Let’s say I pulled a Doc Brown and was able to offer you the following headline six-and-a-half months ahead of time at the start of the year:

So you would have known coming into the year the inflation rate in the United States would hit its highest level in 13 years.

Knowing nothing else, the textbooks would tell you to short bonds and buy gold. And if you’re truly anti-establishment, you should buy some bitcoin too because the government is printing so much money that fiat currencies will be worthless.

All of these hedges sound reasonable to me with the exception of the end of the U.S. dollar as we know it.1

The problem is, markets don’t always react like you think they should.

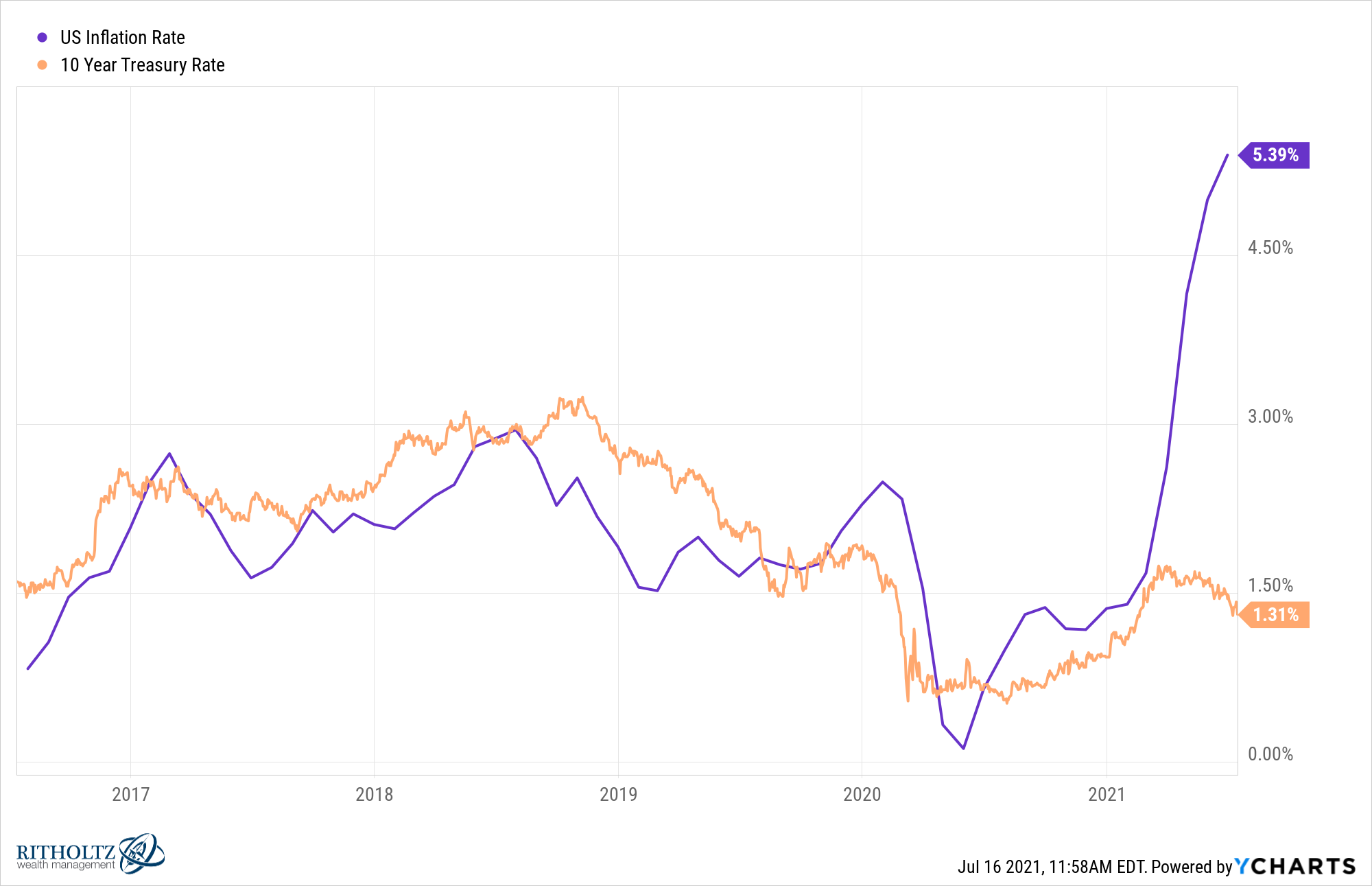

Inflation is rocketing higher but bond yields remain glued to the floor and have actually fallen in recent weeks:

See if you can spot the divergence from the trend here.

The reason this seems off to many investors is the fact that inflation is by far your biggest risk as a bond investor. When you own a bond or bond fund, you receive periodic fixed payments. Those fixed payments are worth less to you over time when inflation rises.

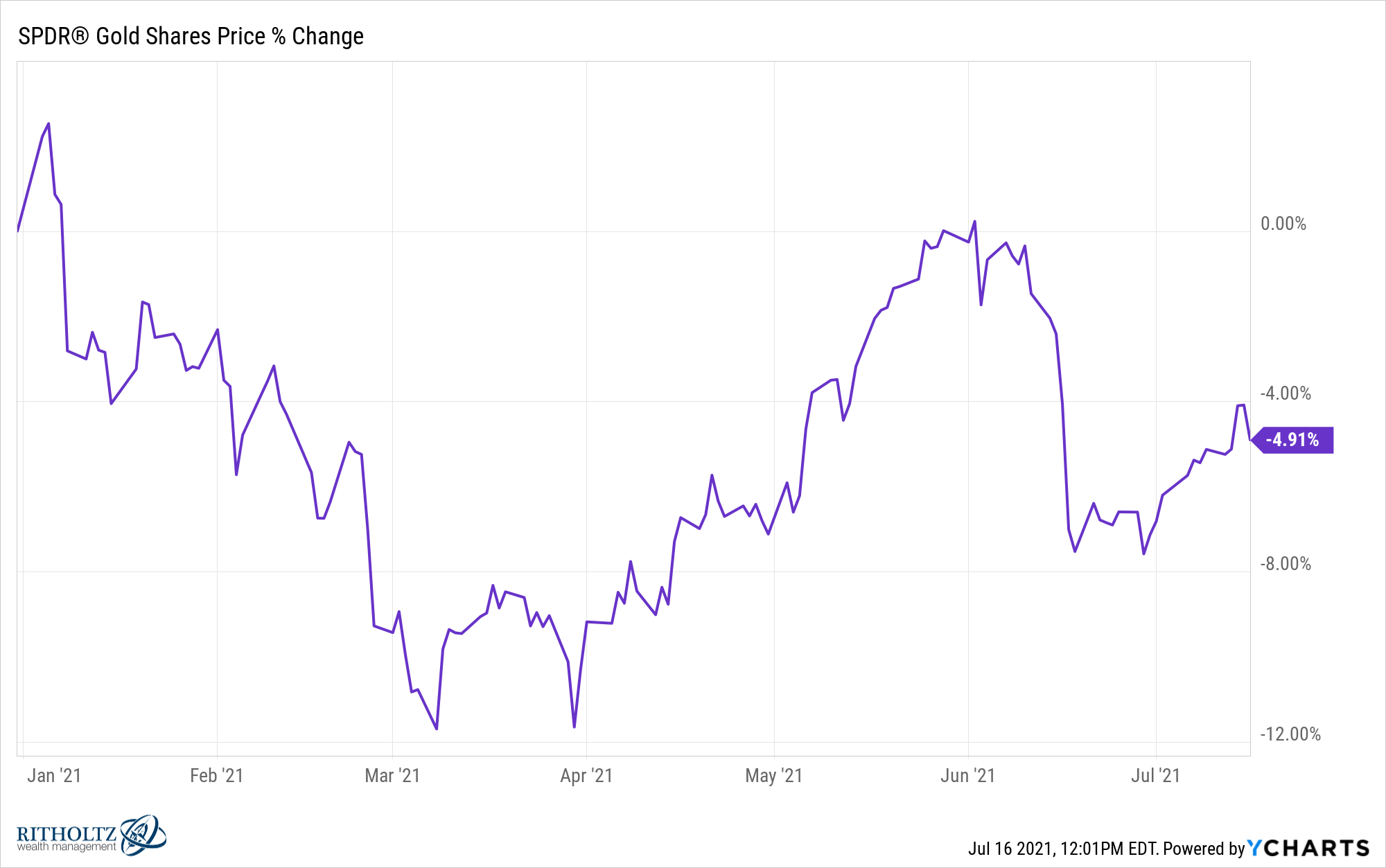

How about gold?

The yellow metal is basically flat over the past year and down nearly 5% year to date in 2021:

Gold is in the midst of a 13% drawdown from its highs in the summer of 2020.

How about bitcoin?

It’s actually still up marginally on the year (7% or so as of this writing) but it was up well over 100% in 2021 through mid-April and is now in the midst of a 50% crash.

Of course, there are legitimate reasons you could offer up for all of these head-scratching price moves.

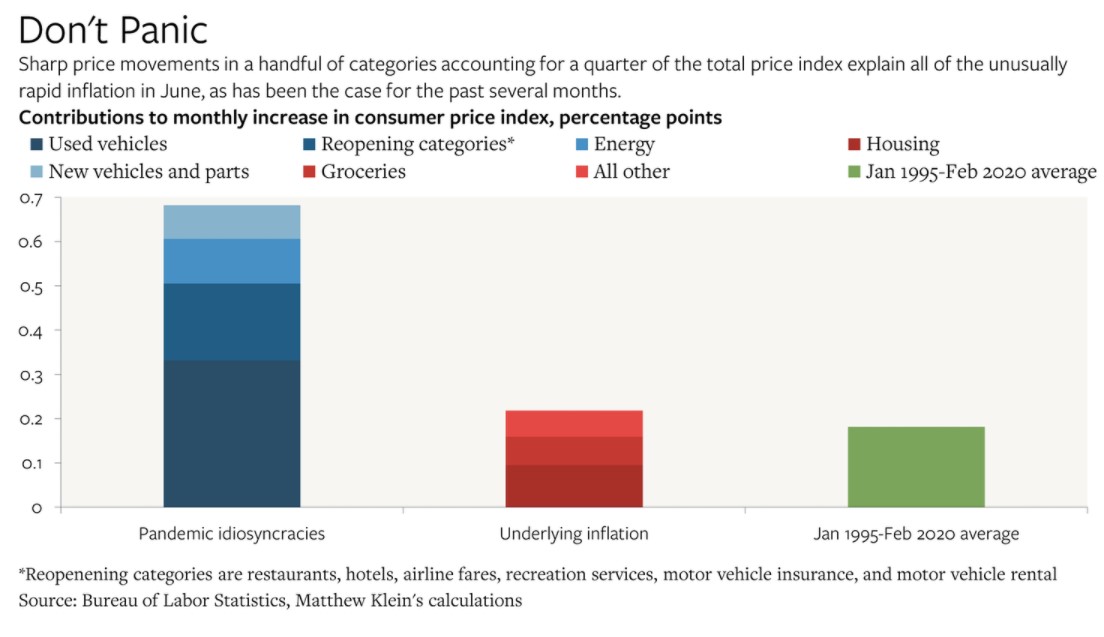

Markets could be telling us inflation is transitory. We could be experiencing a short-term boost in prices from a combination of supply constraints, pent-up demand from the pandemic and fiscal stimulus money floating around.

Matthew Klien makes that case at The Overshoot:

Klein explains:

Outside of a few categories that are either experiencing significant idiosyncratic supply constraints or healthy price normalization due to reopening, prices rose about as much as could reasonably be expected.

That’s certainly a possibility. Maybe markets are sniffing things out. The bond market is supposed to be the smart money after all.2

Then you have the fact that the Fed is buying bonds along with yield-starved boomers and pension funds.

Maybe rates would be higher without all this demand.

And while gold and bitcoin are currently experiencing drawdowns, both were up huge in 2020. Gold was up 25% last year while bitcoin soared more than 300% (and these numbers include the Corona crash).

So it’s possible prices just got ahead of themselves for these assets and they were due for a breather.

Markets always require context but the biggest lesson here is how hard it can be to hedge against short-term risks in the markets.

People have been pounding the table on inflation for a number of years now. I’m sure many of them were ready for a victory lap now that it’s finally here.

Yet the markets aren’t cooperating.

The problem with trying to hedge short-term macro risk factors is you never know what’s already been priced in. Maybe the markets know inflation is transitory or maybe they will freak out down the line if it turns out higher inflation is here to stay.

The truth is no one ever really knows what’s priced in and that’s what makes short-term investing calls so difficult.

You could have nailed the macro data on inflation and still been wrong on your investment thesis depending on how creative you tried to get with your inflation hedges. Nailing short-term market moves requires not only getting the news or data right but also the positioning of other investors.

The majority of investors are better off hedging against long-term risks rather than trying to hedge every short-term macro speedbump.

Further Reading:

How to Hedge Against Inflation

1There are far better reasons to own crypto than the anti-Fed trope.

2I don’t really buy this.