John Templeton once said:

The 10 most dangerous words in investing are “If you would have just put ten thousand dollars into…”

Alright, alright, Templeton didn’t actually say this.1

But if he was around today, maybe he would have.

Everywhere you look people are getting rich. And it’s happening in such a short window of time as well.

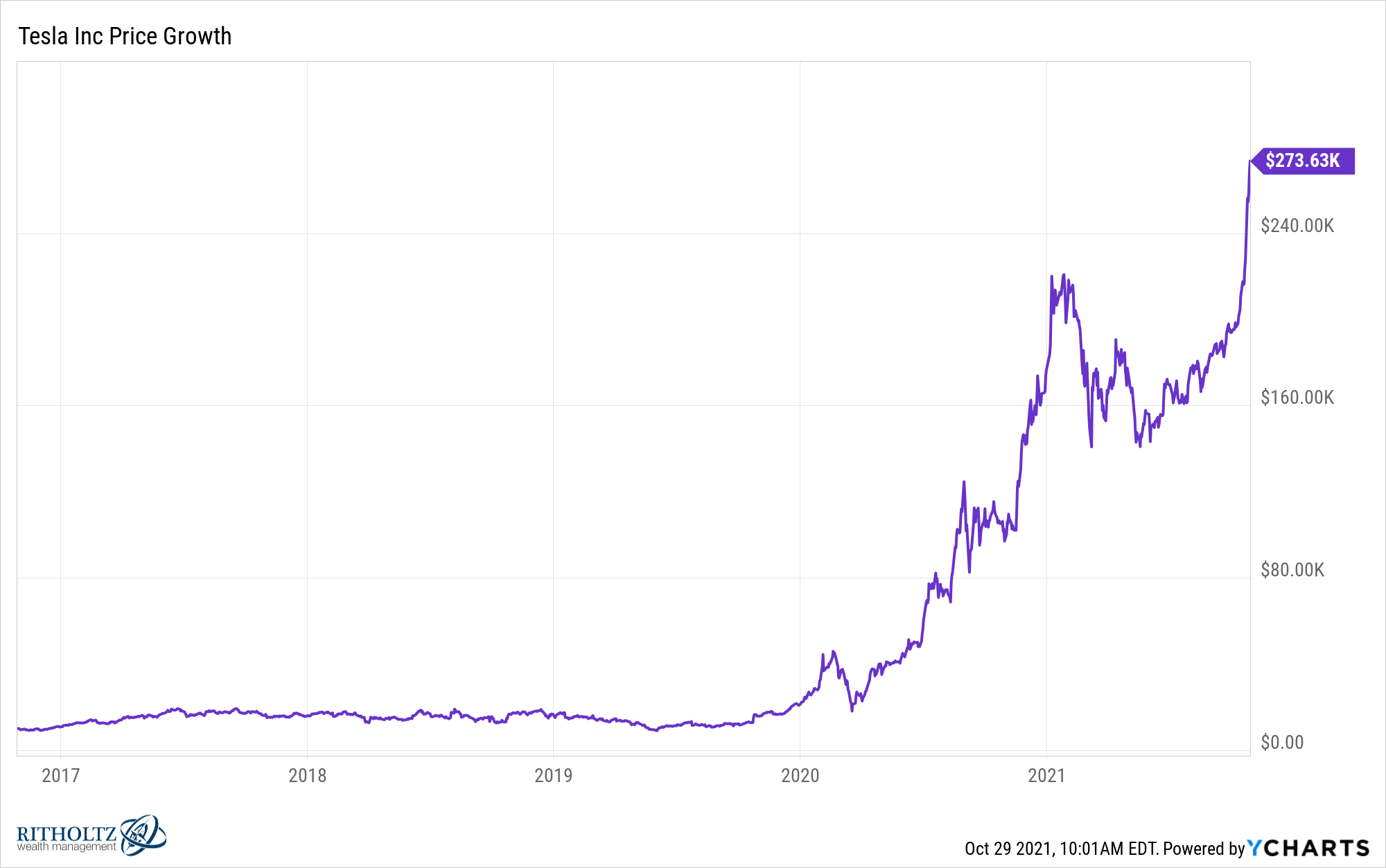

Take Tesla as an example. Here’s a look at $10k invested in the company 5 years ago:

By the end of 2019, that $10k stake would be worth around $20k. That’s a double in less than 4 years. Not bad.

But look at what it’s done since then. From $20k heading into 2020 all the way up to nearly $275k today.

The stock is now up a cool 2600%+ over the past 5 years, just an extraordinary run.

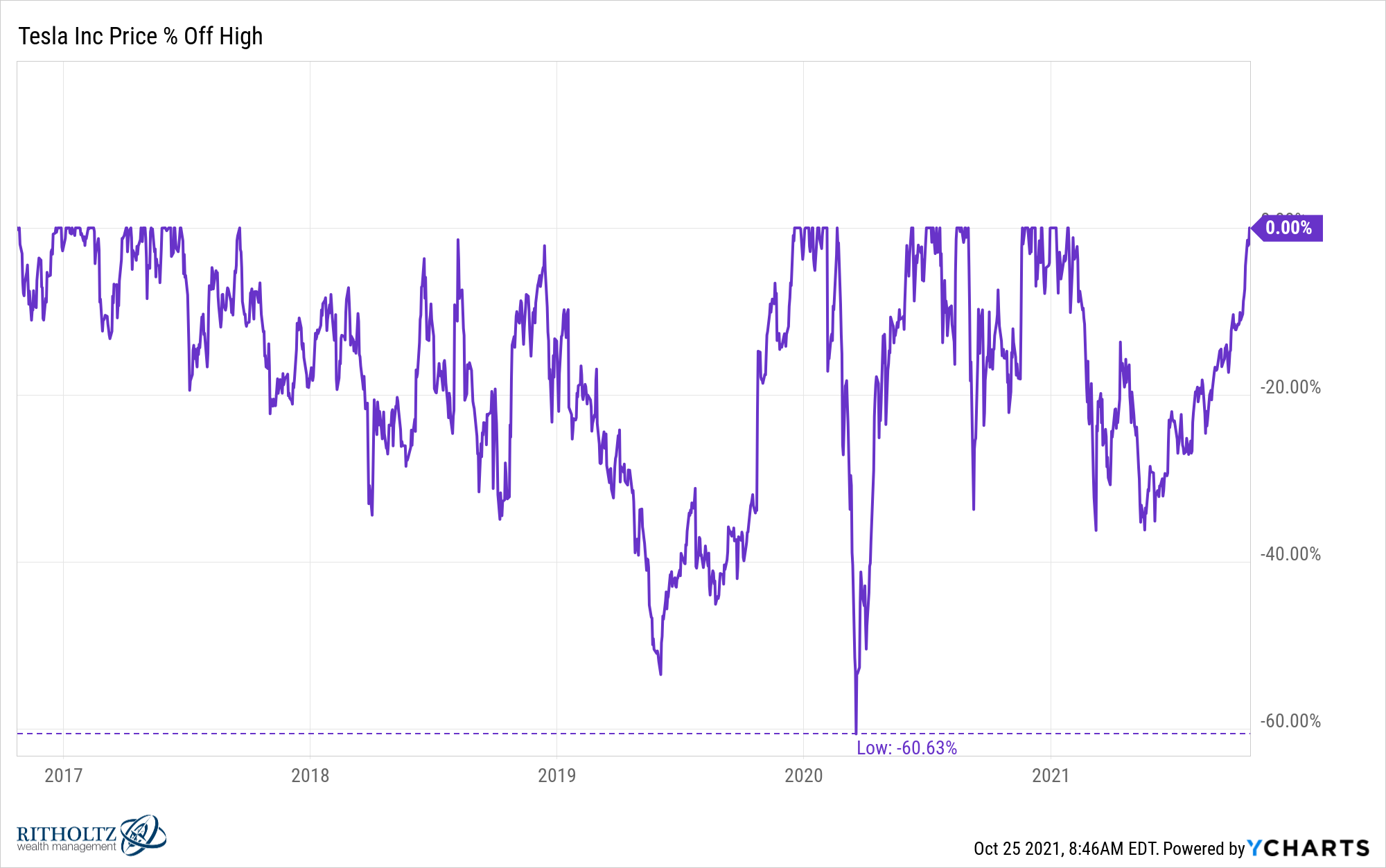

If you held on for the ride, nicely done because look at the drawdown profile of the stock in that time:

In the past 5 years, there were drawdowns of 30%, 50%, -60% and -35%. This stock was down 60% in 2020! It’s up a cool 1000%+ since then.

And the crazy thing is there were plenty of Tesla shareholders who did hold on for the entire ride. They were true believers in the face of relentless negativity about the company and its founder.

Kudos to them.

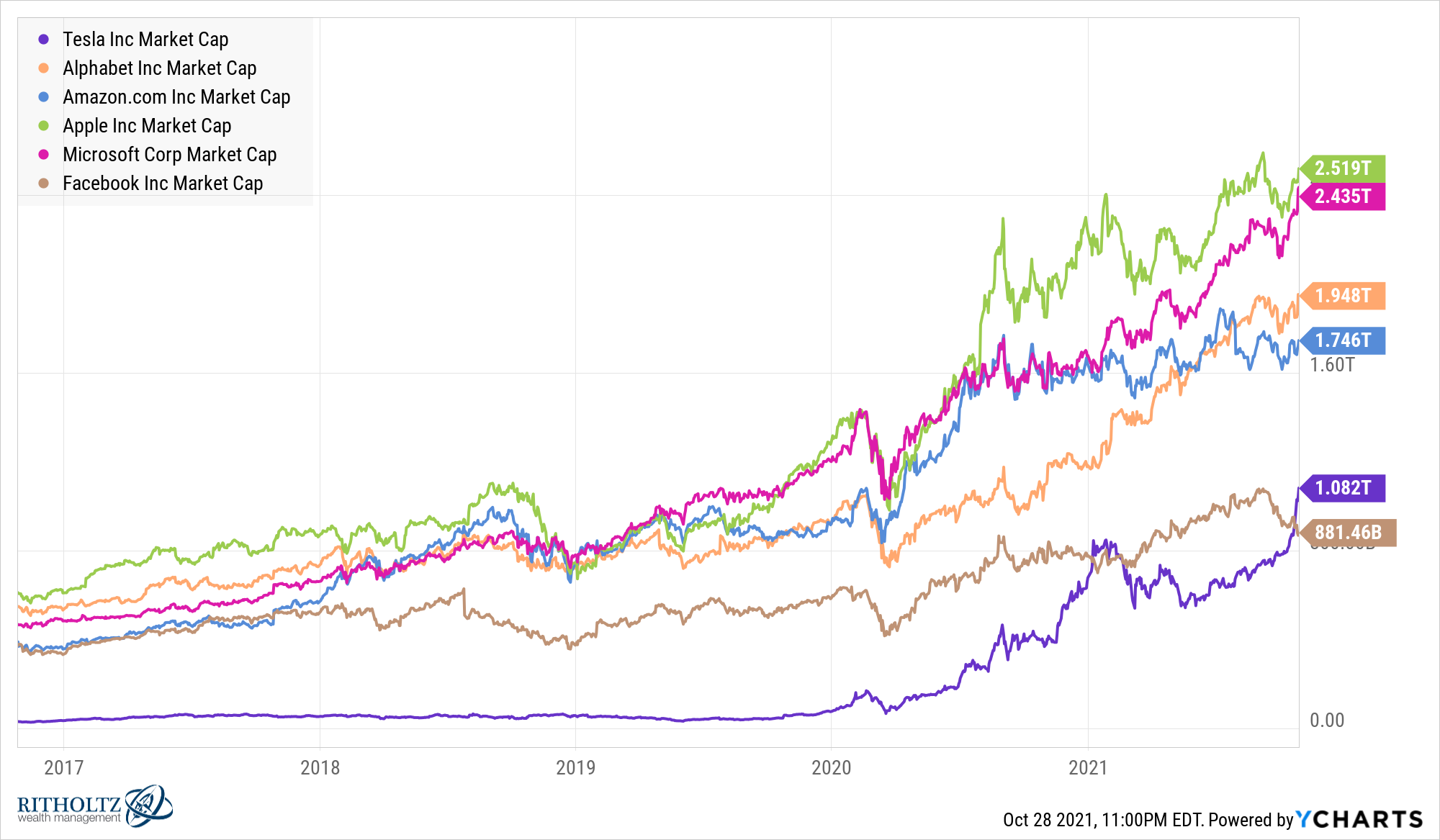

So now we have 5 stocks with a market cap over $1 trillion (Facebook was there but recently went back under):

These companies sport a collective market cap of nearly $11 trillion, a truly staggering number.

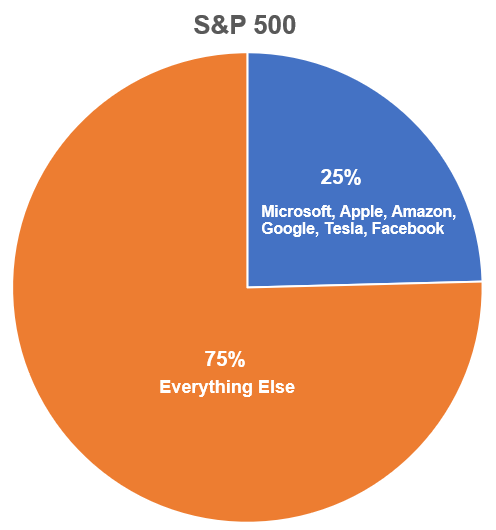

Look at how large the top 6 companies are now as a percentage of the S&P 500:

If you would have just put ten thousand dollars into each of these companies at their IPO…

It’s tempting, isn’t it?

On the one hand, you have to give credit to the people who have been in these stocks for the long run. It seems obvious now but these stocks have all been doubted the entire way up. There was always a good reason to sell.

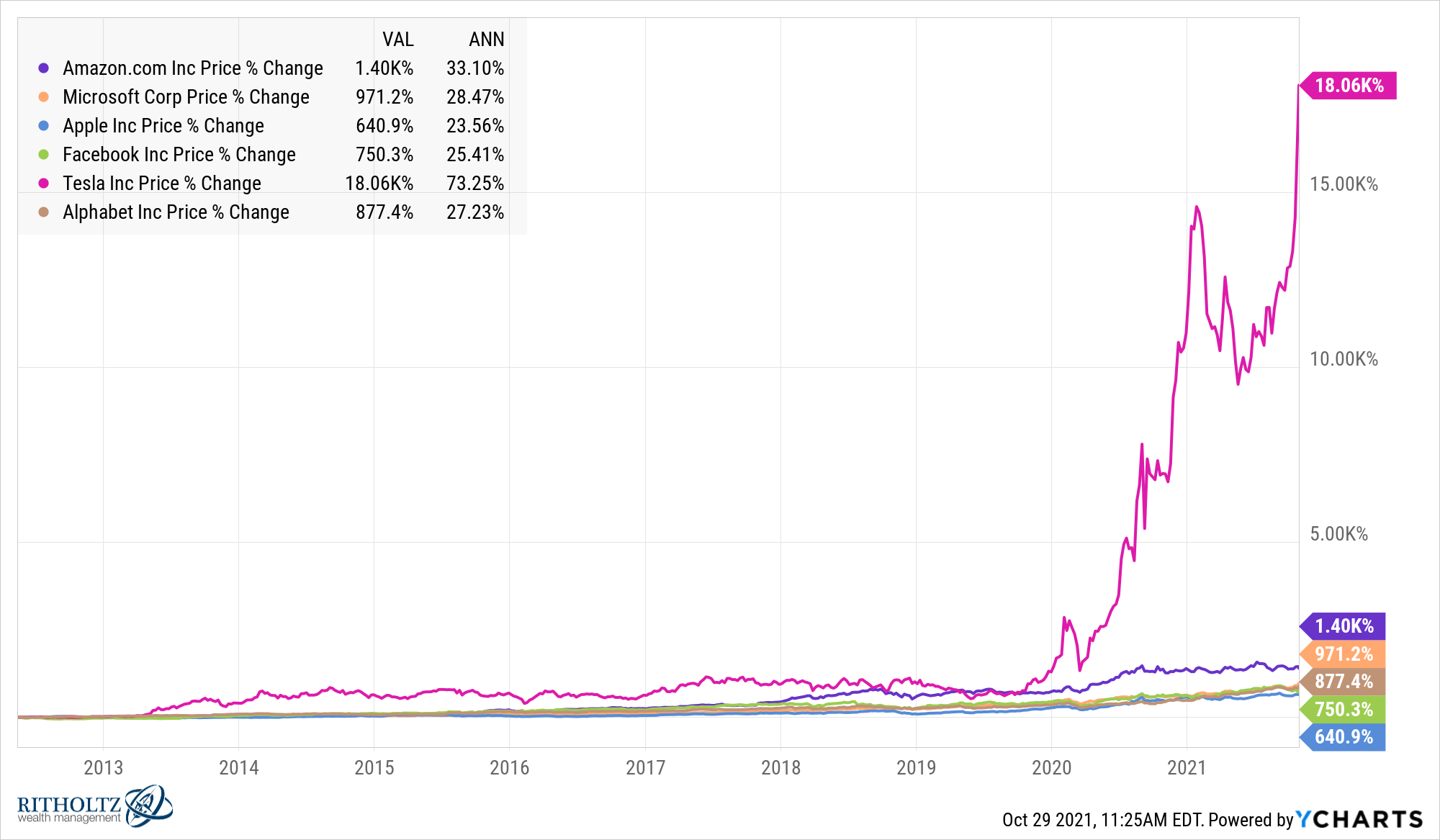

Over the past 10 years, the annualized returns on these stocks are bananas:

Unbelievable.

On the other hand, picking winners like this is exceedingly hard.

My strategy for owning the biggest winners in the stock market boils down to holding index funds.

Yes, it’s a boring strategy but I simply don’t have the ability to pick the winners myself. I know there are people who can do this in the stock market but it’s not me.

Oh well.

Michael and I discussed Tesla, Bill Miller’s latest, Jack’s hyperinflation call and a whole bunch of other stuff on this week’s Animal Spirits video:

Subscribe to The Compound for more of these videos.

And if you missed my new show Portfolio Rescue yesterday, please check it out and send us a question.

Further Reading:

Idiots, Maniacs & the Complexities of Risk

Now here’s what I’ve been reading lately:

- Meet the guy who spends $150 a year to eat at Six Flags for every meal (Mel Magazine)

- Is hyperinflation coming? (Prag Cap)

- Risking, fast and slow (Of Dollars and Data)

- Does money buy happiness? (Female Finance)

- Sc3nius (Not Boring)

- Investors need an anti-reading list (A Teachable Moment)

- Brand in the influencer era (Skyline Capital)

- The craziest decision we ever made (Ryan Holiday)

- Moms are cool (CNBC)

- Let the market worry for you (Irrelevant Investor)

1Here’s what he actually said: “The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.” It is worth noting that Templeton also said 20% of the time things really are different.