Last week the Financial Planning Association released its annual investment survey of financial advisors — 2017 Trends in Investing Survey: Where Financial Advisors are Investing Now. The survey consists of responses from over 300 financial advisors to various questions about how this group is thinking about the current investment landscape.

There were a few data points in the report that solidified many of the more popular industry trends at the moment. Almost 90% of the advisors surveyed said they use or recommend ETFs in their portfolios, with half of the respondents claiming they plan to increase the usage of ETFs in the coming year.

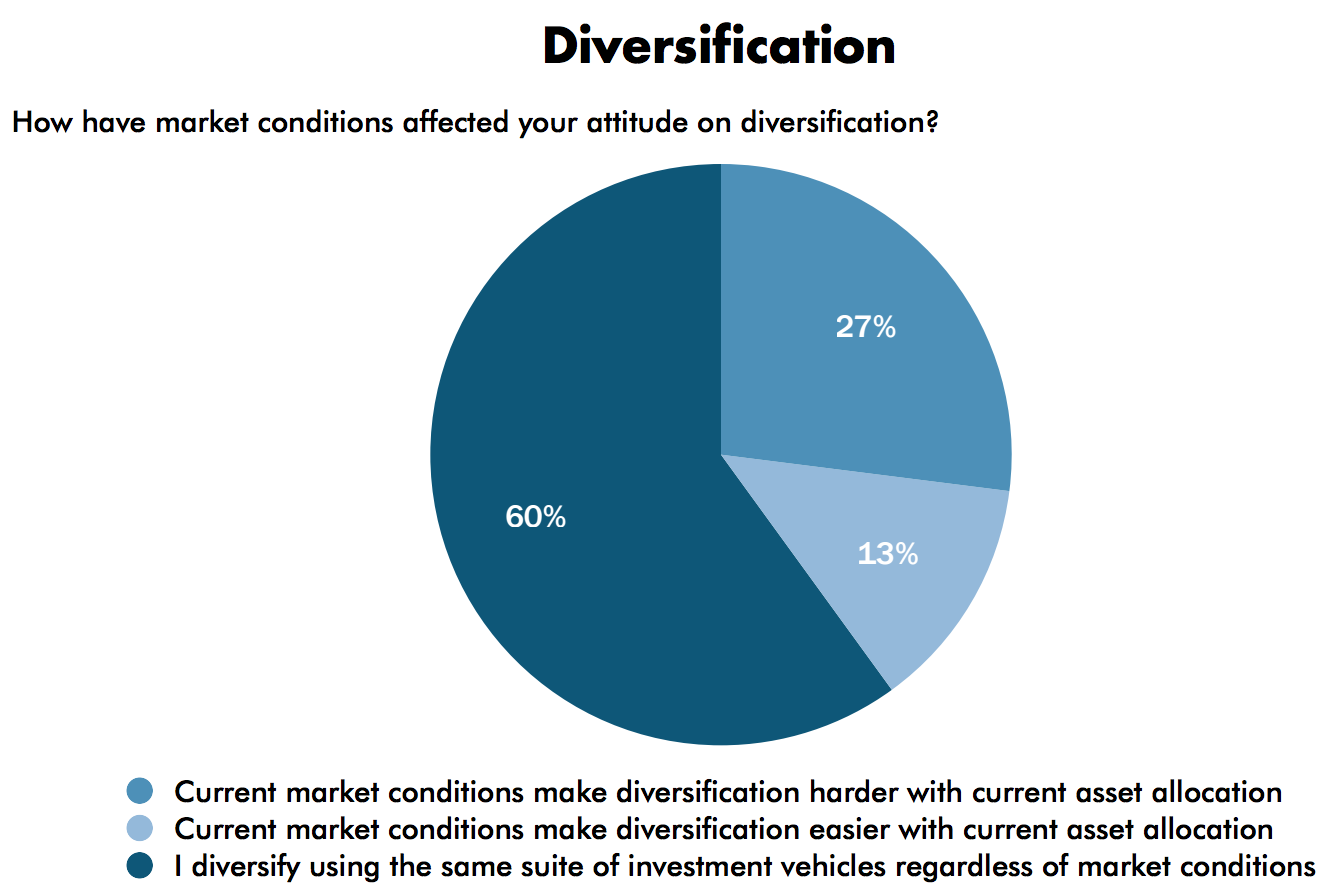

But there was another trend that caught my attention — the advisors’ thoughts on diversification. Here’s a graph showing the responses about how current market conditions have affected attitudes about diversification:

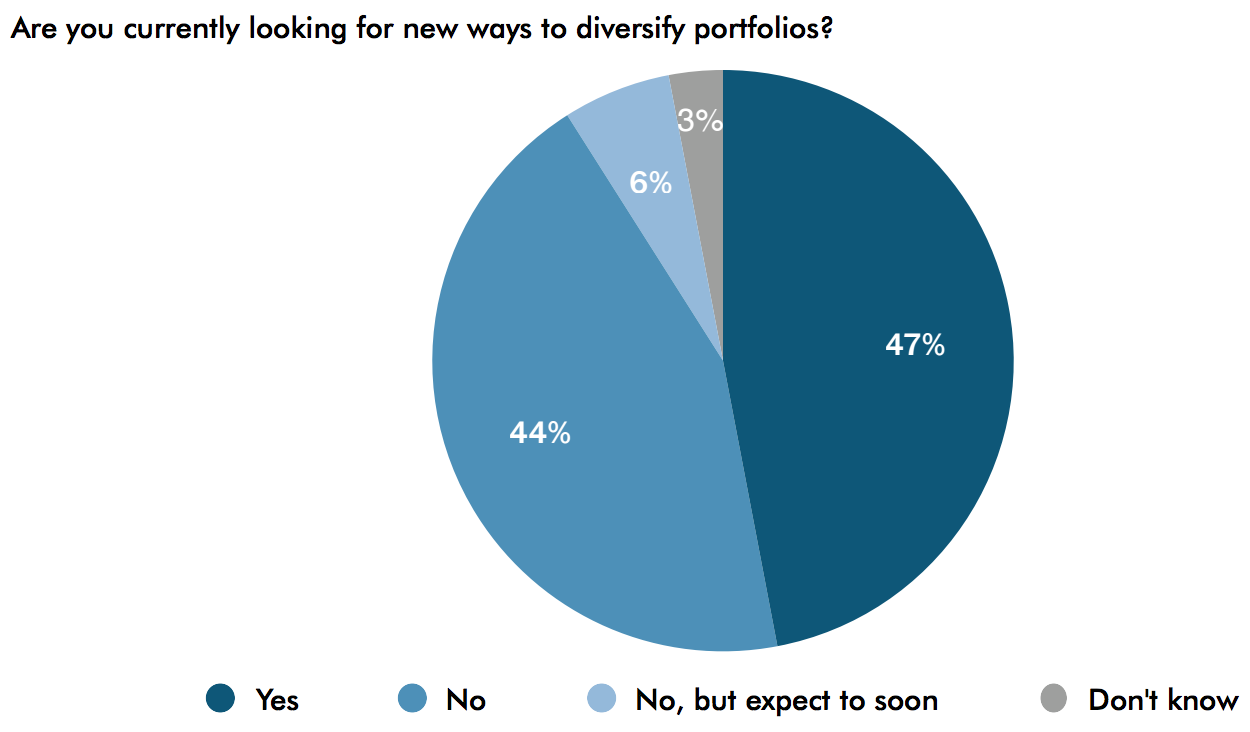

And the follow-up on what this means for their portfolios:

Although 60% of advisors said they diversify using the same suite of investment vehicles regardless of market conditions, around one-third said current conditions make diversification more difficult. And almost half of advisors in this survey are looking for new ways to diversify their portfolios. It’s hard to know why for sure but here are my guesses on why this is the case:

- U.S. stock market valuations are high and interest rates are low. This has been true for a number of years but that doesn’t make dealing with this scenario any easier.

- There have never been more fund or product choices available to tempt advisors and investors alike from making portfolio additions or changes.

- Managing other people’s money is really more about managing someone else’s emotions than anything else. And managing emotions is really hard to do so there’s a feeling that advisors have to make changes to justify their fees.

- Many wealthy people make their money by placing concentrated bets in business. It can be difficult for advisors to change a client’s mindset from what it takes to build a fortune to what it takes to preserve a fortune.

- Investors want what they can’t have. They mostly want strategies that work in every environment, fixate on short-term market moves, obsess over the performance of people doing better than they are and would rather focus on what’s working now versus what works over the long haul. Needless to say, this is at odds with reasonable investment advice that doesn’t work all the time.

- Diversification is hard.

You can look at all the long-term stats on diversification you want (see here, here, here, here and here), but long-term data isn’t always the easiest pill to swallow when faced with an uncertain future.

Any sort of diversification is going to look foolish from time-to-time and it’s even harder to stick with at market extremes when certain investment styles or asset classes are doing particularly well. How many advisors do you think have been asked questions about Bitcoin in recent weeks after the run-up we’ve seen in cryptocurrencies?

Does it make sense for financial advisors to reassess their asset allocations and investment holdings on a regular basis? Definitely. Things change. Markets evolve. Better products become available. There are always going to be legitimate reasons to make a portfolio change.

The problem is that giving up on a viable long-term strategy at the wrong time simply because it isn’t working at the moment is basically indistinguishable from a failed strategy.

It’s impossible to know for sure if and when it makes sense to pull the trigger on a change to your holdings or asset allocation but here are a few questions to help to avoid a huge mistake or unforced error:

- Have my goals or circumstances changed enough to force me to make a change to my portfolio?

- Will I be better off just sitting on my hands and doing nothing for a while and reassessing at a later time?

- Am I making decisions based on a sound long-term process or overreacting to short-term outcomes that are out of my hands?

- Is there a better, more efficient, or low-cost way to implement my plan?

- Does a change in expectations require a change in allocation or strategy?

- What will I regret more — making a change and being wrong or staying put and missing out on opportunities?

- How well do I understand my current holdings?

- How well do I understand any potential new holdings?

- If I started from scratch and was invested in all cash, would I still put together the same portfolio as I currently hold?

There are no easy answers to these questions, which is one of the things that makes investing equal parts fascinating and excruciating. Changing your portfolio is never an easy decision. I obsess over these decisions as much as anyone. But my first rule for these things is to be patient and take my time when making or implementing a change.

There’s no reason to rush things as long as you’ve got a well-thought-out investment process in place. And although it’s more comforting to make a change every once in a while to show you’re doing something and making a difference, more times than not the best decision is to simply do nothing but follow your pre-established investment guidelines.

Source:

2017 Trends in Investing Survey (FPA)

Further Reading:

My Evolution on Asset Allocation

The Financial Advisor’s Guide to Asset Allocation