Here’s a headline from the Wall Street Journal that makes people who are very online quite upset:

Here’s another one from Bloomberg that has the same effect:

Why do these headlines make some people angry?

Well, buying a house is not easy these days. Demand is outstripping supply and many areas of the country are seeing a scenario where people are bidding against one another.

Institutional capital has deep pockets, giving them the ability to outbid normal people who just want to buy a house.

People are understandably upset at the current housing market, especially if you’re trying to buy a starter home.

But it’s not necessarily BlackRock that’s to blame here. Institutional buyers are much smaller than you think at the moment. Unfortunately for those who are against this, they’re only going to get bigger from here.

Before getting into all of that, let’s look at some statistics to see how professional investors stack up in residential real estate.

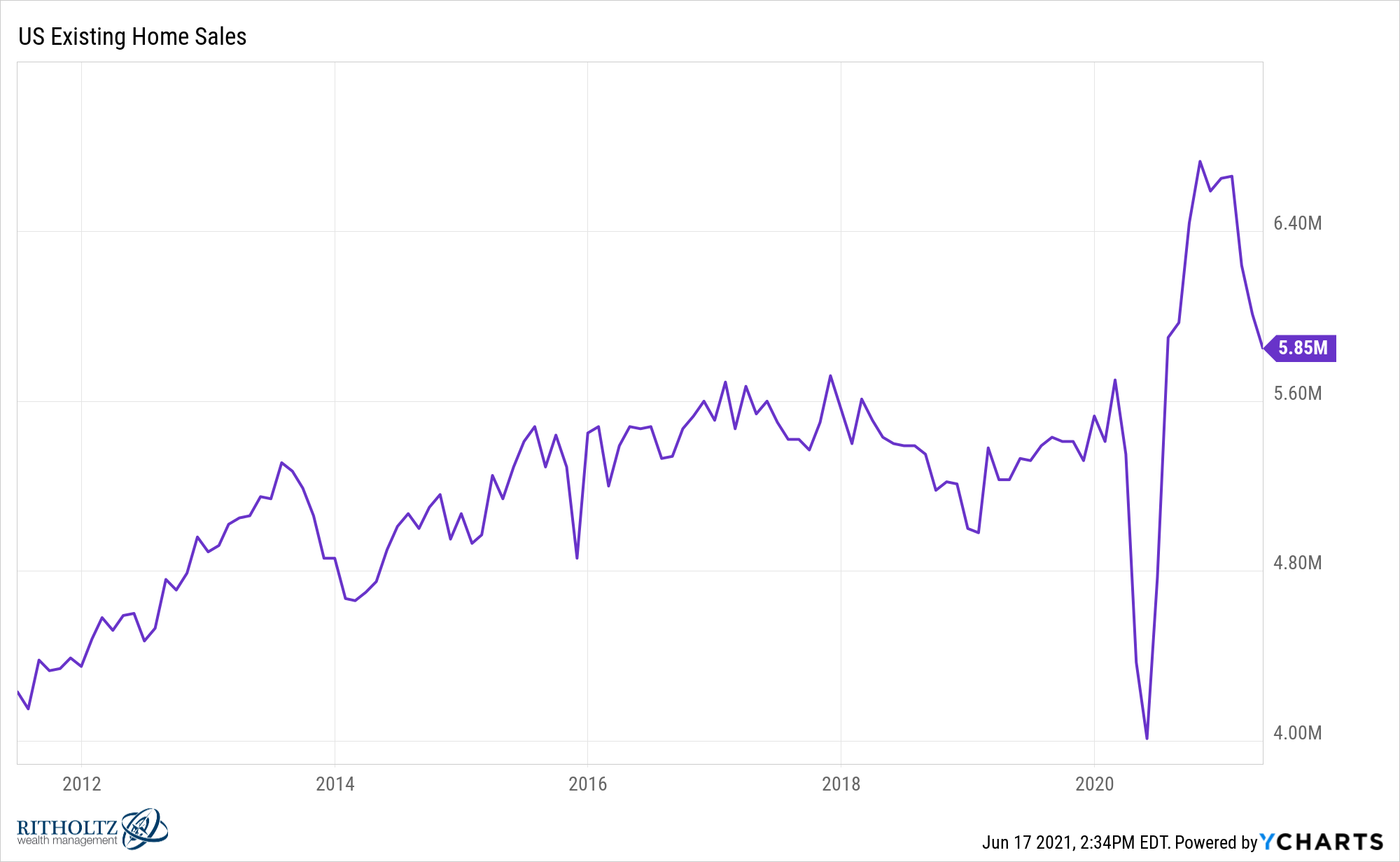

It’s estimated as of 2019 there were around 300,000 single-family home rentals operated by professional investors. That same year there were more than 5.5 million houses sold in the United States. In 2018, there were 5 million homes sold. 2020 saw more than 6 million homes change hands.

The residential real estate market is ginormous. A few hundred thousand houses here and there is not going to have a huge impact on the overall housing market. It could impact certain local markets that are being targeted but not the housing market overall. Professional buyers are still a drop in the bucket.

Here are some more numbers from Bloomberg:

More than half of the country’s multifamily properties are owned by institutional investors compared with an estimated ownership of 2% to 3% of single-family rentals, a gap that he expects to narrow in time.

BlackRock owns around $60 billion in real estate assets. The value of the housing market in the United States is more like $36 trillion.

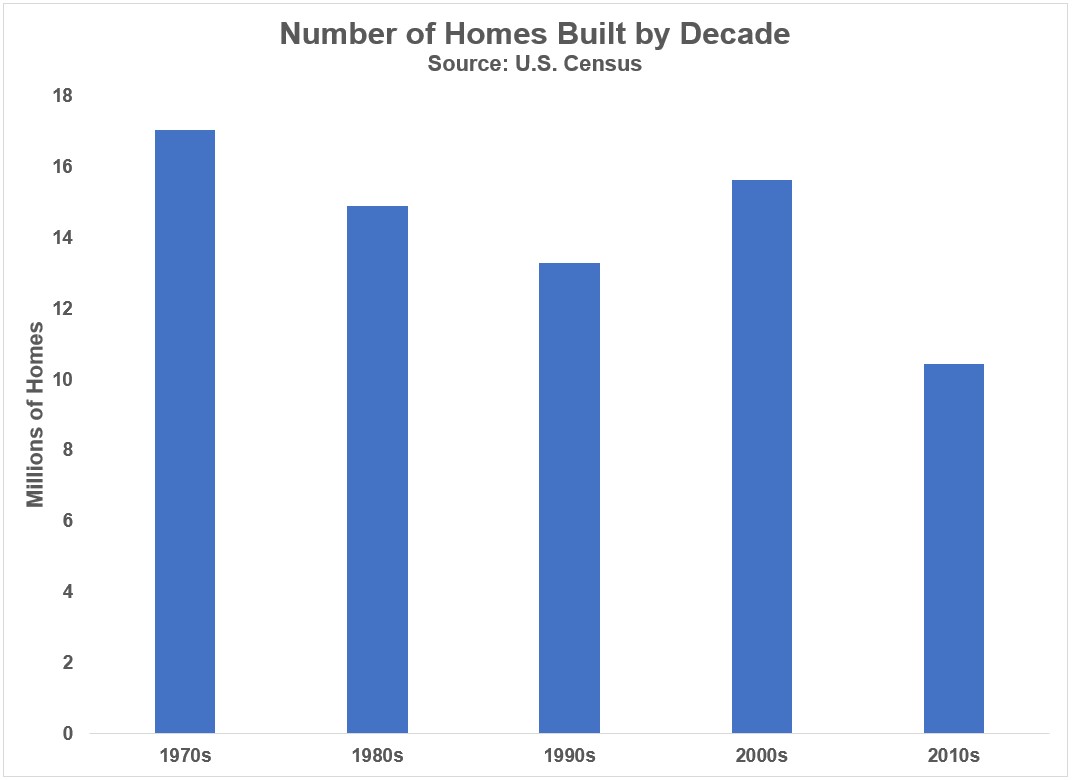

If you want to be mad at anyone here, direct your ire at local governments who make it difficult to build more houses. We need to build more homes:

Unless the government incentivizes more housing development, it’s not going to happen (listen to this to hear why).

The reason there was a big housing boom in the 1950s is not because homebuilders made it happen but because the government incentivized them to build more.

Ironically, it could be the professional investors who pick up the slack in terms of building more starter homes. The only difference is those starter homes will be rentals.

For many young people, this could be the future. The Journal had another story this past week discussing this trend:

Investors have been buying up single-family houses to rent out for some time, typically in disparate bunches in communities where most people own their homes. Tenants may have absentee landlords. Built-to-rent developments, however, are entirely new subdivisions designed for renters. They are managed more like new apartment buildings, with designated staff for repairs and maintenance. In the past few years, the model has taken off around Phoenix and elsewhere—and is likely to become a dominant force in the rental housing market in the coming years, with implications for the communities that surround them, and the nature of home ownership.

They estimate the number of built-to-rent single-family homes in the U.S. will double by 2024.

Some young people don’t want to get tied down with a 30 year mortgage or all of the ancillary costs that come with home ownership. Flexibility could be more important than ever in the years ahead, especially as people now have more options when it comes to remote work.

You could make the case that having these huge companies with the resources and scale build more homes like this could be a good thing. They handle the upkeep. They pay the taxes. They handle the lawn care and maintenance. They pay for remodels when parts of the house eventually break down.

The biggest problem for many is they lose out on the American Dream.

This means you’re not getting the equity that comes with owning a home, which for many acts as a form of forced savings.

Renters could take the money they’re not spending on things like taxes and other costs associated with housing and invest the difference in real estate. That places the onus on people to be more financially savvy but could make sense for those who don’t want to own.

Owning a home is not for everyone so it wouldn’t shock me to see this become more prevalent with younger generations.

But if you’re someone who doesn’t like the trend of financial institutions owning single-family homes you better get used to it. This is a trend that is here to stay and this is only going to become a bigger part of this market in the years ahead.

Michael and I discussed this trend and much more on this week’s Animal Spirits video:

Subscribe to The Compound for more videos.

Further Reading:

Owning a Home is Not For Everyone

Now here’s what I’ve been reading lately:

- Blink (Irrelevant Investor)

- Winners & losers of the work from home revolution (The Atlantic)

- Don’t win the game too early (Of Dollars and Data)

- Technology saves the world (a16z)

- How to be smart with your money (Stanford Magazine)

- Get financial advice first, then investment advice (Morningstar)

- Why Hacks is one of the best shows of the year (The Ringer)