This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

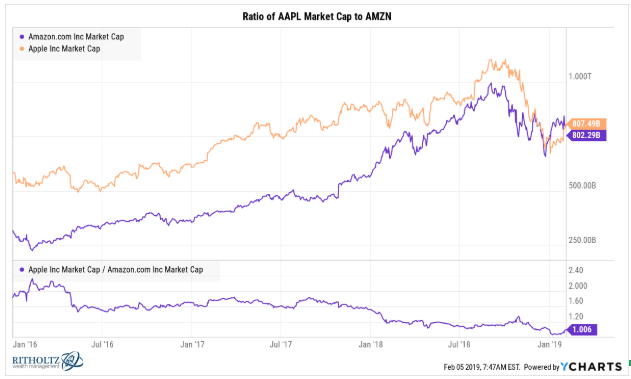

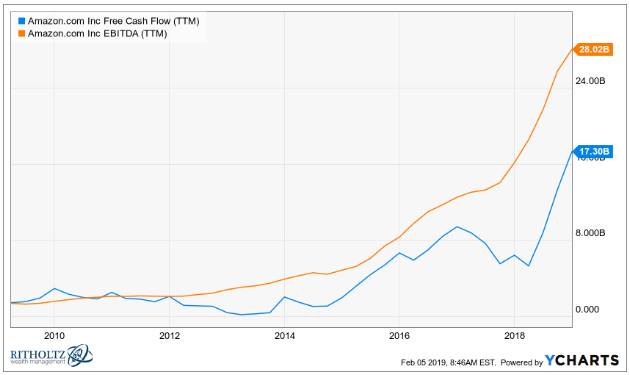

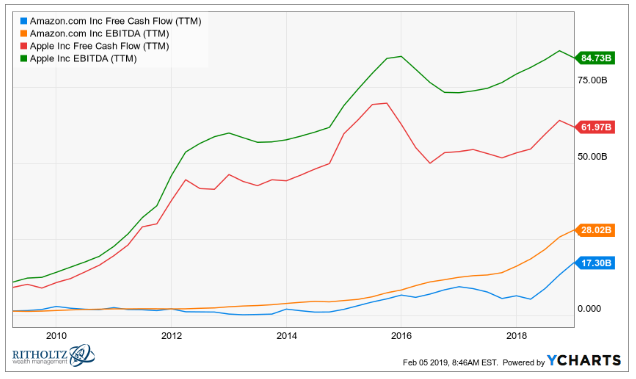

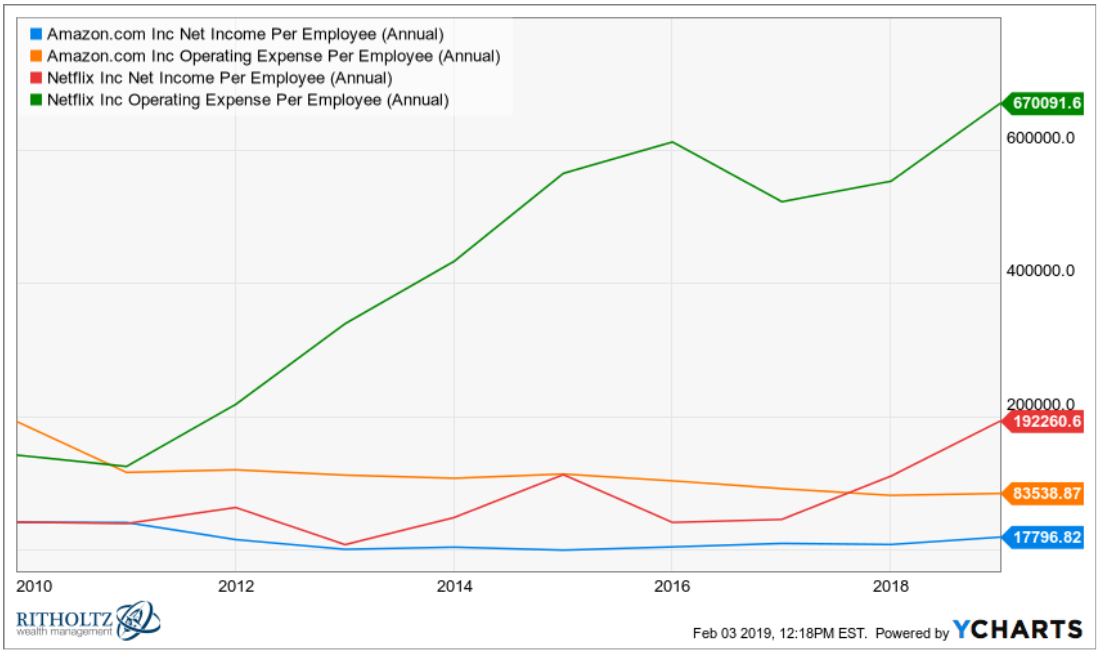

- Apple vs. Amazon in a heavyweight battle of fundamentals & market caps.

- Facebook employees make a lot of money.

- Is banning stock buybacks really going to help anything?

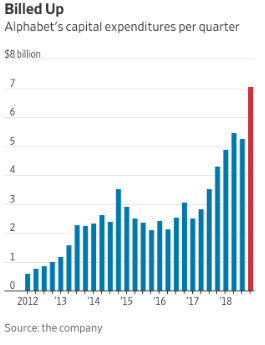

- Google’s spending spree.

- What would actually help wealth inequality?

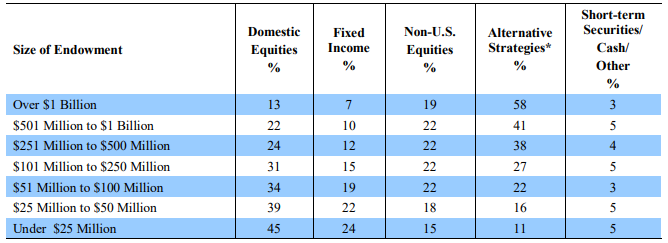

- How much money should institutional investors have in alternatives?

- When should you stick with a money manager and when should you move on?

- Why do endowments have so much money in alts?

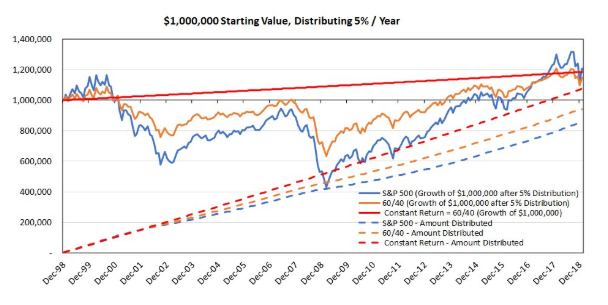

- Why volatility matters when spending down your portfolio.

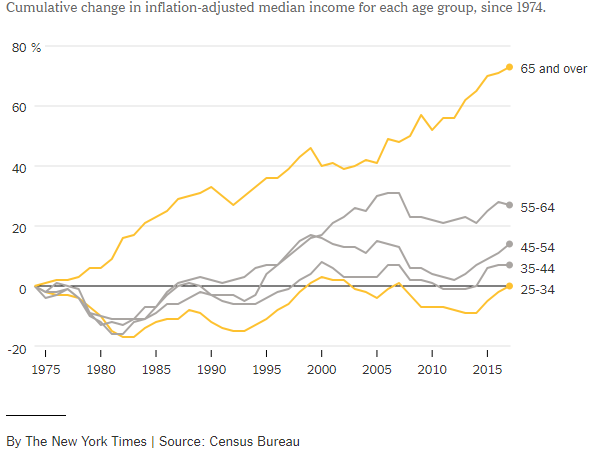

- Why have all the income gains gone to baby boomers?

- The best part about the Fyre Festival pitch deck.

- Why is there still so much money in low interest rate bank savings accounts?

- Will Acorns help young people save more money?

- More likely: Bigfoot is real or a comfortable retirement?

- The proper ratio for trail mix and much more.

Listen here:

Stories mentioned:

- Yes, median pay at Facebook really is $240,000 a year

- Dalio fund dumped by tiny county pension fund

- Simple vs complex, 2018 edition

- The fleecing of millennials

- Fyre Festival slide deck

- Increasing your own rates even if the Fed won’t

- Acorns raises $105 million

- The shocking number of Americans who couldn’t cover a $400 expense

- Many Americans believe the existence of bigfoot more likely than a comfortable retirement

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: