A reader asks:

Need help with Dad! He’s never been much of an investor but was always a saver. After a fairly successful sales management career he lost his job back in 2018/19 right before the pandemic. Since then he’s been spending his nest egg slowly while delivering Doordash for some income to help stay afloat while looking for a job. He’s 61 and doesn’t spend money frivolously and he is single.

He recently started investing small amounts weekly but suggested he should cut that out to compensate for a recent rent increase. He doesn’t see much growth in such a small portfolio but he does feel like his weekly deposits are being flushed down the drain with this recent volatility. Any words of wisdom to convince him to weather the storm?

He’s very healthy and should have another good decade or 2 of healthy life. What would you guys suggest?

The good news is your dad is a saver and not a big spender. The bad news is he doesn’t have a lot of time to allow compounding to help with new savings.

I wrote an entire chapter in my book Everything You Need to Know About Saving For Retirement about getting a late start investing your retirement savings.

I’ll share an example from that chapter that might help here.

Let’s assume Carl and Carla Carlson are both 50 years old with little in the way of retirement savings. The kids are now out of the house so they can supercharge their savings to make up for lost ground.

Carl wants to take more risk to make up for their shortfall while Carla would rather increase their savings rate to make up for lost ground.

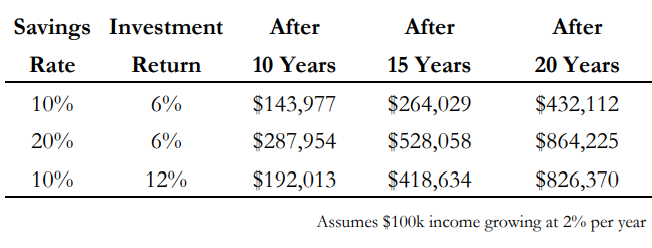

The Carlsons currently have a household income of $100,000 that will grow at a 2% cost of living adjustment each year. Carla expects their investments to compound at 6% annually and would like to save 20% of their income, while Carl thinks he can do much better than that by trading stocks and saving a little less. Carla thinks Carl is too overconfident in his stock-picking abilities and would rather save more money than take on a riskier investment strategy.

The couple wants to retire by age 65 or 70 but are unsure how far their savings can get them in such a short amount of time.

Let’s look at an example that shows some baseline assumptions, a scenario with a higher savings rate and one where Carl’s stock picks knock it out of the park:

Surprisingly, doubling up your savings rate would lead to better outcomes than doubling up your investment returns over 10, 15 and 20 years.

And chances are Carl is not the second coming of Warren Buffett so increasing their savings rate is far easier than increasing their investment returns. You have control over how much you save. Few mere mortals have the ability to double up the financial markets.

So the fact that your father has more experience saving than investing is a net positive since saving is going to be more important than investing.

But this doesn’t mean your father can ignore the financial markets simply because he’s a saver.

The average life expectancy for a 61-year-old male is around 84 years old. That’s more than two decades to plan for (and it could be even longer if he’s above average).

An inflation rate of 3% would turn $1 today into just 54 cents in real terms 20 years into the future. You still need to invest to keep up your standard of living during your retirement years.

You can’t just hide out in a checking account for 20 years and hope for the best.

One way to get your dad more comfortable with market volatility could be a bucket approach to his savings. In essence, you divvy up the portfolio into short-term (cash, money market funds, CDs, etc.), intermediate-term (bonds) and long-term (stocks, real estate, etc.).

The point here is to match assets, liabilities and time horizons the best you can.

Some of those savings are going to be drawn down in the next few years while other savings won’t be touched for over a decade or so.

Try to fill that long-term bucket up with risk assets that have a time horizon of at least 5 years or more.

You just have to work with him on figuring out the right mix of short, intermediate and long-term assets. And once that asset allocation is created, it should be easier to stomach some volatility in the near-term for those assets that won’t be spent for many years.

There are other levers to pull here as well.

You could always work longer.

Delaying retirement allows you to save more money, lets your money compound for longer and lowers the amount of time you need your portfolio to last.

Each year you delay taking Social Security benefits from age 62 to age 70 increases your payout by 8% per year (around 70% in total). The average monthly check size for a retiree is now more than $1,600.

Obviously, not everyone wants to work until they’re 70 but every decision you make in retirement planning requires trade-offs.

If you want to take less risk you have to either save more money or live a more frugal lifestyle.

If you didn’t save enough money you either have to take more risk, work longer or adjust your expectations.

If you want to draw on Social Security benefits at age 62 you’re going to have to accept a lower payout than you’d get from waiting.

I should also point out that older people have the ability to save more money in tax-deferred retirement accounts.

In 2022, the standard IRA contribution limit is $6,000 per year. But if you’re 50 or older, there is a $1,000 catch-up provision that allows you to save up to $7,000 per year in a tax-deferred retirement account.

And if your dad found a new job that came with a 401(k) plan, he could add an additional $6,500 on top of the $20,500 limit.

Giving financial advice to family members can be challenging. It’s also hard to teach an old dog new tricks when it comes to stock market investing.

Creating a retirement plan with different buckets that each have their own time horizon and risk profile is a good way to change the framing on this one.

We covered this question on this week’s Portfolio Rescue:

Bill Artzerounian joined me once again to talk about real estate investments, mega backdoor Roth IRA contributions and more.

Here’s the podcast version of the show: