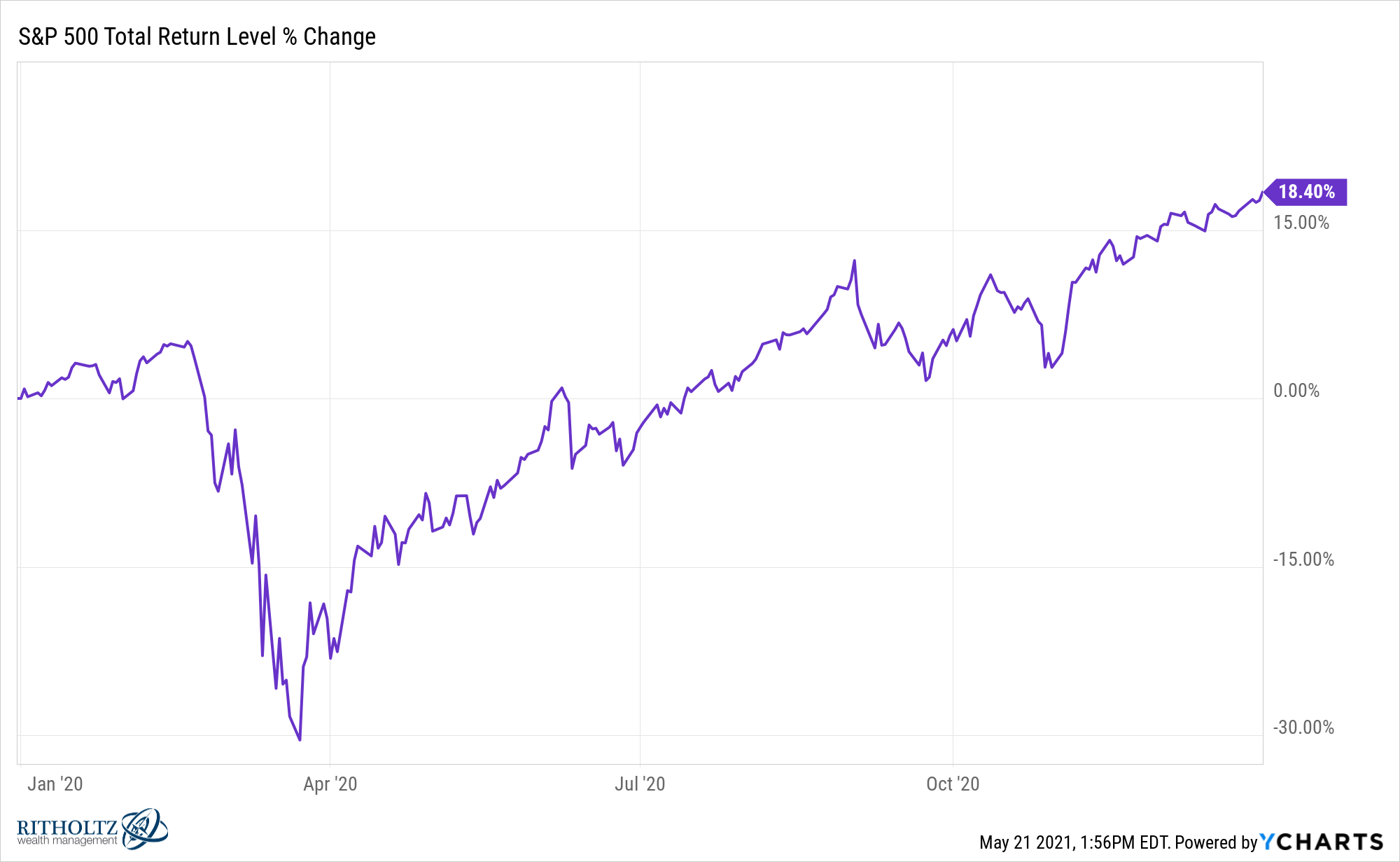

Last year the S&P 500 was extremely volatile but still finished the year with a double-digit gain:

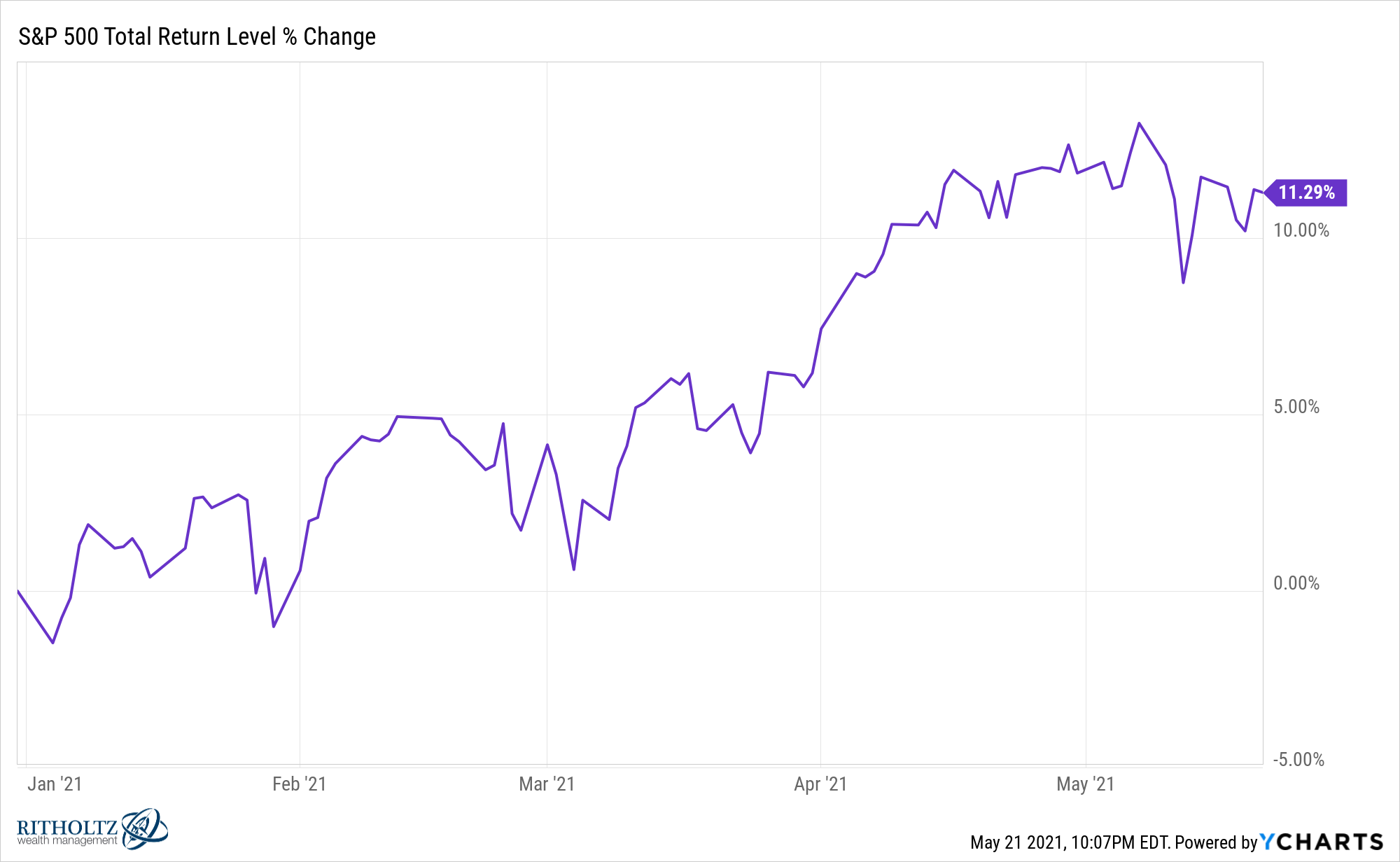

This year the S&P 500 hasn’t seen much volatility at all but is still up double-digits:

We’ll see if it lasts. If history is any guide, it won’t always be this easy.

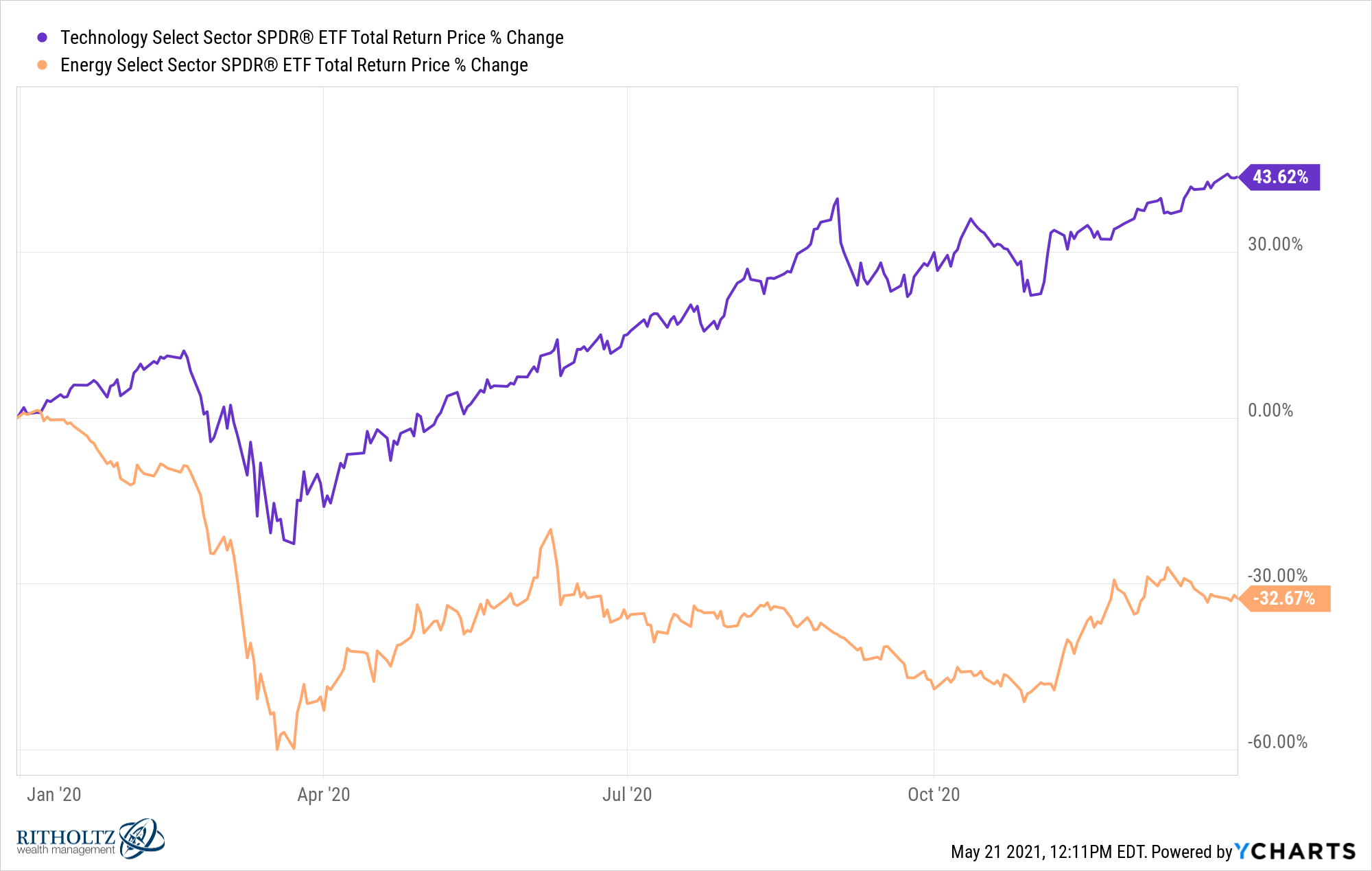

Last year tech stocks crushed it and energy stocks got crushed:

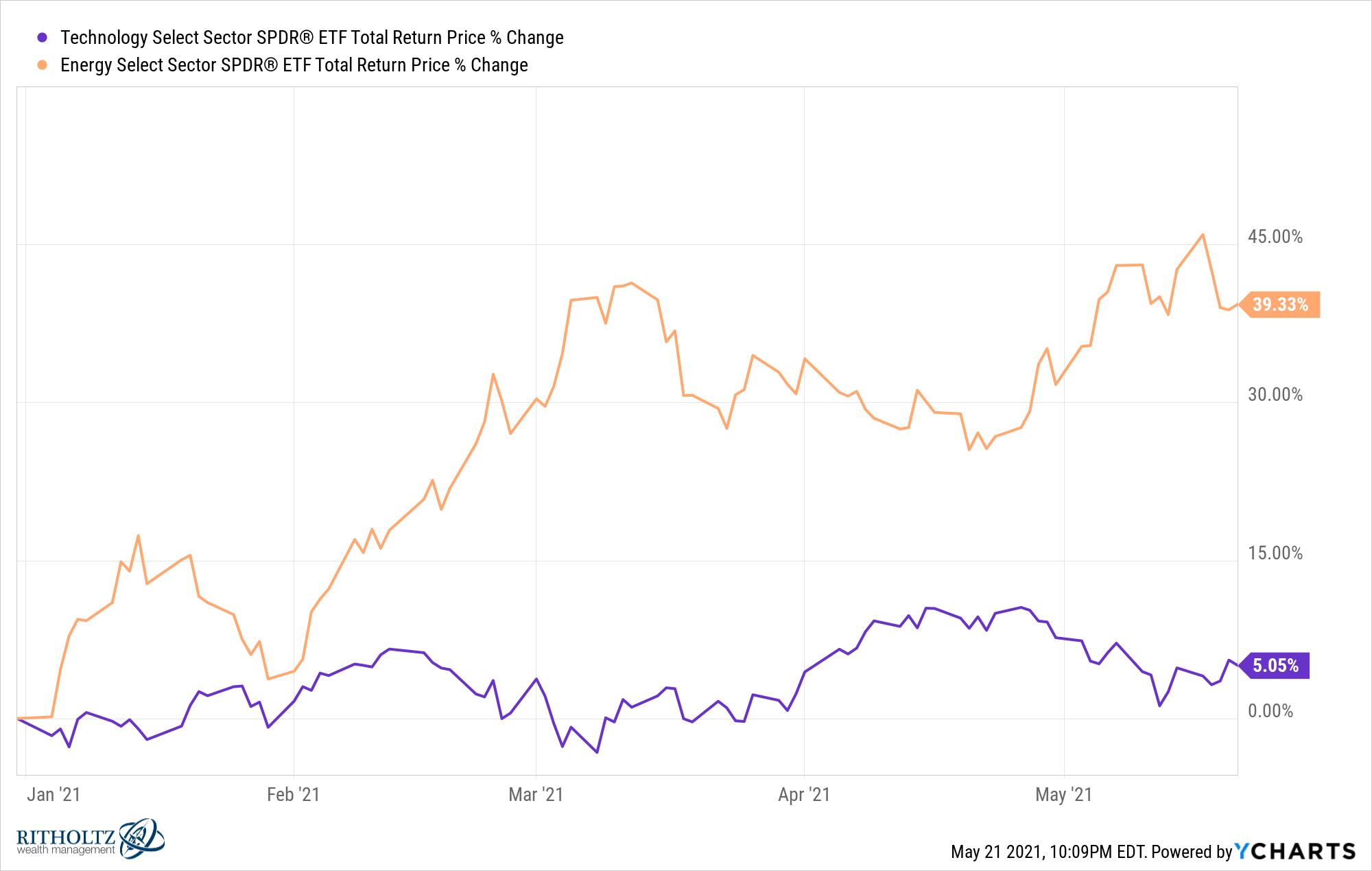

This year energy stocks are crushing it while tech stocks have finally slowed down a little:

If you would have bought the energy sector the day after oil prices went negative in April 2020 you’d be up 70% right now.

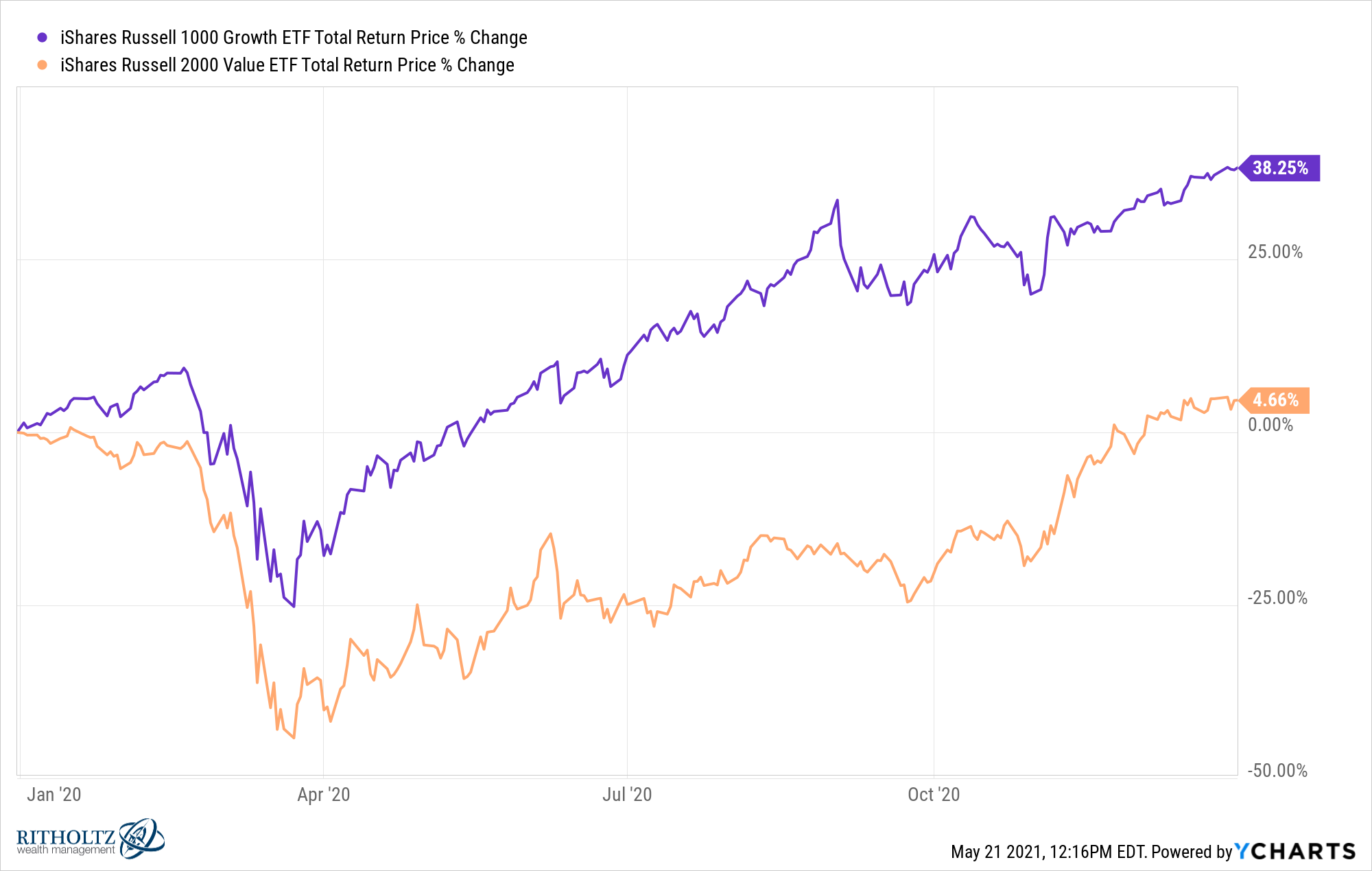

Last year large cap growth stocks destroyed small cap value stocks:

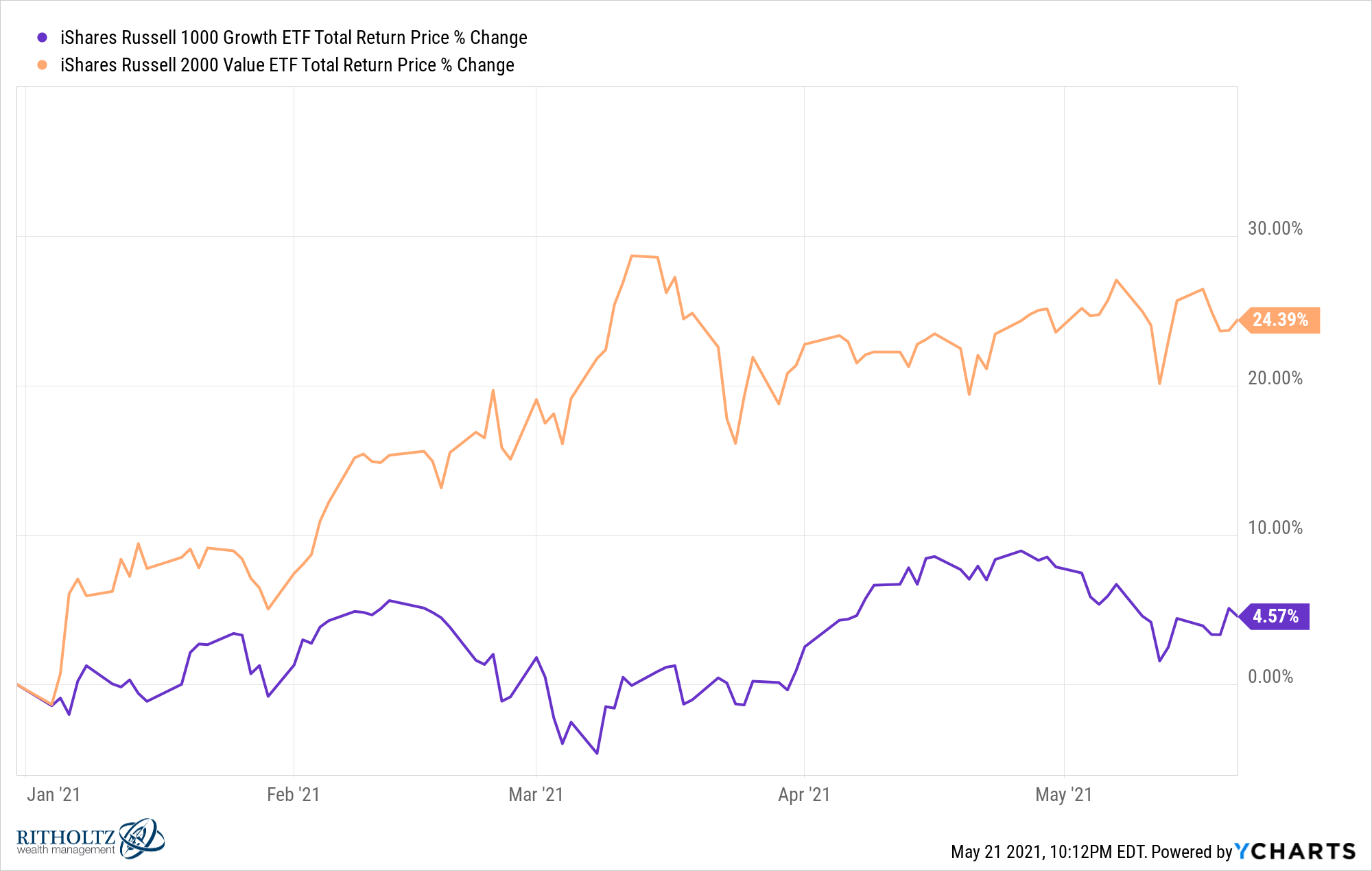

This year the opposite has occurred:

This one was a long time coming and it could have legs if the economy remains strong. Investors haven’t dealt with higher than average GDP growth in some time. That would theoretically be good for value stocks.

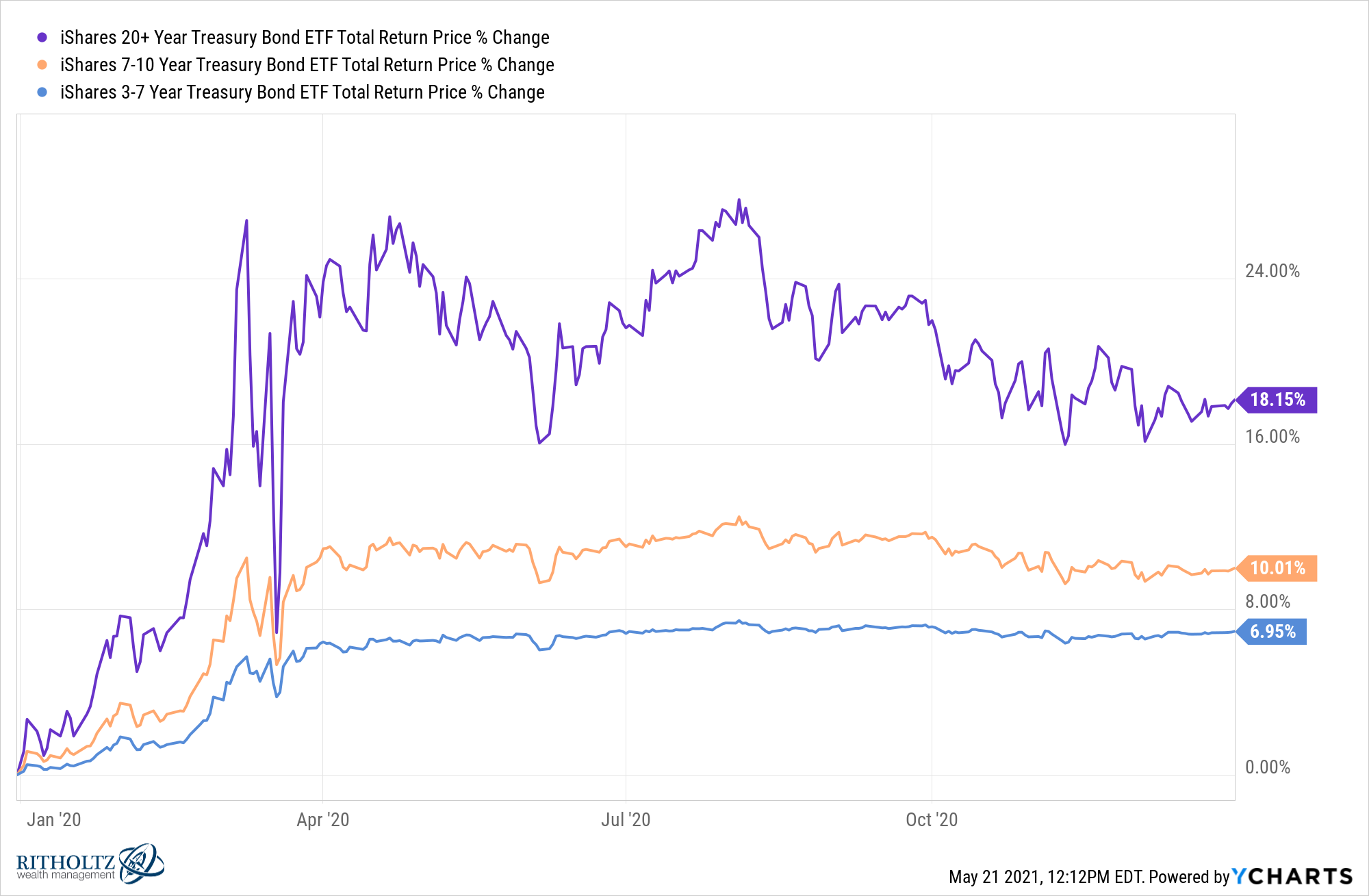

Last year bonds performed wonderfully, especially of the long duration variety:

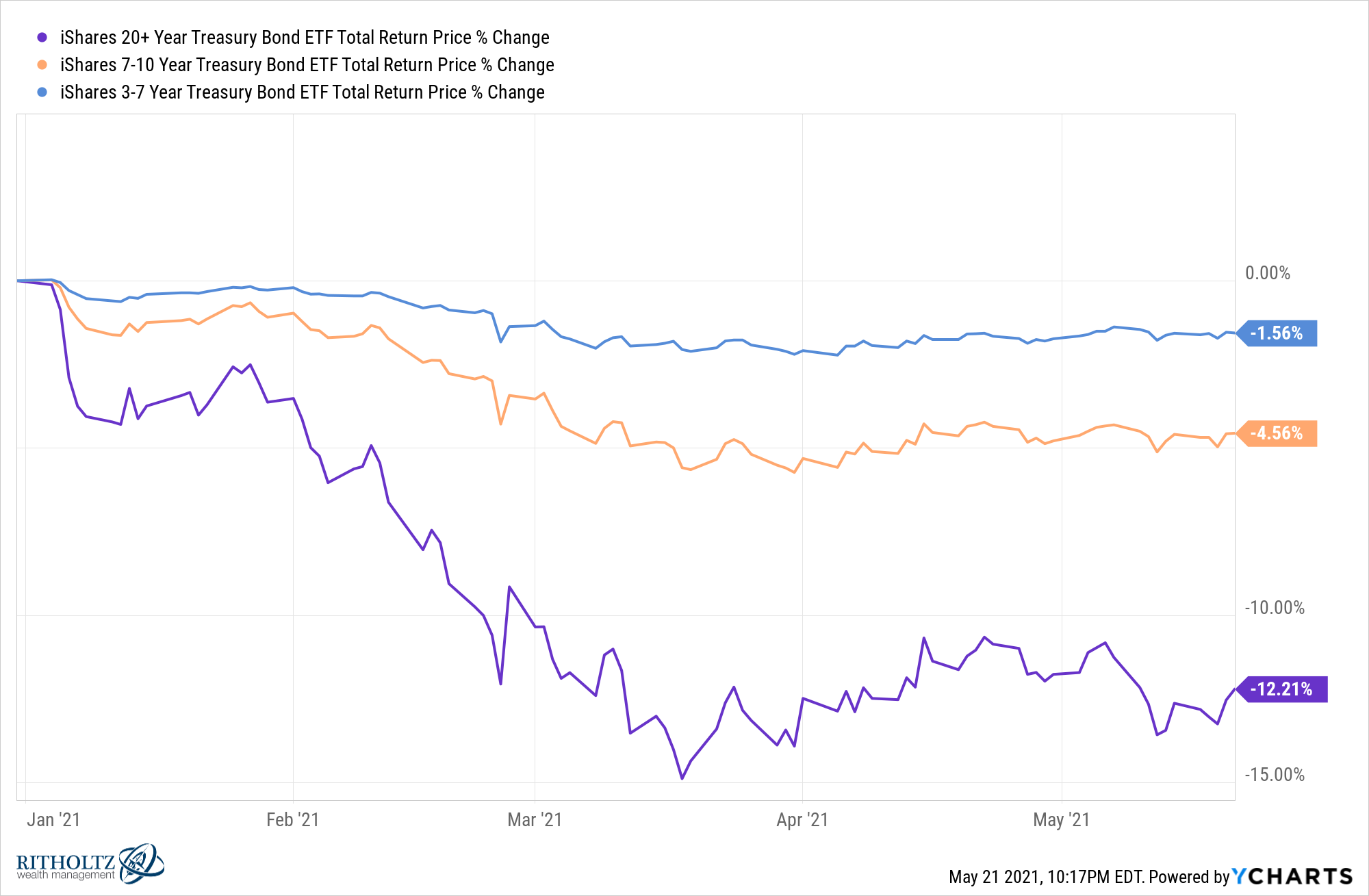

This year rates have risen and longer maturity bonds are in correction territory:

Shorter maturity bonds offer a lower yield but also much lower volatility when interest rates rise.

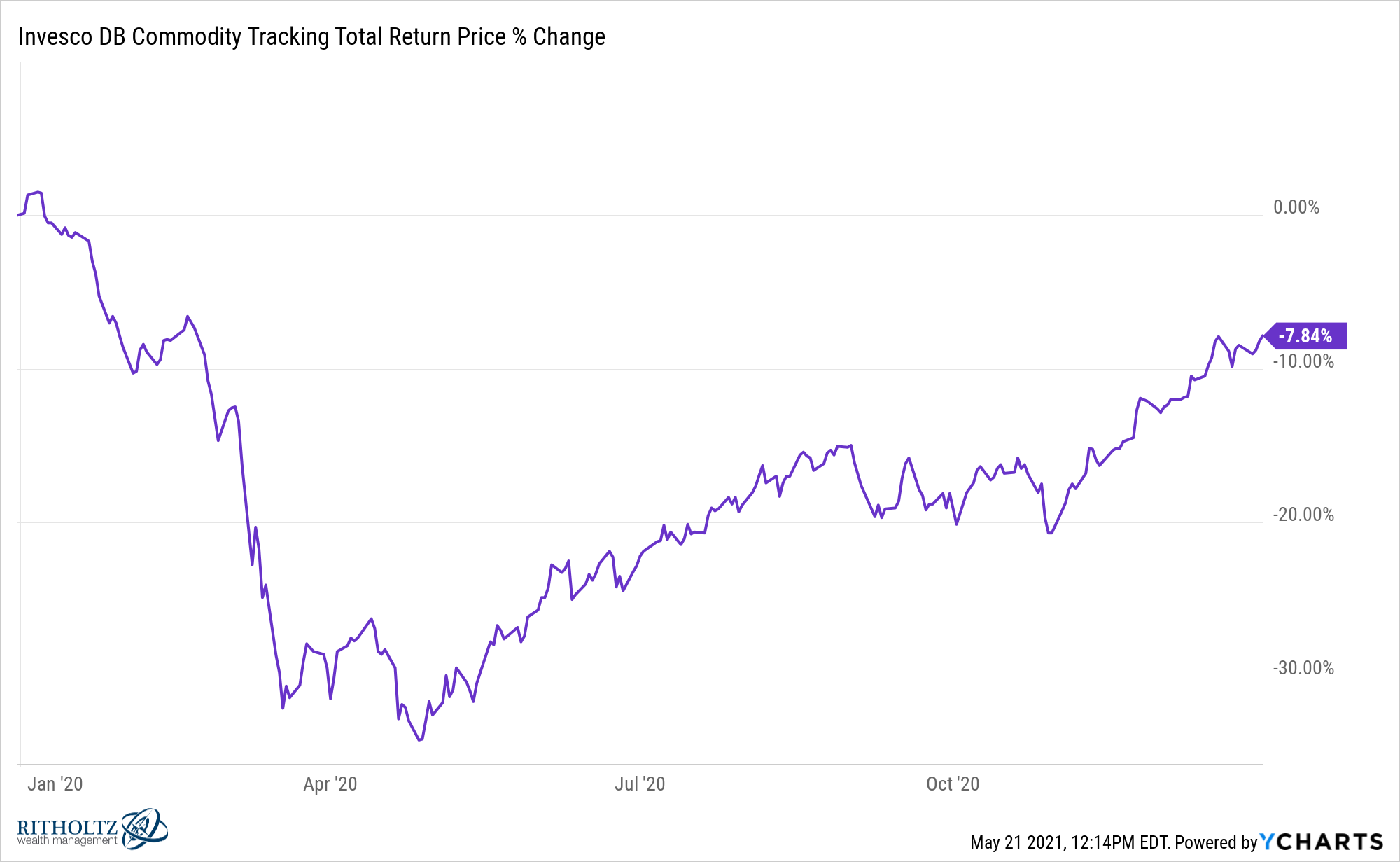

Last year commodities were one of the few asset classes to post a loss:

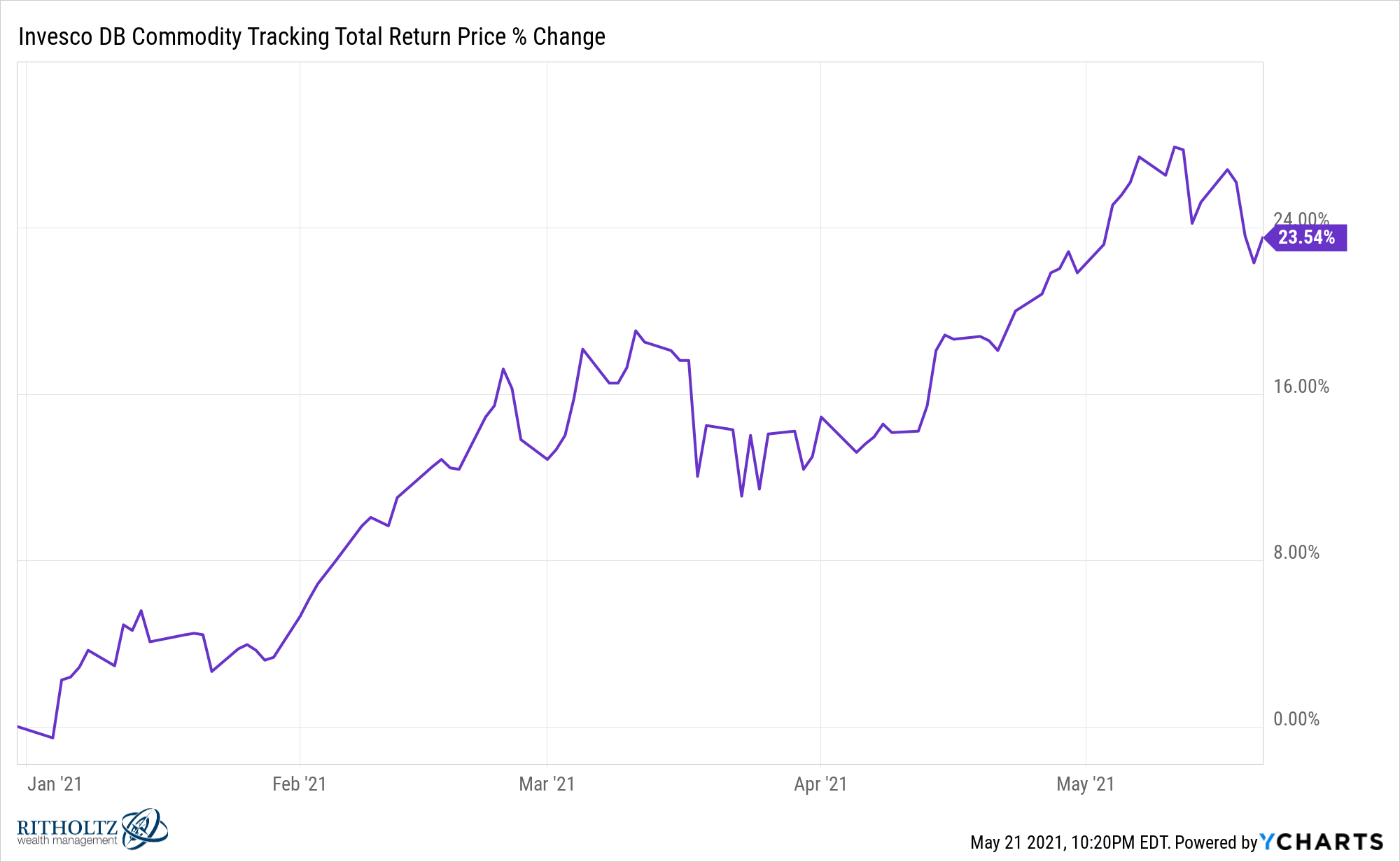

This year commodities are on fire:

Commodities have been one of the worst-performing asset classes over the last decade. This one is worth watching to see if higher inflation is here to stay or just transitory.

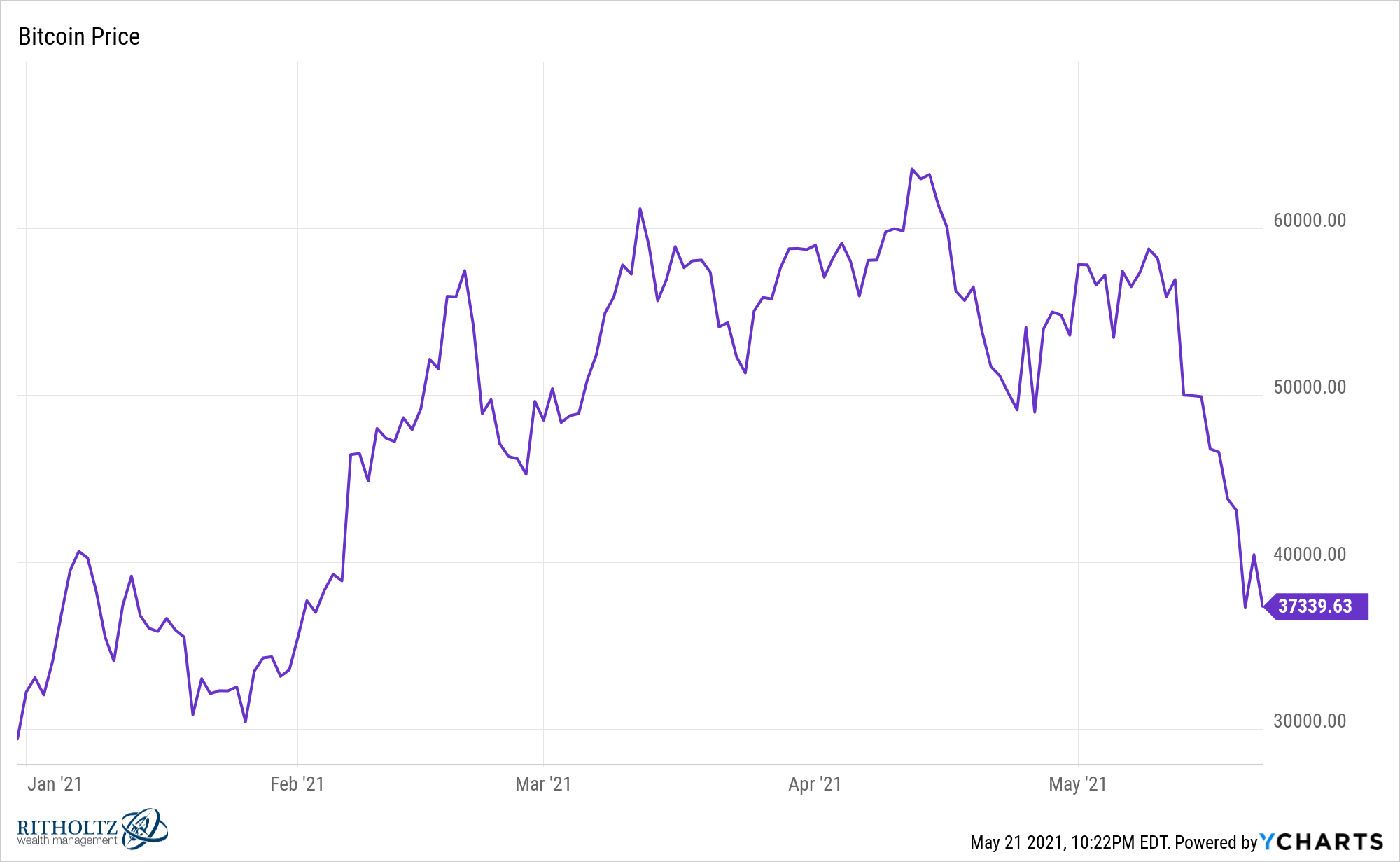

Last year crypto crashed but was still up big:

This year crypto was up big but now it’s crashing:

It seems like crypto experiences some combination of 1929, 1999, 1987 and 2009 every 6 months or so. What a crazy asset class this stuff is.

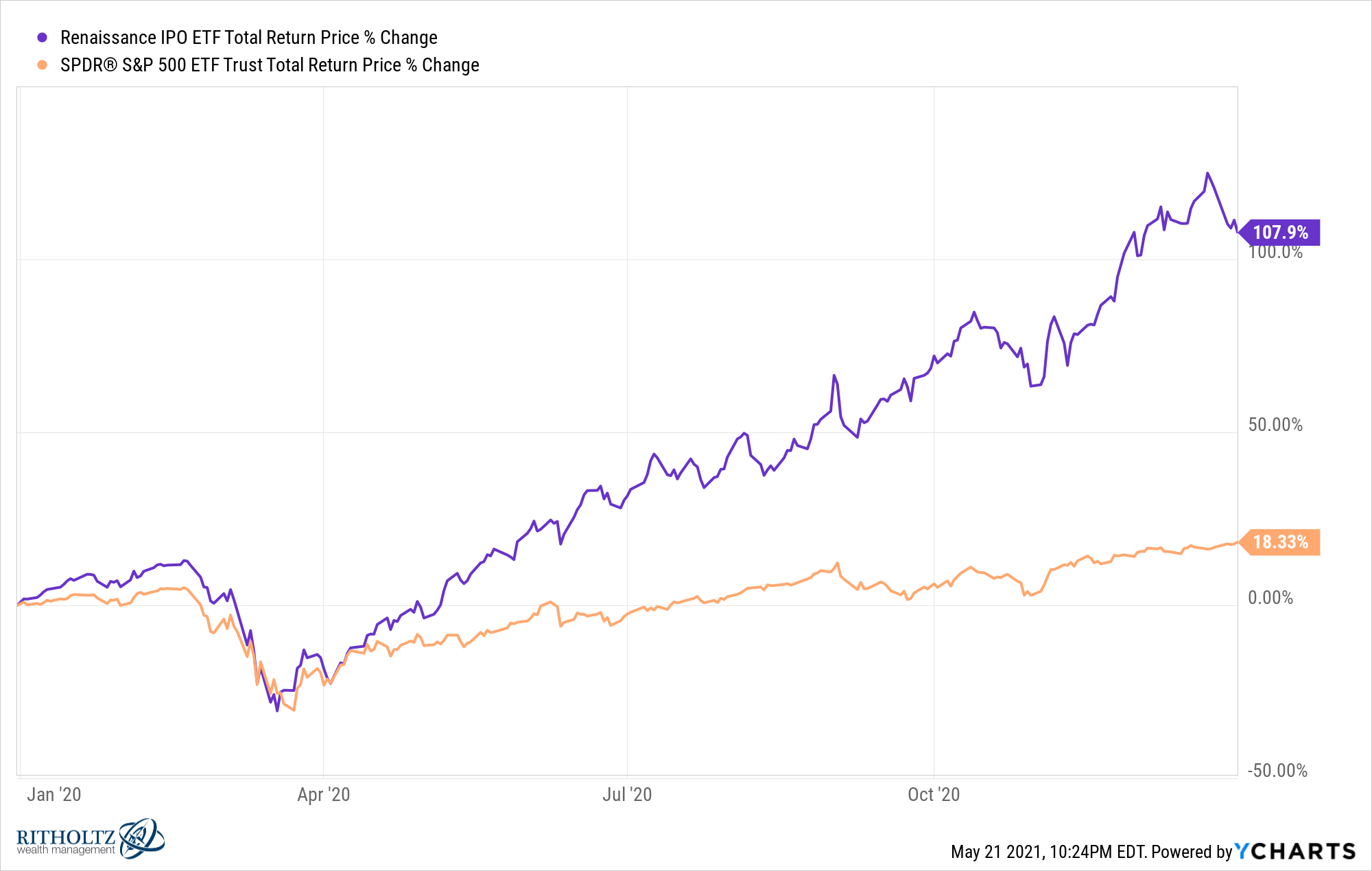

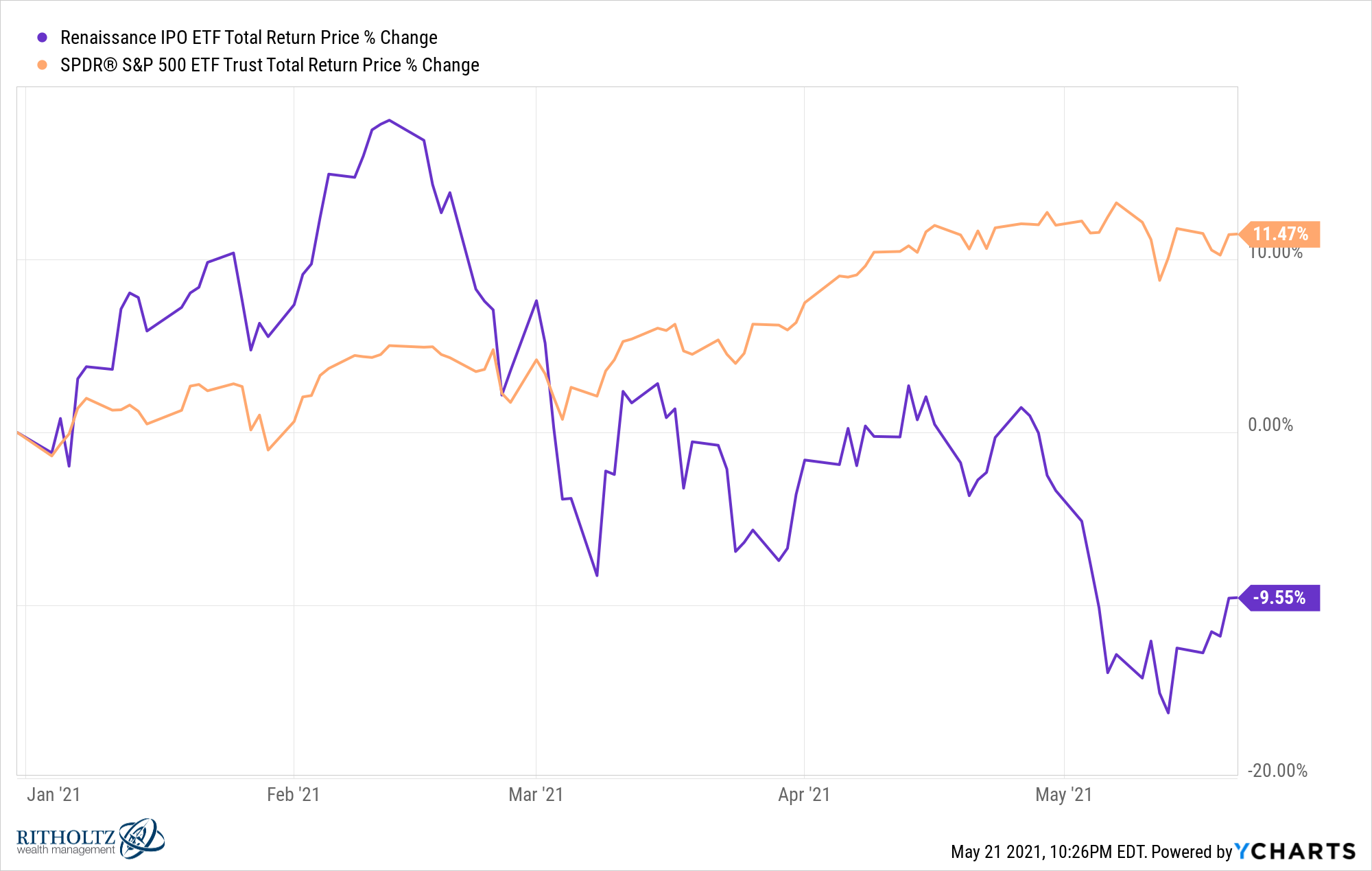

Last year stocks that came public in recent years performed phenomenally:

This year IPOs have lagged:

Stocks like Zoom, Peloton and Coinbase have all struggled in recent months.

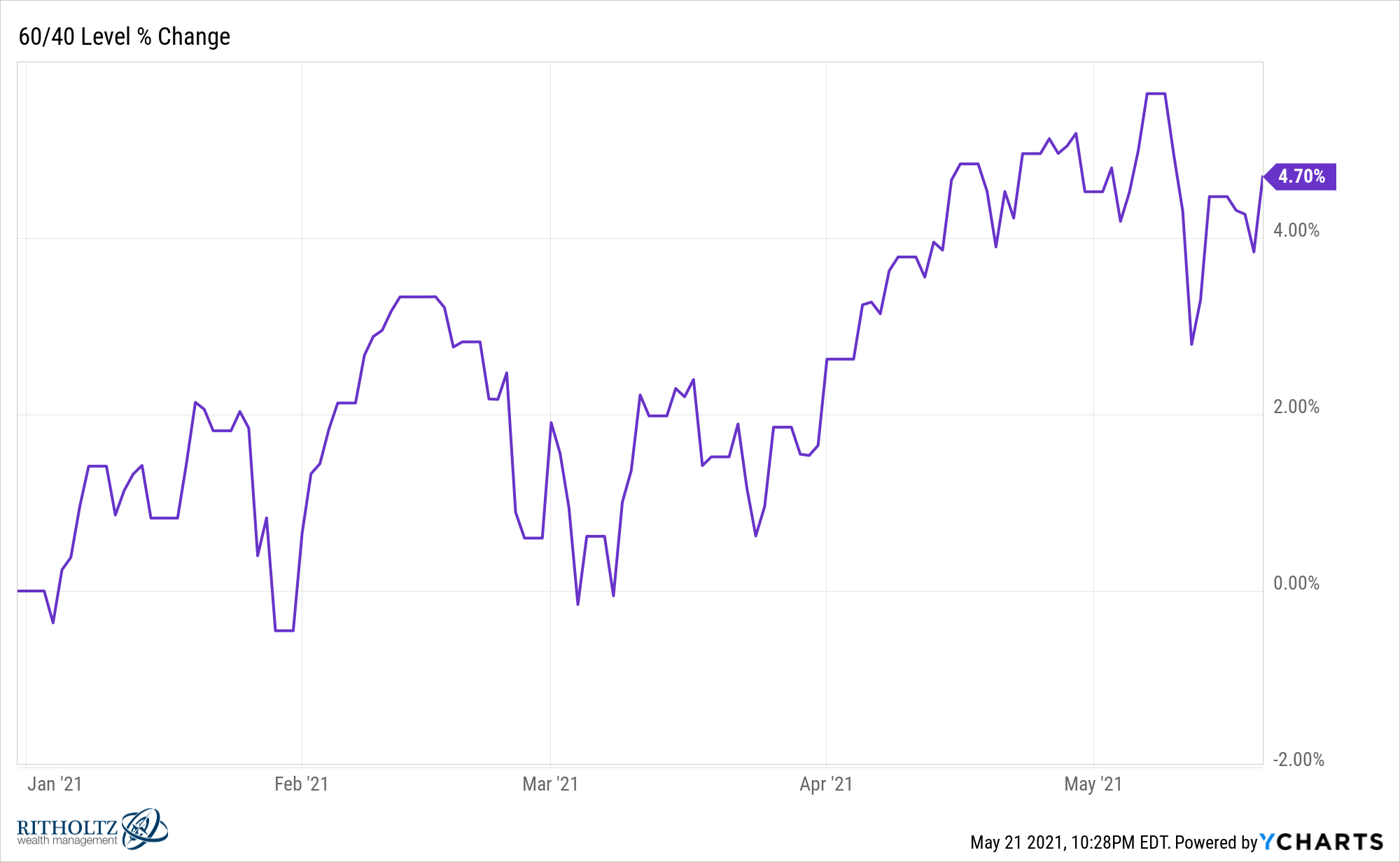

Last year a diversified portfolio held up well, all things considered:

This year a diversified portfolio is holding up well, all things considered:

Markets are not always like this. It’s not quite that simple.

But the market action between this year and last year is a nice reminder that trees don’t grow to the sky. Nothing works always and forever. And eventually the most hated assets can get cheap enough that they outperform.

Paying attention to trends is important in the markets to help understand what’s going on but everything is cyclical when it comes to investing.

Further Reading:

Stock Market Returns Are Anything But Average