On this week’s Animal Spirits with Michael & Ben we discuss:

- Why the current low interest rate environment is so challenging for investors.

- Why share buybacks get such a bad rap.

- The psychological difference between dividends and buybacks.

- The difficulty in running a hedge fund.

- Why wealthy investors prefer to pay higher fees.

- The problem with choosing an advisor based on a beauty contest.

- Do people need more life insurance?

- Go anywhere funds.

- Why momentum is such a misunderstood phenomenon in the markets.

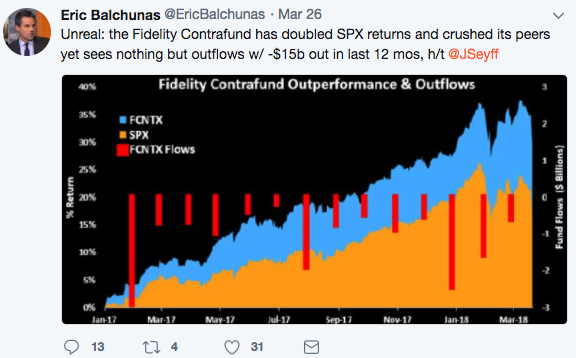

- What active mutual funds are up against.

- The crazy real estate stories coming out of the Bay Area.

- Michael explains technical analysis to me and much more.

Listen here:

Stories mentioned:

- Is investing getting harder?

- Are stock buybacks bad?

- Stock buybacks demystified

- Lawmakers don’t understand how buybacks work

- The last days of Whitney Tilson’s Kase Capital

- Doing a beauty contest to find a financial advisor

- Do people need life insurance?

- The decline of life insurance is a mystery

- Two centuries of momentum

- Bay area housing prices

Books mentioned:

- Quantitative Momentum by Wes Gray & Jack Vogel

- Legacy of Ashes: The History of the CIA by Tim Weiner

- Drive: The Surprising Truth About What Motivates Us by Daniel Pink

Podcasts mentioned:

Charts mentioned:

Jim Carrey paintings mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: