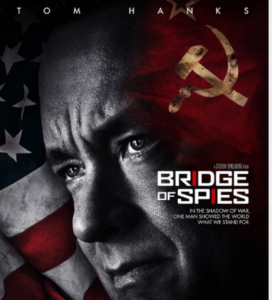

I recently watched the movie Bridge of Spies with Tom Hanks. It was an excellent true story about a lawyer who was brokering deals for hostages with the Soviet Union during the Cold War in the 1950s.

Hanks played the main character, James Donovan, who was tasked with the unenviable job of defending a Russian spy by the name of Rudolf Abel, played by the relatively unknown actor Mark Rylance. (Rylance won an Oscar for Best Supporting Actor for this role. He was terrific in this movie but not nearly as good as Tom Hardy in The Revenant. But I digress).

Throughout the movie, Abel faced an uphill battle because he was hated by both American and Russians alike as a spy who got caught on U.S. soil. Throughout his time spent in prison, during his trial and in the hostage negotiations Abel remained stoic and showed little emotion.

Each time it looked like Abel was out of options during one of these ordeals Donovan would ask, “Aren’t you worried?”

And every single time Abel would offer the deadpan response, “Would it help?”

Faced with difficult circumstances his cool demeanor made you like the character a little more each time he said this even though he was a Soviet spy. These were by far some of the best exchanges in the movie.

My warped brain was immediately thinking about the financial parallels to the even-keeled emotions Abel showed in under stressful situations. The biggest takeaway for me was that you focus on what you can control and don’t let those things that are out of your control worry you too much. There are enough things in life to stress you out without adding the unnecessary issues that are out of your control.

Here are some examples using the Bridge of Spies reaction:

The markets have gone nowhere for over a year. Aren’t you worried?

Would it help?

Tax rates may rise in the future. Aren’t you worried?

Would it help?

Stocks could go into a bear market any time now. Aren’t you worried?

Would it help?

Future returns could be lower from current valuation levels. Aren’t you worried?

Would it help?

Interest rates are negative around the globe. Aren’t you worried?

Would it help?

Your brother-in-law makes more money than you. Aren’t you worried?

Would it help?

The economy will go into a recession in the coming years. Aren’t you worried?

Would it help?

We all have to make financial decisions with imperfect knowledge about the future. Aren’t you worried?

Would it help?

Social security and medicare programs will require changes in the coming decades. Aren’t you worried?

Would it help?

What about the outcome of the Presidential election? Aren’t you worried?

Would it help?

What if we see a repeat of 2008? What if China has a hard landing? What if Marc Faber is right for once and the stock market crashes? What if economic growth doesn’t reach the same levels it hit in the past? Aren’t you worried?

Would it help?

The point here is not that these issues don’t matter to investors. Certainly many of them will have implications on the markets and your personal finances. It’s just that at a certain point the majority of this stuff is completely out of your hands. You have no control over the outcomes of what happens with the markets, tax rates, politics or the economy. The best you can do is implement a sound financial plan that looks to minimize unforced errors and risks and gives you a high probability for success. Nothing good can come from constantly stressing out about things are are out of your control.

You can’t control most outcomes but you can control your reaction to them.

Further Reading:

We’re All Smart

“You’re brother-in-law…” -> “Your brother-in-law…”

Sorry, just wanted your article to be (cognitive) error-free.

Also, it’s one thing to say “Would it help?” when one cannot plan or take action to safeguard oneself (as was the case with Abel), and another to say it when one can — as is the case with most financial market participants. So, worrying in the latter case does seem to have some utility by triggering one into action.

Not to nit pick but the analogy is not quite correct. In the case of the stock market, “would it help?”

causes one to abandon one stategy, by selling near the bottom and buying at the peak because

a person can act on his/her impulse (unlike Abel who truly could not do much in prison).

When I was laid off after 20 years in 2002 and my company gave me 95k as a lump sump to invest

as a parting gift (no pension), I had no choice but to really learn how to invest.

I credited my Buddhism background and my mindfulness meditation as a tool to not waver in my

strategy. I did achieve 23% on average for the last 14 years, but it was very hard in the first few

years as the results did not look too good initially.

I think you missed the point. ‘Would it help?’ does mean stick with your strategy and forget about all of the other things you can’t control. The only thing you do control is your own plan.

I think you missed the point. ‘Would it help?’ does mean stick with your strategy and forget about all of the other things you can’t control. The only thing you do control is your own plan.

“But seek first his kingdom and his righteousness, and all these things will be given to you as well. Therefore do not worry about tomorrow, for tomorrow will worry about itself. Each day has enough trouble of its own.” Matthew 6:33-34 (NIV)

I like that one

I like that one