“Rebalancing, or the process of restoring a portfolio to its original composition, is integral to the winning investment strategy. It requires you to buy what has done relatively poorly (at relatively low valuations) and sell what has done relatively well (at relatively high valuations).” – Larry Swedroe

Larry Swedroe has an interesting strategy for rebalancing your portfolio back to target asset allocation weights.

Here’s his explanation from Think, Act, and Invest Like Warren Buffett:

Rebalancing should occur only if the change in an asset class’s allocation is greater than either an absolute 5 or 25 percent of the original target allocation, whichever is less.

For example, let’s say you have a portfolio with an asset allocation of 70% in stocks and 30% in bonds. When stocks fall to 65% of the portfolio (so bonds would be 35%) you sell 5% of your bond allocation to buy 5% in stocks to get back to the 70/30 target mix.

The reason this works out well is you would be selling an asset that has risen in price (bonds) to buy an asset that has fallen in price (stocks) to take advantage of mean reversion. You are also practicing the age old investment maxim of buying low and selling high.

Easy enough.

The 25% rule would kick in for those sub-asset classes that have a much smaller allocation. So if you have a 10% allocation to small cap stocks, the range wouldn’t be 5-15% for the rebalancing trigger. This is because 25% of 10% is 2.5%. So 10% plus or minus 2.5% gives you a range of 7.5-12.5%.

Because the allocation is a smaller piece of your portfolio, you rebalance based on the magnitude of the allocation so it doesn’t get completely out of whack either way.

I like Swedroe’s idea here for those that are willing to go the extra mile and monitor their allocations on a regular basis.

But for most investors, I’m a big fan of automating the process and picking a date ahead of time to rebalance. All of the fund companies for your 401(k) or IRA provider will have this feature and you can usually choose to rebalance automatically on a quarterly, semi-annual or annual basis.

They take care of the buying and selling for you and it’s completely out of your hands which takes away the second guessing that can come along with taking profits and reinvesting in your losers.

Here’s a simple example of the benefits of periodic rebalancing:

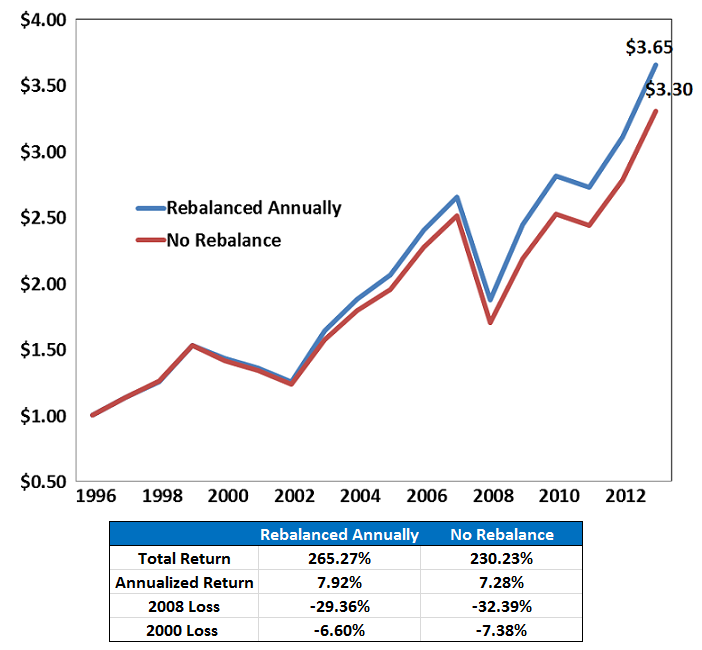

This is a hypothetical portfolio of Vanguard funds (30% Total Stock Market, 15% Small Cap, 20% Total Int’l Stock, 10% Emerging Markets and 25% Total Bond Market) that goes from 1997 to the end of 2013.

One portfolio was rebalanced at year end while the other portfolio was never rebalanced and left to drift.

You can see that the returns were much better on the rebalanced portfolio, but the risk control is the key here. Sticking with your asset allocation really helps during the inevitable selloffs in stocks.

The losses in both 2000 and 2008 in the rebalanced portfolio were less severe because this hypothetical investor was disciplined enough to take gains in stocks and them into bonds during the good years.

Better returns aren’t necessarily guaranteed from rebalancing over certain market environments. This is especially true when stocks are in a long uptrend. The biggest benefits you see from rebalancing come at those times when markets go in different directions allowing you to take advantage of diversification.

Really diversification is useless if you don’t rebalance to take advantage of the fact that different asset classes and sub-asset classes outperform over different cycles.

Source:

Think, Act and Invest Like Warren Buffett

I like Larry’s idea but as my portfolio is mostly CDN and US stocks, with a couple equity ETFs, I find I don’t need to rebalance as much. I simply buy and never sell and collect the dividends and distributions.

What do you think? Even more simple 🙂

Mark

[…] Larry Swedroe […]

I’d say that you could probably slightly improve your performance by rebalancing between your US & Canadian holdings when there are huge divergences like 2013.

Interesting theory, I have never heard of it before. While I have heard of rebalancing your portfolio I haven’t applied the concept myself. I continually add my monthly savings to my portfolio and allocate that capital where the best opportunities are.

Dollar cost averaging into new investments can be a form of rebalancing if you make investments into your lagging holdings.

[…] have yet to find a perfect rebalancing system. The one that works best will be the one that each investor is personally able to pull off without […]