Many of the most intelligent investment thinkers out there today are in agreement that future returns for U.S. stocks and bonds will be subpar. This has been pointed out by many for a number of years now, but eventually it will happen.

The S&P 500 is up 16% per year over the past 5 years. It would only take an annual return of 3.5% over the next 5 years to see a 10 year return number of 9.6%, the long-term average. This is a simplified example, but generally periods of above average performance are followed by periods of below average performance. Hence, an average.

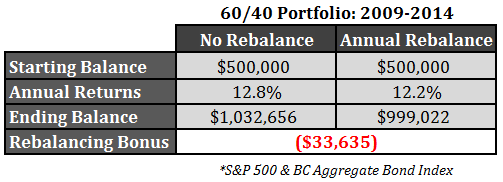

One of the problems for disciplined investors in a strong bull market such as the one we have experienced the past six years is that risk management isn’t always rewarded. Take a look at a simple 60/40 stock/bond portfolio with and without an annual rebalance using a $500,000 starting value:

In this case you would have been better off, from a performance perspective, not rebalancing your portfolio. When this happens it can be easy for investors to become lax with their risk controls.

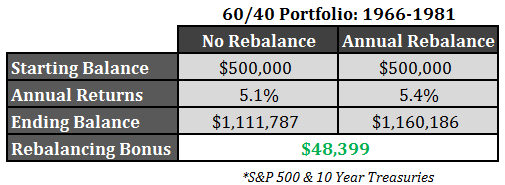

Now let’s look at the flipside, which is a poor performing market that so many are now calling for. The 1966-1981 period was one of the more difficult market environments to navigate in the post-WWII era for a simple stock/bond portfolio. The S&P 500 was only up 6.0% per year over this time while 10 year treasuries gained just 3.6% annually. The inflation-adjusted returns were much worse. Here’s the same analysis from above during this time frame:

Now there is a nice boost from risk management. While 0.3% per year in returns may not sound like much, you can see that small return differentials can add up to real dollars over time. Summing up both rebalancing tables, investors have been penalized during strong stock bull markets, but reaped the gains during more volatile and low-returning periods. Some people would look at these numbers and ask why they should even bother rebalancing.1

It’s a fair question. I’ll let Yale’s David Swensen explain:

Far too many investors spend enormous amounts of time and energy constructing policy portfolios, only to allow the allocations they established to drift with the whims of the market. […] Without a disciplined approach to maintaining policy targets, fiduciaries fail to achieve the desired characteristics for the institution’s portfolio.

The whole point of setting a desired asset allocation in the first place is not about maximizing returns. If that was the case then it would probably make sense to have your entire portfolio invested in stocks. The point of asset allocation is to diversify your risks and manage your emotions. That means adhering to a disciplined approach by occasionally rebalancing by buying some of your relative underperformers and selling some of your relative outperformers.

I have yet to find a perfect rebalancing system. The one that works best will be the one that each investor is personally able to pull off without second-guessing the action and putting it off until later. The point of risk management is admitting that you’ll never be able to perfectly time every investment move.

Risk management isn’t something you can just turn on and off when you feel like it. Risk is ever present in the markets. No one really knows when bull markets are going to start and stop. Just ask anyone that’s been calling for a top in U.S. stocks over and over again for the past three years. If we do experience lower financial market returns in the future, rebalancing and managing risk will be much more important than they have been for the past few years.

But even if future returns aren’t substantially lower than they’ve been in the past, giving up on risk controls in a portfolio rarely ends well for investors.

Further Reading:

The Joy of Investing in Down Markets

What if Henry Blodgett is Right About the Stock Market

The Psychology of Lower Returns

1It’s also worth noting that adding more diverse asset classes will usually add to the rebalancing bonus in a portfolio. This is a very simple example.

Here are my favorite reads from this week:

- The biggest threat to your portfolio (Reformed Broker)

- Why bear markets are inevitable (WSJ)

- A simple formula for investment success (Clear Eyes Investing)

- Older investors pray for a bubble. Younger investors pray for a crash (Philosophical Economics)

- The incorrect approach in fund assessment (Alpha Architect)

- Turney Duff on the biggest difference between your 20s and your 40s (The Mid)

- Jack Bogle’s success principles to live by (CNBC)

- How to avoid getting cheated by bad investment advice (Safal Niveshak)

- There have really only been 4 years out of the past 20 where it really was a stock-picker’s market (Servo)

- Enduring lessons from a 30-year old meeting (Tom Brakke)

- The eternal battle when investing: The fear of missing out vs. The fear of holding the bag (Howard Lindzon)

Interesting … Michael Edesses also put forth an article questioning rebalancing http://www.advisorperspectives.com/newsletters14/Does_Rebalancing_Really_Pay_Off.php

Seems like the big catch phrases of this bull market have been: rebalancing, passive, and (income from) dividend paying stocks

Yeah as with anything sometimes things work sometimes they don’t. Caveats abound in the markets.

Should be interesting to see what happens when those catch phrases are challenged in the next downturn.

[…] Many of the most intelligent investment thinkers out there today are in agreement that future returns for U.S. stocks and bonds will be subpar. […]

Do you recommend rebalancing a portfolio of 100% stocks back to their targeted allocation such as 30% international?

Good question. Yes a rebalance within asset classes is something I recommend. See here for more:

https://awealthofcommonsense.com/avoiding-recency-bias-foreign-stock-markets/

[…] Risk management is not an on-off sort of thing. (awealthofcommonsense) […]

Because of the long term performance advantage of equities, how often an investor rebalances may also be affected by where they are in their investment life cycle. A younger investor might be willing to rebalance less often, expecting that an increasing equity exposure would deliver higher returns over time, whereas an older investor, with less time to recover from a market downturn, might be unwilling to accept the higher risk associated with less frequent rebalancing. Having recently retired after 40+ years in the trust & investment business, I am more keenly aware now of the need for risk management in my personal investments than I ever was on behalf of a client.

That’s a great point. The time horizon could has a lot to do with it. As long as younger investors have liquid emergency funds they should be comfortable with way more risk. Although many can’t handle those kinds of swings so rebalancing could make sense from a psychological point of view. But common sense-wise, I’m all for young people being ver equity heavy in their portfolios.

[…] Risk management always matters… – A Wealth of Common Sense […]

[…] a Wealth of Common Sense – risk management makes a difference, even if you can cherry pick times when the stock market outperformed bonds and your […]

[…] Risiko-Management ist immer von Bedeutung (Englisch, awealthofcommonsense) […]

Good discussion. It seems to me, assuming you choose the appropriate asset allocation to begin with, the most important reason to rebalance is to minimize the chance you will do something wrong at the absolute worst time. Like sell stock in the middle of a bear market. It gives you a better chance of sticking to your original plan. It also helps you buy low and sell high.

I agree. The whole point of setting it from the beginning is because it’s an allocation you’re comfortable with. Avoiding the big mistake at the worst possible moment should be one of the things most investors strive for. Anything that helps reduce that risk is huge. Well said.

[…] Risk Is Always On | A Wealth of Common Sense […]

[…] Management Always Matters (A Wealth of Common Sense) “The point of asset allocation is to diversify your risks and manage your […]

[…] Ben from A Wealth Of Common Sense notes that even though rebalancing has not rewarded investors during the current bull market, it should not be abandoned and has proven to be an important risk management technique. […]

One could also let asset weights run with trends in the shorter/medium term and only rebalance for mean reversion in the longer run?

Yes, that works too. Some suggest rebalancing between 12-18 months because that allows for the momentum effect to take place. Placing bands around you target weights is another good way to do this. So if your target weight is 10% and you aren’t going to rebalance until it gets away from your target by, say 15%, you would rebalance when it gets to 8.5% or 11.5%. Something like that.

[…] Reading: Risk Management Always Matters Doubling Down on […]

[…] Further Reading: Defining This Time is Different Risk Management Always Matters […]