On this week’s Animal Spirits with Michael & Ben we discuss:

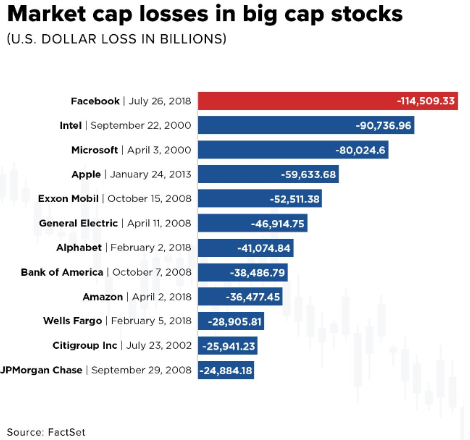

- Facebook’s massive stock price crash.

- Why my immediate reaction was to buy Facebook after its decline.

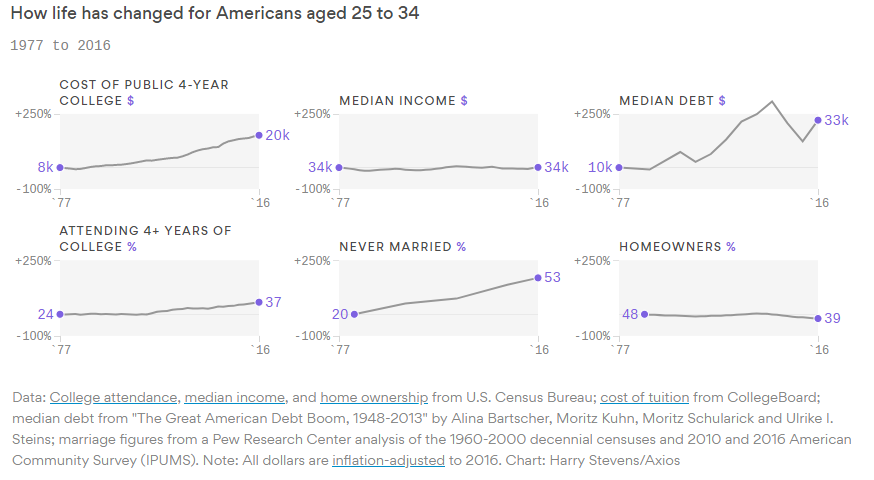

- Why being 30 is so much harder for the current generation than their parent’s.

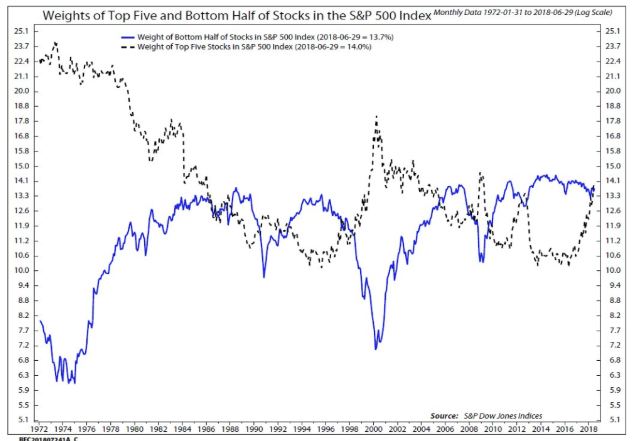

- Is trend-following dead?

- The conflicts of interest that arise when hedge funds have internal funds not open to outside investors.

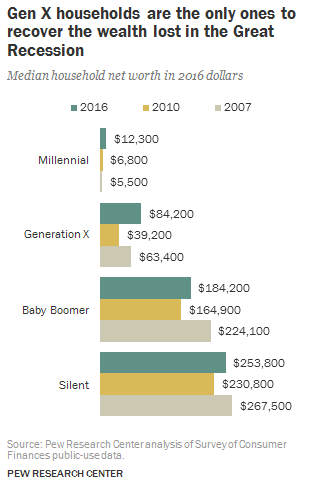

- Why Gen X has come out of the Great Recession better than other generations in terms of net worth.

- Everyone assumes they have above average intelligence.

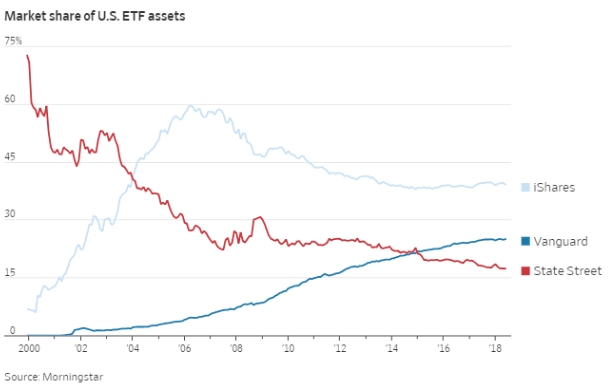

- The race to zero in ETF providers.

- How State Street lost market share in the ETF business.

- Why pop culture contrarian indicators don’t work anymore (and never did in the first place).

- What the song Don’t Worry, Be Happy has to do with 1987.

- It is possible to have an economic expansion when the housing market is breaking down?

- Should you pay off student loans before saving for your children’s college education?

- Is now a good time to borrow from your 401(k) to use as a down payment on a house?

- Surveys of the week and much more.

Listen here:

Stories mentioned:

- Being 30 then and now

- Why Winton’s David Harding is turning away from trend-following

- These hedge funds are doing well but they don’t want your money

- Gen X rebounds as the only generation to recover the wealth lost after the housing crash

- Most Americans think they have above average intelligence

- People have 15 perfect days a year, on average

- How did the firm that pioneered ETFs lose its lead?

- Elizabeth Banks is now working for State Street

- State Street’s opportunity

- Mean reversion & the placebo effect

- Contrarian indicators

- Housing is out in left field

- How an ex-cop rigged the McDonalds monopoly game and stole millions

- ETF stock finder

Books mentioned:

Charts mentioned:

Videos mentioned:

https://www.youtube.com/watch?v=sDLNyfOtZMw

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: