Based on the MSCI World Index, the U.S. stock market makes up over 50% of global equity markets. We constantly hear updates about the Dow Jones, S&P 500 and even Russell 2000, but rarely pay attention to foreign markets.

This home bias causes many investors to overweight U.S. stocks in their portfolio. As everyone debates the current valuation of U.S. stocks, it’s now easier than ever to diversify globally. And while investors worry about the fact that U.S. markets have run so far so fast, many international markets haven’t kept pace.

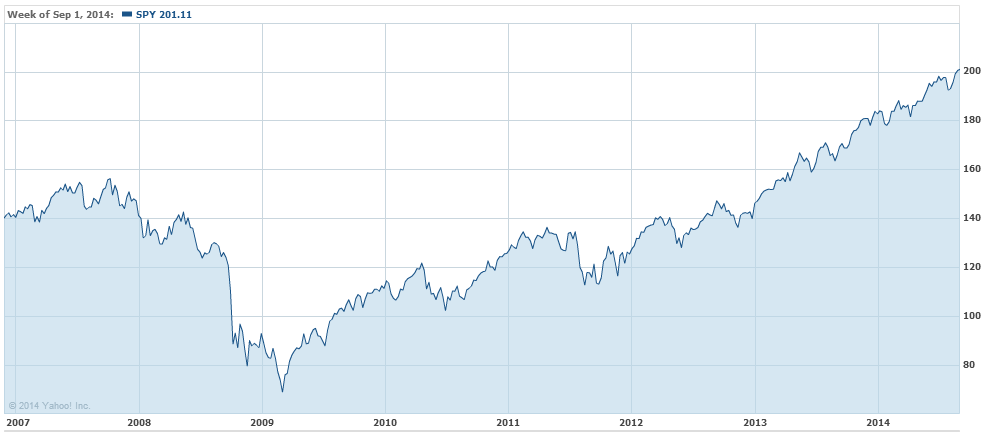

The S&P 500 (SPY) passed through its 2007 peak in early 2013:

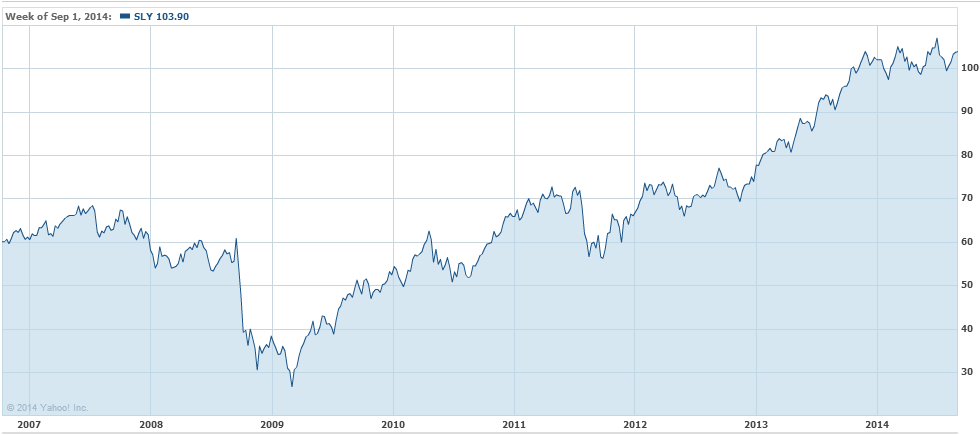

The S&P 600 Index (SLY) of small cap U.S. stocks broke its previous highs in early 2011:

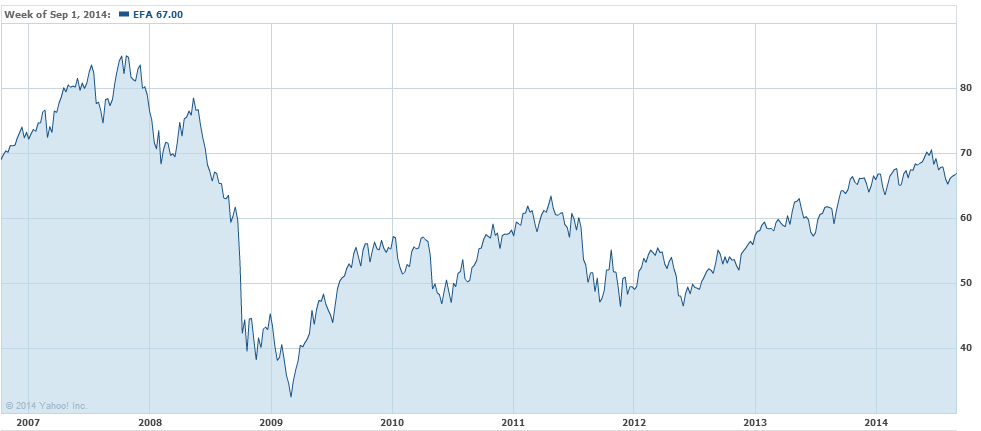

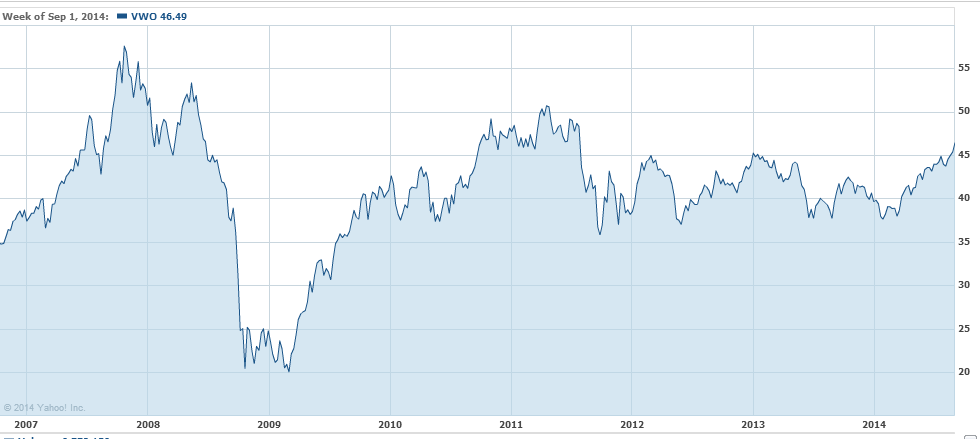

Now for a list of broad foreign markets that are still well below their 2007 peaks seen before the global financial crisis hit.

The MSCI EAFE (EFA):

Emerging Markets (VWO):

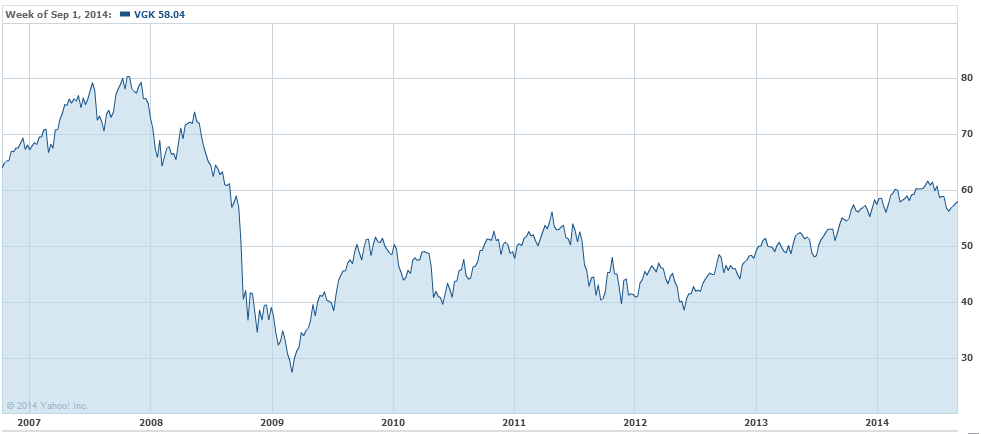

European stocks (VGK):

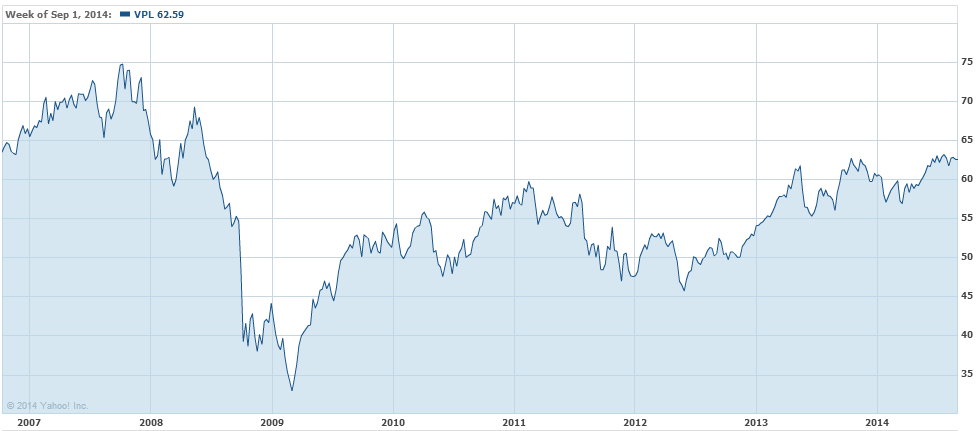

Asian stocks (VPL):

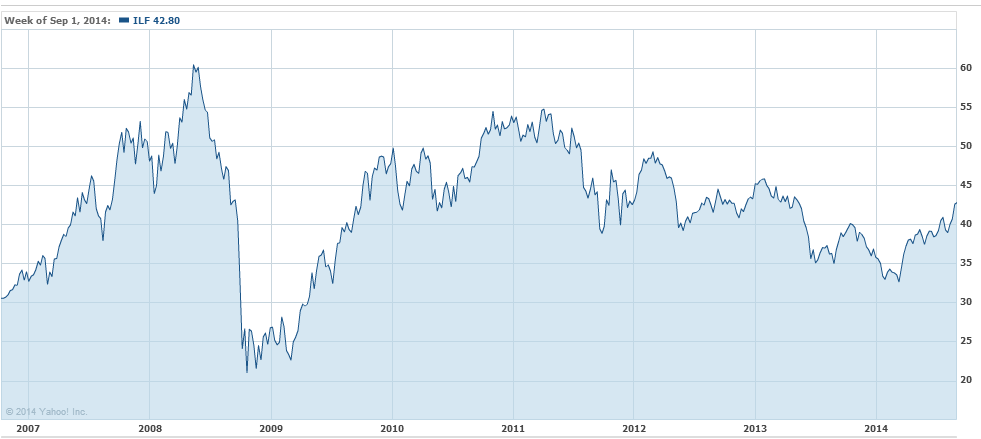

Latin America (ILF):

There’s nothing that says international markets have to immediately outperform U.S. stocks anytime soon. But for those that are worried about CAPE ratios and profit margins, diversifying globally is one of the best forms of risk management over longer time horizons.

Further Reading:

You should hate some of your investments

[…] What markets are NOT at new all-time highs. (A Wealth of Common Sense) […]

[…] A bit of perspective on stock markets: not all have gone up like the US’s https://awealthofcommonsense.com/markets-recovered-financial-crisis/ […]

I have been seeing a lot written like the above about how investors should globally diversify. However, global diversification can be a big mistake. During 2006-07, equity mutual funds focused on developed international markets and emerging markets provided strong relative returns to U.S. stocks. During that period, U.S. investors made net purchases of $285 billion in mutual funds investing in non-U.S. stocks, and liquidated on balance some $35 billion from funds focused on U.S. stocks. This occurred because, like now, it was touted by fund marketers as adding “non-correlated assets,” or “reducing volatility risk.” In 2008 — with non-U.S. developed market funds falling by 45% and emerging market funds tumbling by 55%, we learned once again that, just when we need it the most, international diversification lets us down. Global diversification provided neither superior returns, nor reduced volatility, versus investing in a broadly diversified US index fund (such as SPY or VTI).

Some articles argue that because international markets have largely underperformed since 2009 that now is the time to invest in them. This smacks of market timing, which scholarly studies have shown consistently results in poor investment results.

It is also worthwhile noting that the average investor has some knowledge of what is happening in the US economically, but knows much less regarding what is happening around the world. Importantly, just owning the S&P 500 or the US Total Market Index already gives substantial international diversification, since roughly half of its revenue comes from outside the US. Meanwhile, because these companies are based in the US they avoid the corruption, political risk, and lack of the rule of law that often is associated with many countries outside of the US and Europe.

So, all in all, investors are better served by keeping their stock investments in US based companies.

06/07 was another case of performance chasing since int’l mkts had outperformed for a number of years. Even with 50% or so of sales coming from abroad you still get diversification benefits from investing in other countries from a sector/economic/demographic perspective.

You’ve been steadfast on your int’l vs. US stance. I respect that, but it’s impossible to predict which markets are going to outperform in the future. US has many advantages but who knows if that translates into future outsized returns vs. the rest of the globe. I have a post planned for the coming weeks on global investing that you may find interesting/surprising. Stay tuned.

[…] at A Wealth Of Common Sense shows that not all markets have recovered from the financial crisis. In fact, most foreign markets are still beneath their peaks in 2007. This doesn’t mean that […]

[…] What markets are NOT at new all-time highs. (A Wealth of Common Sense) […]

[…] til forskjellige tider. For eksempel stiger det amerikanske markedet stadig til nye høyder, mens store deler av verden fortsatt ligger på nivåer lavere enn før finanskrisen. For ikke å snakke om den russiske børsen, som etter Russlands kreative inngripen i Ukraina for […]

[…] Investors Can Take Advantage of These Markets That Haven’t Recovered Yet — (A Wealth of Common Sense) […]

[…] Further Reading: Torturing Historical Market Data Caveats on the Long-Term Global Diversification: Accepting Good Enough to Avoid Terrible Not All Markets Have Recovered From the Financial Crisis […]