“Fear has a greater grasp on human action than does the impressive weight of historical evidence.” – Jeremy Siegel

If I had to narrow down the list of reasons that so many investors have missed out on one of the greatest bull markets in history it would be these two factors:

- The recency effect has investors constantly on edge in anticipation of another crash.

- Investors cannot get over the fact that we’ve had a subpar economic recovery.

Nearly the entire run-up stocks investors have been warned of double-dip recessions, a stagnating economy and high rates of unemployment. This can take its toll on investors that are unaware of the fact that the stock market is not the economy.

In fact, just five days before the stock market bottomed in March of 2009, the Wall Street Journal ran an op-ed with the following headline:

It was a scary time. The word depression was being thrown around quite a bit during those dark days.

Many investors simply can’t force themselves to grasp that these periods of unrest are the absolute best times to put your money to work in stocks (although you’ll never be able to perfectly nail the bottom).

The unemployment rate is a perfect example of the fact that the best times to invest are when things seem the worst.

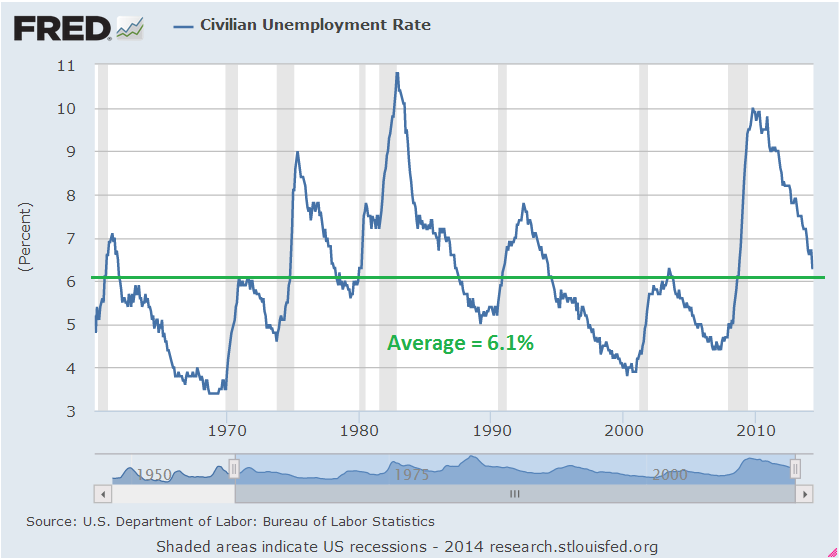

Here’s the unemployment rate going back to 1960:

The rate is never really stable but you can see that we’re actually approaching the long-term average with the latest reading.

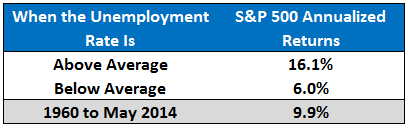

I looked at the performance of the S&P 500 during all of the periods that stocks were above the long-term average, roughly 40% of the time, and compared them to the below average periods. Here are the results:

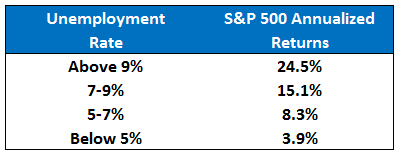

Next, I broke down these numbers even further so you can see the relationship between terrible economic data and stock market returns:

From a contrarian point of view these numbers make sense, but intuitively they’re hard to grasp. It’s difficult to imagine a scenario that involves poor economic conditions along with a rising stock market, but it happens more often than you’d think.

Since 1960 we’ve had eight recessions lasting an average of just under twelve months a piece. That means every six years or so economic activity contracted.

What most investors fail to realize is that the times that seem the bleakest are also when the expectations are the lowest. It becomes a relative game. Even if the data is still terrible on an absolute basis, when things start getting less worse it can actually lead to better performance.

The opposite can also be true that when things seem great on an absolute basis, but aren’t improving at the same pace, we can see the market deteriorate.

Of course, the unemployment rate was only above 9% around 8% of the time so the best opportunities to invest don’t come around very often (the rest of the breakdown: 7-9% was 22%, 5-7% was 47% and less than 5% was 24% of the time).

Also, there are structural issues that could cause the unemployment rate to stay elevated for a number of years. It’s difficult to say if the same range will be seen going forward.

Yet it’s still true that expectations matter with forward-looking markets. This is why the best time to invest is when assets are beaten down in price with low future expectations as opposed to those times of sky-high expectations and large price increases.

[…] Stock Peformance […]

[…] Should the unemployment rate mean anything to stock market investors? (WealthOfCommonSense) […]

[…] Bullish – Alhambra Partners Stocks and Bonds Are Sending Mixed Economic Signals – RCM How The Unemployment Rate Affects Stock Market Performance – AWOCS Draghi Stock Rally Runs to Record Price-Earnings Ratio – Bloomberg […]

[…] Brown mentioned a post today at A Wealth of Common Sense: How The Unemployment Rate Affects Stock Market Performance. The author is discussing investing … The unemployment rate is a perfect example of the fact […]

[…] Street and A Dirty Little Secret Josh Brown mentioned a post today at A Wealth of Common Sense: How The Unemployment Rate Affects Stock Market Performance. The author is discussing investing … The unemployment rate is a perfect example of the fact […]

Hi Ben,

My guess is that what you describe in this article is at least partly due to the fact that when unemployment is high the government more often than not takes action to stimulate the economy and the Fed tends to lower interest rates – both of which tend to lift the market. And the opposite occurs when unemployment is very low which tends to cause the market to slow down or fall to some degree – sometimes not badly and sometimes really badly.

John

Good point. It’s a confluence of events that seems to transpire when times are the worst. Could be any combination of a slowing economy, falling company earnings, terrible market sentiment and then the Fed steps in but the timing of all of these factors will constantly shift.

But your general idea is correct.

[…] from leading economist. shared by reddit/Economics, Marginal Revolution, Business Insider How The Unemployment Rate Affects Stock Market Performance awealthofcommonsense.com “Fear has a greater grasp on human action than does the impressive […]

[…] How The Unemployment Rate Affects Stock Market Performance … – How The Unemployment Rate Affects Stock Market … And the opposite occurs when unemployment is very low which tends to cause the market to slow down or … […]