“Most investors are primarily oriented toward return, how much they can make and pay little attention to risk, how much they can lose.” – Seth Klarman

Reader mailbag: Is there a way to create a laddered bond portfolio using bond funds instead of individual bonds?

I can understand why bond investors would be looking at strategies to decrease interest rate risk. It’s impossible to predict when it will happen, but interest rates will rise eventually.

This could lead to a loss in principal on your bond funds (which has happened this year).

You could try to reach for yield in your bond investments, but that brings on the prospect of higher volatility. Save your volatility for your stocks. Bonds are there to act as a shock absorber.

In the current interest rate environment a bond ladder is a great solution to spread your risk and decreases the odds of interest rate risk wreaking havoc on your bonds.

A bond ladder is simply a portfolio of bonds that have different maturity dates to minimize interest rate risk and allow investors to have more liquidity and reinvestment options.

For example, you could buy bonds with maturities of 2, 3, 4, 5, and 6 years. All would have different interest rates and risk profiles. As they mature you purchase new bonds to keep the portfolio balanced across the different maturities.

If rates rise this allows you to put your maturing bonds to work at higher rates but lowers your risk by spreading out your maturity profile.

Barry Ritholtz recently shared his thoughts on bond ladders in the Washington Post:

Given the inevitable increase in rates, many investors have liquidated bonds, further raising their cash balances. Rather than try to time the bond market, the solution here is to hold a ladder of individual A-rated bonds — not a fund subject to redemptions — that will mature over the next three to seven years. As this paper reaches its maturity over time, you simply roll into a similar bond at what is likely to be a higher yield. That is a better strategy than holding cash for the next seven years.

I happen to agree with Barry, but many individual investors will have a hard time executing this strategy because:

- You need a relatively large portfolio to be able to create a diversified portfolio of individual bonds.

- There is much lower liquidity in the bond market and it’s not as easy for individual investors to buy single name bonds as they can with stocks.

- The spreads and transaction costs can put individuals at a disadvantage when buying bonds if they don’t know what they’re doing.

Since bond funds are generally constant maturity funds (the average maturity of the bond holdings in the funds is relatively stable) it’s difficult to create a laddered portfolio.

One way to do this with bond funds is to spread out your portfolio over ETFs with different maturity targets. These are the iShares Treasury bond ETFs at different maturities:

- iShares 1-3 Year Treasury ETF (ticker SHY)

- iShares 3-7 Year Treasury ETF (ticker IEI)

- iShares 7-10 Year Treasury ETF (ticker IEF)

You could split your portfolio between the three funds and move money out of the shorter term funds as rates rise to get access to the new higher rates.

But this is a suboptimal strategy that leaves you guessing at the best times to make your moves. Most investors don’t do well when they have to forecast their portfolio changes based on the direction of interest rates.

There are far too many variables to consider and having a systematic, rules-based approach takes your emotions out of the equation.

Luckily, the landscape in the bond ETF world is changing which gives investors a new option. Blackrock’s iShares ETF unit now offers bond ETFs with a target maturity date to create an ETF ladder.

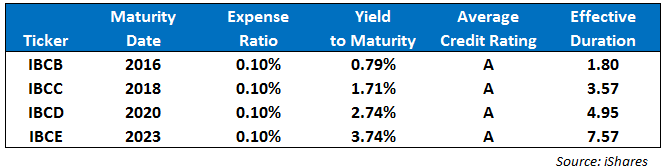

Here are the ETFs along with their relevant information:

Remember duration approximates the sensitivity of bonds to a 1% change in interest rates. So a duration of 5 would imply that a 1% increase in rates would lead to a 5% loss in bonds (remember bond prices fall with rising rates and rise with falling rates).

This feature is what makes shorter term bonds more appealing during a rate rise. The problem is, short term funds don’t offer great yields. So goes the relationship between risk and return.

Using this laddered approach you increase your yield, spread out your risk and have options to reinvest at more attractive yields if interest rates rise in the future.

It’s not a perfect strategy, but when dealing with an uncertain future there are no perfect strategies.

All of these ETFs hold corporate bonds (excluding the financial sector) and each has over 100 individual bond holdings.

At the end of the ETF’s tenure, the principal amount along with any leftover interest payments will be distributed to the shareholders.

If you are concerned about rates rising sooner rather than later, it would probably make sense to have more invested in the 2016 ETF so you are able to reinvest more proceeds at higher reinvestment rates.

How you split the weightings between the ETFs is up to your risk profile and need for yield, but you could probably do worse than an equal weighting between the funds.

An equal-weighted portfolio of these 4 ETFs would give you a yield to maturity of roughly 2.25% with an average duration of around 4.50 years.

It’s not a 5% guaranteed interest rate that most investors would like right now, but we need to invest in the markets as they are not as we would like them to be.

Source:

How much cash should you hold in your portfolio? (Washington Post)

Further Reading:

Investing in bond funds

Good post Ben, but I struggle with investing in bonds right now. I have felt this way for the last couple of years. I don’t see bond yields getting better anytime soon.

For retirees, likely a good thing to have a bond ladder.

For folks like me in their accumulation phase, investing in bonds; as long as you can stomach equity declines of 30% or more, is probably not a great call.

Just my thoughts of course!

Mark

Totally agree with you. I don’t like bonds considering we’re at or near generational lows in rates and the 30+ year bond bull mkt is over.

It’s basically the lesser of all evils for those looking for safe yield and stability. A ladder is the best approach for those close to or entering retirement.

Dividend yields help as well but some investors need principal protection.

I like the ladder idea and I am currently building it with options (having several short puts expiring every month so I can roll them). I am very skeptical in regards to bonds.

What sort of income do you receive on the put options and what is your downside risk if the market falls out of bed?

[…] and hopefully the fixed income portion of a portfolio becomes easier to define. I also think that creating a bond ladder is a straight forward way to manage risk in fixed income assets, as […]

[…] Further Reading: How Interest Rates Affect the Behavior Gap How to Create a Bond Ladder Using Interest Rates […]