Following the Great Financial Crisis, a slew of books came out promising to help you navigate market crashes.

Here’s how to hedge this. Here’s how to hedge that. Here’s how to remain in the fetal position with your portfolio. Here’s how to prepare for Armageddon (just in case).

I get it.

There were plenty of investors who weren’t prepared for one of the worst crashes in history. I’ve spilled plenty of ink myself when it comes to preparing for a correction or crash.

And while it’s always a worthwhile endeavor as an investor to hope for the best but prepare for the worst, that fetal position mindset can be detrimental if you’re unwilling to accept some risk.

There has never been a risk-free way to earn solid returns in the markets, but that’s more true than ever today with rates where they are.

The other side of preparing for bear markets is preparing for a bull market.

Yeah, that’s right, I said it. I know valuations are high. I know the U.S. stock market has been positive 11 out of the past 12 years. I know the past 15 months or so have been a crazy orgy of excess and speculation in certain parts of the market.

But bull markets can last longer than you think.

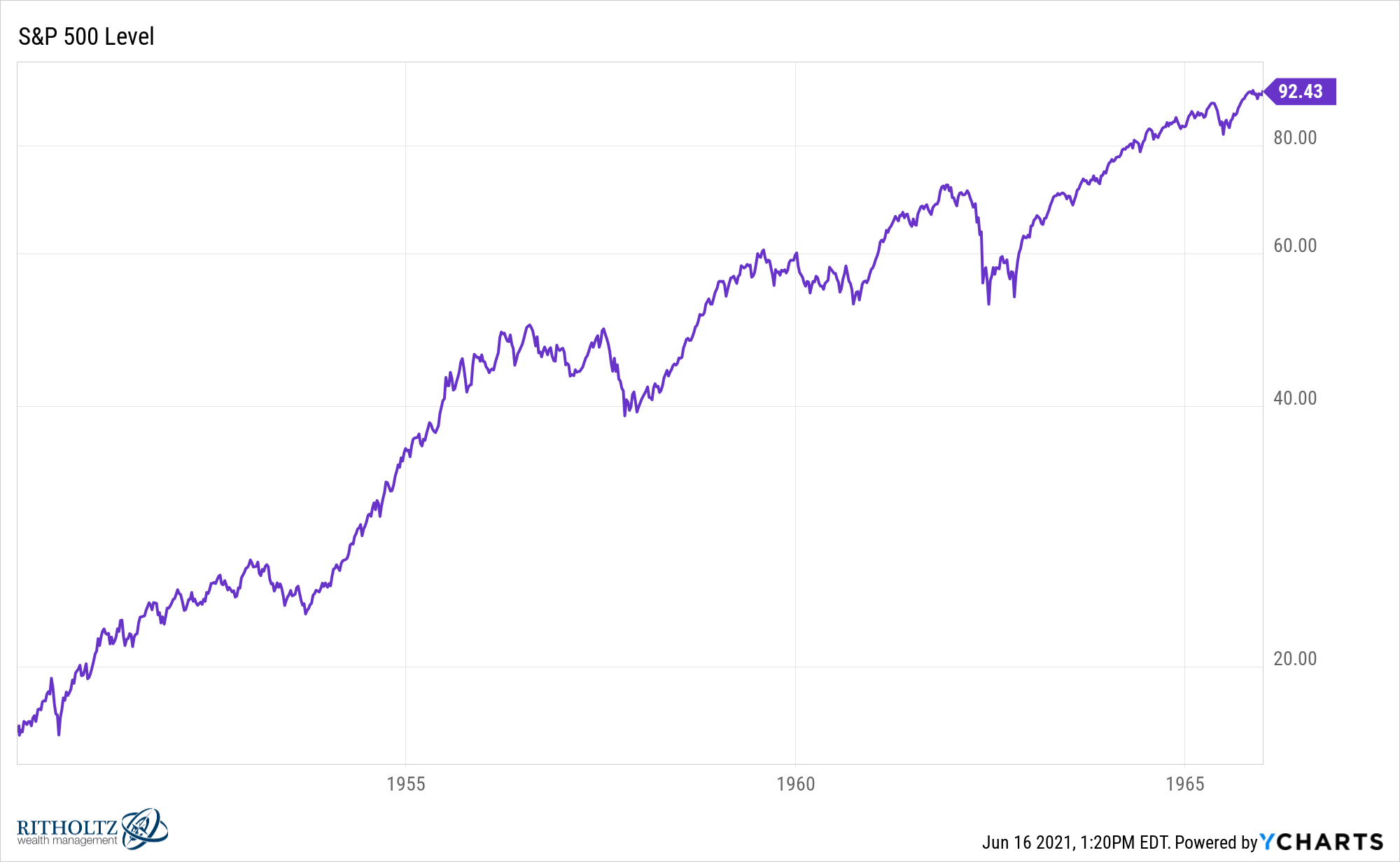

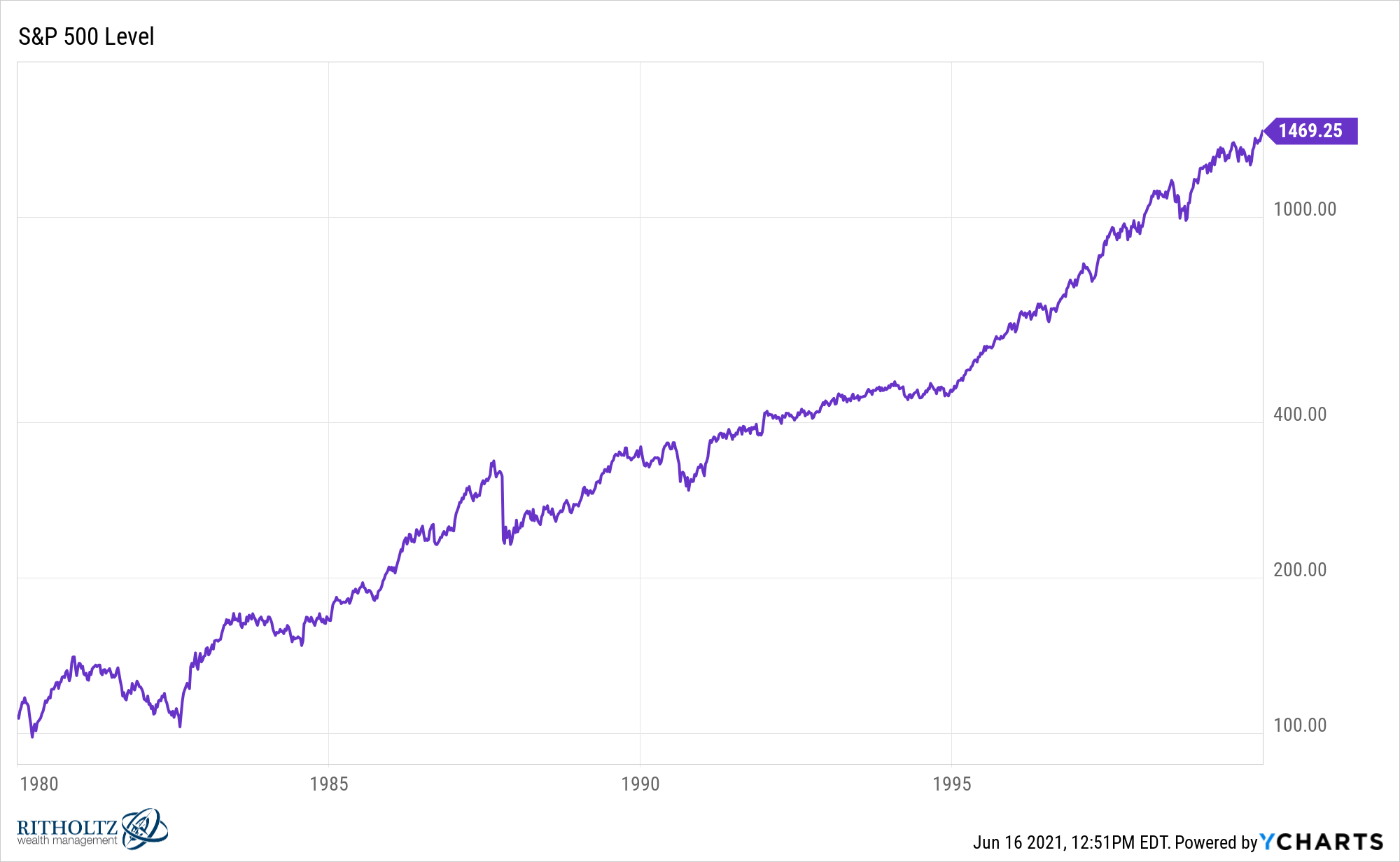

Consider the U.S. stock market returned 15.5% annually from 1942-1965. That’s 24 years of above-average gains. Or how about the 17.7% returns over the 20-year stretch from 1980-1999.1

It’s hard to wrap your head around the idea that this bull market could still have a number of years to run but stranger things have happened. I’m not saying it’s going to happen, just that it could.

Since we’ve been inundated with pieces about how to prepare for a bear market, here’s how to better prepare for a bull market:

Expect pullbacks along the way. Returns in the previous long bull markets were extraordinary but they didn’t come without setbacks.

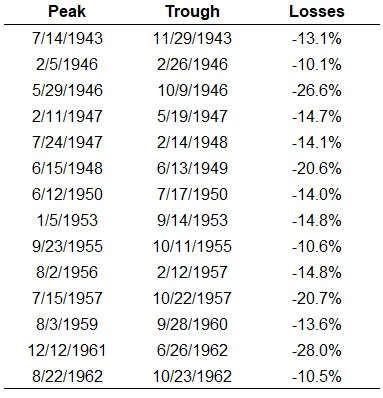

There were plenty of corrections and bear markets during this lengthy bull market:

I count 14 different double-digit downturns which works out to one every year-and-a-half or so. There were also four different bear markets with losses in excess of 20%. I’m sure every time one of these bears hit people assumed the bull was over yet it kept coming back.

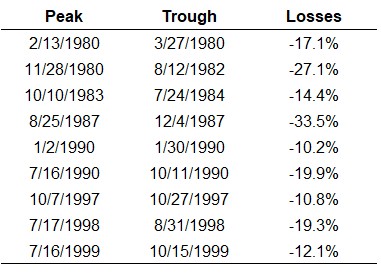

A similar dynamic played out in the 1980s and 1990s:

There were nine double-digit drawdowns from 1980-1999 including the 34% 1987 crash and nearly a 30% hit from 1980 through 1982:

What if the Corona crash was our 1987 moment?

I’m just throwing it out there.

Figure out how to stay invested. If you wish to earn high returns in the stock market you can’t get scared out of stocks when those inevitable setbacks occur.

Holding on during a bull market can be harder than it sounds. The longer the gains last the more tempting it is to time the market.

What if I just go to cash and wait it out until the next crash?

This sounds like a reasonable plan until you realize how challenging it can be from a psychological perspective. And figuring out the right time to get out is nearly impossible.

The simplest way to stay invested is by creating an asset allocation you would be willing and able to hold during both bull markets and bear markets alike. The whole point of diversification is balancing out various market and economic environments.

Rebalancing isn’t as sexy as calling tops and bottoms but it’s much more prudent because it allows you to stay invested, occasionally take profits in your outpeforming assets classes to buy your underperforming asset classes, and manage risk along the way.

The perfect portfolio is only known with the benefit of hindsight so there isn’t necessarily a right or wrong asset allocation. It all depends on your willingness, need and ability to take risk.

Filter out your FOMO. One of the worst parts about bull markets is seeing others take irrational risks and make more money than you. It’s difficult to stay satisfied when you see otherworldly returns elsewhere.

The best way to avoid FOMO is by creating filters to define what you will and won’t invest in. If you have a specific set of strategies, asset classes and securities you’re comfortable with it’s much easier to say no to everything else, regardless of how much money others are making.

If you don’t understand it, don’t invest in it is a pretty good rule of thumb.

Avoid unnecessary mistakes. A combination of FOMO and greed can make people take really dumb risks with their money during a bull market. This opens you up to all sorts of scams, frauds, charlatans and hucksters looking to take advantage of loose risk parameters.

If it sounds too good to be true, it probably is.

Of course, there’s no guarantee the lengthy bull markets of the past will repeat. I could write an entire follow-up piece on the differences between now and then. Things that have never happened before seem to be happening all the time these days.

It always feels better investing when things are moving up than when they’re moving down but bull markets still present their own set of challenges.

Further Reading:

A Short History of U.S. Stock Market Corrections and Bear Markets

1If we start from the end of 2008 the current run is more than 15% per year.