While researching my last book one of the statistics that stuck with me the most was the fact that every year Americans spend more money on the lottery than they do on movie tickets, music, professional sporting events, video games, and books combined.

I also found people on the lower end of the income scale are more likely to play the lottery than people who make more money.

Bankrate found in 2018 that the lower income households in the United States spend an average of $412 annually on lottery tickets while the highest-income households spend $105 on average. And roughly one-third of people in the lowest wage group buy lottery tickets at least once a week compared with 20% of people at higher wage levels.

There are a number of behavioral biases related to our affinity for lottery ticker payouts.

Prospect theory shows people place a high value on the prospect of a low probability event occurring, assuming the outcome would drastically change their lives. Rich people wouldn’t experience the relative change from winning the lottery as much as a poor person, thus it makes sense people on the lower rungs of the income scale would play more often.

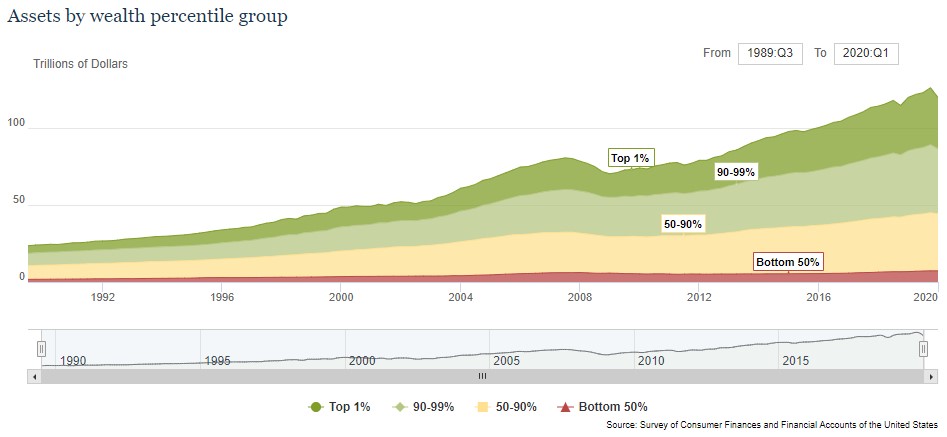

And as wealth inequality grows these lottery ticket-style behaviors are sure to increase.

Why wouldn’t you take greater risks if you have nothing to lose? Why not gamble on a low probability outcome if it has the ability to change your life?

This doesn’t makes sense from a probabilistic perspective, but it does from a psychological one.

I think prospect theory is at play when it comes to the new army of daytraders trying to take over the stock market as well.

Vox spoke to a number of new daytraders to figure out what was driving their behavior. Much of this has already been covered — people are bored, there are no sports to gamble on, the government sent out checks, the stock market has been wildly volatile, etc.

But people also see day trading as a lottery ticket if they use the right types of vehicles. One person they talked to, who lost her job during this crisis, turned to options:

“With options, you can make money so much faster. So I was then having days where I would make $1,000 a day, and then I made $10,000 in a day,” she said. “And then I started getting really cocky, and I didn’t even think I could even lose so much money. Then during the day when it was like we had a really big drop, I lost everything I had made.”

Another mentioned the fact that it’s boring to get rich slowly:

“It’s boring watching stocks, it’s not exciting, they’re not making these crazy prices,” said Adam Barker, a 31-year-old software engineer in Massachusetts. “You don’t get a rush throwing money at Berkshire Hathaway and waiting 15 years.”

I’m not saying these actions make sense. Successful investing is almost always slow and boring but our brains aren’t wired to accept slow and boring. We want exciting and explosive gains right this minute.

When things aren’t going your way, either personally or financially, it’s even more tempting to press the issue to make something happen.

As long as wealth inequality continues to get worse, there will likely be a large group of people who will place their bets on lottery tickets.

Those lottery tickets could be speculative investments. But they also may come in the form of politicians or political causes or protests.

When people have nothing to lose why wouldn’t they take a flier every once and a while?

Further Reading:

Bubble Behavior During a Depression