We discuss:

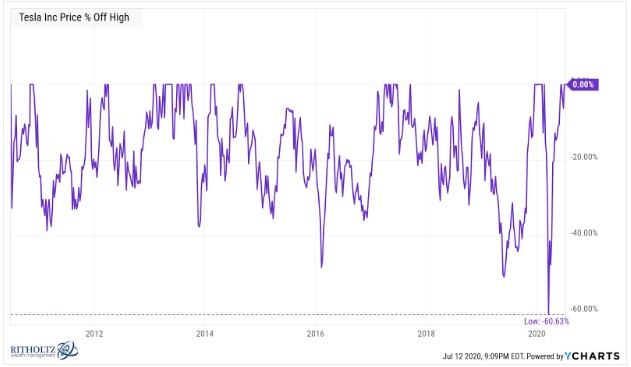

- Tesla’s massive price rise

- Managing an outsized position in your portfolio

- Does it make sense Elon Musk is richer than Warren Buffett?

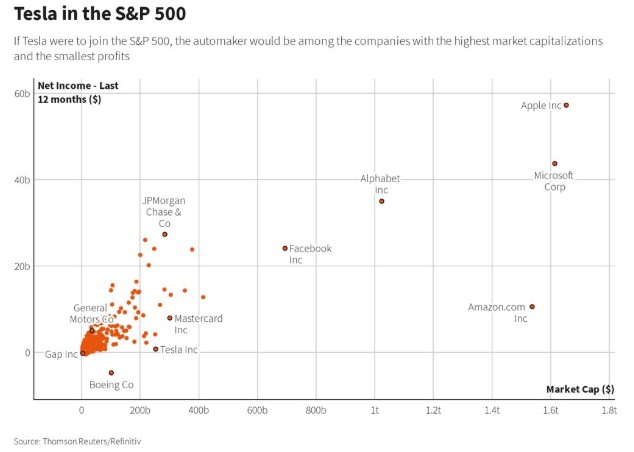

- Why isn’t Tesla in the S&P 500 yet?

- How is it possible Robert De Niro is going broke this year?

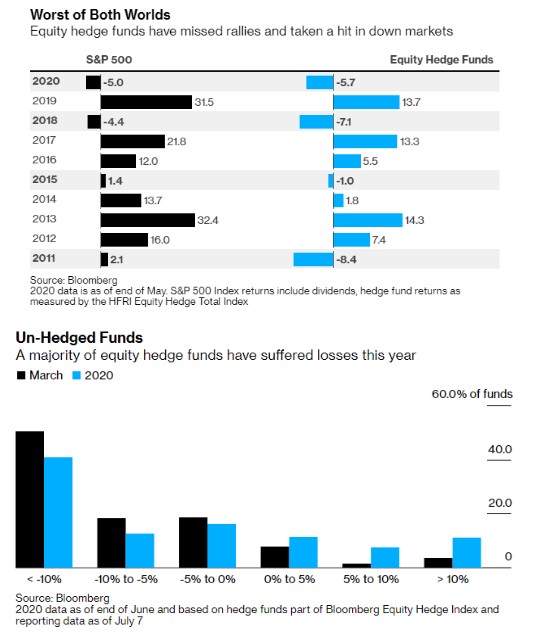

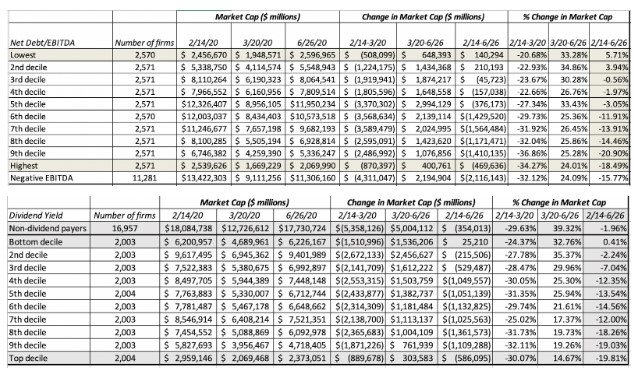

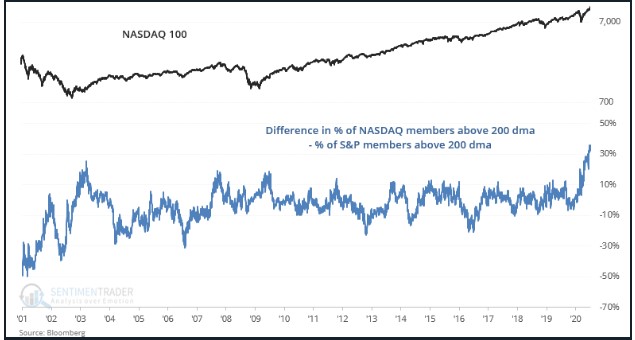

- Simple is beating complex this year

- Why isn’t more money pouring out of long/short funds?

- Why market neutral funds are so difficult to deal with

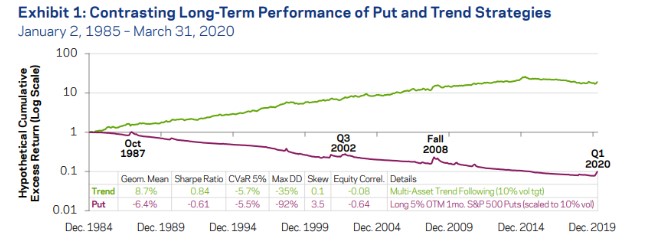

- Why tail risk strategies are so hard to implement without losing a ton of money over the long-term

- Why do so many institutional investors continue to shovel money into alts?

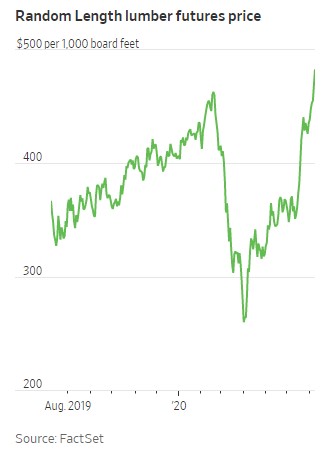

- The boom in home renovations

- Why the stock market makes more sense than most people realize

- What do you do if you sold out of stocks in March?

- Do technology companies need to take more responsibility for their users’ actions?

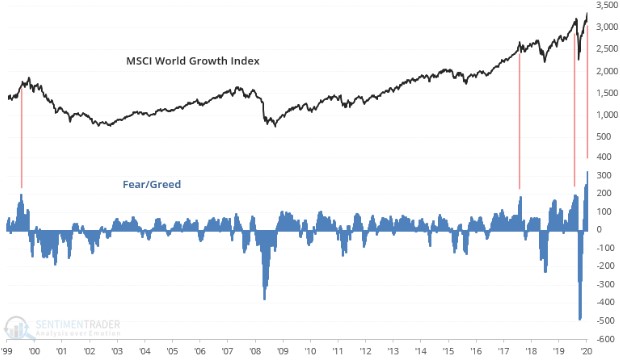

- Is wealth inequality driving the rise in gambling on the markets?

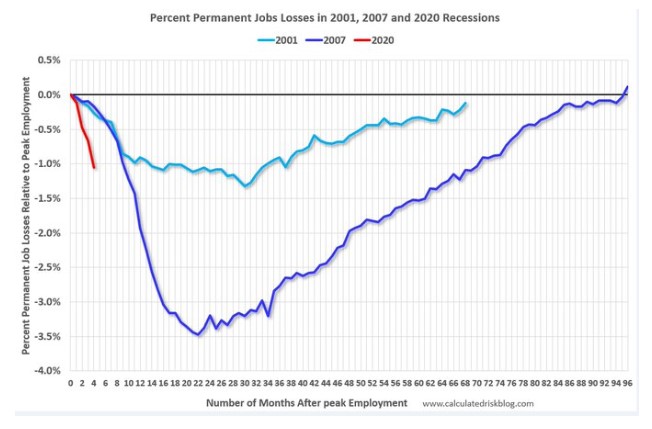

- Bankruptcies and layoffs are on the rise

- Hulu is better than Prime and much more

Listen here:

Stories mentioned:

- Elon Musk now richer than Warren Buffett

- Robert De Niro says he’s going broke because of Coronavirus

- Low vol in name, big losses in practice

- Market neutral can be a positively baffling fund label

- The hottest hedge fund strategy faces and existential crisis

- Tail risk hedging

- Alternatives a loser’s game

- The flexibility premium

- Once you’re out of the market it’s tricky to get back in

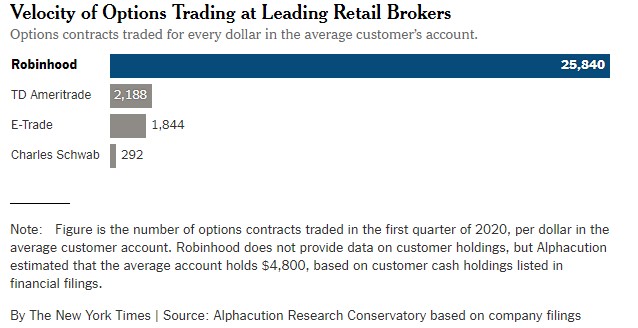

- Robinhood has lured young traders, sometimes with disastrous results

- Who gets to be reckless on Wall Street?

- Covid-19 is bankrupting companies at a relentless pace

- Walmart rolls out an Amazon Prime competitor

- A cheaper Peloton treadmill could be coming

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: