The personal part of personal finance is always harder to deal with than the finance part because circumstances color the way we view our money decisions.

You can create all of the spreadsheets and financial plans you want but certain life events can change the way you think about spending, saving, investing and risk.

Financial planning requires more guessing than most wealth management professionals are willing to admit because the hardest variables to forecast often have nothing to do with the stock market or future tax rates or interest rates.

It’s impossible to know how you’ll feel about certain life events until you’ve gone through them.

Having kids was one of those life events for me.

There are certainly steps you can take that prepare yourself financially to have children but it’s impossible to prepare yourself emotionally because it’s one of those experiences where you have no idea how you’ll feel until you go through it.

It is helpful to consider how those feelings will evolve, however, because the financial implications are still there waiting for you no matter how you feel about them.

Michael and I spend a lot of time talking about our children and the different ways our lives have changed over the years since having kids. So we decided to record a podcast about our feelings on the matter, some of the biggest financial considerations parents need to be aware of and our journey as parents.

We discuss:

- How can you prepare yourself financially to have kids?

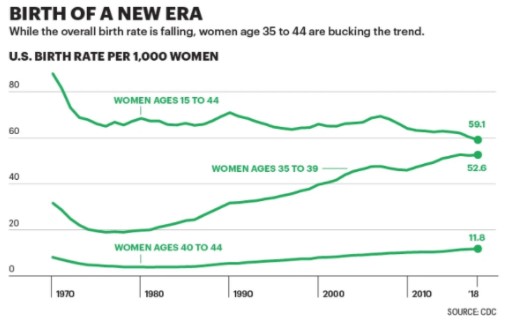

- Why people are having kids later in life

- How to get your financial house in order before having children

- The finances of infertility

- How much does a hospital stay cost when you have a baby?

- How much money do you spend on a newborn?

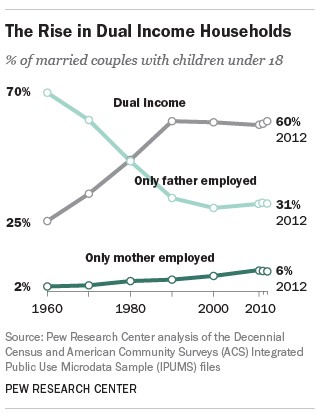

- How many dual-income families are there?

- Why are daycare costs so high?

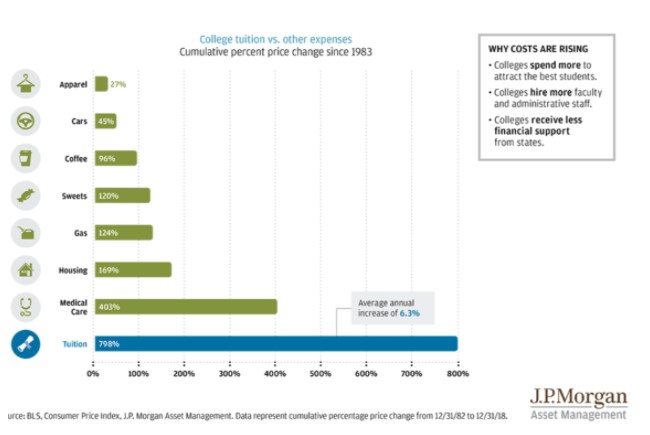

- Which chid costs have risen the most over the past 40 years?

- How having kids impacts your housing decisions?

- The longest week of my life

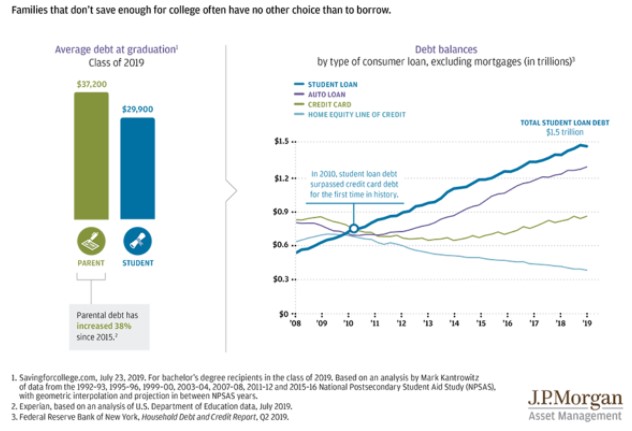

- Can college prices keep rising at the same rate?

- How do new parents even attempt to estimate future college costs?

- Higher priority — retirement savings or college savings?

- Michael Lewis and Tom Hanks on being a parent

- How to teach your kids about money

This episode is presented by Naviplan by Advicent:

Go to www.advicent.com/animalspirits to learn more about how their software can help with the financial planning surrounding saving for college and family financial planning.

Listen here:

Stories mentioned:

- 7 things to buy when you have kids (that no one tells you about)

- When your financial plan gets thrown out the window

- 10 money revelations from being a parent

- The economics of having twins

- Fertility Inc.

- Is daycare the next student loan crisis?

- Child care costs are almost as much as rents

- College planning essentials

- Raising the best kids you can

- This Tom Hanks story will help you feel less bad

Books mentioned:

- The First National Bank of Dad by David Owen

- Home Game by Michael Lewis

- The Opposite of Spoiled by Ron Lieber

Video mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: