This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

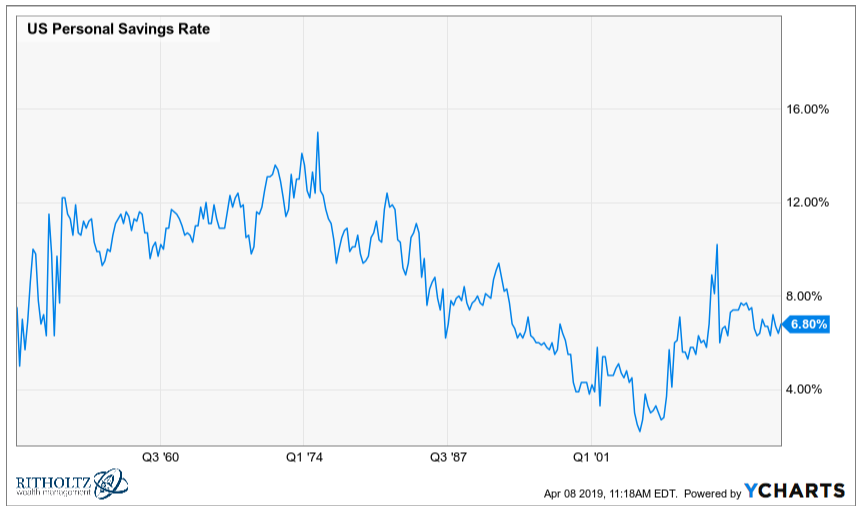

- Is the retirement crisis overblown?

- Or is it worse than most people assume?

- What do we do today that will seem crazy in 50 years?

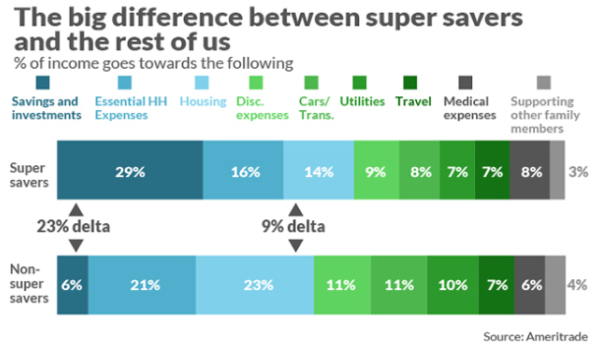

- Pay attention to housing is you’d like to be a super saver

- Do bull markets have an expiration date?

- Take long/short backtests with a grain of salt

- Will you buy the new Alexa earbuds?

- How the dinosaurs went extinct 66 million years ago

- Private planes and Walt Disney money

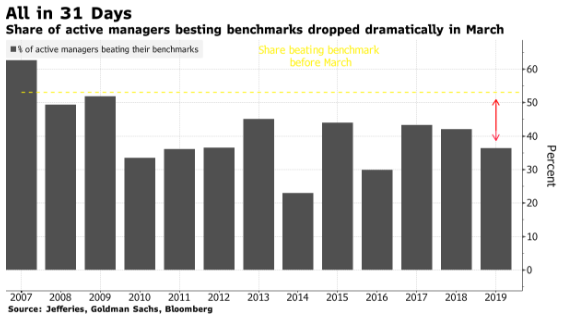

- Active managers get blown up again

- Will computers help us make better decisions in the future?

- What’s the appropriate time horizon for a backtest?

- My favorite stand-up comedian and much more

Listen here:

Stories mentioned:

- The phony retirement crisis

- Americans know they’re not ready for retirement

- Want to become a super saver? Pay attention to housing

- This bull market has no expiration date

- Lyft is the most expensive stock to short

- The day the dinosaurs died

- What it’s like to grow up with more money than you’ll ever spend

- Active managers get blown up again

- 401ks will be considered unthinkable in 50 years

Books mentioned:

- Wolf Pack by CJ Box

- It Was a Very Good Year by Martin Fridson

- The Half-Life of Facts by Samuel Arbesman

- The Age of Gold by H.W. Brands

Charts mentioned:

TV Shows/Movies/Podcasts Mentioned:

- Schitt’s Creek (Netflix) – I’m almost done with the first season of this one. It’s one of those sitcoms that grows on you over time. Not a drop everything and binge it now but I like it enough to keep watching.

- Pet Semetary – Michael says this one scary but a terrible movie.

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook and Instagram

Subscribe here: