“Even investors who were guided by a quantitative stock selection system can let their human inconsistencies hogtie them.” – Jim O’Shaughnessy

CAN SLIM is a well-known growth stock picking system developed by William O’Neill that gets published in the Investor’s Business Daily. It takes into account a number of technical and fundamental factors (including rapid earnings growth, trading volume, industry leadership, etc.) to come up with a list of stock picks.

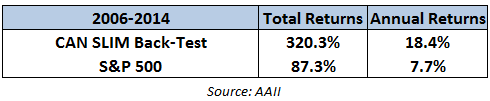

It’s a rule-based system where each letter stands for a different guideline. The system also makes use of stop-losses to go to cash to avoid big losers. The back-tested results of the strategy are impressive. Here are those performance numbers set against the S&P 500 produced by the American Association of Individual Investors:

These returns look pretty amazing. Wouldn’t it be great if there was an easy way to invest in this strategy?

Well, actually there is.

The CAN SLIM Select Growth Fund (CANGX). Here’s how it’s described by the mutual fund company that runs it:

The Fund seeks long-term capital appreciation and will invest primarily in common stocks of all sizes exhibiting accelerated earnings growth, market leadership, and other characteristics consistent with the CAN SLIM® System.

Published by Investor’s Business Daily®, the CAN SLIM® Select List represents those companies that, according to the CAN SLIM® Select List, possess the seven most common characteristics that all great performing stocks have before they make their biggest gains.

Let’s see if the fund has lived up to its claim.

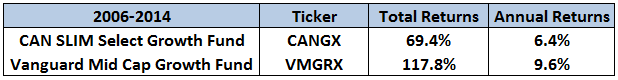

Morningstar categorizes CANGX as a mid cap growth fund so it doesn’t make sense to compare it to the S&P 500. Here are the performance numbers from the inception of the fund in 2006 through the end of June of this year set against the Vanguard Mid Cap Growth Fund:

Obviously the back-tested returns from this strategy haven’t translated well into the real world. It would be easy to assume that the back-tested results are unrealistic, but there could be a number of issues that have caused the performance to lag both its category and the system’s results.

The easiest issue to diagnose is the fact that real world investing incurs costs that don’t get picked up by a back-test. According to Morningstar, the fund carries an expense ratio of 1.58% and has annual portfolio turnover of 269%. Those costs create a high hurdle rate to beat right off the bat from trading activity and fees. The excessive trading can also lead to an increased tax bill if not held in a tax-sheltered account.

It’s impossible to know for sure but with a highly active strategy like this there is always room for human error. Although rules-based or quantitative models are a great way to take the emotions out of investing decisions, there will always be the temptation to make tweaks to try to improve results or add rules when the strategy runs into trouble.

Back-tested results assume the rules are followed exactly as they were laid out with no tinkering along the way. It can be very difficult in actual market conditions to implement a model and stay out of your own way to let it work.

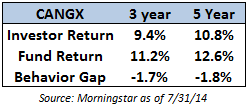

Investors in the fund aren’t without fault here either. Poor timing decisions in the fund made the average results even worse than advertised:

The 5 years investor returns are actually ranked in the worst 5% of all funds in its fund category. Flows into and out of a fund like this can be what makes it so difficult to be a mutual fund manager.

If investors want to sell after losses have already occurred the fund manager has no choice but to sell stocks to meet those redemptions. And if investors flood a fund with contributions after gains then the fund manager has no choice but to buy stocks.

Add it all up — high costs, human error, poor investor behavior — and you get performance that is nowhere close to the market-beating back-tested results that look so great on paper.

This doesn’t mean CAN SLIM doesn’t or can’t work. Just like all other models or investment strategies the end user and portfolio structure have much more to do with the final results than the system itself.

Source:

Stock screen performance (AAII)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Excellent post! Those are good points to consider. I am a CANSLIM investor and would never invest in this fund because it’s not a true application of the CANSLIM system. Here’s why. From the the fund managers website, it states that the fund invests in “nearly 100 stocks” in a rising market, each stock will receive 1% allocation to reduce risk. That’s not real CANSLIM. CANSLIM picks the best of best. That may mean only five stocks are worth investing in. So, it sounds like the fund management just picks the first high ranking 100 stocks from the IBD universe of stocks.

I spend quite as bit of time reviewing the IBD universe of stocks each week for new picks and sometimes it ‘s just hard to pick more than a dozen at most. There are some potential candidates I’m watching at the moment, but I’m not planning on buying yet because the market isn’t prime yet. So I sit in cash and wait…that’s true CANSLIM.

The other thing that is “anti-CANSLIM” from the fund management website is that CANGX will continue to be invested in “as little as 20%” in a declining market. True CANSLIM methodology says it’s OK to be in cash 100% until the right setups present themselves.

CANSLIM is akin to waiting for the perfect pitch before swinging your bat. CANGX appears to be swinging at the first 100 balls that are pitched. This fund will never come close to replicating true CANSLIM performance because it doesn’t apply all the the rules that make CANSLIM investing successful.

The only way to successfully use CANSLIM is to learn to do it yourself or find a money manager who follows the rules exactly and is not afraid to move their clients to cash when necessary. In full disclosure, I am a CANSLIM money manager.

Gotcha, makes sense. Thanks for the clarification.

I’m sure there are some regulatory issues to consider for the mutual fund for why they can’t get as concentrated. This is why mutual funds aren’t always the best vehicles for all strategies.

Thanks for sharing.

[…] A closer look at real world CANSLIM performance numbers. (A Wealth of Common Sense) […]

[…] A closer look at real world CANSLIM performance numbers. (A Wealth of Common Sense) […]

[…] An important reminder of how backtests can different from real world performance. One of the most important lessons for investors: (A Wealth of Common Sense) […]