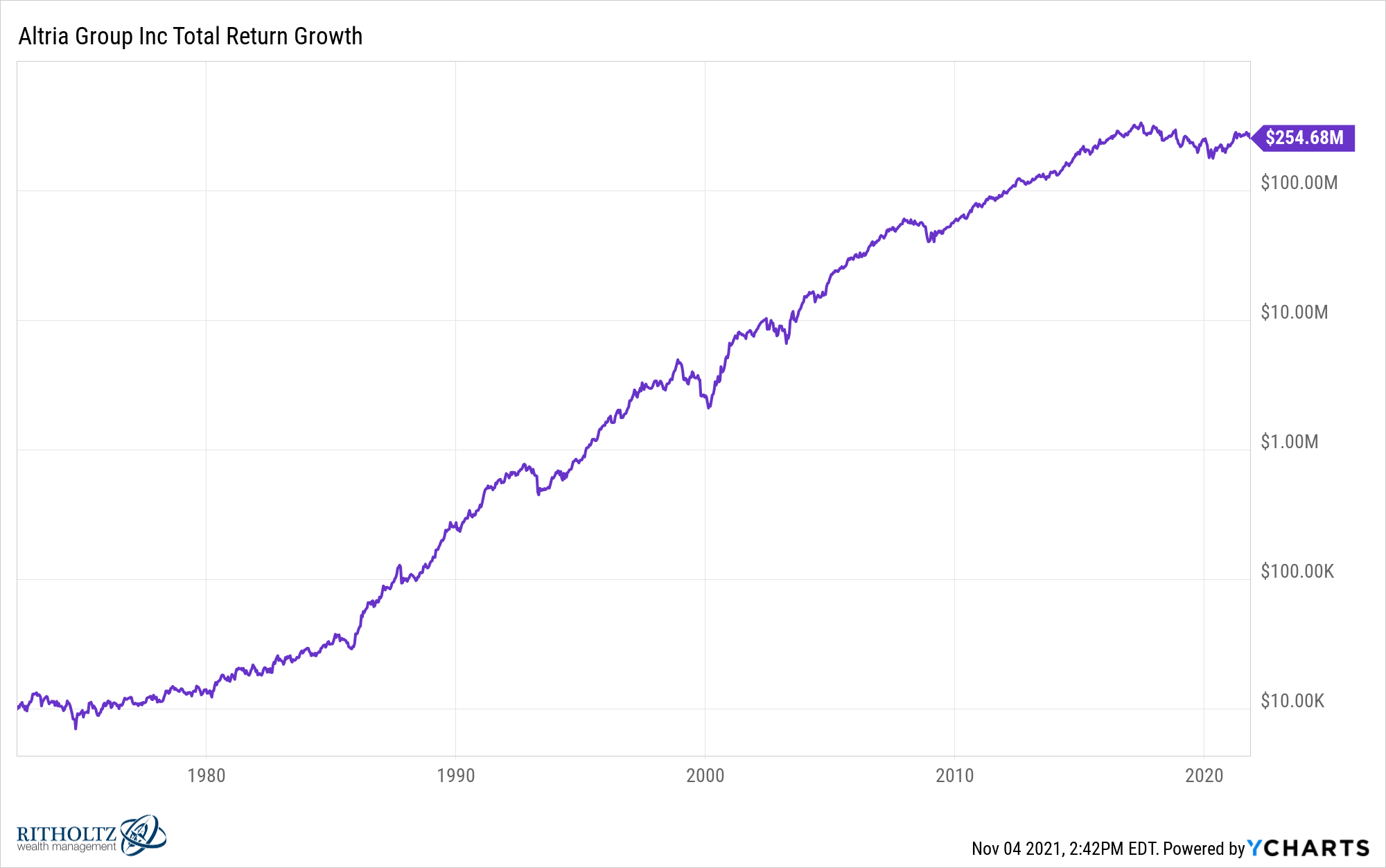

Altria (formerly Philip Morris) is one of the best-performing stocks of all-time:

That’s $10k invested in the early-1970s running up to $254 million! Unbelievable.

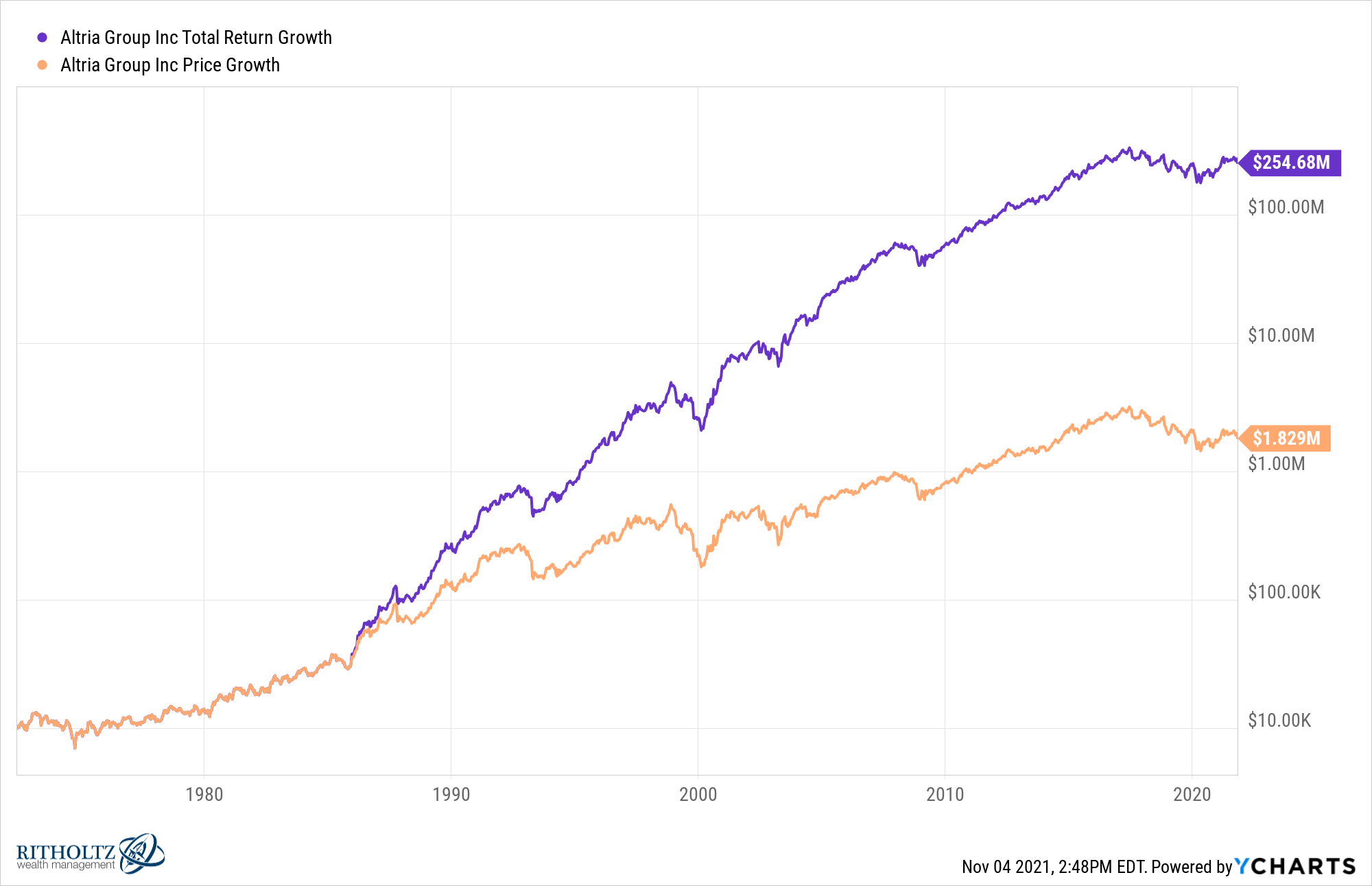

And the crazy part is the majority of that return came from reinvesting dividends. Look at the difference between the price return (no dividend reinvestment) and the total return (dividends reinvested):

Those regular cash payments were a compounding machine.

This is the kind of FOMO that only exists in hindsight. It was difficult to see at the time because it was a slow, boring way to build capital, despite the fact that returns were ridiculous over this time frame.

Long-term FOMO isn’t all that difficult to deal with because it requires time, patience, discipline and a time machine to truly play the ‘what if?’ game.

Level 1: I need to find the next dividend compounding machine.

Level 2. IPO FOMO

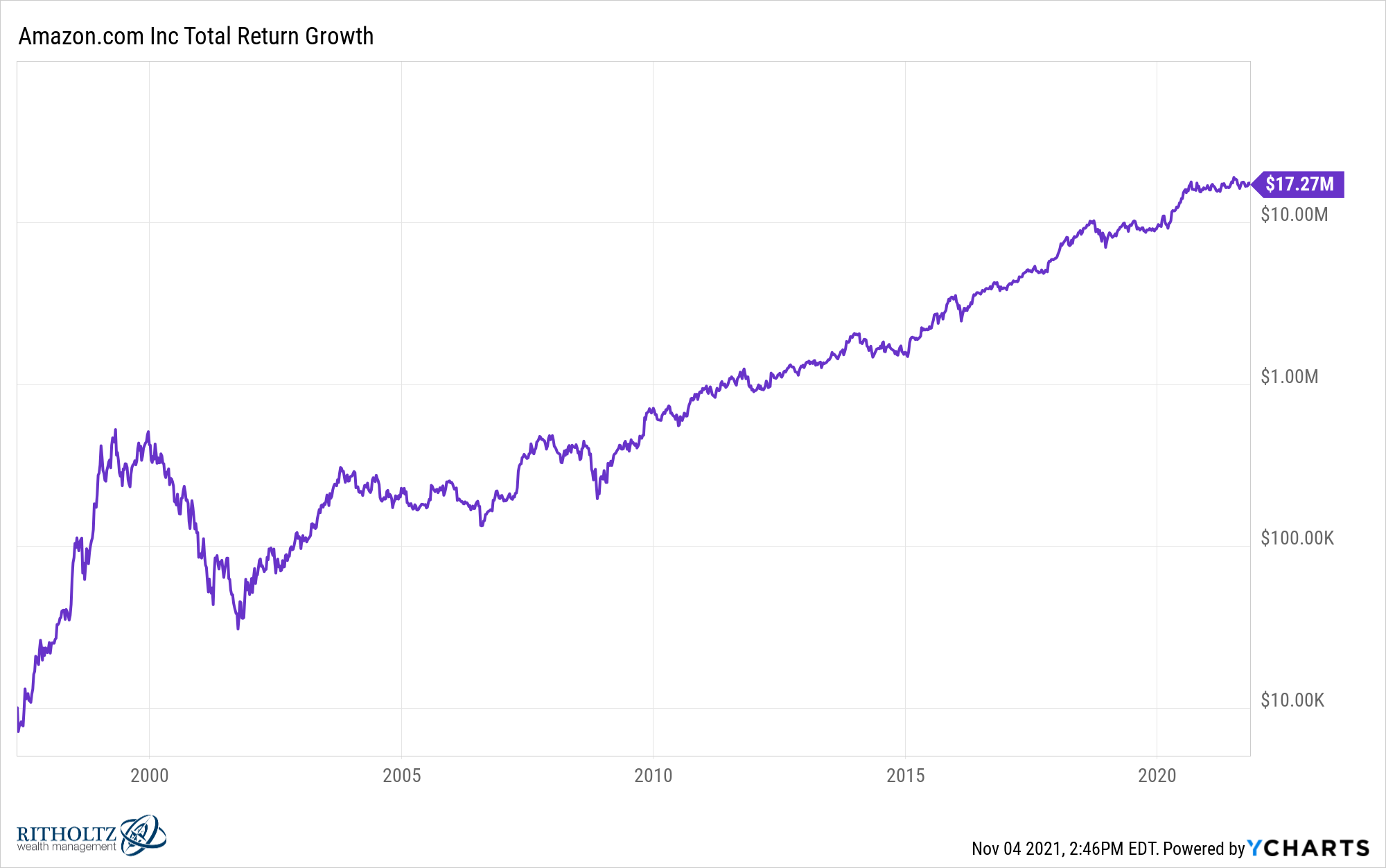

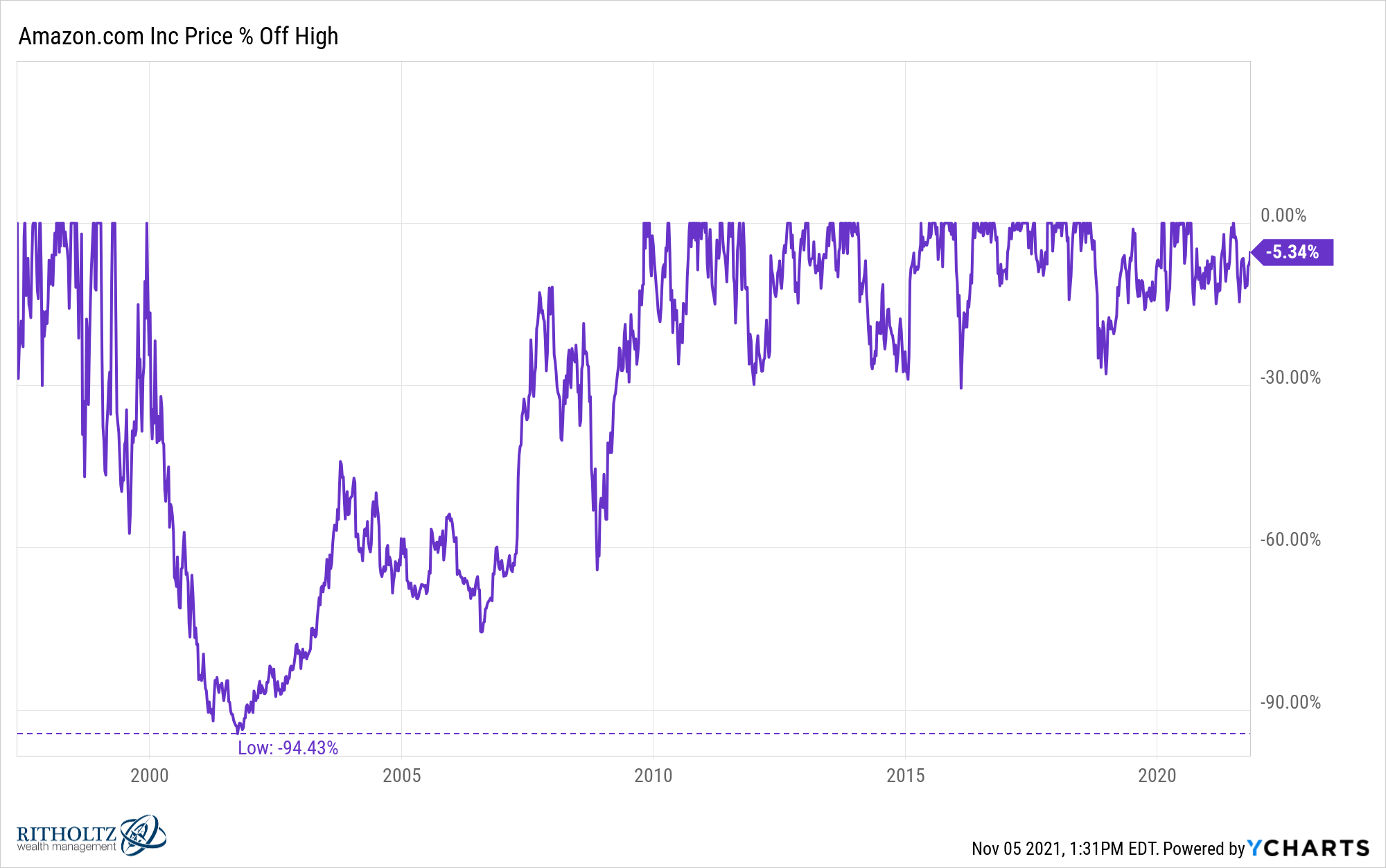

Amazon is the ultimate example of a company you wish you would have bought when it went public and just held on for the ride:

Ten thousand dollars invested in 1997 is now worth more than $17 million.

IPO FOMO stings because it’s the kind of investment you wish you had in your back pocket to brag about.

I was on the Amazon train before it was cool. I knew Bezos was going to do something special.

It now seems so obvious Amazon became one of the largest, most successful companies in the world even though it was never so simple at the time:

IPO FOMO makes it tempting to constantly look for the next big thing in tech. You want to be that cutting-edge investor who sees secular trends before anyone else. This is why investors are constantly chasing the next hot stock or sector.

Hope springs eternal that we’ll find the next IPO lottery ticket.

Level 2. I need to find the next world-changing company.

Level 3. Get Rich Overnight FOMO

The current FOMO is being driven by start-up success to some extent but also the massive wealth that’s being created in crypto.

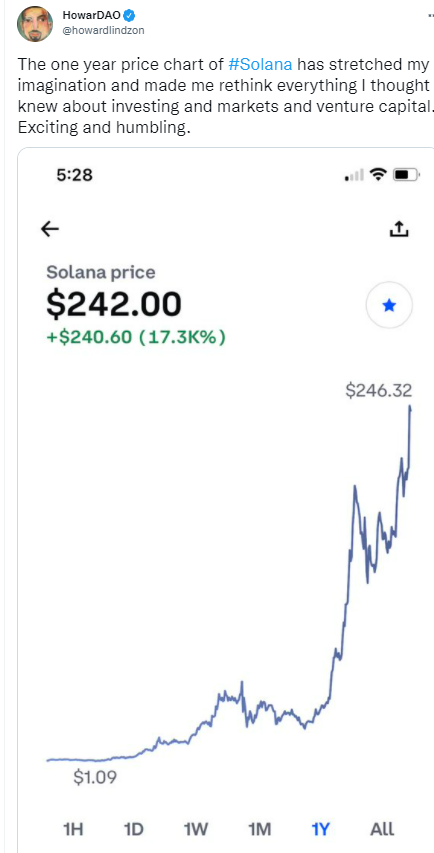

This week Howard Lindzon tweeted a one year chart of Solana:

A 17,000%+ gain in 12 months. Just a breathtaking chart.

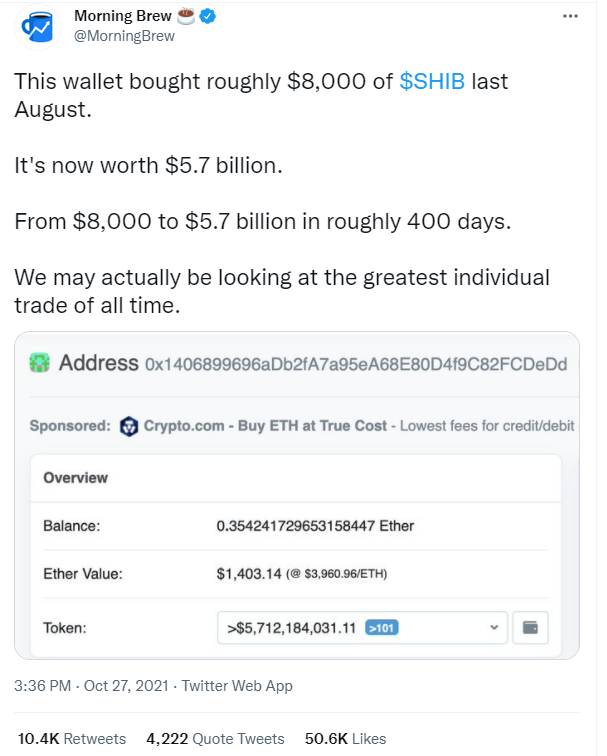

And speaking of breathtaking (or maybe gut-punching) the Shiba Inu meme coin that is going absolutely berserk. Morning Brew shared this stat that almost made me re-think everything I’ve ever learned about finance:

Someone turned $8,000 into nearly $6 billion by “investing” in a meme coin of a dog that is a derivative of another dog meme coin. It took a little over a year.

Now everyone wants to find the next Shiba or Doge or whatever else is up a million percent in the past 3 weeks.

Level 3. I’m going to become a shitcoin millionaire.

It’s not supposed to be possible to earn so much money in such a short amount of time.

The FOMO from this cycle is going to mess with people’s brains in ways we probably can’t even comprehend at the moment.

The sheer amount of wealth that’s been created, mainly by young people, in recent years is sure to have some bizarre unintended consequences in the years ahead.

We talked about the levels of FOMO and more on this week’s Animal Spirits video:

Subscribe to The Compound for more of these videos.

Further Reading:

The 3 Levels of Wealth

Now here’s what I’ve been reading lately:

- Zillow Fight! (Reformed Broker)

- How much money is enough? (Incognito Money Supply)

- The nothingness of money (More to That)

- What really happened to Tony Soprano? (THR)

- What seems obvious isn’t always true (Humble Dollar)

- Swedish start-up Quartr gains high profile investors (CNBC)