In a research note late last year, AQR’s Cliff Asness described what long-term means when it comes to the markets (emphasis mine):

Basically, we know a lot more about volatility than the level of returns over the short term (and remember five years is still pretty short-term). I think we all know this already, and it’s implied by basic mathematics, but it helps to be reminded of its importance occasionally.

All in all, this full 45-year period is our most reasonable looking realized efficient frontier yet. So what lessons do we take away from the above, and also from living a fair amount of these 45 years “real time”?

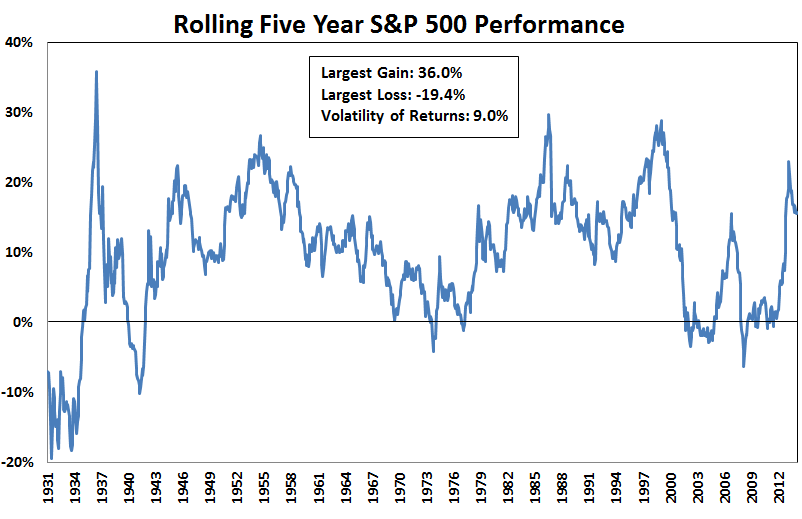

- Five years is not a very long time. You see crazy things over five years. Of course, it often feels like a lifetime to actually live through it.

- Over the long haul (which I’ll call 45 years here though there is no perfect agreed upon definition) some of the most basic parts of financial theory look pretty darn good.

- The long haul is a really long time. It sometimes feels like several lifetimes to actually live through it.

No one considers five years to be short-term in the world of finance, but in terms of risk management it’s a good starting point for setting expectations. And I agree with Asness that volatility is far more predictable than performance over the short-term, but it can be difficult to think this way.

Some concepts are better explained visually, so I put together annual return graphs using rolling monthly returns on the S&P 500 starting in 1927 broken out by different time horizons.

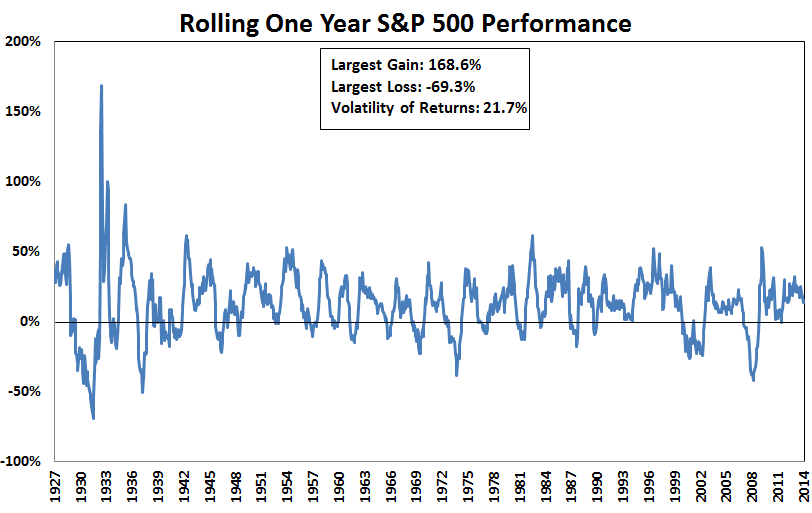

These are the one year numbers where roughly three out of every four years have shown positive returns, but they have been all over the map:

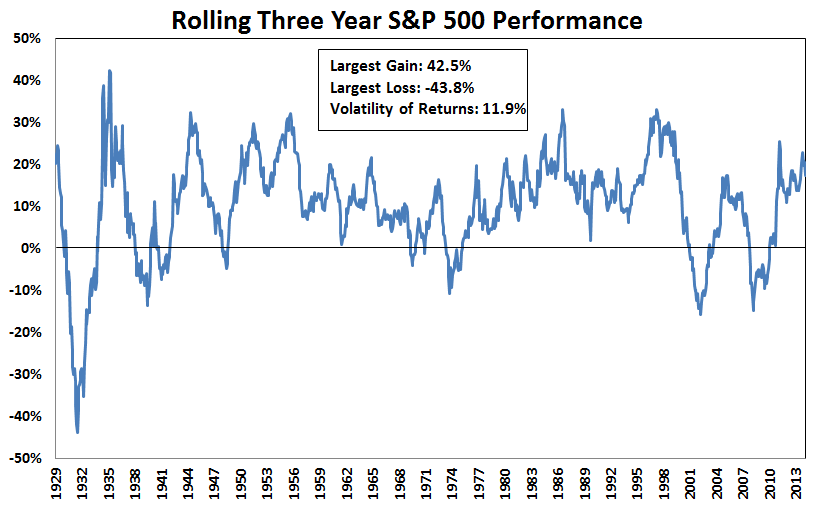

Three year annual returns have been positive in 83% of all rolling windows, but still in a fairly wide range:

Once you hit five years, what Asness still considers pretty short-term, almost 88% off all annual returns have been positive, but again, the numbers have varied greatly over time:

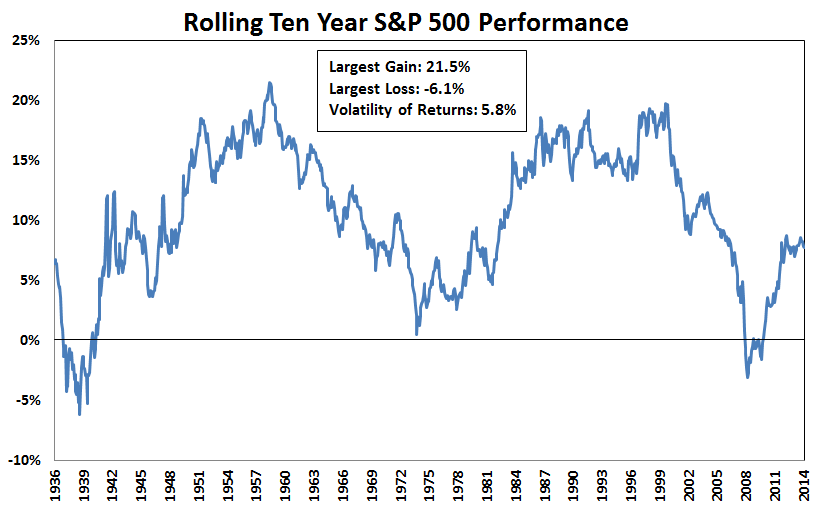

Go out to ten years and the only two periods with annual losses were experienced in the aftermath of the Great Depression and the Great Recession with 94% of all periods in the black:

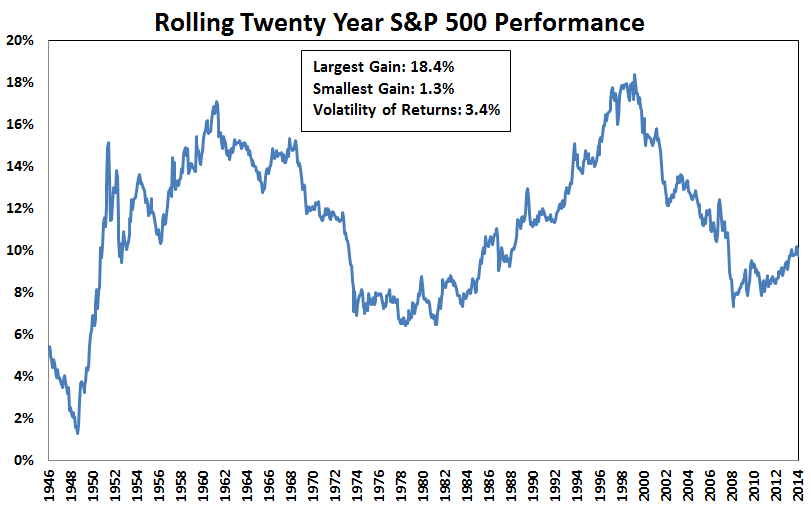

There’s never been a negative return over a 20 year time frame, but roughly one-third of all rolling 20 year periods were below the long-term average market return:

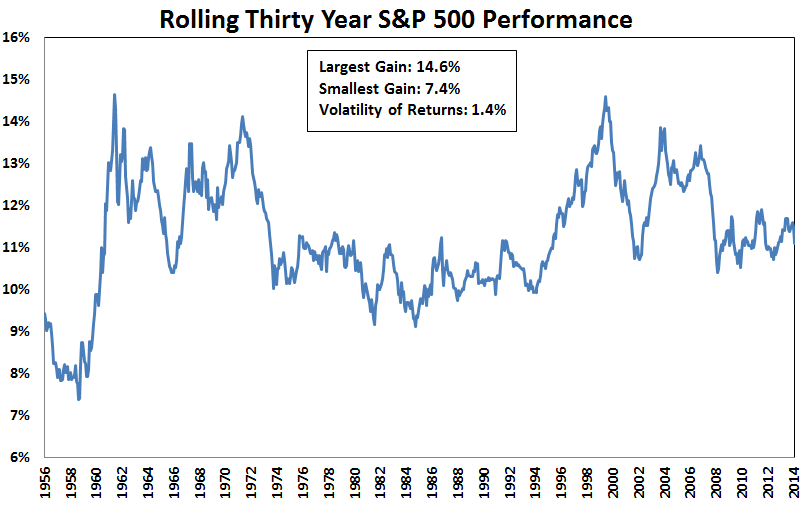

Once you get to 30 years the volatility of the average returns is only a fraction of the volatility seen in one year returns. Although they’re in a much tighter band, there’s still some variation over time depending on the start and end points:

It’s worth mentioning that none of these long-term results take into account taxes, fees, commissions or inflation. They also don’t account for the cost of poor behavior which is mostly caused by the very first graph of one year returns.

Some investors mistakening believe that by holding stocks for the

“long run” they will be guaranteed a certain return on their investment. This is not true. Investors aren’t promised 8-10% annual returns just because they increase their holding period. Stocks are risky because even over longer holding periods there’s variation in the results. But history shows that you increase your probability for success by extending your holding period by decreasing your odds of experiencing loss.

Long-term means different things to different investors depending on their circumstances. It’s not realistic to assume all of your capital is going to be able to be set aside in thirty year chunks. I like to start by defining what short-term means and using that as a the baseline to be able to figure out what constitutes the long-term. Only when you’re comfortable enough to be able to handle the short-term you can figure out how to utilize the long-term to your advantage.

Source:

Efficient Frontier “Theory” for the Long Run (AQR)

Further Reading:

The Long Run Revisited

[…] ET Dollar won’t crash the S&P 500 as long as the Fed stays friendly – MarketWatch What Constitutes Long-Term in the Stock Market? – A Wealth of Common Sense Yellen Gives Gold Bulls Biggest Rally on Rates Since January […]

Your 20-year returns say there has never been a negative period and that is what the chart shows, however the heading for the chart shows “Largest loss”. Maybe to avoid confusion it should not be called “Largest loss”?

That’s a good point. I missed that. Thanks for the head up.

[…] What does the ‘long run’ mean to you? (awealthofcommonsense) […]

A time series of rolling returns is autocorrelated, and more so if the rolling window is larger. One should should not assume that the statistical properties of returns over 20 year periods based on a 40 year sample, which only has 2 uncorrelated data points, is equal to the statistical properties of the rolling time series with a 20 year window.

You’re confusing statistics with the real world. In the real world, investors don’t simple make two investments at two distinct points and call it a day. They invest throughout the course of their lifetime so seeing different rolling periods is helpful because not every dollar invested is going to be put to work at one or two specific intervals.

[…] this week I posted a handful of graphs that showed rolling returns for the stock market over various time frames. The point was to show how much variation in performance there’s […]

For the rolling periods shouldn’t you use only the full periods? i.e. for the 30 year rolling shouldn’t the last data point be in 1984 (2014-30)? Any datapoints after that doesn’t contain a full 30 years.

Good question. The dates here represent the end points, so you’re right that the latest 30 year period starts in the 80s, but the total returns are shown now where they stop. So technically this data goes all the way back the 1927 as a starting point.

[…] is another obvious question that every investor should think about: “What Constitutes Long-Term in the Stock Market?” The answer may not be quite so obvious in this case. (A Wealth of Common […]

[…] What Constitutes Long-Term in the Stock Market? […]

[…] change as longer time periods alter the return profile? A recent regional note has highlighted a blog that talks about these concepts in the context of US […]

[…] been no 20 year periods since that investing in the S&P 500 has not produced positive gains. (A Wealth Of Common Sense) This helped me realize that investing in stocks the right way really isn’t as risky as I […]

[…] Reading: What Constitutes Long-Term in the Stock Market? So You Want to be a Top […]

Are the largest gains and smallest gain/ largest loss figures per annum? Or does the last graph show that the largest gain over 30 years was a total of 14%?

[…] Further Reading: What Constitutes Long-Term in the Stock Market? […]

[…] The longer you stay invested in the stock market, the more likely it is that you’ll get a positive return. […]

[…] The longer you stay invested in the stock market, the more likely it is that you’ll get a positive return. […]

[…] The longer you keep invested within the inventory market, the more likely it is that you’ll get a positive return. […]

[…] longer you stay invested in the stock market, the more likely it is that you’ll get a positive return […]

[…] are a pair of charts put together by Ben Carlson of Ritholtz Wealth Management showing rolling one-year returns for the S&P 500 and rolling […]

[…] Source: A Wealth of Common Sense […]