A reader asks:

Lately, we hear the terms “soft landing” and “hard landing” regarding the Fed actions. Can you explain what these two phrases mean in market terms?

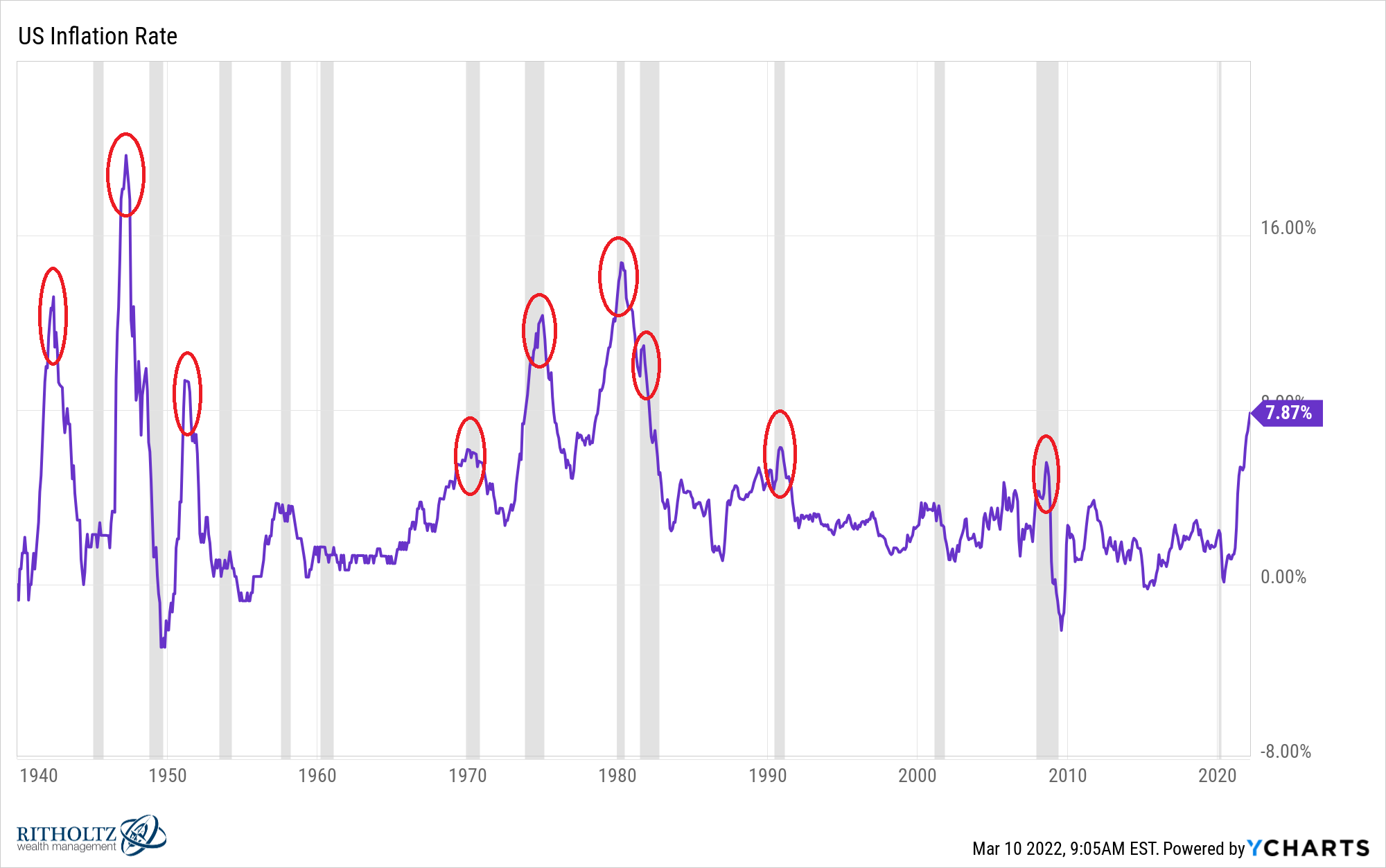

A couple of months ago I looked back at every inflationary period going back to the 1940s:

There’s a theme here. This is what I wrote at the time:

Inflationary spikes don’t cause every recession but every inflationary spike has only been alleviated by a recession.

Each time inflation went over 5% in short order there was a recession either right away or in short order.

A hard landing would be the Fed raising interest rates so high to fight inflation that it pushes us into a recession.

A soft landing, on the other hand, would see the Fed raising interest rates just high enough to bring down inflation but not so much that it causes an economic contraction.

This is what former Fed chair and current Treasury Secretary Janet Yellen said about this today:

All of those things suggest that the Fed has a path to bring down inflation without causing a recession, and I know it will be their objective to try to accomplish that.

Yellen says a soft landing is possible.

History shows a soft landing with inflation this high has never happened before.

Choose your fighter.

As far as the market implications go, the U.S. stock market is effectively already in a bear market. The S&P 500 is down 19% or so from all-time highs.

The question is: Will the U.S. go into a recession or can the Fed thread the needle and orchestrate a soft landing?

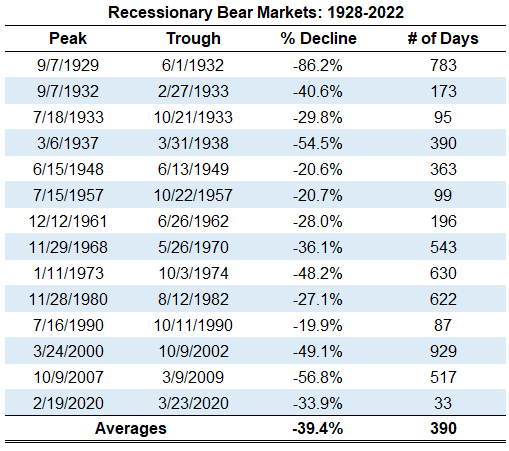

First up, these are the bear markets that happened in and around a recession going back to the Great Depression:

The biggest crashes in history have been caused by recessions. This makes sense when you consider people lose their jobs during a recession. Companies go out of business. People lose money and stop spending as much.

It doesn’t take a genius to figure out why the stock market tends to fall a lot during a collapse in economic growth.

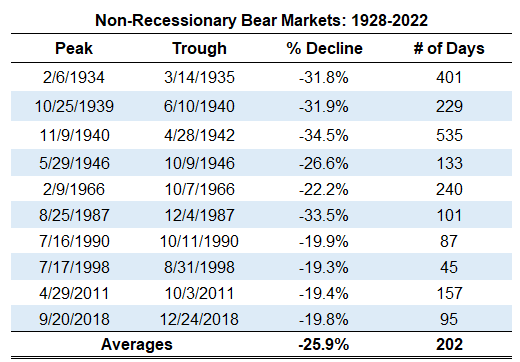

Bear markets tend to coincide with economic contractions but there have been plenty of bear markets that occur outside of a recession. A recession is not a prerequisite.

I count 11 non-recessionary bear markets over the past 90+ years:

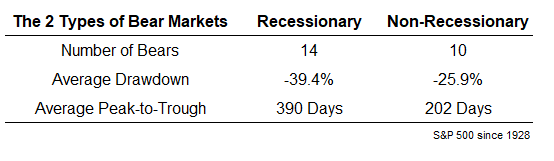

Here’s the tale of the tape:

The obvious takeaway here is bear markets that occur outside of a recession tend to be shallower and less lengthy while recessionary bears are greater in both magnitude and time.

If you think the Fed can keep us from going into a recession, we may be closer to the end than the beginning of this bear market.

If you think the Fed has no chance of side-stepping a slowdown, there could be more pain ahead.

It is worth mentioning not every recession in history leads to a bone-shattering crash. The bear markets in 1990, 1980-1982, 1961-1962, 1957 and 1948-1949 were all losses of less than 30%. It is possible to have a recession that leads to a relatively minor bear market.

Regardless of how things shake out in the economy, the one thing no one can predict is the actions of investors.

The run-up in prices following the pandemic crash was massive. The pendulum could always swing too far in the other direction if investors really panic.

Or we could bottom today. Who knows.

The hardest part about bear markets is no one knows when they will come to an end.

The good news is they do always come to an end at some point. You might just have to be patient to see how this one plays out.

We talked about this question on this week’s Portfolio Rescue:

Barry Ritholtz joined me to discuss the 4% withdrawal rule in retirement, changing your asset allocation, the Fed and how new investors should think about bear markets.

Further Reading:

How Long Do Bear Markets Last?

Here’s the podcast version: