“In the short term the impact of costs may appear modest, but over the long run, investment costs become immensely damaging to an investor’s standard of living. Think long term!” – John Bogle

At this point, most investors are aware of the fact that keeping your costs low is one of the most important factors in a successful investment plan.

Morningstar’s 2010 study on the best predictors of fund performance showed that expenses are the only predictive factor that is able to help investors make better decisions with their investments.

The recent Nobel Prize win by the father of the efficient market hypothesis, Eugene Fama, has opened up the debate among academic circles as to whether or not the markets are perfectly efficient. In other words, is it possible to gain an edge over the market through better research, strategies, rationality, etc?

If this is the case then low-cost index funds are your only sane option.

But this debate gets settled every time an investor buys a stock because his co-worker told him it’s a can’t lose investment or we go into mania or a panic. Irrational human nature leads to irrational markets at the extremes.

Generally, over the very long term markets sort out these irrational periods and returns are fairly similar.

John Bogle has never viewed index funds through the lens of the efficient market hypothesis. For him, it has always been the Cost Matters Hypothesis. The Cost Matters Hypothesis (CMH) from Bogle states:

The case for indexing isn’t based on the efficient market hypothesis. It’s based on the simple arithmetic of the cost matters hypothesis. In many areas of the market, there will be a loser for every winner so, on average, investors will get the return of that market less fees.

In a new article in the Financial Analysts Journal, Bogle shows that it’s not only expense ratios that make it difficult for active mutual funds to beat index funds.

Expense ratios alone don’t tell the entire story.

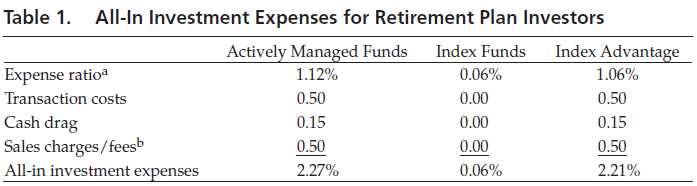

Bogle’s research found three factors that influence a funds “All-In” costs:

1. Cash Drag

2. Portfolio Turnover

3. Fees for brokers, advisors and sales loads

Cash drag is simply inflows and outflows from investors in the funds. Mutual funds typically carry anywhere from 2-5% in cash to be able to distribute proceeds to those that would like to sell out of the fund. Cash earns much less than stocks over time so this hinders performance.

Mutual fund managers don’t control the timing of the buys and sells from investors, but it’s still a cost that they bear. Bogle estimated this cost to be roughly 0.15% annually.

Portfolio turnover has increased from 30% in the 1960s to 140% today. That means in the 60s portfolio managers would hold their stocks for roughly 3 years. Today, the hold time is much less as fund managers buy and sell their entire portfolio in less than a year on average.

That much trading activity can lead to both market impact costs and timing decisions that can differ from overall market performance. Bogle’s estimate for turnover costs is 0.50% a year.

The third cost in addition to the expense ratio is for broker fees, advisor fees, and sales charges. Wall Street does their best to get an extra cut where they can. This one comes in at 0.50% per year.

Add these three costs to the average expense ratio of 1.12% and Bogle gets 2.27% for all-in costs.

Here is the table from the article that shows the breakdown between actively managed funds and index funds:

Assuming you can find ways around the broker and sales charges (easy to do these days) and you still get 1.77% in costs.

The reason for index fund superiority has nothing to do with senseless fund managers that don’t know how to pick stocks. On the contrary, there are more smart investors chasing fewer opportunities today. They are all competing with each other along with hedge funds, pensions, computer algorithms and individuals.

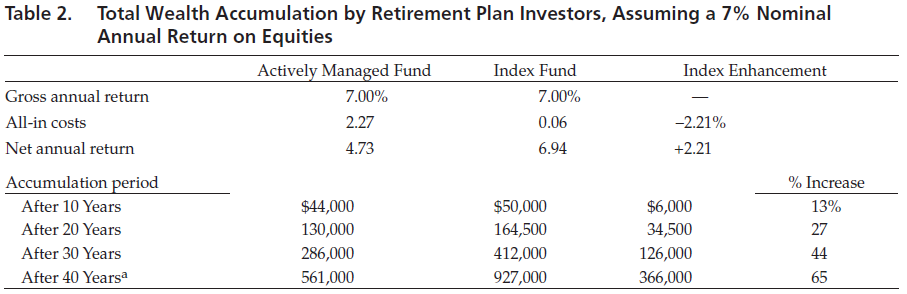

That means that the margin for error is extremely thin in today’s markets. Giving index funds a 2.21% head start makes for a huge hurdle to jump over. This is the reason that index funds consistently perform better than 70-80% of active funds over longer time frames.

Compound interest is your greatest ally when saving over the years, but costs work the same way, only they compound against you.

Bogle puts it this way in the article:

Do not allow the tyranny of compounding costs to overwhelm the magic of compound returns.

Here is his analysis on the compounding effects of costs on a portfolio:

Wall Street has convinced investors in the past that the only way to gain an edge is to stay ahead of the crowd, find the best performing funds and trade in and out of the markets. Good luck finding a large Wall Street firm that will preach long term investing in a low-cost approach and minimal activity.

Luckily, investors are catching on to Wall Street’s ways. They’ve been burned far too many times.

According to Investment News, almost 98% of all U.S. equity fund purchases in 2013 were done through Vanguard funds.

I think this is a great development.

The good news for investors is that Wall Street won’t just sit there and lose out to low-cost investment options. The proliferation of ETFs will lead some enterprising fund companies to offer active strategies at a low cost to investors.

They have to do this eventually or face the facts that they can no longer continue the game of ripping off investors at every turn.

If you can implement an actively managed strategy in a low-cost manner, by all means, use that strategy if you can consistently stick with it.

Bogle has even stated in the past he’s not totally against active strategies (as some would think), but he does detest high expenses.

Whether you choose a passive or an active investment stance, keep your cost hurdle rate low to give yourself the best chance of getting your fair share of the market’s gains over time. That’s the goal.

Sources:

The Arithmetic of “All-In” Investment Expense (Financial Analysts Journal)

Vanguard raked in almost every dollar that went into U.S. equity funds this year (Investment News)

Fund expenses more important than 5-star status (NY Times)