A reader writes:

I am reaching out because I have shared your work on simple vs. complex investing for endowments and seem to have missed it this year. I have shared the 2018 and 2019 articles you have done with our Foundation Board Investment committee. I may have missed your 2020 review of the NACUBO study of endowments this year.

I completely missed my annual review of the NACUBO 2020 Endowment Study.

I came up in the endowment world in the early part of my career and was always miffed at the sheer amount of complexity used in that space. So for the past few years I have been comparing the complex portfolios of college endowment funds to a simple 3-fund portfolio from Vanguard.1

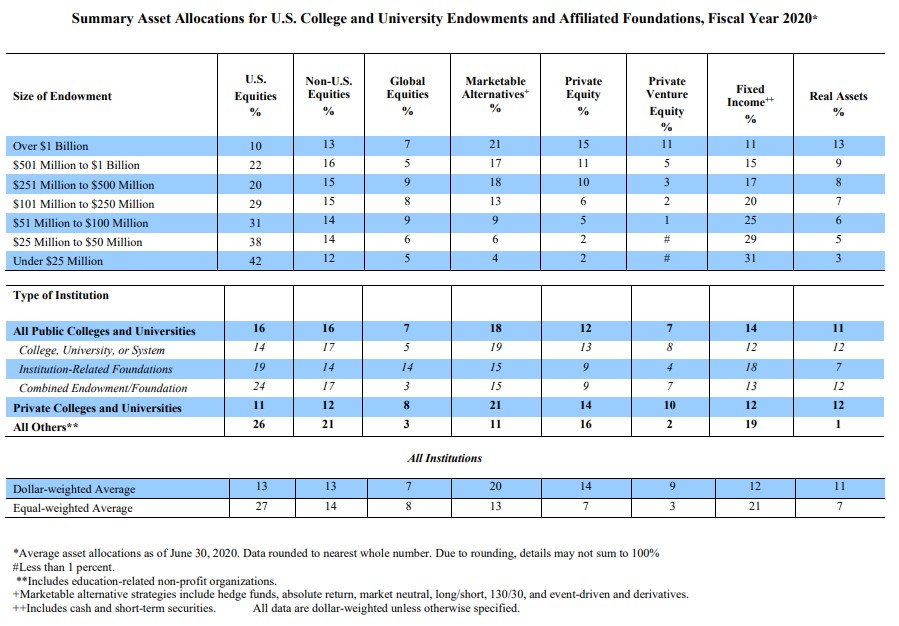

Before getting to the performance numbers, here’s a look at the allocations for college and university endowments by size:

You can see the ratio of equities and alternatives to bonds ranges anywhere from around 90/10 to 70/30 for these funds. This makes sense when you consider most of these endowments are set up to last in perpetuity.

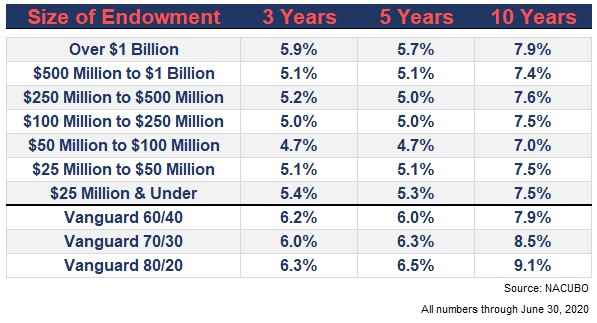

Since there are differences in allocations depending on the size of the endowment, I included a handful of Vanguard benchmarks ranging from 60/40 to 80/20 for comparison purposes:

Score another win for Jack Bogle.

Not only did the simple Vanguard 3-fund portfolio beat the average endowment over 3, 5 and 10 years but it also finished in the top quartile over those same periods. Top quartile returns for these endowments were 6.2%, 5.8% and 8.0%, respectively over 3, 5 and 10 years ending June 30, 2020.

Not bad for a dumb index fund portfolio.

To be fair to these endowments, they have to manage liquidity and cash flows. Backtests don’t have these constraints. They also have to manage committees, board members, alumni, donors and many investment manager relationships.

This is not an easy task.

Low cost index fund portfolios solve many of these problems but they don’t magically make them disappear for good.

Managing an endowment fund requires as much political savvy as it does investment skills.2

But those investment skills don’t have to be overly complex to succeed either. Portfolio and risk management are often overlooked in lieu of manager selection when it comes to long-term performance.

Rebalancing is a simple risk management tool but it can become a real source of outperformance when adhered to in a disciplined manner.

For instance, these are the 10 year annual returns of the Vanguard 3-fund portfolio for the 10 years ending June 30, 2020:

- Total U.S. Index Fund: 13.6%

- Total Bond Index Fund: 3.7%

- Total International Index Fund: 5.2%

If you were to simply multiply the weights for the 80/20 portfolio (48% U.S. stocks, 32% int’l stocks, 20% bonds) by these returns you would get an overall annual return of 8.9%.

But the actual 10 year annual return for the 80/20 portfolio shows 9.1%.

How could this be?

The difference here is the rebalancing bonus. I used a simple annual rebalance back to target weights here and that made a huge difference over a decade.

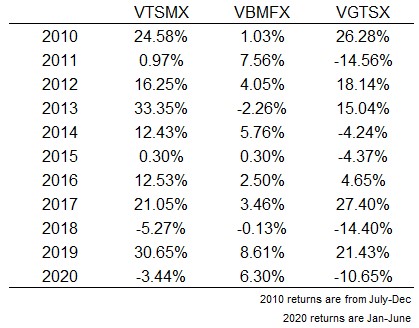

Here are the returns for each of these funds over this time frame:

At the tail end of 2010, stocks had a furious rally coming out of a correction. At the end of that rally, this portfolio sold some stocks to buy some bonds that had badly lagged. As luck would have it, bonds outperformed in 2011 by a wide margin.

Then you would have sold some bonds to buy some stocks just before stocks had a comeback year in 2012 and an even bigger year in 2013.

After strong returns in 2019 for stocks, you would have purchased more bonds right before a stock market crash in 2020.

Obviously, these things don’t always work out so neatly. Sometimes you sell what’s been working to buy what’s been lagging and those trends don’t reverse.

Rebalancing isn’t so much about timing the market as it is about resetting the original risk parameters on your portfolio.

This is actually one of the biggest benefits of a simpler portfolio structure.

There are no liquidity constraints on index funds. No lock-ups. No 300-page prospectus to read. No illiquid holdings you can’t get out of. No rich portfolio managers shutting down their funds to “spend more time with family.”

You know exactly what these funds hold, there is daily pricing and it costs nothing to trade them.

Granted, there are some psychological benefits of the illiquid private funds many endowments hold. You’re forced to take a much longer-term view on private equity, venture capital and hedge funds because of the way these funds are structured.

It’s like owning your house in many ways. You don’t see the value changing on a day-to-day or even minute-to-minute basis. This can be helpful in terms of thinking and acting for the long-term.

But it’s much harder to rebalance these fund structures. The cash flows into and out of them are irregular. They’re difficult to plan for. And you can’t exactly rebalance your private fund structures when markets offer a fat pitch or throw your asset allocation out of whack.

Rebalancing is not very exciting but investing doesn’t have to be exciting to work.

Further Reading:

Simple vs. Complex, 2019 Edition

1As with previous incarnations of this analysis, I used the Vanguard Total Stock, Total Bond, and Total International Funds (with the U.S.-to-international weighting set at 3-to-2 in favor of the U.S. since that’s roughly how these funds are allocated on average).

2If you’re interested in learning more of my thoughts on institutional asset management, check out my short book on the topic: Organizational Alpha