Today’s Talk Your Book is brought to you by State Street.

We spoke with State Street’s Matthew Bartolini about the outlook for diversified portfolios and the market in 2021 and beyond.

We spoke with State Street’s Matthew Bartolini about the outlook for diversified portfolios and the market in 2021 and beyond.

We discuss:

- What is the alternative to a 60/40 portfolio?

- Are junk bonds strategic holdings or better for tactical investing?

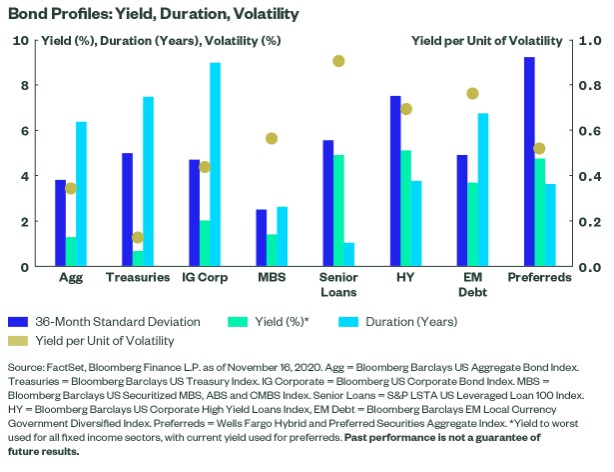

- Do investors need to diversify more in fixed income?

- The 3 types of risk in bonds

- Could retirees who need to earn returns going to keep valuations high?

- How to think about investing in preferred stocks

- Why it’s so difficult to build a bond portfolio with yield right now

- Bonds allow you to take more equity risk

- How much would bond investors lose if rates rise?

- What is the origin of the 60/40 portfolio?

- How much of a home country bias to U.S. investors currently have?

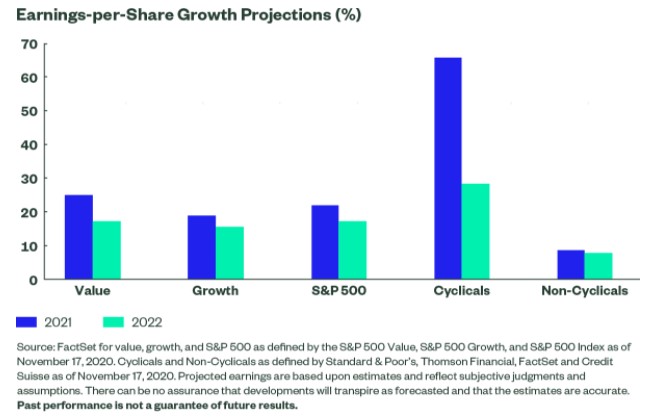

- Did stock market investors pull forward 2021 fundamentals?

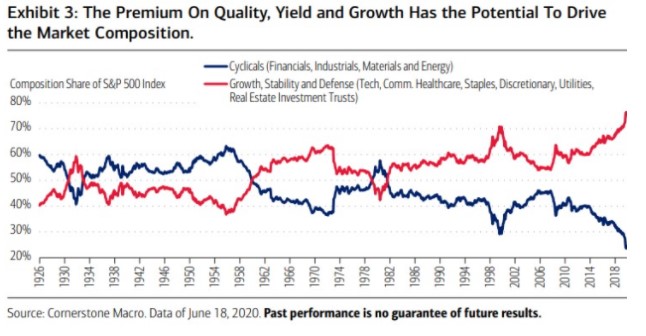

- Why cyclical stocks have gotten crushed

Listen here:

Links:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: