Whenever the topic of inflation comes up the obvious rebuttal to the low reported number is the cost of buying a home.

Housing prices have been going crazy for the past year or so but certain areas have been pricing out a large segment of the population for some time now.

But the housing market in the United States may not be as expensive as it seems.

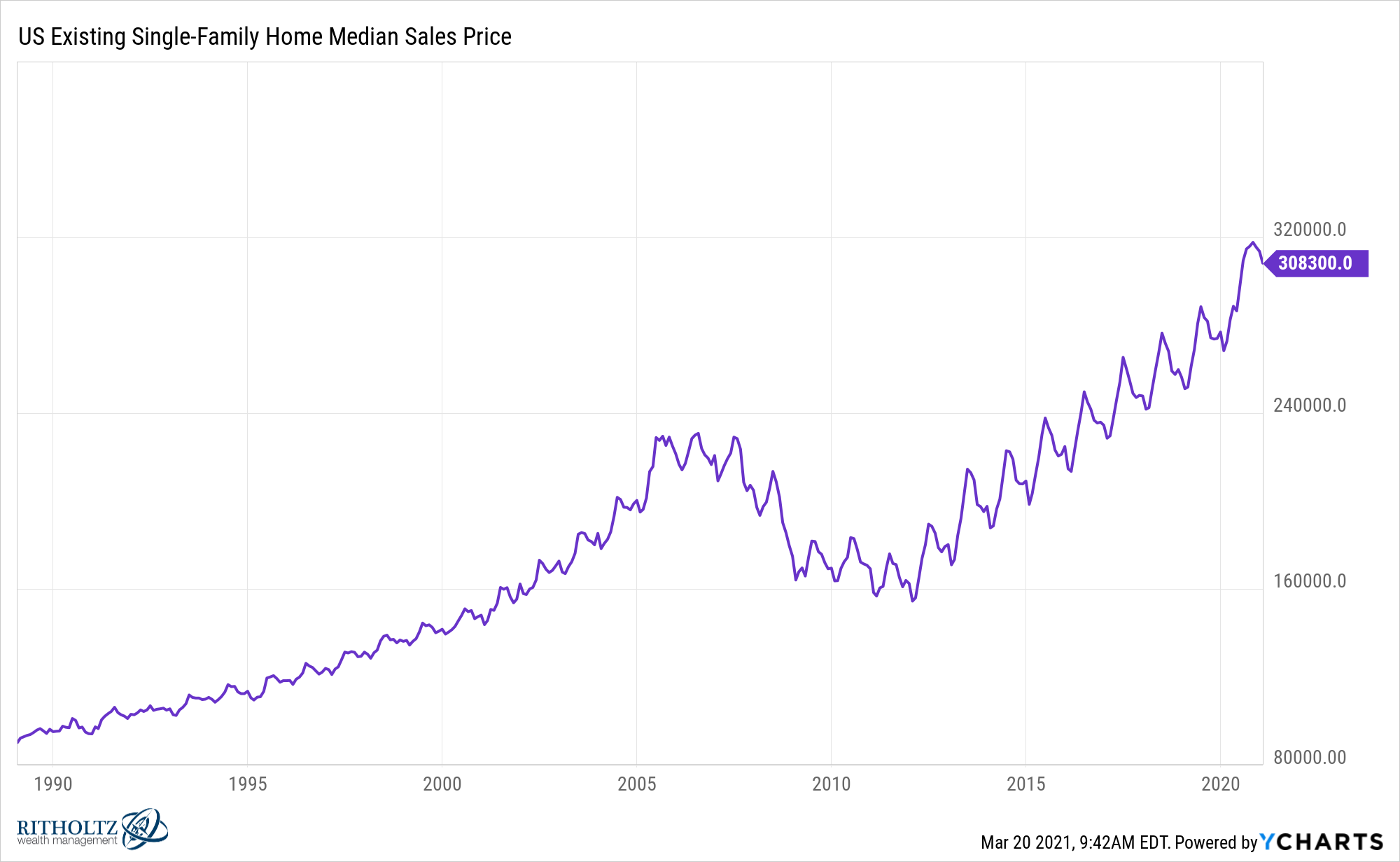

Here is the median sales price for existing single-family homes since 1989:

Prices paid are up more than 240% since 1989 and 56% since 2013 alone.

Unaffordable?

In certain places for sure but it’s not as bad as it looks once you make some adjustments. You have to put these prices into context.

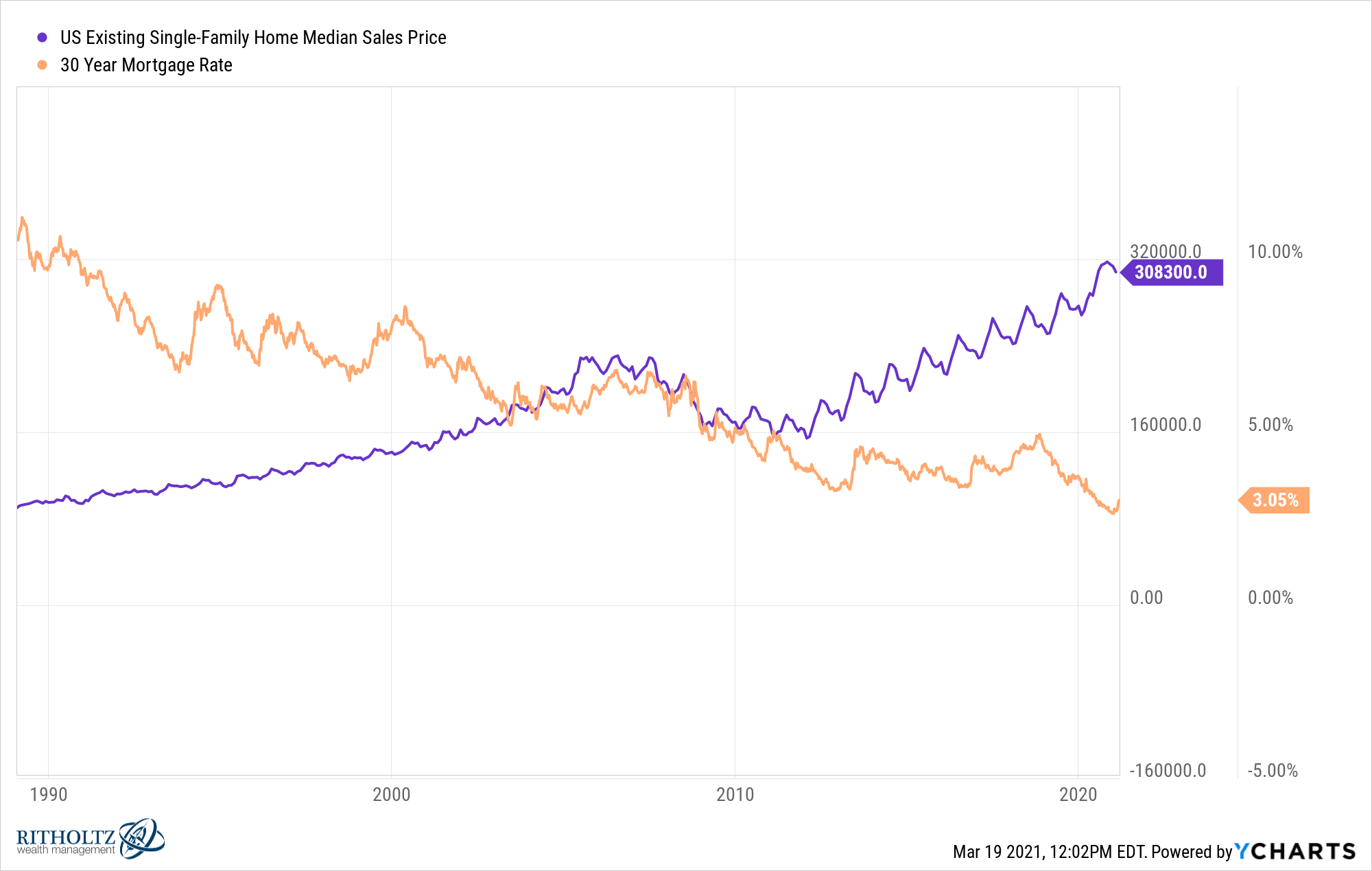

Look at mortgage rates over this time:

Mortgage rates were more than 10% in 1989. So while prices were far lower in the past, borrowing rates were much higher.

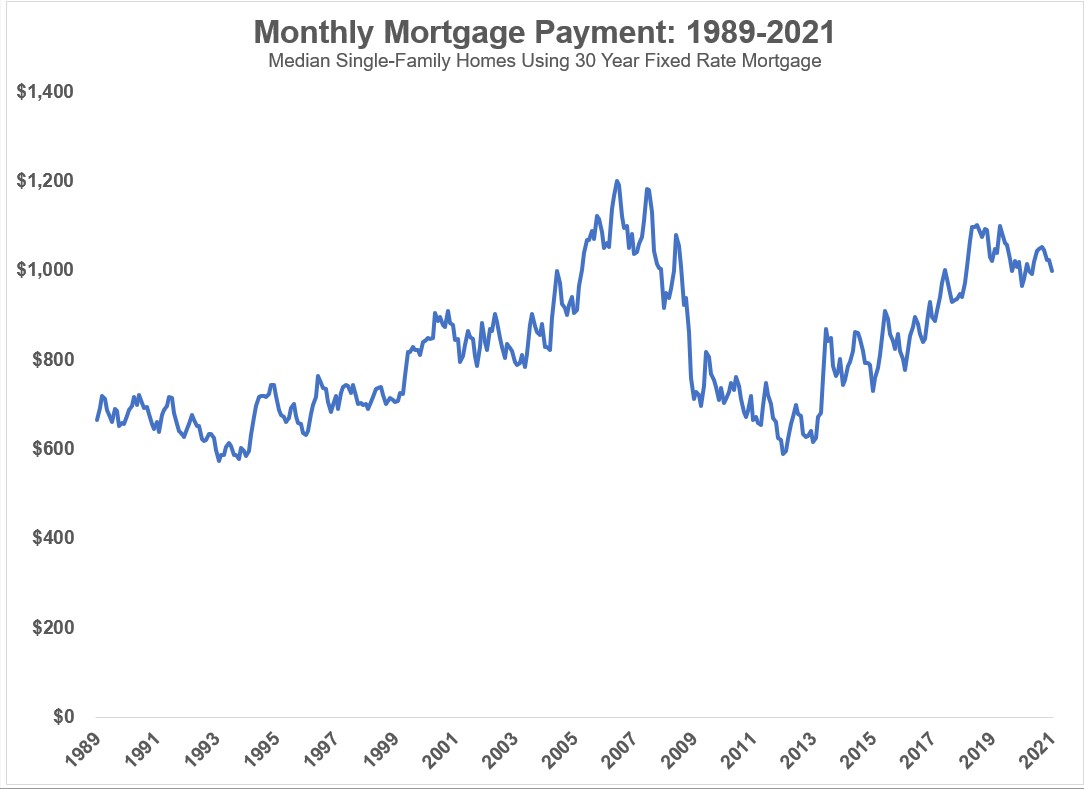

Taking the median sales price and applying the prevailing 30 year fixed mortgage rate (after accounting for a 20% down payment) shows a different story when it comes to monthly payments:

Today’s monthly payments are higher than they were in 1989 but once you account for interest rates it’s only 50% more rather than the 240% increase in prices. And because rates are so low today, monthly payments are below what people were paying in 2006 and 2007.

But wait there’s more!

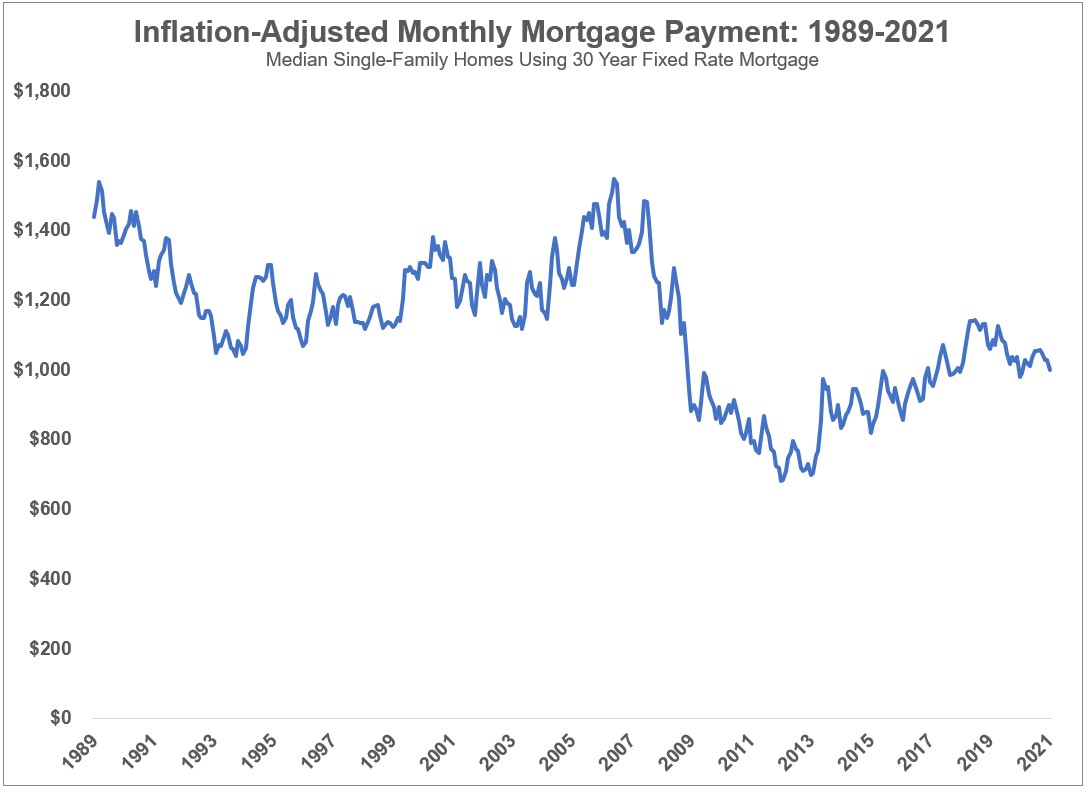

One thousand dollars in 1989 is not the same thing as one thousand dollars in 2021. Now let’s adjust these monthly payments for inflation:

After adjusting for inflation and interest rates, monthly mortgage payments are now 30% lower than they were in 1989.

There is some cherry-picking here and it was after the biggest housing bubble we’ve ever had, but 2012 appears to be a generational buying opportunity in housing.

There are caveats here of course.

The people who complain loudest about housing costs are in places like Silicon Valley or New York City where prices are ridiculous. And there are things like taxes and down payments to consider that don’t really get much of a break from lower rates.

This is why inflation is basically an impossible idea for people to grasp — averages don’t matter if your personal experience contradicts the average.

Not only are housing prices more reasonable than they appear, but houses are so much better than ever before.

The U.S. Census puts out an annual report on characteristics of new housing. Check out the differences between now and the early-1970s:

- In 1973, 49% of homes had no air conditioning. Now just 7% of houses have no AC.

- In 1973, 40% of homes had 1.5 bathrooms or fewer. Today just 4% have fewer than 1.5 bathrooms.

- In 1973, 64% of houses had 3 bedrooms while 23% had 4 bedrooms or more. Now 42% of houses have 3 bedrooms while 47% come with 4 bedrooms or more.

- In 1973, the median house had 1,525 square feet of space. Today it’s closer to 2,500 square feet.

- In 1973, the average size of a U.S. household had 3 people living under one roof. That average is down to 2.5 residents per house.

Houses are bigger, have more amenities and don’t have as many people living in them. I partially blame this on the fact there was no HGTV back then to peer pressure homeowners into having open floor plans, granite countertops and places to entertain.

Now before you send me hate mail about how difficult it is to buy a house right now because of all-cash offers, multiple bids over asking or the inability of certain borrowers to come up with a 20% down payment, I recognize the housing market is not perfect.

There isn’t nearly enough supply to meet demand. There are certain areas where a wide swath of the population has been completely priced out. And it’s possible rising mortgage rates could throw a monkey wrench into this market.

But the fact that a house is by far the biggest purchase most people will ever make in their lives can play head games with people.

The sticker shock of only thinking in terms of prices and not considering interest rates or how much better houses are today than they were in the past makes housing seem far more expensive than it actually is.

People have no problem thinking in absolute terms but have a hard time thinking in relative terms.

It feels like housing prices are out of control. And in some places they are.

But housing is not as expensive as it appears based solely on the sales price.

Further Reading:

The Youths Are Coming For the Housing Market