After peaking in the fall of 2007 with the onset of the Great Financial Crisis, the U.S. stock market didn’t hit new all-time highs again until the spring of 2013.

At this point, the S&P 500 was already up more than 150% from the bottom in March of 2009.

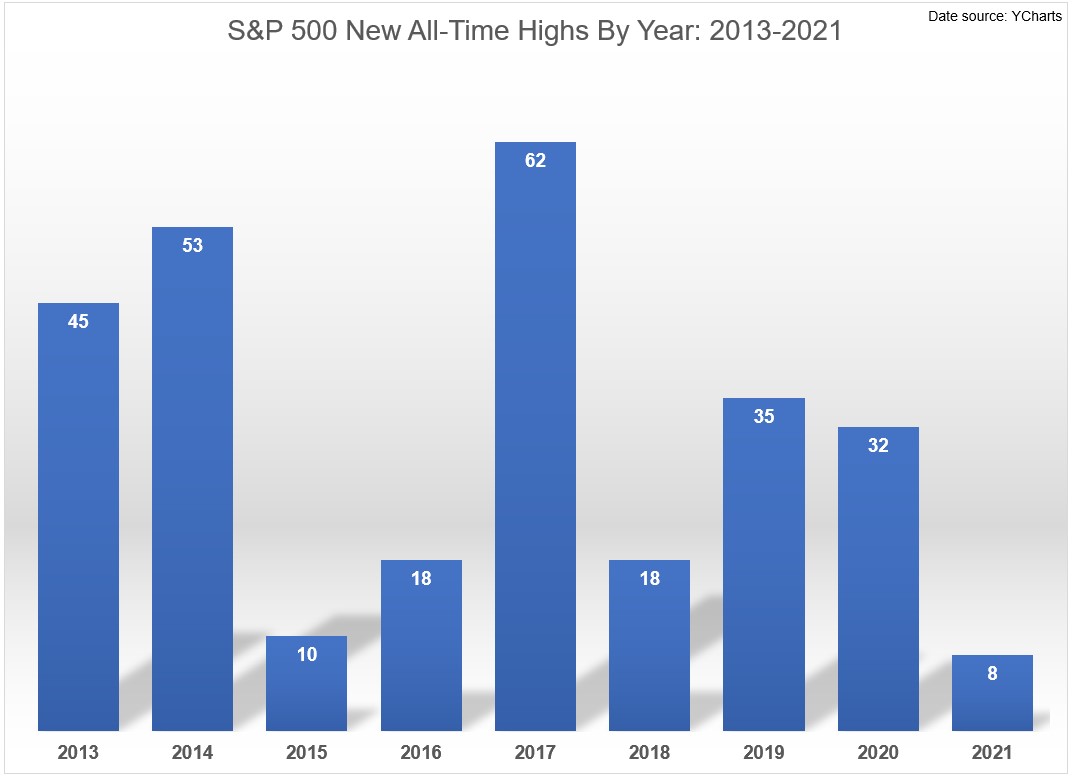

There would be 45 new all-time highs in total in 2013, a year in which the S&P rose more than 30%.

At this point people became worried the easy money had been made. Too far, too fast they warned.

The market didn’t care.

There were 53 new highs in 2014, 10 more in 2015 and an additional 18 in 2016. Then things really ramped up in 2017 with 62 new all-time highs, which was followed by 18 in 2018. Then in 2019 the market was again up more than 30% plus 35 more new highs.

Surely, this couldn’t persist.

And in the face of a global pandemic, it sure seemed like it probably wouldn’t last. After 13 new highs before things started to shut down in March, it seemed like the party was over.

And it was, at least for a few months. But then there were 19 more new highs for the remainder of the year after stocks came roaring back, good enough for 32 new highs on the year.

In 2021, the U.S. stock market has already tallied 8 new highs through the close on Monday. That’s a total of 281 brand spankin’ new highs since 2013.

The entire way up there have been naysayers warning about stretched valuations, the Fed, government debt, interest rates, euphoria and bubbles.

And to be fair there have been corrections and crashes in this time. Since 2013, the S&P 500 has experienced drawdowns of -12%, -13%, -10%, -20% and -34%. Yet each time it’s come charging back to new highs.

Investing is always hard no matter the environment. It’s hard when stocks are falling because losing money is painful and it always feels like stocks could fall further. And it’s hard when stocks are rising because you have to balance the FOMO that comes from watching others get richer than you with the worry that any day now could be THE top.

To cope with the difficulty of investing in each of these market environments I keep things extremely simple — I just keep buying either way.

Investing periodically over time completely takes the idea of market timing and the inherent stress that comes with it, off the table. I don’t spend my time looking for the fat pitch or shoeshine boy sign of a top. I’m not trying to outsmart the market while simultaneously outsmarting myself.

And this isn’t some genius strategy by any means, it’s purely situational.

I plan on being a net saver for many years into the future. I’m perfectly comfortable with the fact that sometimes I’ll be buying an asset that has appreciated substantially, sometimes I’ll be buying an asset that has fallen substantially and sometimes I’ll be buying something that has gone nowhere for years at a time.

Take bitcoin as an extreme example.

I bought some in 2017 just in time to experience the insane run-up in prices. Then I watched my holdings fall 80% or so from there. I made some sporadic purchases in the meantime but last year finally decided to simply dollar cost average to take the guesswork out of the equation.

Now I make purchases of a set amount on a set schedule.

Based purely on my personality, I have an easier time buying an asset that is falling than rising. I’m just not a let-your-winners-ride kind of investor. I need rules in place to guide my actions. And one of the hardest things to do when you don’t have this mindset is to continue buying something that is trending higher.

But dollar cost averaging into bitcoin has forced me to buy at $10k, buy some more at $20k, a little more at $30k and still more at $40k. Had I not planned these purchases out ahead of time there’s no way I would have been able to keep buying as prices rose.1

When bitcoin rises every single day:

I missed the boat but I'm definitely buying the next time it crashes

When bitcoin crashes:

I'm not buying this. It's probably going to zero

Repeat until angry

— Ben Carlson (@awealthofcs) January 11, 2021

Are some of those purchases going to be near or at the top of the market before a crash?

Definitely.

Will you know that ahead of time?

Not a chance.

Is this a perfect strategy?

No, but a perfect strategy does not exist.

The beauty of dollar cost averaging is you diversify across time and market environments so you don’t need to worry about the timing of your purchases as much.

Further Reading:

When Dollar Cost Averaging Matters the Most

1Do I wish I would have put more into it? At today’s price, the obvious answer is yes.