On this week’s Animal Spirits with Michael and Ben…

We discuss:

- Kobe Bryant and learning to deal with death

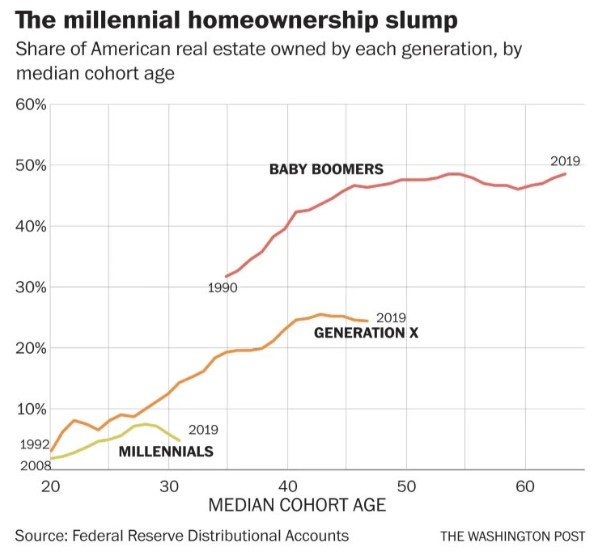

- Why did boomers own so many more homes at a young age than millennials do now?

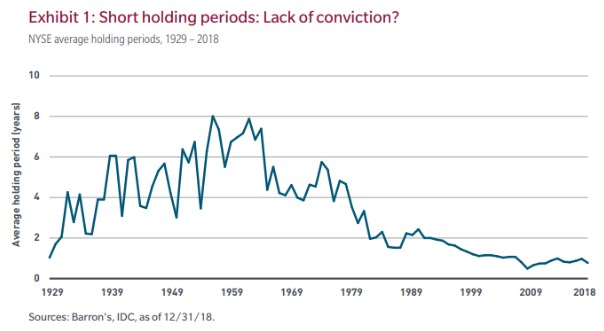

- Have zero trading commissions led to increased trading?

- Why has the turnover of stocks increased in recent decades?

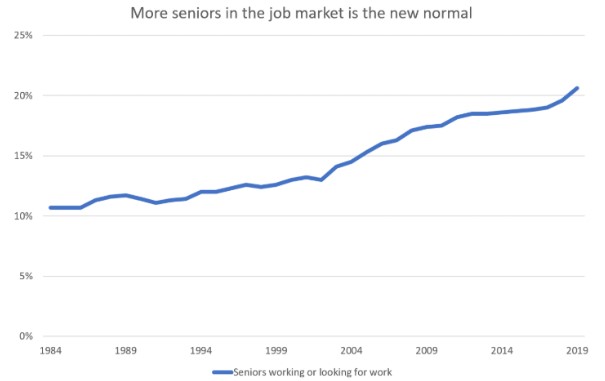

- Reasons for working longer when you hit retirement age

- How much is your stream of social security payments worth?

- Should social security be thought of as a bond substitute?

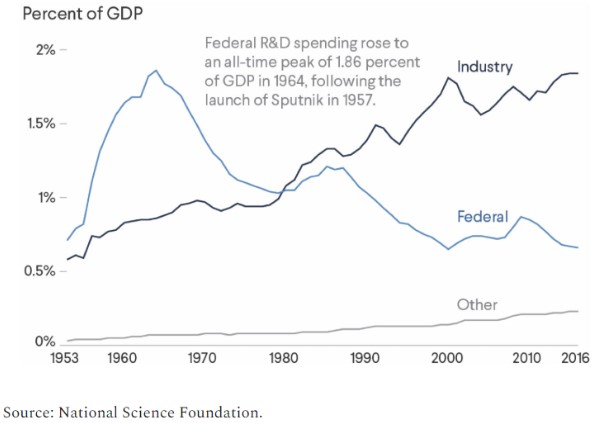

- Who do we trust more to invest for the future: the government or private enterprise?

- Which personal finance knowledge really matters?

- Why are REITs the best performing asset class this century?

- Is it now more economical to ditch your car and simply pay for ridesharing?

- Why overpopulation is not something you should worry about

- Why young people are so fed up with capitalism

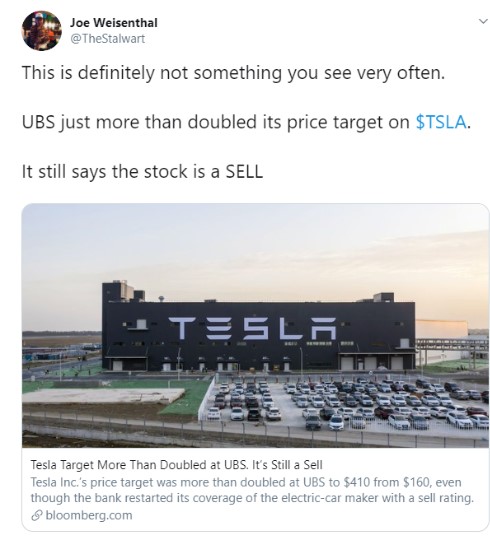

- Why do analysts still use price targets and buy/sell ratings?

- Lump-sum investing an inheritance and much more.

Listen here:

Stories mentioned:

- Live for today

- Millennials’ share of the housing market is small and shrinking

- Online brokers go from zero to hero

- Lengthening the investment time horizon

- Death of retirement?

- “We don’t feel especially frugal”

- Let it gush or let is bleed

- Asset allocation quilt redux

- Ditch your car: ridesharing is more cost-effective

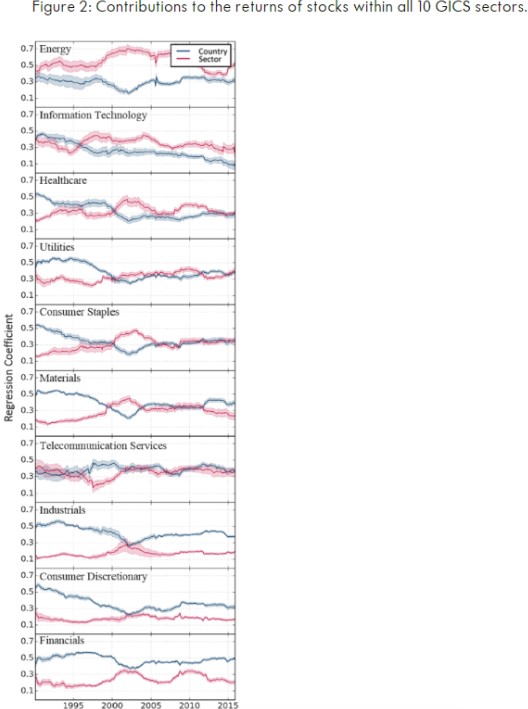

- The role of sector and country in stock market returns

- The problem of an aging population

- A 22-year-old’s tough questions about capitalism

Books mentioned:

- Falling Short: The Coming Retirement Crisis and What to Do About It by Charley Ellis

- Fewer, Richer, Greener by Laurence Siegel

- Factfulness by Hans Rosling

- Inferno by Dan Brown

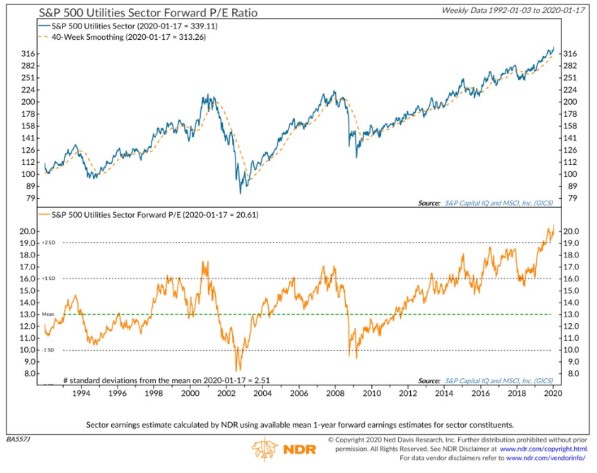

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: