“There’s only one absolute truth about investing…it isn’t easy.” – Howard Marks

Investing is hard.

Markets are extremely challenging.

Beating the market is not easy.

Coming to these realizations is maybe the hardest part about investing because we all like to assume that we’re above average. Case in point — a few years ago MarketWatch columnist Chuck Jaffe shared some anecdotal evidence on the irrational overconfidence many investors have in their own abilities. Active investors at a Fidelity Traders Summit conference were surveyed to see how many of them expected to meet or beat the market’s return over the following 12 months. Over 90% of these investors said they would outperform.

I’ll take the under on that one every time.

Overconfidence surely affects novices, but professional investors are probably the ones who are the biggest culprits of overestimating their own investment skill. Some combination of ego, career risk, and an ultra-competitive gene suggest that this trait won’t be going away any time soon. Jim O’Shaughnessy provided a perfect example of this on his blog recently in a reprint from his book, What Works on Wall Street:

Professor Nick Bostrom, the Director of the Future of Humanity Institute at Oxford University points out, in his paper Existential Risks: Analyzing Human Extinction and Related Hazards that “Bias seems to be present even among highly educated people. According to one survey, almost half of all sociologists believed that they would become one of the top ten in their field, and 94% of sociologists thought they were better at their jobs than their average colleagues.”

The great thing about the sheer amount of overconfidence in the markets is the fact that certain groups of investors will always be able to take advantage. The downside is that there will also always be investors who are being taken advantage of, whether they’re willing to accept this fact or not. Someone always has to take the other side of a winning bet.

In his latest quarterly letter, legendary investor Howard Marks does a deep dive into how difficult it is to outperform:

Why should superior profits be available to the novice, the untutored or the lazy? Why should people be able to make above average returns without hard work and above average skill, and without knowing something most others don’t know? And yet many individuals invest based on the belief that they can. (If they didn’t believe that, wouldn’t they index or, at a minimum, turn over the task to others?)

Marks went on to say that only a small percentage of investors possess enough superior skill to outperform over the long-term. Carl Richards penned the term ‘the behavior gap’ to describe the difference between the returns reported on an investment and the returns actually earned by investors. I think there’s also a ‘Lake Wobegon gap’ that can explain the underperformance in most actively managed strategies, as certain individuals or groups of investors are unwilling or unable to admit that they don’t have what it takes.

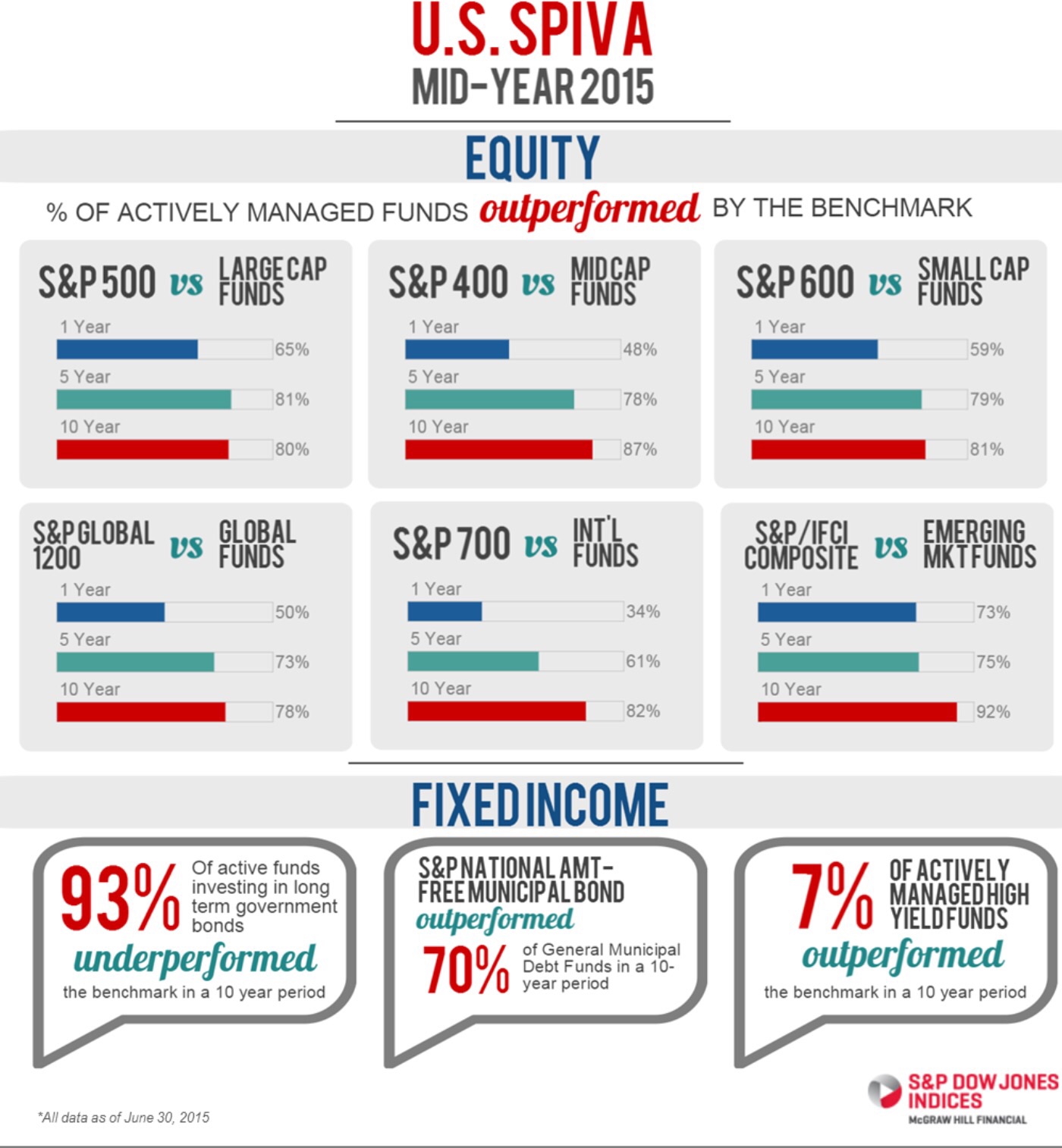

The paradox of “average” returns is that they will almost certainly always be above average in the long run because of compounding costs, poor market timing and overactivity by this group of overconfident investors. The latest SPIVA scorecard provides a good illustration of this:

These numbers shouldn’t be all that surprising to anyone when you take into account the long-term impact of costs and the zero-sum nature of benchmark investing. Individuals and organizations spend so much time and effort trying to beat the market that they never stop to consider how easy it could be to outperform their peers or other professional investors by simplifying.

Most would do much better for themselves if instead of trying to beat the market, they first focused on not underperforming the funds they’re invested in, regardless of how those funds perform relative to the market. When you think about investing in terms of behavior and mistake minimization and not just outperformance, you begin to align your portfolio with your actual goals, the only thing that truly matters.

Some people seem to think index funds are going to continue to gain market share from active funds over time as more and more people do the math on passive vs. active investing. I agree, but only up to a certain point. I think human nature is such that index funds will never gain a majority share for the simple fact people are so competitive. We like to gamble and take chances. It’s in our nature to try to be the best.

We also have to remember that there’s much more that goes into the investment process than beating an arbitrary index or benchmark. The questions investors need to ask themselves are simple:

Do I really need to try to outperform the market?

Or should I be content with outperforming the majority of my investing peers and not underperforming my own investment plan?

Sources:

Poll Shows Wide Range of Investor Psychology

It’s Not Easy (OakTree)

The Unreliable Experts: Getting in the Way of Outperformance (WWOWS)

Further Reading:

We’re All Smart

[…] Would you invest with someone who said they probably wouldn’t out perform the index in the year to come? Probably not. Most investors like to think that they are better than the average, same outcome if you ask people about their driving skills – Something Most Investors Simply Cannot Accept […]

It’s interesting (and irrational) that despite all the information out there that people opt for performance investing. It’s like we prefer to gamble with our retirement money, or use it for entertainment. As Larry Swedroe likes to say “it’s better to find a less expensive form of entertainment”.

I think it can actually be a good thing to relieve that temptation, but you just have to right-size it and only try with 5-10% of your portfolio.

Why anyone would even think about “beating the market” is beyond me. I look for average annual returns over forever of inflation + 7%. That will double my invested assets, in real terms, roughly every 10 years.

There may be fund managers who can beat their benchmark pretty often but I am not ever going to invest all of my assets in large caps, or all in small caps, or all in international equity funds. I am going to diversify and usually hold some cash, and I could not care less about competing with the 100% invested indices.

Further, tough to beat the indices when you are using funds. The only hope you have of accomplishing it is to invest in individual equities. Problem is, it is the rare indvidual investor or financial/investment advisor who has the knowledge, patience, experience and discipline to invest in individual equities.

very true about how tough it is to beat the market using funds. many times these PMs are handcuffed by the structure of the fund or the investor base too. not an easy ballgame.

[…] Do I really need to try to outperform the market? (awealthofcommonsense) […]

My future cash flow analysis indicates that the difference between a slowly declining savings balance in retirement and one that just keeps growing can be very small. A 1% difference in returns is likely to lift my wife and I above our personal threshold – that’s powerful incentive to try to goose those returns just a bit. A more aggressive portfolio is the most painless way to up our chance of making it – at least until the odds turn. It’s more painful in the short term, but wiser in the long-run, to simply increase one’s savings rate… and yet, despite what I’ve said before about just wanting to have a ‘decent’ allocation, I keep playing with portfolio construction of all the silly things…

good point on the balance between saving more taking on more risk and portfolio management. I think that’s a choice not many people consider when building a portfolio.

Eye opening. Only 20% (about) of actively managed funds over a ten year period beat the market. This should be enough information for any fund manager to loose a little bit of their confidence, but i don’t think that will happen any time soon.

Some good insight as well into why index funds won’t continue to grow in popularity.

These numbers may be a little skewed by the 6 year bull market (where index funds tend to perform much better than active strategies) but these numbers also include the financial crisis, so you’re right that they are eye opening every time.

It is a bit bonkers that retail investors focus on comparing their investment returns to those of “the market”, even though they don’t really have a definition of “the market” (most likely it’s the S&P 500 and/or Dow which info tee we has shoved down their throats for 20 years) and it is most likely the wrong benchmark.

Also a bit bonkers that retail investors probably never sit down an figure out the investment returns they need and/or want and build a portfolio to try accomplish that goal; instead they take whatever “the market” gives them, and complain when it misses the mark more often than not.

Active investing may not beat all, but proactive investing will surely beat most.

yup, setting expectations and planning things out should be one of the first steps people take. it’s not only how much risk you’re willing to take, but how much you can afford to take and how much you actually need to take to reach your goals.

I know I’m not alone, but I would be one of those annoying people who would be asking “what you do mean, ‘market’?” US large caps? Global equities? 60/40? The global market portfolio? Before/after fees/commissions/taxes? Leverage? For how many years? (by that time, the person who is administering the survey probably got bored and gave up).

That’s the thing — most people don’t even take this first step to define what it is they’re measuring themselves against. The “market” doens’t have anything to do with your personal goals.

A simple (?) reply by a professional:

https://www.vanguardcanada.ca/advisors/articles/research-commentary/vanguard-voices/desired-return-vs-required-return.htm

this is really great. thanks for sharing

Thanks for the link. That chart drives home the message that *market returns are always extreme*. Those smoothly sloping portfolio curves that many advisors use to project future returns are absolutely terrible at reassuring investors when SHTF.

[…] Is Likely to Stand Pat This Week (Bloomberg) • Something Most Investors Simply Cannot Accept (A Wealth of Common Sense) • Insiders Beat Market Before Event Disclosure: Study (WSJ) see study The 8-K Trading Gap […]

[…] It’s a close competition. But probably the biggest mistake of most investors is overconfidence. Read all the arguments in this piece. […]

Everyone thinks they are a great driver, have above-average intelligence and a great cook as well 🙂

The reality is, we aren’t as good as we think we are in many things!

Good post Ben.

Mark

Funny how that works. Thanks Mark.

[…] I received some great feedback on my post from my post earlier this week on the challenges involved with beating the market (see: Something Most Investors Simply Cannot Accept). […]

[…] Forget beating the market, perhaps simply matching the market should be the real goal (awealthofcommonsense) […]

[…] Do I need to outperform the market? (Wealth of Common Sense) […]

[…] Something most investors can’t accept – A.W.O.C.S. […]

[…] Do you think you are a good stock-picker? Are you sure? Investing is not easy, above average results are uncommon. Something Most Investors Can’t Accept. […]