Today’s Animal Spirits is brought to you by Interactive Brokers.

Check out their Portfolio Analyst tool to see all of your investment accounts in one place.

We discuss:

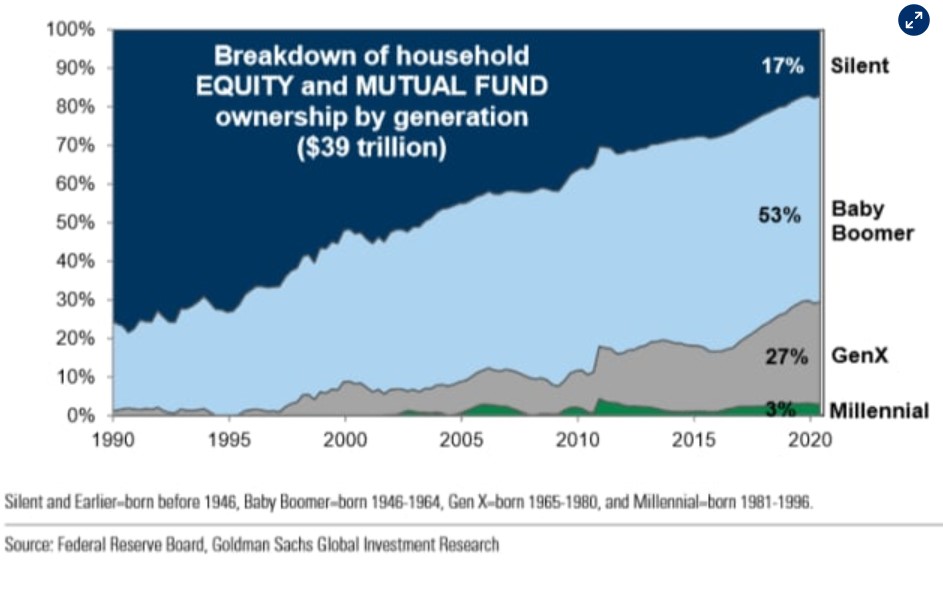

- Why are baby boomers selling their stocks?

- How target date funds are growing in importance

- Why aren’t more value funds closing down?

- Why there were so few distressed opportunities in this bear market

- At what point does historical market data become useless?

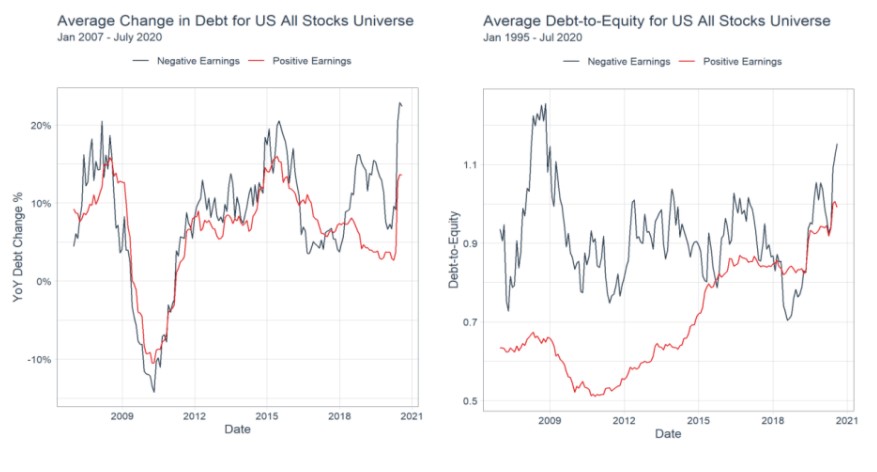

- Isn’t it a good thing companies are taking on more debt with rates so low?

- Why it’s hard to use rules of thumb in finance

- Is the 4% rule still applicable for retirement withdrawals?

- Is Cathie Wood the most underappreciated fund manager in the business?

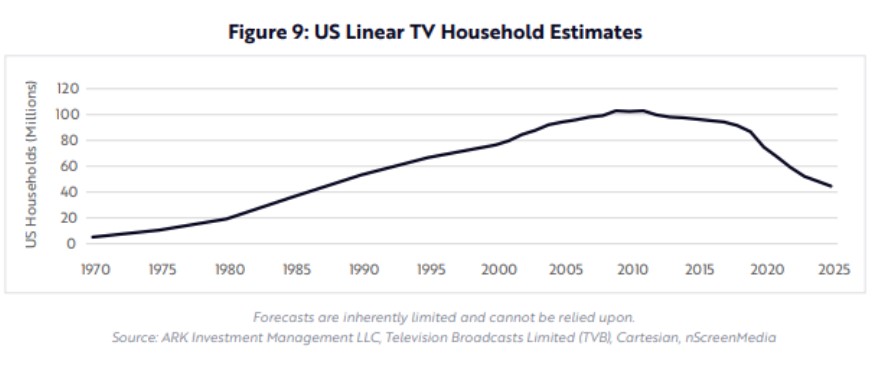

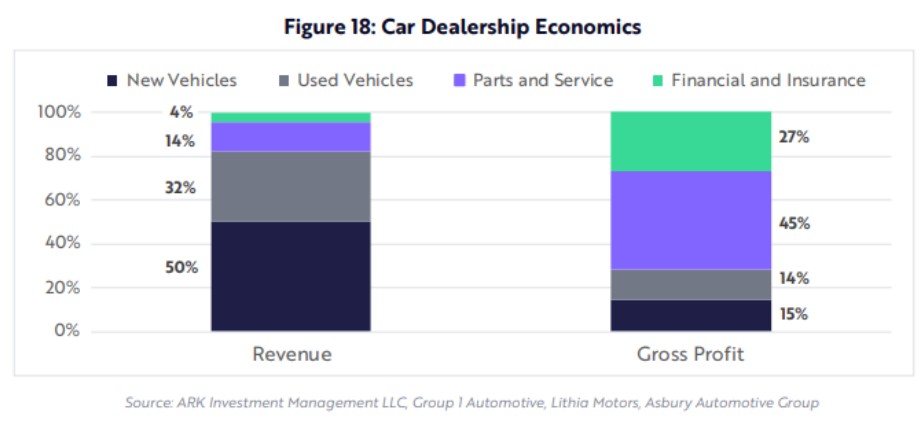

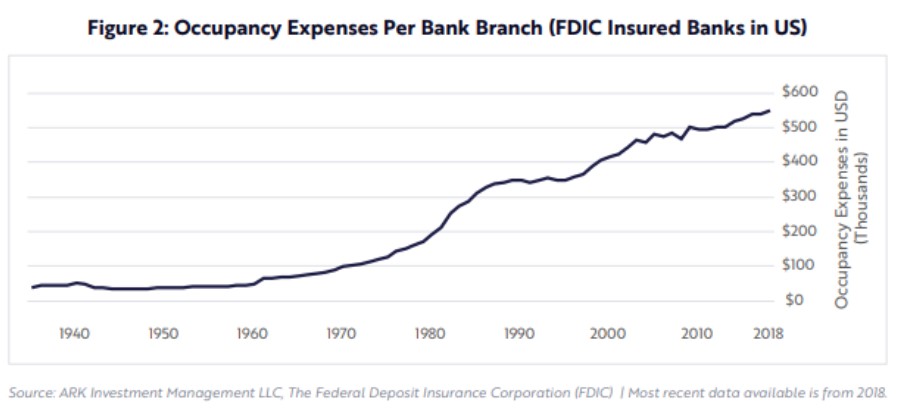

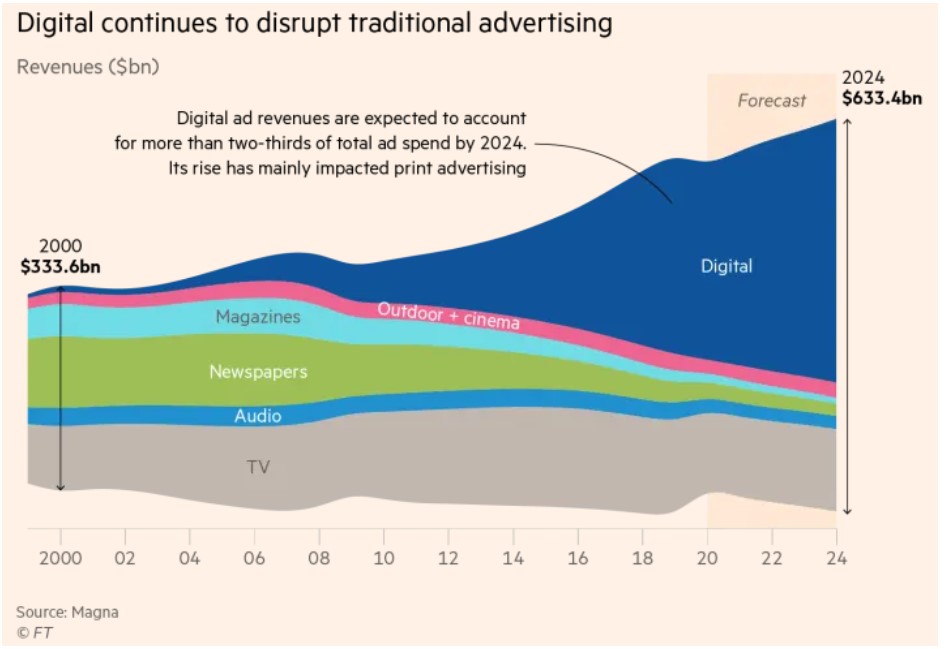

- What are some of the most disruptable industries of the future?

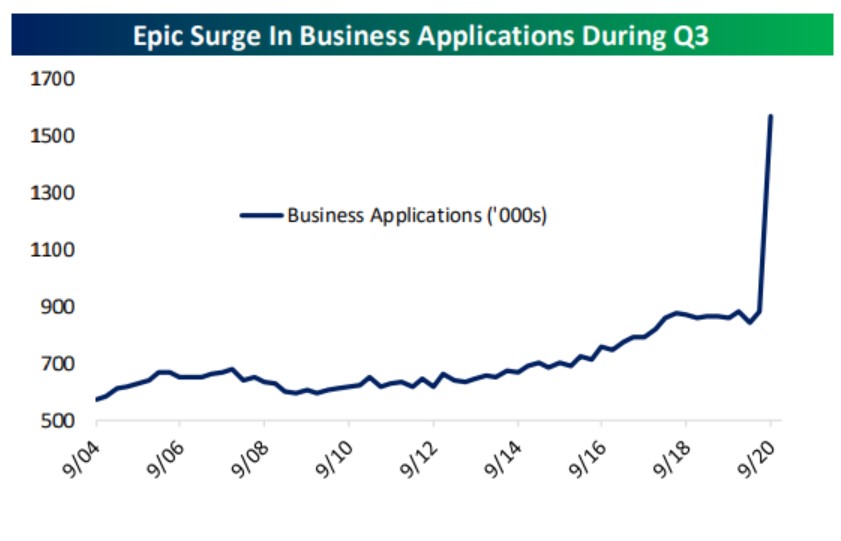

- Will we see more government spending during future economic crises?

- Why did credit scores rise this year?

- Collapsing levels of trust

- How many different versions of history will be written in the future?

- Some optimism about the end of the pandemic

Listen here:

Stories mentioned:

- America is having a moral convulsion

- Older Americans are selling the stock market slowly bu ceaselessly

- Value investor calling it quits

- Coming into focus

- Q3 2020 commentary

- What if the 4% rule for retirement withdrawals is now the 5% rule?

- Ark’s bad ideas report

- Buy now pay later

- Coronavirus tanked the economy. Then credit scores went up

- A dose of optimism

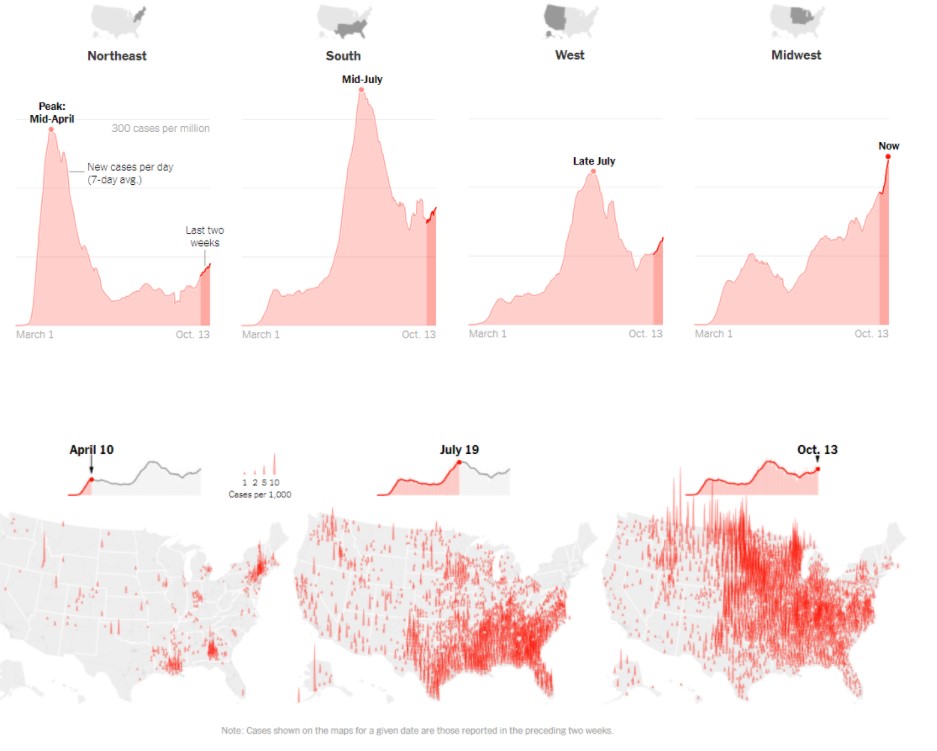

- US virus cases climb toward a third peak

Books mentioned:

Podcasts mentioned:

- How the creator of the 4% rule applied it for his clients

- Japan is trading at the lowest valuation in 30 years

- Cooper Raiff on Sh*thouse

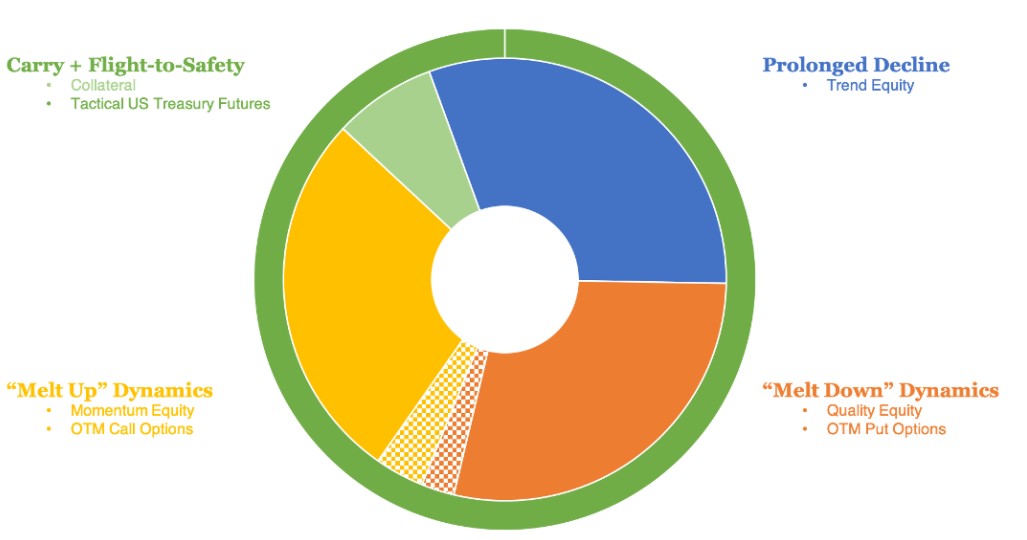

- The Case for Tactical Equity

Charts mentioned:

Commercials mentioned:

https://twitter.com/ARKInvest/status/1316483578189012992?s=20

Norm MacDonald bits mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: