A house a few doors down from mine went up for sale a couple of weeks ago.

After being on the market for a few days there was word of multiple offers above asking price. The whisper number on what they received for the house was a much higher price than they paid.

My wife and I immediately did the back of the envelope on what that kind of price action would mean for the value of our home.

Well if they got that can you imagine what we would get for our house?! It’s way more than we paid for it.

But there’s a catch in this line of thinking.

Yes, we could probably sell our home for well above the price we paid for it right now what with the shortage of housing supply on the market and the fact that the real estate market is going crazy from a combination of demographics and the pandemic.

Unfortunately, the price you sell your home for is only one side of the equation. You have to live somewhere so selling your house for a higher price simply means you would turn around and have to buy another house that’s also trading for a higher price, thus negating any windfall from the sale of your home.

I suppose you could always downsize or move to a lower cost of living area but this shows the strange psychology involved when buying and selling a home. People could get into a bidding war on your home and drive the price up but you’re just as likely to get into a bidding war of your own these days for the house you want to buy.

It’s the catch-22 of any real estate transaction for people who already own a home.

This is a conversation being had by people all across the country right now because the real estate market is so hot.

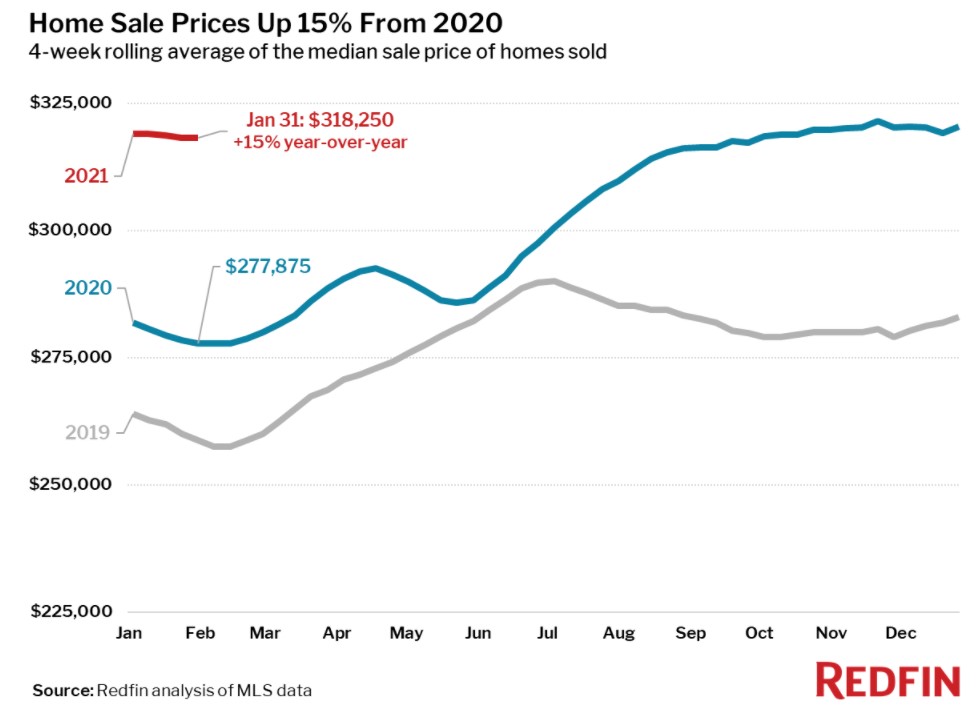

According to Redfin asking prices are now at an all-time high, up 10% from just a year ago while the number of active houses listed for sale is down 36%. Meanwhile, home sale prices are up 15% from a year earlier:

These higher prices mean many current homeowners are sitting on a lot of equity at the moment. According to Bloomberg:

By the end of last year, more than 30% of U.S. homeowners were considered equity-rich — meaning their property was worth twice as much as the underlying mortgage, a report showed.

So what do you do if you’re lucky enough to be in the position of being equity rich?

You could sell your house. We’ve already gone over this one in terms of pricing trade-offs but there is another benefit to having a decent chunk of home equity — you can use it as capital for your next down payment.

With prices trending higher and mortgage rates on the floor, coming up with enough money for a down payment remains one of the biggest roadblocks for first-time homebuyers. Maybe the most overlooked aspect of being a homeowner is the fact that it allows you to bank savings you can use towards the down payment for your next home.

Regardless of the catch-22 nature of this transaction, the temptation to sell is likely higher than it’s been in many years because equity can help soften the blow of higher prices in the form of a down payment.

Use it to fix up your home. Not only does moving to another home right now mean paying a higher price but the entire process of moving is a pain.

There are transaction costs involved. You always end up spending way more than you plan outfitting your new place. And many people have an emotional attachment to their current home, neighborhood and community.

It’s probably less of a headache for most people to simply use their equity to fix up or improve their current house. And you can do so by taking out a home equity line of credit if you don’t want to tap cash reserves at the moment.

This is one way to take advantage of lower rates and improved equity positions. We took out a HELOC on our home last year with a 3% borrowing rate. And if you use that line of credit to improve your home the interest is tax-deductible.

Cash it out and use it for something else. I like the HELOC option because it offers flexibility. It can act as a form of emergency financial backstop since you aren’t forced to do something with it right away.

But you could always do a cash-out refinance if you have enough equity in your home. You could invest that money. Pay down other high-interest rate debts. Start a business. Take a blow-out trip when the pandemic is over.

Maybe that money is better off staying put for many people but with rates where they are today, I can see the appeal of putting that equity to work elsewhere.

Do nothing. The last option is by far the most boring but you could just stay put and continue to pay down your mortgage. There’s nothing that says you have to use your equity to make a move. Some people are content simply paying off their home and don’t look at it as an asset that requires financialization.

In fact, forced savings are one of the biggest benefits of homeownership.

The current environment won’t last forever. Eventually, interest rates will rise1 or we’ll have another recession or demand will finally slow down for some reason we can’t even think of right now.

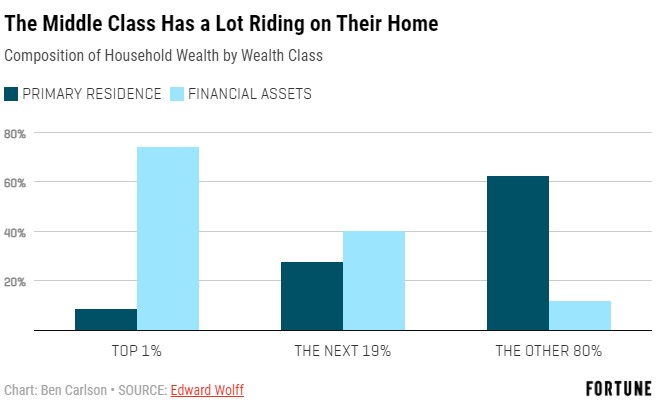

But home equity remains by far the largest asset for the majority of the middle class.

Many retirees are going to want to (or have to) utilize their home equity in some form in the years ahead.

This space is ripe for a fintech firm to come in and make it easier for people to tap their equity.

Further Reading:

Why Housing Could Be One of the Best-Performing Asset Classes of the 2020s

1I think?